Comparative advantage without tears: A Cobb

advertisement

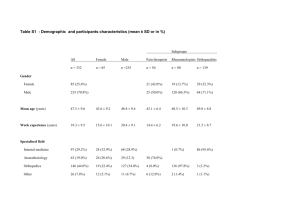

ECON 4415 International trade – notes for lectures 2-3 Comparative advantage revisited: A Cobb-Douglas version of the Heckscher-Ohlin-Samuelson (HOS) model Arne Melchior January 2004 Abstract In research on the increased wage gap between skilled and unskilled workers in some rich countries, it is, based on the HOS model, normally assumed that trade between rich and poor countries leads to an increased wage gap in rich countries. In this paper, we show that this only applies unambiguously when factor prices are equalised in the HOS model. If the poor country is fully specialised in production intensive in unskilled labour, the relationship between international trade and factor prices is modified. The paper shows that international trade leads to a welfare gain for both countries also when one country is fully specialised. On the other hand, it is shown that international trade is less important for countries than to have an appropriate mix of production factors. For poor countries, policies aimed at increasing the stock of physical or human capital are therefore more important than free trade, although the latter is beneficial. As a by-product of the analysis, the paper provides a complete analytical treatment of the 2x2x2 HOS model, using simplified functional forms that provide explicit analytical solutions on most issues. 1. Introduction This note is written in order to provide a complete treatment of the HeckscherOhlin-Samuelson (HOS) model of international trade, using functional forms that allow us to derive analytical solutions for production, trade and welfare. For this purpose, the HOS model is formulated with Cobb-Douglas production and utility functions. The choice of these functional forms restricts generality in on sense, but on the other hand we gain by being able to provide a complete analytical treatment of the model. Compared to the so-called “hat calculus” (see, for example, Jones 1965)1 or the “duality approach” (see, for example, Dixit and Norman 1980)2, we believe that the Cobb-Douglas version provides a simpler treatment and overview of the model. The simplified approach allows us to focus on some features of the model that have received less attention in the literature. For example, we show that a country’s factor composition is more important for its welfare than international trade. Furthermore, we examine the gains from trade under complete specialisation, and how the impact of international trade is modified when there is complete specialisation. 1 Jones, R.W. (1965), The Structure of Simple General Equilibrium Models, Journal of Political Economy 73: 557-572. Reprinted in Bhagwati, J. (1981), International Trade: Selected Readings, first edition, MIT Press. 2 Dixit, A. and V. Norman (1980), Theory of International Trade, Cambridge University Press. 1 In section 2, we derive production, trade and welfare in a closed economy, and thereby develop tools that are later, in section 3, used in the analysis of international trade, with or without factor price equalisation. 2. The closed economy case 2.1. Production technology Consider a single economy with factor endowments K and L (capital, labour, skilled or unskilled labour, etc.). There are two sectors A and B, using K as well as L in production, with KA, KB, LA, LB denoting the factor amounts used in the two sectors. Factors can move freely between sectors. Factor rewards are r (for K) and w (for L), respectively. Production functions are Cobb-Douglas: (1) FA = KA LA1- (2) FB = KB LB1- Total cost in sector A is (3) CA = rKA + wLA Maximising production in sector A subject to given costs, we obtain the firstorder conditions (4) FA/ KA = A r and (1-)FA/ LA = A w where A is a Lagrange multiplier. Now substituting for KA and LA in (3), we find that (5) A = FA/ CA so the Lagrange multiplier is equal to the inverse of unit costs. Substituting this into (4), we obtain (6) KA = CA/ r and LA = (1-) CA/ w This also confirms that (7) K wL r A A 1 i.e. the costs shares under the Cobb-Douglas technology are constant. These are given by (6), i.e. = rKA/ CA and (1-) = wLA/ CA. By substituting (6) into (1) and rearranging, we find the cost function (8) CA = ZA FA r w1- where ZA = -(1-)(-1) Similarly, we obtain for sector B 2 where ZB = -(1-)(-1). (9) CB = ZB FB r w1- 2.2. Production and factor use In the model, production, factor use, goods prices and factor prices are all endogenously determined. In order to understand how the model works, it is nevertheless useful to proceed step by step and examine first how production and factor use depend on prices, if we treat the latter as given. In this paragraph, we shall therefore analyse how production and factor use are related to factor prices – without full solutions for the latter. We assume that factors are fully utilised: (10a) KA + KB = K (10b) LA + LB = L Substituting into (10) from (6) and (8-9), we obtain (11) (12) ZA FA (r/w)-1 + ZB FB(r/w)-1 = K (1-) ZA FA (r/w) + (1-) ZB FB(r/w) = L Solving for FA and FB, we obtain 1 (13) w 1 FA = ( ) Z r w 1 FB = ( ) Z r w K (1 ) L r A (14) B 1 w K (1 ) L r Consider, for example, that L becomes relatively more expensive so that the factor price ratio w/r increases. In both sectors, there would be an incentive to use less L and more K. But because L must also be fully utilised, this is not possible; one of the sectors has to expand in order to “absorb” the L stock. From (14), we can find that this has to be the L-intensive sector. Similarly, if r increases, production in the K-intensive sector will expand. The higher is w/r, the more will be produced of the L-intensive good, and the lower is w/r, the more will be made of the K-intensive good. This reasoning is for given K and L; in the general equilibrium analysis, w/r is determined by K/L. An increase in K will cause production of K-intensive goods to increase, but the corresponding increase in w/r will modify this effect. For the later analysis, it is important to observe that production is positive for both sectors only for a specified range of w/r. By setting (13) and (14) equal to zero, we find that (15) FA=0 if w/r = K/L * (1-)/ (16) FB=0 if w/r = K/L * (1-)/ 3 Hence if the factor price ratio falls outside the range defined by these two values, the economy will specialise in one of the two sectors. In the closed economy, we shall see that the equilibrium factor prices are within this range. With international trade, however, this needs not be the case, and countries may become specialised. Diagram 1 illustrates this “range of diversification” in the model. Diagram 1: Factor prices and factor composition (Note: Due to software limitations, and