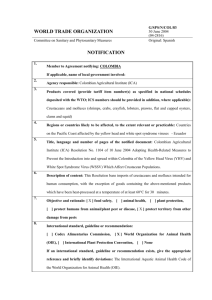

III. trade policies by measure - SICE

advertisement