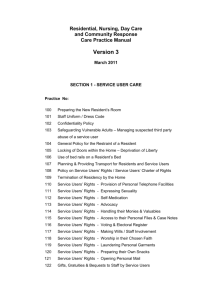

Rights and accountability: Management of money policy (doc 132.5

advertisement

Disability Services Rights and accountability: Management of money policy April 2010 Accessibility If you would like to receive this publication in an accessible format, please phone 1300 366 731 using the National Relay Service 13 36 77 if required, or email disability.legislation@dhs.vic.gov.au This document is also available as a Word file on the internet at www.dhs.vic.gov.au/disability Published by the Victorian Government Department of Human Services Melbourne, Victoria © Copyright State of Victoria 2010 This publication is copyright, no part may be reproduced by any process except in accordance with the provisions of the Copyright Act 1968. This document may be downloaded from the Department of Human Services web site at www.dhs.vic.gov.au Authorised by the State Government of Victoria, 50 Lonsdale Street, Melbourne April 2010 Printed on sustainable paper by Sovereign Press, 6 Traminer Court, Wendouree 3355 Contents Context statement 4 Definitions under the Act 4 Other definitions/terms 5 Application of policy 5 Objective 5 Key policy principles 6 SECTION A: MANAGEMENT OF MONEY — ALL DISABILITY SERVICE PROVIDERS 8 SECTION B: MANAGEMENT OF MONEY – RESIDENTIAL SERVICES ONLY 9 B1 Appointment as a guardian and or financial administrator – residential service 9 B2 Residents’ money 11 B3 Maximum amount of cash being held on behalf of a resident 13 B4 Resident’s money – Inclusions and exclusions 13 B5 Accountability for residents’ funds 14 B6 Provision of end-of-month financial statement and access to records 14 B7 Authorised access to records 15 B8 Investment of trust funds 15 B9 Limit on resident funds held in trust 16 B10 Trust money must be paid when person leaves 16 B11 Residents’ trust fund – Departmental-managed residential services 17 Related policies, procedures and legislation 18 Contacts 18 Approved 18 Rights and accountability: Management of money policy (April 2010) 3 Context statement The Disability Act 2006 (the ‘Act’) was passed by Parliament on 4 May 2006 and became fully operational from 1 July 2007. The Act provides the framework for a whole-of-government and whole-ofcommunity approach to enable people with a disability to actively participate in the life of the community. The Act is guided by the principles of human rights and citizenship and provides substantial reform to the law for people with a disability in Victoria. Definitions under the Act ‘Community residential unit’ means a residential service that is declared to be a community residential unit under Section 64. (Please note: in practice this means a residential service in a ‘group home’ that is declared a community residential unit under Section 64) ‘Department’ means the Department of Human Services. ‘Disability service provider’ means: a. Department of Human Services regional management and staff; or b. a person or body registered on the register of disability service providers. ‘Disability service’ means a service provided by a disability service provider specifically to support people with a disability. ‘Public Advocate’ means the Public Advocate appointed under Section 12 of the Guardianship and Administration Act 1986. ‘Resident’ means a person who receives disability services at a residential service. ‘Resident’s administrator’ means the resident’s attorney appointed under an enduring power of attorney to administer the resident’s property or a person appointed by a court or tribunal as the administrator of the resident’s property. ‘Resident’s guardian’ means the resident’s guardian appointed under the Guardianship and Administration Act or appointed by a court and, if the resident is a child, includes the child’s guardian whether or not they are the child’s natural parent. ‘Residential service’ means residential accommodation with rostered staff provided by, or on behalf of, a disability service provider for the purpose of providing disability services to: a. one or more residents in a community residential unit; or b. one or more residents in a residential service other than a community residential unit. ‘Residents’ Trust Fund’ means the Residents’ Trust Fund continued under Section 91. ‘Secretary’ means the Secretary to the Department of Human Services. Rights and accountability: Management of money policy (April 2010) 4 Other definitions/terms ‘Authorised representative’ in the role of a ‘financial administrator’ means a person who is appointed under an enduring power of attorney (financial) to administer the person’s property or a person appointed by a court or tribunal, such as the Victorian Civil and Administrative Tribunal (VCAT), as the administrator of the person’s financial and legal affairs. ‘Nominated representative’ means a person who is the recognised signatory to the resident’s Centrelink bank account or who has been nominated to provide and be responsible for financial management support under the financial plan of the person with a disability. ‘Group home’ is a residential facility where shared supported accommodation is provided and supports are linked to the funded residential service provided to one or more people with a disability on a long-term basis by staff employed by the disability service provider. ‘Penalty units’ the Monetary Units Act 2004 governs the indexation of fees and fines set by various departments. Fees and fines are automatically indexed through the value of a fee or fine unit being fixed by an ‘annual rate’, and applied from 1 July each year. When fixing the annual rate, the Treasurer takes into account the rate of inflation and the cost of delivering government services. The value of the fee or fine unit is subsequently published in the Government Gazette and major newspapers. ‘VCAT’ is the Victorian Civil and Administrative Tribunal that can appoint guardians and administrators for persons with a disability over the age of 18 years. VCAT may appoint family members or the Public Advocate as guardian. VCAT may appoint family members or companies such as the State Trustees as administrators. Application of policy This policy applies to