are written as a and b, respectively.) Diagram 1 shows how the K/L ratio in the two sectors responds to the factor price ratio. From (7), we see that the curves KA/LA and KB/LB must be rays from the origin, with slopes /(1-) and /(1-), respectively. In the diagram, we have assumed that sector A is more K-intensive. When w/r=(1-)/, we know from (14) that the production of A goods is zero. Then all the resources in the economy are used in sector B, so we must have KB/LB=K/L. Similarly, when w/r=(1-)/, we have FB=0 and KA/LA=K/L. Diagram 2 shows how production in the two sectors varies with w/r, simulating the model with =0.7 and =0.3, and K=L. 4 Production levels Diagram 2: Production of goods A and B at various factor price ratios Good A Good B 0 1 2 3 4 Factor price ratio (w/r) Here the minimum value of w/r (for the range of diversification) is 0.43, while the upper bound is 2.33. The two curves intersect with the horizontal axis at these values. Finally, observe from (13-14) that if we treat factor prices as constant, the impact of an increase in the K stock depends on the sign of , which again depends on whether > or not. An increase in the K (L) stock will increase production in the K-intensive (L-intensive) sector, and reduce production in the other sector. This corresponds to the Rybczynski “theorem”, stating that increasing one factor will lead to a more than proportionate increase in production in the sector using that factor intensively, and reduced production in the other sector. This conclusion, however, is not valid in the general equlibrium situation, where goods and factor prices are allowed to vary. In general, an increase in K will lead to a reduction in the r/w ratio, and this will – according to the analysis above – contribute to lower production in the K-intensive sector. Later, we shall examine the outcome in this more general case, and we shall se that there is no “magnification effect”. 2.3. Goods prices and factor prices In standard textbook treatment of the HOS model, a second “magnification effect” is the Stolper-Samuelson theorem: A change in relative goods prices leads to an even stronger change in relative factor prices. For example, if the price for K-intensive goods increases, the factor price ratio r/w will increase even more. With perfect competition, unit costs must equal the price, hence we have (17) (18) CA/ FA = ZA r w1- = pA CB/ FB = ZB r w1- = pB 5 It should be observed that these relationships only apply when production is positive; hence the following result only applies when the economy is diversified. Dividing (6) by (7), we obtain w Z A r ZB 1 (19) pA p B 1 or p p A B w Z Z r A B This describes the relationship between relative goods and factor prices. Diagram 3 simulates the relationship, with varying values for and . Diagram 3: w/r as a function of p A/pB 3 w/r 2 a=0.1,b=0.9 a=0.3,b=0.7 1 a=0.7,b=0.3 0 0.025 1.025 2.025 pA/pB In the graph, we only show the curves within the range of diversification defined by (15)-(16). If the two sectors are very different, this range is large (cf. the curve for =0.1, =0.9, where the permissible segment is even larger than shown). When sectors become more similar, the non-specialisation range becomes more narrow (the two other curves). If sector A is more K-intensive, w/r is a decreasing function of pA/pB. If A is more L-intensive, the curves are upward sloping. We have (arbitrarily) chosen values so that +=1, therefore all the curves pass through the point (1,1). Around this point, the curves are steeper, the more similar the two sectors are in terms of factor intensity. If the sectors are very similar in this sense, small price changes may lead to large changes in the factor price ratio, and consequently also in output for the two sectors. But if the sectors are similar, changes in factor endowment will have little impact on their relative prices, so not too much emphasis should be put on this effect. The elasticity of the factor price ratio with respect to pA/pB is equal to (20) (9) El w r p A p B 1 6 Given that 0<,<1, the absolute value of the denominator is smaller than 1, so the elasticity is larger than 1 in absolute value. This is the magnification effect expressed in the Stolper-Samuelson Theorem. Contrary to the Rybczynski theorem, this is a general property of the HOS model. It should be recalled, however, that is only applies within the range of diversification. 2.4. Solving the model: The closed economy case In order to derive goods and factor prices, we need to introduce the demand side of the model. Still keeping things as simple as possible, we use a Cobb-Douglas utility function: (21) U = Aa B1-a where A and B are consumption levels for A and B goods, with a and (1-a) as the consumption shares. Hence we must have (22) p p A B A B a 1 a In a closed economy, we must have consumption = production; A=FA and B=FB. Now substituting into (22) from (13-14), and replacing pA/pB with r/w using (19), we obtain the equation: K (1 ) L w (23) r a 1 a K (1 ) L w r which gives the solution (24) w K a (1 ) (1 )(1 a ) r L a (1 a) Hence the factor price ratio is (inversely) proportional to the K/L ratio; an increase in K leads to a relative reduction in r. Observe that since , and a are all positive and smaller than 1, the fraction to the right is positive. The equation can also be re-written as (24a) a (1 a) w K 1 1 ( ) r L a (1 a) a (1 a) which shows that w/r is a weighted average of the factor price ratios defining the range of diversification. Hence the single economy is diversified. The numerator and denominator of the fraction to the right of (24) are weighted averages of the factor cost shares of the two sectors, with the consumption shares as weights. Since these expressions will appear several 7 times in the following calculations, we shall use the notation = a+(1-a), = a(1-)+(1-a)(1-), hence we may write w K r L (24b) For later use, it is useful to observe that + = 1 (this is frequently used for simplifying expressions). If any of the two sectors become more K-intensive, it will lead to a relative increase in r (a reduction in w/r). We have (the reader may easily check these results): r 0 r 0 w (25) w and If sector A is K-intensive, an increase in its consumption share will lead to a relative increase in r. We have r 0 if > w (26) r 0 if < w and a a Corresponding to these factor price effects, we have corresponding changes in goods prices. Using (19) and the solution (24), we have (27) p p A B K Z Z L A B with and defined as above. It is then easy to verify that an increase in K leads to a relative decline in the price for the K-intensive good. It is also unambiguously the case that an increase in the consumption share for a sector will lead to a relative increase in its price. The price impact of changing technology; i.e. changing factor intensity in the sectors, is more complex: As seen from (27), changes in or will affect all the three components of the expression (remember that ZA and ZB are functions of these parameters). In order to limit the length of this note, we drop a closer examination of this issue. 