CREATING A LOCAL WIND INDUSTRY Experience from Four

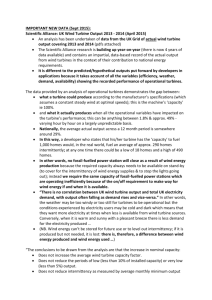

advertisement