both department-managed and funded services provided by community service organizations (CSOs). Objective The objective of this policy is to give effect to the implementation of Part 6 of the Act – Rights and accountability, Division 2 – Provisions relating to the management of money. This policy will provide disability service providers and their staff with an understanding of their roles and responsibilities in relation to the management of money for people with a disability living in department-managed or funded residential services provided by registered disability service providers. The same requirements apply to any other support services that involve handling of program participants’ funds. The key purpose of this part of the Act is to create specific rights for persons receiving supports, particularly those residing in residential services, and to impose specific obligations on registered disability service providers who are involved in the handling and management of money belonging to people with a disability. Rights and accountability: Management of money policy (April 2010) 5 Key policy principles Fundamental to this policy is the department’s desire to support improvements in the management of residents’ financial affairs. Provision of residential services necessitates the frequent handling of significant amounts of residents’ funds. Key considerations in meeting this responsibility include: • Financial planning Financial planning should consider current and future circumstances and incorporate estate planning for the individual. This is the responsibility of a financial administrator. Development of a clear financial plan for accommodation support only to guide the application of a resident’s finances for discretionary purposes and to meet their financial obligations including the payment of fees and charges is a part of the financial planning process, which involves the disability service provider’s input. The resident’s financial plan for accommodation support should be reviewed on a regular basis between staff, the resident and/or the guardian or administrator to ensure currency of circumstances and directions as well as the effectiveness of financial management arrangements. This should occur at least annually. • Independence and choice People with a disability receiving funded support services or living in residential services should be supported to manage their own money as far as they are able. Where appropriate, such support may be provided by families or formally appointed administrators. In undertaking these responsibilities it is important that the parties act in the best interests of the individual, maximize the individual’s involvement in decisions, show due regard for confidentiality of information, maintain accurate records of information and are accountable for directions made. Disability service providers must not act as financial administrators for people with a disability for whom they provide support. Restricting the role of disability service providers in the direction and control of money safeguards individuals from potential conflicts of interest and perceptions of influence. Other safeguards available include the appointment of a formal administrator by the Victorian Civil and Administrative Tribunal (VCAT). Advice should be sought from the Office of the Public Advocate before making an application to VCAT. The department recognises that efforts to enhance financial management practices will occur over time and the department and CSOs will actively support families, carers and guardians to pursue this, being respectful of the important role that families and carers play in supporting residents. Where a person with a disability lacks the capacity to make informed decisions regarding their financial affairs, the department will accept instructions related to the disability support financial plan from a formally appointed administrator or the nominated representative of the person with a disability. • Accountability, transparency and confidentiality Clear information, records, processes and systems need to be in place to account for the expenditure of money held in trust for a person with a disability. Decisions about the expenditure of funds need to flow from the financial plan Rights and accountability: Management of money policy (April 2010) 6 with authorisation by the nominated representative or the formally appointed administrator, if any, on the application of funds. • Privacy People with a disability are to be afforded the same rights of privacy in financial matters as other members of the community. Provision of information The provision of any advice, notification or information in relation to these guidelines should be undertaken in line with the requirements of Part 2 – Objectives and principles of the Act, S7, Provision of advice, notification or information under this Act. 1. The contents of any advice, notice or information given or provided to a person with a disability under the Act must be explained by the person giving the advice, notice or information to the maximum extent possible to the person with a disability in the language, mode of communication and in terms that the person is most likely to understand. 2. An explanation given under (1) must, where reasonable, be given both orally and in writing. 3. If a person is incapable of reading and understanding the information provided, the disability service provider must use reasonable endeavours to convey the information to the person in the language, mode of communication or in terms that the person is most likely to understand. 