2.5. Factor use, production and the lost Rybczynski effect Using (7), the factor market clearing equation (10a) may be rephrased as (28) 1 L A 1 L B r K w 8 Using (10b) as well (LA+LB=L) we can solve for LA and LB, and by using (7) we also find KA and KB. Now substituting for r/w (or w/r) using the solution (24), we obtain the solutions for factor use at equilibrium: K a (29a) K A (29b) K B (29c) L (29d) L A B K (1 a) L(1 ) a L (1 ) (1 a) The comparative statics are straightforward (remember to spell out and in the calculations for a, α and β), e.g. for KA: (30) K A K 0 K A 0 K A 0 K A a 0 K A L 0 - An increase in K will increase the use of K in both sectors, without affecting the use of L. Observe that the ratio KA/KB is unaffected by K, so capital use will be scaled up proportionately in both sectors. - The more K-intensive a sector is, and the less K-intensive is the other sector, the more K will it use. If the two sectors “compete for the same factor”, they will as a result use less of it. - If the demand for goods from one sector increases, the quantity of both factors used in that sector increases, but shrinks in the other sector. Observe also that factor use is unambiguously positive as long as all parameters are positive. As noted above, there will always be diversification in the closed economy. By substituting the factor price ratio (24) in the expressions (13)-(14) for production, or by inserting the solutions (29) into the production functions (1)(2), we can derive equilibrium levels of production. The resulting expressions may be written in a simple form: (31) (32) FA = K L1- A(a,,) FB = K L1- B(a,,) where A and B are functions that may, for given values of a, and , be considered as (positive) constants.3 Hence the production levels in the two sectors are simple functions of the factor stocks in the economy. This stylised 3 We do not report these expressions. The reader may derive their form; most easily by inserting the solutions for factor use into the production functions. 9 outcome is a property of the Cobb-Douglas technology, and will not apply generally. As noted above, an increase in e.g. the K stock will increase the use of K in both sectors, while their use of L will be unchanged. Hence production must increase in both sectors, so the Rybczynski effect with reduced production in one of the sectors does not apply. The elasticities for production with respect to factor endowment changes can be read from (31-32) directly: If K increases by 1%, production in sector A increases by %, and production in sector B by %. Hence production in the K-intensive sector will increase faster, but there is no “magnification effect” in the sense that production in this sector will increase relatively more than the supply of K. This illustrates that the “Rybczynski Theorem” is a special case. This case is at odds with the general logic of the HOS theory – which is that prices adjust endogenously and depend on technology, demand and factor stocks. 2.6. Welfare in the closed economy It is intuitively evident that if a country has a factor composition which is very different compared to the cost shares for the sectors, it will be worse off compared to a situation where there is a “match”. For example, if and are both high (K-intensive), but the country’s K/L ratio is very low, K will be scarce. In this situation, r will be very high, but the physical use of K will be low in both sectors. In order to show this formally, we insert the solutions for FA and FB (3132) into the utility function (21) and obtain: (33) U = Ka+(1-a) La(1-)+(1-a)(1-) (A(a,,))a (B(a,,))(1-a) or equivalently (33a) U = K Lτ where and are as before, and we use τ = (A(a,,))a (B(a,,))(1-a) in order to simplify notation. Given that as well as are positive, any increase in K or L will add to the economy’s welfare. Given that U applies to the whole country, and K as well as L also reflect country size, this is not surprising. It is more interesting to study how the composition of factor endowments affect welfare. We therefore examine welfare with the assumption that K + L = R, where R is a constant. Hence we keep the size of the economy constant and study how factor composition affects welfare. The utility function is then: (33b) U = K (R-K) Now we find: (34) 1 R U K ( R K ) 1 K K 10 The sign of this derivative is ambiguous, depending on the sign of the expression in brackets. This is zero when the K share K/R is equal to (=a+(1-a)). With some more calculation, we find that U K 2 (35) 2 2 2 R K (R K ) 2 ( 1) 0 Since 0<<1, this expression is negative. This implies that welfare reaches a maximum when K/R=γ=a+(1-a), or equivalently (since L/R must then be 1-γ=θ) K/L=γ/θ. Hence the better the match between factor endowments and the cost shares in production, the more efficient will the economy be. Diagram 4 shows how production volumes in the two sectors, and welfare, changes with K/L, given that K+L=R is constant. The illustration is based on a “symmetrical” case with =0.7, =0.3 and a=0.5, i.e. good A is the K-intensive: Diagram 4: Production of the two goods, and welfare, when the K/L ratio changes Good A Good B Utility -5 -4 -3 -2 -1 0 1 2 3 4 5 K/L ratio (logs) With a low K/L-ratio, less will be produced of good A, and with a high K/L ratio, less will be produced of good B. With a high K/L ratio, good A will be relatively cheaper. For both goods, production is highest when the K/L ratio is equal to cost shares in production (i.e.0.7/0.3=2.33 for sector A, 0.3/0.7=0.43 for sector B). For the economy as a whole, welfare is highest when K/L is between these two values. Given that consumption shares are equal in our example and +=1, welfare is highest when the K/L ratio is equal to 1 (i.e. ln(K/L)=0). The property that production is maximised for each sector when K/L is equal to the ratio between cost shares, is easily confirmed analytically: By using K+L=R and substituting for L in (31-32), and calculating the first and second order derivatives with respect to K, we find that FA is maximised when K/R=, or equivalently K/L=/(1-), and FB reaches its maximum when K/R=, or 11 equivalently K/L=/(1-). As shown above, welfare maximum is obtained K/R is a weighted average of and , with the consumption shares as weights. Diagram 4 illustrates the importance of a “match” between factor endowments and technological requirements. This result also raises some interesting questions with respect to international trade. Suppose, for example, that a country with a K/L ratio that is optimal for welfare integrates with a country that has an extreme K/L ratio. We would then expect that the latter has more to gain from international trade. An issue is even whether the “optimal” country could even lose from trade. As we shall see, this is not the case. 2.7. Summing up: The HOS closed economy Before proceeding to international trade, we may sum up how the model behaves. The main results are: 1) The factor price ratio w/r increases monotonously with K/L. 2) An increase in K/L leads to a relatively lower price for the K-intensive good. 3) The higher the price for one factor, the larger is production in the sector using that factor intensively. 