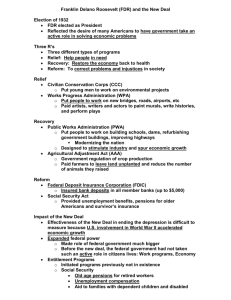

New Deal Outline - U

advertisement