4. The disability service provider may give a copy of the advice, notice or information to a family member, guardian, advocate or other person chosen by the person with a disability. Where no person is chosen, the information may be given to a person the disability service provider considers can assist the person with a disability. The person must not be employed or be a representative of the disability service provider. It is important that families are supported to participate in the life of the individual in order to foster positive and cooperative partnerships between family and disability service providers. This is of particular importance with respect to assisting the individual to understand their rights, responsibilities and support available to them. It is important, however, that all parties are mindful of respecting the wishes of the individual accessing services. Victorian Charter of Human Rights This policy has been developed to support the principles and requirements of the Act and ‘The Victorian Charter of Human Rights and Responsibilities’. This document is presented in two sections: • Section A: Applies to all service provision. • Section B: Applies only to residential services. Rights and accountability: Management of money policy (April 2010) 7 Section A: Management of money — all disability service providers S90 A disability service provider, or a person employed by a disability service provider must not act as a financial administrator for a person with a disability provided with disability services by that disability service provider. Penalty: 60 penalty units Policy application: 1. Restricting the role of disability service providers in the direction and control of money safeguards people with a disability, employees and the service provider from potential conflicts of interest and perceptions of influence that could occur. 2. The role of financial management, where one is required due to a person’s lack of capacity to make informed decisions about their finances, may be undertaken by families and friends or significant others, or an authorised representative through formal appointment as an administrator for a person with a disability. Only one of these individuals will have the primary responsibility and accountability as the ‘nominated representative’ if there is no formally appointed administrator for the person. Further information on the appointment of financial administrators can be obtained from the Office of the Public Advocate or the Victorian Civil and Administrative Tribunal. 3. Wherever possible, a person with a disability must make his or her own financial decisions. Staff should provide assistance only in a support role, not a decisionmaking role. This support must be provided in the context of the type of disability support service provided, for example, accommodation support, community access, day programs and respite. Staff should not provide advice outside areas of their responsibilities, for example, investment advice. Exceptions: 4. S90 (2) allows the Secretary to provide such a function where it is exercised under the power of another Act. 5. Refer to B1 of this document in respect of specific limited exceptions for a residential service. Rights and accountability: Management of money policy (April 2010) 8 Section B: Management of money – Residential services only1 The following legislative requirements are in addition to Section A for all residential services that are provided by a registered disability service provider and the Secretary. B1 Appointment as a guardian and or financial administrator – residential service S93(6) The disability service provider or a person employed by the disability service provider must not accept an appointment as a resident’s guardian or resident’s administrator in respect of any resident of the residential service. Penalty: 60 penalty units The objective of restricting disability service providers and their staff from performing functions as a guardian or financial administrator in a residential service is to safeguard residents and staff from potential conflicts of interest and perceptions of influence. The separation of these two responsibilities and functions is paramount to achieving this objective and that of providing protection against a power or influence relationship between a resident and staff-carer arising from a service provision context. Policy application 1. A disability service provider or an employee should not accept appointment as a resident’s guardian or resident’s administrator in respect of any resident of the residential service from 1 July 2007 when the Act came into effect. 2. This section does not apply to formal appointments of guardians or administrators prior to the commencement of the Act. Guardians or administrators appointed before 1 July 2007 are not required to relinquish their existing appointments. 3. The disability service provider must ensure that there are procedures in place for all employees and members of boards or committees of management to be aware of the requirements under this section of the Act. 4. Where a member of a board or committee of management is involved in a decision-making process that might impact upon a resident in the service who is a family member, the board member must declare, at the outset, any potential risk of conflict of duties and abstain from participation in that process. The board or committee must satisfy itself that there is no direct conflict of duties before allowing the member to contribute to the decision-making process, where appropriate. 1 The provision of outreach services does not fall under the definition of a residential service within the context of the Act. Section B is, therefore, not applicable to outreach services. For department-managed services, this means that the residents’ trust fund and the client expenditure recording system must not be used to manage funds for individuals receiving outreach support. All support providers should consider the management of an individual’s funds within the service planning context mindful of the individual’s needs, financial management skills and the ongoing development of these skills. This should include identifying situations where staff may be required to handle money on an individual’s behalf and implementing an appropriate level of accountability that is not administratively burdensome. Handling money may incorporate activities such as using cash or having access to bank account details, and account access cards. Rights and accountability: Management of money policy (April 2010) 9 5. Employees have the responsibility of advising management of any potential conflict of interest. 