4) The closed economy will always be diversified, with a factor price ratio that is a weighted average between the values that would lead to specialisation in one of the sectors. 5) An increase in one factor of production will expand production in both sectors, with faster expansion in the sector using that factor intensively. Hence the “Rybczynski theorem” is a special case that depends on fixed prices. 6) Within the range when the country is diversified, there is a StolperSamuelson “magnification effect” in the sense that a given change in relative goods prices corresponds to an even larger change in the factor price ratio. 7) Welfare is highest when the country’s K/L ratio is equal to a weighted average of the relative cost shares for the factors in the two sectors, with the consumption shares as weights. 3. International trade 3.1. Potential gains from integration As we have seen, the closed economy will always be diversified, with an equilibrium factor price ratio that lies between the values that would lead to zero production in one of the sectors. Now we shall study the case when two economies with different K/L ratios are integrated, with free trade between them for both products. We assume that factors are immobile between countries. We use the notation K1, K2, L1,L2 for the factor stocks in the two countries, with KW=K1+K2, LW=L1+L2 as “world” factor stocks. If factors had been mobile between the two countries, the integrated economy would behave as a single country. In order to study the impact of integration, we could use our former results and compare output levels for the 12 two countries before integration, with their combined output level after integration. For sector A, for example, we may construct the difference (36) ΔA=FWA-F1A-F2A= (KW LW1- -K1 L11- -K2 L21-) A(a,,) Using shares of total factor stocks, e.g. sK1= K1/KW etc., and also sK2=1-sK1 etc., we have (36a) ΔA= KW LW1- ﴾1-sK1 sL11- -(1-sK1) (1-sL1)1-﴿ A(a,,) Diagram 5 simulates the value of the bracketed expression in the middle, using =0.5. If this expression is positive, it implies that production in the integrated economy is larger than combined production in the two countries before integration. Diagram 5: Global change in production in sector A, with integration and factor mobility 0.7-0.8 0.6-0.7 0.5-0.6 0.4-0.5 0.3-0.4 0.98 0.82 0.66 0.5 0.34 Share of world 0.18 L stock, 0.02 0.02 0.18 0.34 country 1 0.5 0.66 0.82 0.98 0.2-0.3 0.1-0.2 0-0.1 Share of world K stock, country 1 Along the diagonal from lower left to upper right, the two countries have equal K/L ratios, so integration does not cause any change in production levels. But in all other cases, the integrated economy may produce more than the two countries combined. The more different the two countries are, the larger is the gain. At the maximum, production will increase by more than 70%. Since a similar diagram applies to sector B, we can be sure that the same applies to sector B and that full integration will increase welfare, if the K/L ratios differ. (This outcome is easily verified analytically, by studying the first and second order derivatives of the bracketed expression with respect to e.g. sK1. The sign of the first order derivative is ambiguous, but zero when sK1=sL1, and the second order derivative 13 is positive. When sK1=sL1, the bracketed expression is equal to zero, and the derivatives confirm that this is a minimum.) With free trade between the two countries, but not factor mobility, we cannot be sure that the production levels shown above will materialise. The reason is that one of or both countries may specialise in one of the sectors. As shown before, the link between goods prices and factor prices is then broken. While it must be the case that international free trade equalises goods prices in the two countries, it is not certain that factor price equalisation will occur. The following diagram illustrates the issue: Diagram 6: Will factor price equalisation occur? Here we have replicated Diagram 1, but added a second country. Points z1 and z3 indicate the factor price ratios that define the range of diversification for this country. z2 and z4 are the corresponding values for the other country (as in Diagram 1). In the diagram, we have also added a line describing the equilibrium factor price ratio, as defined by (24), for different K/L ratios. If free trade leads to an equilibrium factor price ratio in the shaded area, both countries may remain diversified. As an illustration, we have also drawn a line for the KW/LW ratio for the combined economy. This crosses the line for the equilibrium factor price ratio within the shaded area, and hence factor price equalisation is possible. If, on the other hand, countries were more different, or if country 2 (in this illustration) was very large, the KW/LW line could cross the equilibrium factor price line outside the shaded area, and there would not be a common price ratio with diversification in both countries. 3.2. The case with factor price equalisation In the following, we shall study the case with free trade when the K/L ratio in the combined economy corresponds to a factor price ratio that does not lead to full specialisation in either country. In this case, the link between goods and 14 factor prices described by (19) will hold, and since goods prices must be common, there will be factor price equalisation. In the following, we shall study the impact of integration between two countries in this case. The common factor price ratio in the integrated economy is defined by (24), i.e. (37) w* r* K L W W which will be lower or higher than the factor price ratios in countries 1 or 2 before integration, depending on their initial K/L ratios. Given that the same factor prices will prevail in both countries, global production of the two goods will still be defined by (31-32); hence we have: (38) (39) FAW = KW LW1- A(a,,) FBW = KW LW1- B(a,,) We have already shown that these production levels must be higher that the sum of production in the two economies before integration. But since each country produces with a K/L ratio that may differ from the global average, production will be unevenly distributed. As long as countries remain diversified, however, they can realise the efficiency potential in the integrated economy by means of trade. In order to derive production levels, we use equations (13-14) that are general and also apply to the individual countries after integration. We obtain (40) F F A1 A2 (1 ) L w * K r* * K (1 ) L w * r* * 1 1 2 2 where we use asterisks in order to indicate the outcome in the integrated economy. Given that (41) FA1* + FA2* = FAW we use (40) to express FA1 as a function of FA2, insert this in (41) and solve for FA2 and then FA1. The solutions are: (42a) FAi* = FAW (1 ) s Ki s Li a ( ) i = 1, 2 The corresponding solution for sector B is (42b) FBi* = FBW (1 ) s Ki s Li (a 1) ( ) i = 1, 2 15 where we have used factor stock shares sK1 etc. instead of the absolute values for endowments. We have also written FAW and FBW for notational simplicity; the solutions are provided above. A similar method may be applied in order to derive consumption levels. The Cobb-Douglas demand functions are e.g. for good A in country 1 (43) A1* = apA-1Y1 = apA-1 (r*K1+w*L1) Since goods prices are common, we must therefore have (44) A * r*K A * r*K 1 1 2 2 w * L1 w * L2 Consumption must also equal production at the global level, so we have A1* + A2* = FAW. Expressing A1* as a function of A2*, we obtain the solutions (45a) Ai* = FAW (sKi + sLi) i=1,2 and for sector B, the corresponding solution is (45b) Bi* = FBW (sKi + sLi) i=1,2 Deriving exports and imports, we find e.g. (46) FA1* – A1* = F AW ( s K 1 s L1) a ( ) Hence if sector A is K-intensive (>) and country 1 is relatively K-abundant (sK1 > sL1), expression (46) is positive so that country 1 is an exporter of good A. This corresponds to the Heckscher-Ohlin Theorem; a country tends to export the good which is using relatively more of the factor that the country is relatively well endowed with. 3.2.1. Free trade and welfare Hence we have shown that free trade, under the assumption of nonspecialisation, leads to a global production (and hence welfare) gain, and countries will specialise according to their comparative advantage. But how will this gain be distributed? Within each country, we already know that international trade will have a distribution effect: As the factor price ratio changes, the income distribution will change. Hence owners of K in a relatively K-rich country will have a relatively higher income. This is well known from international trade theory. On the other hand, a standard story is that the country as such will gain from international trade. This is, however, not so certain: Searching the textbooks for a definitive answer leaves us in some confusion. Surely, with the “small country assumption”, the gains from trade are normally secured. But in general, when prices are allowed to vary, things are not that easy. As stated by 16 Bhagwati (1998, 273), “Although free trade is optimal from a viewpoint of world welfare, it is not so from the viewpoint of a single country unless the country is small.”4 A similar caution is expressed by Paul Samuelson (1962): “Free trade will not necessarily maximize the real income or consumption and utilities of any one country – even though by ideal bribes the international winning countries could bribe the losers into a unanimous vote for free trade”.5 Let us therefore examine how each country’s welfare is affected by free trade in our model. In order to do so, we simply insert the consumption levels A1* and B1* into the utility function (21). A1* is given by (45a), and B1* is a similar expression, equal to FBW (sK1 + sL1). We obtain, after rearranging and also using (38-39): (47) U K1 L1 * 1 K 1 K 2 L1 L2 K 1 K 2 L1 L 2 a A B1 a Observe that if K2 and L2 are equal to zero, this collapses to the welfare level for country 1 in autarky, given by (33); i.e. with the appropriate subscripts: (48) U 1 K 1 0 1 a L1 B a A We want to find out whether integration leads to a welfare gain, i.e. whether U1*>U10, and how this gain depends on factor endowments and technology. For this purpose, we form the expression U1*/U10, which has to be larger than 1 if there is to be a welfare gain from integration. Using shares of world factor stocks, we have: (49) U U * 1 0 ( s K 1 s L1) s K 1s L1 1 In order to simplify calculations, we write sK1 = φ1 sL1 i.e. φ1 is the ratio sK1/sL1. If the two countries have the same K/L ratios, φ1 is equal to 1. If country 1 is relatively K-abundant, it is larger than 1. Now inserting in (49), we obtain: * (50) U (1 ) 1 U 1 0 1 1 4 In Bhagwati, J., A. Panagaryia and T.N. Srinivasan (1998), Lectures on International Trade, Second Edition, MIT Press. 5 Samuelson, P.A. (1962), The Gains from International Trade Once Again, The Economic Journal 72: 820-829, reprinted in Bhagwati, J. (1981), International Trade. Selected Readings. First edition. MIT Press. 17 i.e. the expression depends only on φ1 and not on the absolute magnitude of sK1 or sL1. Hence it is the relative factor proportions that matter, not country size. If φ1 is equal to 1, the ratio (50) is also equal to 1, i.e. if the two countries have the same K/L ratios, there is no welfare gain from integration. By taking the first and second order derivatives of (50) with respect to φ16, we find that - the first order derivative is negative if φ1<1, equal to zero if φ1=1, and positive if φ1>1 - the second order derivative is always positive. Hence the value for φ1=1 is a global minimum. This confirms that the ratio U1*/U10 is always larger than 1 if sk1≠sL1, and also larger, the more different is sK1 from sL1. Remember that our calculations only apply to the set of factor allocations that bring about factor price equalisation. Hence the calculations confirm that the welfare impact of integration follows the pattern for global production, shown in Diagram 5. If the K/L ratios of the two countries are equal, there is no welfare gain from integration, but if they are not, both countries always gain from integration. The more different the K/L ratios of the two countries are, the larger is the relative welfare gain. As an illustration of the implications of this conclusion, consider a case in which country 1 is K-abundant country, while country 2 is L-abundant. If L2 increases, welfare in country 1 will increase. If, on the other hand, K2 increases, welfare in country 1 will decrease. If K is skilled labour and L is unskilled labour, for example, the theory tells that skill-abundant countries will gain by an increase in the stock of unskilled labour in their trade partners (e.g. by population growth in poor countries), and will lose from an increase in the stock of skilled labour (e.g. through education in poor countries). Whatever the K2/L2 ratio is, however, they K-abundant country will gain from free trade, compared to autarky. Our welfare conclusion implies that even a country with a K/L ratio that is optimal for welfare in autarky, can gain from trade. Diagram 7 illustrates the welfare impact of trade integration for a country of given size (i.e. K1+L1=R1), but with varying K/L ratios. The diagram is based on the same assumptions about technology as Diagram 4, i.e. α=0.3, β=0.7, and a=1-a=0.5. Hence θ=γ=0.5, and the K/L ratio optimal for welfare in autarky is 1. For this reason, the curve for welfare in autarky is symmetrical around the mid-point where K1/L1=1. The first order derivative is γφ1-γ-1 (φ1-1) (1-γ) and the second order derivative is equal to γ (1-γ) (1+γ) φ1-γ-2. 