6. Residents under 18 years old: This section applies only to residents under 18 years. The department acknowledges that people under 18 years of age with a disability are best supported within family environments. Where this is not possible, a small number of people under the age of 18 years may live in a residential service. 6.1 Children between the ages of 15 and 18 years have the right to make their own decisions without parental consent. Where parents are not involved in the day-to-day care of their child less than 17 years but wish to act as guardians and or financial representatives in making financial decisions for them, contact is to be made with the Regional Intake Team Leader, Child Protection to discuss the issue. Departmental staff or disability service providers must not assume the role of guardian or financial representative. 6.2 Residential services managers, including departmental disability accommodation services managers, can make financial decisions on behalf of these residents only when these decisions are funded from sources other than residents’ money, for example, from the residential service’s operating budget. 6.3 When residents turn 16 and are entitled to apply for a disability support pension, staff should assist them in lodging an application to Centrelink and opening a private bank account. Staff must not be a signatory to the account. 6.4 Where the resident lacks the capacity to provide informed consent or to lodge an application themselves and there is no other external person, such as a family member, known to the resident who is prepared to undertake this function, management can lodge an application directly with Centrelink, on the resident’s behalf. A trust account in the name of the resident should be set up either with a bank or as a subsidiary account within the resident’s trust fund held by the organisation. Centrelink payments are to be credited to the resident’s trust account. 6.5 Consistent with the principles of the Act, and the right as well as responsibility of residents to pay the residential charge, the service provider can advise Centrelink to deduct a specified amount from the support pension towards meeting the board and lodging costs of the resident (refer to the Centrelink rent deduction scheme). This is only appropriate where the costs are not met elsewhere (for example, financial support provided by the Office of Children). 6.6 The specified amount is to be based on the same board and lodging fee, or the sum of the rent component and the agreed housekeeping contribution that is applicable to the other residents in the same residential service. The amount can also include additional costs to cover any other program costs (for example, day program, education fees), including personal expenditure for personal items and community access that have to be met on behalf of the resident. However, the department’s policy states that the specified deduction amount must not exceed 75 per cent of the disability support pension, and 100 per cent of commonwealth rent assistance. Note that the provider has the responsibility to ensure that these funds are applied to cover all costs incurred on behalf of the resident. Rights and accountability: Management of money policy (April 2010) 10 6.7 Consistent with good practice, transparency and accountability principles there will be two different accounts held in trust in the name of the resident: a. A Residential charge deduction account – this account will receive the rent deduction paid by Centrelink. All outgoings are to be paid from this account, with proper authorisation by management and documentation for review or audit purposes. The residual balance in this account after deduction for board and lodging is for the purpose of meeting the personal expenditure needs of the resident. Where funds are insufficient to meet the financial needs of the resident, a reduced residential charge is to be applied where necessary. Note that any surplus funds from this account that have accumulated until the person turns 18 should be transferred to the resident’s account and funds handed over to a formally-appointed administrator (see below). b. A resident account to hold Centrelink payments – these funds will not be accessible until the person turns 18 and a formal administrator is appointed to make financial decisions on behalf of the resident. The disability service provider is responsible for providing all transaction details to the formal administrator. 6.8 All residents, irrespective of their age, who have the capacity and ability to make financial decisions have the right to make decisions about the use of their own money. Staff must provide appropriate support and guidance where requested but cannot make financial decisions on their behalf. This is a right of the individual and applies even when staff have a different view regarding the resident’s judgement on the use of funds. 7. All employees are expected to raise issues or concerns regarding conflict of interest between residents and parents, administrators, and nominated representatives. This includes bringing any demonstrated risks of financial neglect, exploitation or abuse of a position of trust to management’s attention. Assistance and support should be provided to the parties concerned. If unresolved, a request for a review of the current financial arrangements should be made to VCAT under the Guardianship and Administration Act 1986. Advice should be sought from the Office of the Public Advocate in these circumstances. B2 Residents’ money S93(1) Disability service providers may manage or control an amount of money that is not greater than the prescribed amount only if the disability service provider has written consent to do so from the resident or the resident’s guardian or the resident’s administrator. The objective of this section is to ensure adequate protection to the resident and the disability service provider when the resident lacks financial decision-making capacity regarding their funds and assets. Residents have varying capacity to make decisions at various times and in different situations. Where residents are capable of handling their own funds, they should operate and