6 18 Welfare country 1 Diagram 7: The welfare impact of free trade Autarky K2/L2 low K2/L2 high -5 -4 -3 -2 -1 0 1 2 3 4 5 Ln (K1/L1) The thin line describes welfare in autarky, as in Diagram 4. The solid thick line shows welfare when there is free trade, and country 2 has a low K/L-ratio (and of equal size as country 1). This line is tangential to the autarky welfare line when the K/L ratios in the two countries are equal. To the left of this point of tangency (where K1/L1<K2/L2), or to the right of it (where K1/L1>K2/L2), country 1 gains from integration. The curve for U1* ends when factor price equalisation is no longer possible. The welfare impact of integration when country 2 has a higher K/L-ratio is shown by the dotted curve. In this case, zero gains are obtained for a higher K/L ratio in country 1. In both cases, even a country with K1/L1=1 gains from free trade. Diagram 7 shows that countries may generally gain from free trade, but also that their factor endowment ratio may be even more important for their welfare. If country 1 has a “sub-optimal” K/L ratio, it can gain from free trade but it may not be able to reach the welfare level that would prevail in autarky with K/L=γ/θ (i.e. the level that is optimal for welfare). This shows that aspects that affect the K/L ratio, such as education, population growth, capital accumulation etc., may be even more important for welfare than free trade. Observe also that the point is not to have as much K as possible; also with a “too high” K/L ratio may welfare be lower. From our previous analysis, we also know that world welfare will be highest when the world K/L ratio is equal to γ/θ. If, for example, the world has too much unskilled labour in the light of current technologies, education may be more important that free trade. Nevertheless, free trade is positive. 3.2. International trade with complete specialisation Comparing diagrams 5 and 7, it is slightly worrying that free trade does not seem to be able to realise the potential of the world economy. With factor price equalisation, there is some gain from trade, but it is not massive, and it is even more important for countries to have the appropriate mix of factors. Knowing that factor prices indeed differ around the world, we should maybe not focus only on the FPE set. Sometimes, economists keep silent about things that are not “twice differentiable”; i.e. the concern for analytical 19 tractability leads to a bias in the focus of research, in terms of what problems are important empirically. This is surely one reason why the literature on HOS has focused excessively on cases with factor price equalisation. We might hope that our Cobb-Douglas approach can facilitate the analysis of specialised outcomes. Another reason for studying non-diversified outcomes is that the HOS model is thought to be particularly relevant for the study of North-South trade. But many developing countries are extreme in terms of factor composition, with abundance of unskilled labour and exports of labour-intensive goods. Hence we should study cases where specialisation occurs, in order to shed light on the impact of free trade for such countries. Diagram 8 shows possible cases of specialisation in our model, assuming that sector A is more K-intensive. Diagram 8: Cases with specialisation There are six possible cases of specialisation, with both countries specialised in two of them, and one country specialised in the remaining four. In the Appendix, an analytical treatment is provided for two illustrative cases, one with only one country specialised, and a second where both countries are specialised. For the mixed case (with one country specialised), explicit analytical solutions cannot be obtained for all aspects, but we combine numerical simulations with some analytics based on implicit differentiation. When a country becomes fully specialised, and we still assume full employment, it has to use all its factor endowments in the production of one sector. The physical production of the good is then given by the production functions. This also the case for the factor price ratio, since the cost shares in production are defined by the technology. The factor price levels, on the other hand, will depend on world trade and the other country. When factor price ratios in the two countries differ, their levels will generally also be different in the two countries. Hence for a specialised country, the factor price ratio will be determined solely by the domestic K/L ratio and the technology in production. For example, if country 1 specialises in A, the factor price ratio will be 20 w ** 1 K r ** L (51) 1 1 1 1 Still, this factor price ratio will react “normally” to factor endowment changes; an increase in K1, for example, will lead to a relative decline in r1. But the relative impact of such a change will be stronger than in the case with FPE, since w/r then depends on the world K/L ratio. When K1/L1 changes, KW/LW will change less. When the factor price ratio in the specialised country is “cut off” from the world market, it has some interesting implications for country 2. Consider, for example, that K1 increases. With FPE, this would make K relatively cheaper in country 2 as well. But if country 1 is specialised, the impact may be the opposite. Consider, for example, that country 1 is specialised in L-intensive goods. An increase in K1 will then lead to increased production of the Lintensive good in country 1, and as long as country 1 remains specialised, this will reduce the production of L-intensive goods in country 2. For this reason, K will become relatively more expensive in country 2. Diagram 9 shows this effect from a slightly different angle; here we use the same assumptions as in Diagram 7: Country 1 has factor endowments K1+L1=R1=1000, and we study the outcome when the factor composition changes. In this illustration, we let K2=L2=500. With α=0.7, β=0.3 and a=0.5, country 2 has then the “optimal” mix of factors. Diagram 9 shows the factor price ratios when these two countries integrate. Diagram 9: Specialisation and factor prices Factor price ratios (w/r) 5 4 w*/r* w2/r2** 3 w1/r1** 2 Autarky 1 Autarky 2 1 0 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1 Share K1/R1 In autarky, country 2 will have a factor price ratio of 1 (K2/L2 is fixed), while the factor price ratio in country 1 will vary with the K1/L1 ratio. With international trade and factor price equalisation (the solid curve in the intermediate range), the relative price for each country’s abundant factor will increase compared to autarky. And as K1 increases, KW/LW increases as well so that the common world factor price ratio w*/r* increases (K becomes relatively cheaper). 21 With the given assumptions underlying the diagram, country 2 will never become fully specialised. Country 1, however, will be specialised in B for low K1, and in A for high K1. With specialisation, the impact of an increase in K1 for w1/r1 will be stronger than with FPE. But for country 2, the increase in K1 leads to a reduction in w2/r2, as explained above. In research and debates on the “skill gap” in rich countries; i.e. the increased wage or unemployment gap between skilled and unskilled workers, it is generally assumed that trade integration with poor countries will have a “standard” HOS impact on wages. As seen above, trade integration with poor countries may in fact – in a restricted sense – lead to more equality in rich countries, if L in our model represents unskilled labour. This occurs if the poor countries are specialised, and trade increases with countries with extreme K/L ratios. A corresponding implication is that growth in poor countries may have an ambiguous impact on inequality in rich countries. If growth leads to a gradually higher K/L ratio in poor countries, this will first (as long as the poor countries are specialised) lead to less inequality in rich countries, but later (when the developing countries become diversified), it will lead to more inequality in rich countries. As seen from our former analysis, however, such growth will surely lead to less international inequality (between the countries). This leads us to a final important issue: Are there gains from trade when international trade leads to specialisation? Fortunately, the answer seems to be yeas (although a full analytical proof is not provided here). Diagram 10 shows welfare for the two countries, using the same assumptions as for Diagram 9. Welfare Diagram 10: Trade and welfare with specialisation U1-autarky U1**-specialised U1* U2**-specialised U2* K1/R1 Given that country 2 has the optimal factor mix, its welfare in autarky will be the same as the maximum for country 1 (when K1/R1=0.5). Within the FPE set, both countries will gain from integration, and the gain will be larger, the more different their K/L ratios are. When country 1 becomes specialised, it still gains 22 from trade with country 2, and the relative gain is even larger than with FPE. For country 2, however, trade in the ranges with specialisation in country 1 leads to smaller and smaller benefits, as the factor composition in country 1 becomes more extreme. In all cases shown, however, country 2 is better off with trade than in the autarky situation. Hence in this case, both countries gain from trade, but the specialised country gains relatively more. 4. Reservations The analysis has used a stylised model with many features that are not realistic. For examples, preferences are homothetic and consumption shares equal in both countries. In the real world, this and other assumptions may be violated. Nevertheless, the Cobb-Douglas version of the HOS model has the advantage of tractability, and we have been able to provide a more or less complete examination of the model with explicit analytical solutions. This provides a “base case” which may be extended by modifying various assumptions. Nevertheless, it is important to keep in mind that the results above are based on several stylised assumptions. A second reservation is that we have only compared autarky with free trade, and not intermediate situations with specific trade costs. It is well known from the literature that large countries may gain from imposing a tariff that improves their terms of trade. Although not examined here, we expect that our welfare conclusion would also carry over to a situation with symmetrical trade costs (in both directions, for both sectors), but not to any pattern of trade costs. With more than two countries and regional integration between some of them, it is possible that some countries may lose from freer trade, due to the discriminatory impact. The Cobb-Douglas version of HOS may also be useful as a building block in other models, for example models with imperfect competition. Having provided the explicit analytical solutions in HOS, it may be easier to extend it to more complex cases. 23 Appendix: Non-diversified outcomes With two sectors and two countries, there are six possible cases in which at least one of the two countries is specialised. There are four cases in which one country is diversified, and the other is specialised in one of the sectors. Then there are two cases in which both countries are specialised. Given that the qualitative results will be similar within each type (with varying subscripts etc.), it is sufficient to examine two cases. We shall therefore focus on the two illustrative cases - country 1 specialised in A, country 2 diversified. - country 1 specialised in A, country 2 specialised in B. Country 1 specialised, country 2 diversified If country 1 is specialised in A, it has to use all its factor endowments in the production of that sector. Output of that good must therefore be F1A = K1αL11-α Given the Cobb-Douglas technology, we must have (A1) rK wL 1 1 1 1 1 which is equivalent to (A2) w r 1 1 1 K L 1 1 Hence when a country is specialised, its factor price ratio is fully determined by the domestic K/L ratio and the technology of the sector. Since country 1 only produces A, its total income (Y1) must be pAF1A. Inserting this into the demand function A1=apA1-1Y1, we find that the consumption of good A in country 1 is equal to (A3) A1 = aF1A Hence country 1 has to export F1A-A1=(1-a) F1A. This has to equal the difference between production and consumption of good A in country 2: (A4) (F1A - A1) = (1-a) F1A = A2 - F2A From (13) we have: 1 (A5) F2A = 1 ( ) Z A w2 r2 K 2 (1 ) L2 w r 2 2 24 Consumption of A in country 2 is given by the demand function A2=apA-1Y2, where