manage their own private bank accounts. It is expected that they have full access to their pension and other income. Wherever possible a resident must make his or her own financial decisions. If assistance is needed to do this, that should be provided. This role can be undertaken by families, guardians and administrators. Rights and accountability: Management of money policy (April 2010) 11 Policy application 1. Management or control of a resident’s money by disability service providers for the purpose of this section does not include the agreed financial plan for the accommodation support needs of the resident. This plan covers both the housekeeping provision and personal needs of the resident. Management of money should be linked to the support planning process for a resident. Consideration must be given to identifying the resident’s capacity to manage their own money. If the resident needs support to manage their money, the individual’s support planning process must determine any actions to be undertaken by the disability service provider on behalf of the resident. A financial plan to provide for the day-to-day accommodation needs of the resident should be prepared in consultation with the resident and their family, financial administrator or support network. This is an open collaborative financial planning process that is conducted in the best interest of the resident, during which a nominated representative, other than the disability provider or staff member, is agreed as the most appropriate person to provide financial management support to the resident. The nominated representative needs to make funds available to the disability service provider and to authorise the allocation of a resident’s funds in accordance with the needs of the individual, as agreed in the financial plan. The nominated representative is usually a formally-appointed financial administrator where a formal appointment is already in place, or may be the person who is the signatory to the resident’s Centrelink bank account. 2. Disability service providers are required to manage and account for these funds in a trustee capacity consistent with the authorised financial plan (refer to B5). This is only applicable where these funds are provided to meet planned household costs and personal items outside the residential charge. 3. Employees must not accept any delegations to make financial decisions on behalf of a resident in any transaction that cannot be reasonably considered as within the scope of an accommodation support and community access role. In this situation, a disability service provider or employee can only support a request if specific instruction in writing is provided from the nominated representative. This support does not include the handling of funds for these instructions unless the nominated representative is a formally appointed administrator. Examples of these may include: • Ad hoc significant requests outside the agreed financial plan initiated by the administrator for the benefit of the resident, for example, a special holiday trip or purchase of an entertainment system. In these situations, where required, staff can provide assistance and support to the resident to choose the preferred product and supplier. ‘Significant’ refers to the amount of expenditure involved and is relative to the overall agreed financial plan and the available funds held in trust. The nominated representative will be responsible for making direct payments on behalf of residents to the selected supplier. • Requests for transfer of funds or property of a resident held in trust to another party, other than the nominated representative. 4. Under the duty-of-care principle, staff should be supported by management to prevent ‘harm’ to residents. Harm is defined to include neglect, abuse and Rights and accountability: Management of money policy (April 2010) 12 exploitation. This is extended to the financial affairs of the person. Where there is evidence of this risk, after appropriate consultations and reasonable follow-ups with nominated representatives or administrators to resolve matters of concern, the disability service provider is to initiate a review by VCAT of current administration arrangements. Advice should be sought from the Office of the Public Advocate in relation to each case. B3 Maximum amount of cash being held on behalf of a resident 93(2) Where the amount of money of a resident being held by a disability service provider under (93)(1) exceeds the prescribed amount, and funds will not be spent within 14 days, the funds must be held in trust on behalf of the resident and deposited in a trust account until the funds are required. The objective of this clause is to set a reasonable monetary limit to minimise the risks to staff of holding and handling unnecessary large amounts of cash on the premises and to safeguard residents’ funds. Policy application 1. Prescribed amount: A $250 limit is set under regulation. 2. The Act requires any funds held in excess of this prescribed amount, that are not needed within 14 days to meet the financial needs of the resident, to be deposited into a trust account. These funds are for meeting residents’ daily personal needs, community access, respite or leisure activities over a fortnight whilst maximising the residents’ control over their finances overall. Money received from residents for rent or for board and lodging is not part of this prescribed amount. 3. Disability service providers must ensure processes are in place to identify funds that will not be used within the 14-day period that are over and above the prescribed amount. 