Y2 is income. Now Y2 = r2K2 + w2L2 = r2 [K2 + L2 (w2/r2)] and from unit cost = price, equation (17), we obtain r2/pA = ZA-1 (w2/r2)α-1 Inserting this into the demand function, we obtain (A6) A2 = a ZA-1 (w2/r2)α-1 [K2 + L2 (w2/r2)] Using (A5) and (A6) and simplifying, equation (A4) can be expressed as 1 (A7) (1-a) F1A = w2 1 ( ) Z r2 A K L w2 2 2 r 2 Since F1A is known, the factor price ratio is the only unknown. Hence (A7) determines the factor price ratio. Unfortunately, however, this non-linear equation is not easily solved. We can use it for numerical simulation, but a neat expression for w2/r2 is not possible to find. We can, nevertheless, examine the outcome by means of implicit differentiation. We then rearrange (A7) to form the function 1 (A7a) Φ = w2 1 ( ) Z r2 A 1 K L w2 (1 a) 2 2 K 1 L1 0 r2 For any two variables y and x, the rules for implicit differentiation tells that ∂y/∂x=-(∂Φ/∂x)/(∂Φ/∂y). Using this in order to find how the factor price ratio is affected by factor endowments, we find Table A1: The sign of the derivative of w2/r2 with respect to different variables Variable α>β α<β K1 + L1 + K2 + + L2 The response to changes in K2 and R2 is standard; an increase in the amount of a factor in the diversified country 2 will lower its relative price. From (A1), we know that the same is the case in the specialised country 1, with respect to w1/r1. The special thing with non-diversified cases is that the international links will be different. We already know that the factor price ratio in country 1 is unaffected by factor endowment changes in country 2. And for country 2, Table A1 shows 25 that factor endowment changes in country 1 has a “perverse” effect: An increase in any of the two factors in country 1 will have the same effect on factor prices in country 2. If A is K-intensive, for example, an increase in K1 as well as L1 will lead to increased production of A in country 1. This will increase country 2’s imports of A, and reduce production of A. Since A is K-intensive, this will lower the relative price of K. If sector A is L-intensive, an increase in K1 or L1 will lower the relative factor price w2/r2. This is different from the case with factor price equalisation, where an increase in endowments of a factor will have a similar impact in both countries. The result has interesting implications. For example, consider poor developing countries that are specialised in L-intensive goods, and have a relatively large L stock. If these grow and accumulate physical capital (by investing) or human capital (by education and learning), this may at first be to the detriment of unskilled labour in rich countries. At the point when the developing countries become diversified, further growth will reduce the w/r ratio in rich countries. Hence specialisation may lead to a “discontinuity” in the impact of growth in developing countries. The outcome outlined above will not be sustainable if the countries become too different. At some stage, it is possible that country 2 will specialise in B. From (16) we know that this occurs when w2/r2= (K2/L2)*(1-α)/α. Inserting this into Φ, we obtain the condition K1αL11-α = K2αL21-α. This defines the “borderline” between factor allocations that result in specialisation in good A in country 1 only, and allocations that also create full specialisation in country 2 (in sector B). Corresponding to the other three cases where one country is diversified and the other specialised in one sector, there are three other “borderlines”, as shown in Diagram 7 in the main text. In the main text, we also examine the case when country 1 is specialised in sector B, while country 2 is diversified. The equilibrium condition corresponding to (A7a) is then (A7b) ΦB = w2 1 ( ) Z r2 B 1 1 K L w2 a 2 2 K 1 L1 0 r2 This is used for the simulations in the main text. Both countries specialised We continue assuming that country 1 is specialised in good A; hence equations (A1)-(A3) still apply. For country 2, which now specialises in B, with production F2B=K2 β L21-β, we obtain similarly (A8) w r 2 2 1 K L 2 2 The consumption level for B in country 2 (derived similar to A3) will be (A9) B2 = (1-a)F2B 26 In value, exports of A from country 1 must equal exports of B from country 2. This gives (A10) (F1A - A1) pA = (F2B - B2) pB or equivalently, using the results above and the earlier results for A, (A10a) (1-a) F1A pA = a F2B pB Observe that an implication of this, since Y1= F1A pA and Y2 = F2B pB, is that the income ratio is equal to (A11) Y Y 1 2 a 1 a Hence consumers use a certain share of their money on each good, and these money accrue to the respective producing countries. The income share of a country is independent of its size; it depends only on the consumption shares! If a small country is the sole producer of a highly demanded good, it can become very rich due to the relatively high price for that good. Equation (A10) also defines the price ratio between the goods, which is (A12) p p A B a 1 a F F 2B 1A With perfect competition, unit costs must equal the price in the respective countries, as in equations (17)-(18). Observe that not only will factor price ratios be different in the two countries, but also levels. Replacing pA and pB in (A12) with unit costs, using (17)-(18), (A1) and (A8), we obtain: (A13) w w 1 2 1 a 1 1 a L L 2 1 Hence w1 is relatively larger, if demand for good A is high, if production of good A is relatively more L-intensive (low α or high β), or if the L stock in country 1 is relatively small. Observe that the K’s do not enter here, so e.g. a large poor country with a large L stock can have a very low wage, irrespective of its K/L ratio. In order to examine welfare, we may observe that consumption of the non-produced good in either country is equal to its imports. Using earlier results, we obtain (A14a) U1** = a F1Aa F2B1-a (A14b) U2** = (1-a) F1Aa F2B1-a The ratio between welfare in the two countries is therefore equal to the income ratio (A11), or a/(1-a). Hence how the “pie is shared”, depends only on 27 consumption shares. On the other hand, the “pie may be enlarged” by means of factor endowment increases in either country. With complete specialisation, it is an advantage to be a small country: If e.g. country 2 becomes ten times larger than country 1, country 1 will still have a share of world real income equal to the consumption share of its product. Hence income per factor unit in country 1 must be much higher. A comparison with welfare in autarky could be possible by using the conditions defining the two “borderlines” for this case with specialisation in both countries, for studying e.g. U1**-U10. It is, however, difficult to obtain an unambiguous conclusion for the whole permissible range. 28