4. Disability service providers must ensure that they establish an appropriate trust account to hold these funds. A trust account can be any account that is kept separate from other operating accounts of the organisation and must be linked to the purpose and identities of the beneficiaries, that is the residents. Resident funds can be held in one trust account but an individual’s entitlement under a subsidiary ledger account must be set up. B4 Resident’s money – Inclusions and exclusions S93(7) Money of a resident does not include money: a. payable to a disability service provider in relation to services provided by the service provider; or b. paid to the Secretary to purchase a disability service. Policy application Money of a resident does not include: a. Money for rent, rent and services or a combined board and lodging charge, where payment is made in respect of services received from the service provider. Rights and accountability: Management of money policy (April 2010) 13 b. Housekeeping and personal needs provision identified in the authorised financial plan for accommodation support. c. Any fee-for-service payment to the service provider in addition to all of the above. B5 Accountability for residents’ funds S93(3) Where a disability service provider manages or controls the money of a resident, they must: a. Keep a copy of the consent for that management or control. b. Keep the money of the resident in a secure place. c. Maintain an accurate and up-to-date financial management system that provides a record of: • the money of the resident • the receipt and expenditure by the disability service provider of the money any investment of the money. d. All records referred to above must individually itemise each transaction made on behalf of the resident. Penalty: 60 penalty units Policy application This applies to all funds held on behalf of residents, irrespective of their inclusion in the definition of ‘resident money’ for the purpose of various sections of this division of the Act. For instance, funds may be received in advance on behalf of a resident for subsequent disbursement for payment of rent, board and lodging, housekeeping contributions and so on, to the provider when due. This is the case with departmental managed services. These funds are defined as outside ‘resident money’ but until they are payable on the due date to the provider, they are received in trust as residents’ money. This does not apply to payments received from residents who may choose to pay their residential charges ahead of the due date. 1. Disability service providers must have processes in place to meet the above requirements of S93(3) and ensure that staff are aware of those processes. 2. Residents’ funds held in trust should be subject to an annual audit of the financial accounts of the organisation. 3. Residents must be advised upfront of any applicable fees and charges that are deducted from their account and the basis for these charges. This should be included in the organisation’s fees policy. B6 Provision of end-of-month financial statement and access to records S93(4) Disability service providers who manage or control the money of a resident must provide a statement at the end of each month to the resident or the resident’s guardian or the resident’s administrator specifying: 1. the current balance 2. any income received and expenditure incurred on behalf of the resident since the previous statement 3. the current status of any liabilities incurred on behalf of the resident. Rights and accountability: Management of money policy (April 2010) 14 Penalty: 60 penalty units Policy application 1. All disability service providers who manage or control the money of a resident must provide an end-of-month financial statement to the resident, or the resident’s guardian or the resident’s administrator or nominated representative, within a reasonable time period. This timeframe will depend upon the accounting processes, including reconciliation of accounts before the generation of financial statements. For example, with department-managed services, the statement is issued by the 20th of the month following the month the statement refers to. 2. Disability service providers should advise when this end-of-month statement would normally be available. 3. The financial information is confidential and must not be provided to any person who has not been authorised by the resident or the resident’s administrator or nominated representative. 4. If the statement is given to the resident, management needs to take reasonable steps to ensure that it is provided in a format and mode of communication that the resident is most likely to understand (refer to Section 7 of the Act regarding provider obligations in the provision of advice, notification or information under the Act). 5. Disability service providers need to ensure responsiveness for the timely provision of financial details on current resident account balance and details of recent transactions in response to the ad hoc requirements of residents or their nominated representative. B7 Authorised access to records 93(4) The disability service provider must, upon request, give access to the resident’s financial records held by the disability service provider to the resident or the resident’s guardian or the resident’s administrator. Penalty: 60 penalty units Policy application 1. All disability service providers must establish a culture that supports making financial records accessible and introduce a means of doing so in a way that protects the privacy and confidentiality of other residents’ records. 2. Disability service providers must provide access to the relevant source documents and financial records within a reasonable period in response to a request. Depending on the nature of the request, it may need to be made in writing to the disability service provider. 3. Quite often guardians or nominated representatives request details of household expenses and other costs that are recouped from residents. Where these expenditures are not part of the residential charge, access to these records should be made available when requested. B8 Investment of trust funds S94 The Secretary and disability service provider may invest any money held on behalf of a resident that is not immediately required for use by the resident. Money may be invested in any manner in which money may be invested under the Trustee Act 1958. Rights and accountability: Management of money policy (April 2010) 15 Policy application 1. Residents’ funds can be pooled for investment purposes. Management is responsible for ensuring that adequate resident funds are available to meet cash flow requirements. 2. Investments must be consistent with the requirements of the Trustee Act 1958. Please refer to Part 1-Investments of the Trustee Act. 3. The Secretary and the disability service provider must have a financial system that tracks and manages the investment returns of these funds. This includes a transparent methodology for the calculation of an equitable share of investment income earned and credited back to the individual resident’s trust account. This should be documented in the provider’s policy on the management of residents’ funds and advice provided to residents, guardians and nominated representatives. 4. A disability service provider may charge an administration fee for maintaining the trust account. Any fees and charges need to be transparent and reasonable. Fees and charges should not exceed financial industry charges for equivalent financial service provision. Residents must be advised of these charges before they are automatically deducted from their account. These fees and charges should be included in the provider’s policy for management of residents’ funds. B9 Limit on resident funds held in trust S95 The amount standing to the credit of a resident in that person’s trust account must not exceed the prescribed amount in regulation, which is $5,000. If the amount exceeds the prescribed amount, the Secretary or the disability service provider must arrange for the person, or the person’s representative, to be advised to invest the money in an appropriate manner. Policy application 1. The disability service provider must ensure that there are adequate processes and financial systems in place to identify when funds held are in excess of the prescribed amount. 2. Processes should also be developed to allow the person or their administrator or guardian to be notified of funds above the prescribed amount. These should include arrangements for these funds to be returned to allow the resident, administrator or guardian to invest them in an appropriate manner. 3. A disability service provider may choose to adopt a lower maximum threshold. As an example, it is recommended department-managed services take action when funds reach $3,000 to ensure they do not accrue to the $5,000 regulated amount. B10 Trust money must be paid when person leaves S96 When a resident ceases to reside in a residential service, the Secretary or disability service provider, as applicable, must pay all money standing to the credit of the individual in the residents’ trust fund or any trust account to the person or their representative. Policy application The Secretary or the disability service provider must ensure adequate processes are in place to identify funds attributable to an individual and reconcile all records in Rights and accountability: Management of money policy (April 2010) 16 relation to that individual to allow the return of funds to the resident, administrator or guardian within a reasonable period of time of departure, not exceeding 20 working days. B11 Residents’ trust fund – Departmental-managed residential services2 S91(1) The residents’ trust fund (RTF) established under Section 45 of the Intellectually Disabled Persons’ Services Act 1986 is continued under the Act. S92 Funds attributable to an individual, including all income earned, must be paid into the residents’ trust fund as soon as practicable. Policy application All residential services managed by the department will pay all relevant funds into the residents’ trust fund. Management is to ensure that departmental staff involved with residents’ money are aware of, and comply with, the requirements of all sections of this part of the Act. 2 The provision of outreach services does not fall under the definition of a residential service within the context of the Act. Section B is, therefore, not applicable to outreach services. For department-managed services, this means that the residents’ trust fund and the client expenditure recording system must not be used to manage funds for individuals receiving outreach support. All support providers should consider the management of an individual’s funds within the service planning context mindful of the individual’s needs, financial management skills and the ongoing development of these skills. This should include identifying situations where staff may be required to handle money on an individual’s behalf and implementing an appropriate level of accountability that is not administratively burdensome. Handling money may incorporate activities such as using cash or having access to bank account details, and account access cards. Rights and accountability: Management of money policy (April 2010) 17 Related policies, procedures and legislation Related policies and procedures and legislation for strengthening specific rights for persons residing in residential services in relation to the management of money include: • Charter of Human Rights and Responsibility, 2006 • Financial Management Act 1994 • Department of Treasury and Finance : Fact Sheet, Automatic Indexing of Fees and Fines • Guardianship and Administration Act 1986 • Victorian Civil and Administrative Tribunal Act 1998 • Trustee Act 1958 • Undue Financial Hardship Guidelines • Department of Human Services Information Sheet No 18: Management of money policy – For residents, guardians and administrators • Client Expenditure Recording System (CERS) (Department of Human Services Disability Services policy) • Disability Services Planning Policy • Quality Framework for Disability Services in Victoria • Disability Services Division Policy and Funding Plan Contacts Should there be any questions regarding this policy, please contact: The Legislation Team Disability Services Division Department of Human Services 8/50 Lonsdale Street, Melbourne, VIC, 3000 email: disability.legislation@dhs.vic.gov.au Or, for further information and advice contact: • Your regional Partnership and Services Advisor (PASA) for community service organisations. And for department-managed residential services, contact: • Regional CERS Officers; or • Divisional Client Funds Management Team. Approved Director, Planning and Resource Management Rights and accountability: Management of money policy (April 2010) 18