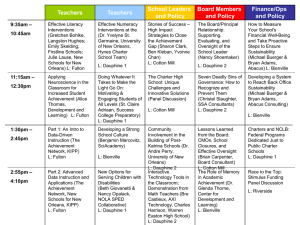

1. Dauphine Capital Partners

advertisement

MASTER 203 Working groups 2012 1. 2. 3. 4. 5. 6. 7. Dauphine Capital Partners .................................................................................................. 2 EMIS ................................................................................................................................... 3 Pandore ............................................................................................................................... 7 Stoic Investment .................................................................................................................. 8 Eurostoxx Systematic fund ................................................................................................. 9 EMER Fund ...................................................................................................................... 10 TRM .................................................................................................................................. 11 1. Dauphine Capital Partners Company name Group name Benjamin #1 Chemarin chemarin.benjamin@gmail.com Investment team #2 Hicham El Bahari h.elbahari@gmail.com (names of the group participants Omar El omar.elkendouci@gmail.com + email of the #3 Kendouci correspondent kenjilee10@gmail.com #4 Kenji Lee Université Paris Dauphine Université Paris Dauphine Université Paris Dauphine Université Paris Dauphine Fund name Dauphine Capital Partners Constant Proportion Portfolio Insurance Stategy, French Stocks, Key words German Bonds Our CPPI strategy guarantees the invested capital by providing in the same time a participation to the CAC 40 performance. It is well Fund suited to the current situation because the worst part of the crisis Objective/Description seems to be behind us but it can move quickly further into disress too. Hence, our fund allows to bet on the recovery of the economic growth by being hedged if this event doesn't appear. Investment universe Equities: Futures on CAC 40 / Fixed Income: Bunds It sounds to be a good project. http://www.lyxor.com/fr/notre-savoir-faire/gestion-structuree/fonds-a-coussin-cppi/ http://en.wikipedia.org/wiki/Constant_proportion_portfolio_insurance Comment 1. You should pay attention to the investor promise, i.e. what do you intend to protect, on wich time frame ?. For example, Sinopia managed a product range name acticlic. You could use this example to settle a quaterly 90% NAV protection. http://www.hsbc.fr/1/2/hsbc-france/entreprises-institutionnels/placements/acticlic-95-by-sinopia Comment 2. I want you to integrate cross assets in the performance engine. For example you could enlarge your investment universe to other risky assets like commodities, FX, Emerging bonds… As I mentioned, the portfolio need to consider an investment universe of at least 10 different assets. 2. EMIS Company name TCP Partners Group name #1 Tilila ELAOUADI t.elaouadi@hotmail.fr #2 Pushkar GUPTA pushkar.com@gmail.com #3 Chow Jin LEE lee_chowjin@hotmail.com Polytech’nice ESCP Europe National University of Singapore #4 Fund name EMIS Key words > Global macroeconomic events > Risk-adjusted return > Directional investment strategy > Use macroeconomic analysis based on global market events and trends to identify opportunities for investment that would profit from anticipated price movements. Fund > Use leverage to take large positions in diverse investments in Objective/Description multiple markets > Long and short positions, in order to profit in both market upswings and downswings Investment universe Equities, bond, commodities or currency markets Data request German bunds, Gold, EUR GBP, CAC40, EUROSTOXX50 This project looks very wide. Could you precise it by defining a benchmark, this will help you in defining your SRRI. I Remind you must consider an investment universe of at least 10 different assets. As you should manage a coordinated fund, take care of the leverage ratio. De : pushkar gupta [mailto:pushkar.com@gmail.com] Envoyé : vendredi 24 février 2012 14:38 À : francois.jubin@wiseam.fr Cc : Tilila El Aouadi; lee chow jin Objet : Master 203 - EMIS group Strategy Equity: 30-40% We will use Pairs trading/beta neutral trading/sector Neutral trading using S&P 500, Eurostoxx, and DAX equities. We will look for potential pairs among these indices and even across these indices from same sector. We enter a position when the spread of the pair is 2x (std dev) higher than historical mean. As the equities are mean reverting, pairs trading can be very useful and we can arbitrage cross country as well. I understand that you get data from individual stocks of the three mentioned markets (SP500, Euro Stoxx and Dax). Is that correct? What can of spread do you mean? Is that a spread in momentum, in valuation ratios or other item? Could you precise this? Fixed Income: 30-40% We will use the trend following strategy to detect the relevant signals like spreads and yield curve convexity. We will then use these signals to make systematic fixed income arbitrage bets. We will only make spread and yield arbitrage strategies using Citi WGBI all maturities bonds (23 countries) and Euribor and libor and other developed countries' swap rates. We will then go for either swap-spread and/or yield curve arbitrage. Do you mean you will consider individual bonds or generic bonds through swap of futures? Currencies: 20-40% We can either go for correlation trading pairs like in equities or for fixed income arbitrage in FOREX swap. We can use all the G-8 currency pairs We will have stop loss strategy to exit our positions without having high losses. We will maintain our leverage ratio equal to 1. The downside of this is that we will not have high potential gains but we will limit our downside risk as well. We will take 5-10 year data to back test. Benchmark:40% MSCI International equity index + 40% CITI WGBI + 20% MSCI EAFE Currency [USD] Index See comments on page “Investment constraints for long only portfolios” of the Template for presentation.PPT Could you forward me an example of portfolio that could meet your strategy and constraints? O Fund du Goofre Company name Du Goofre Asset Management #1 ANDRIEUX Guillaume Investment team (names of the #2 COCAULT Julien group participants + email of the #3 MAHADEA Ghirish correspondent #4 OZHAN Emeline CESEM / Reims Mgt guillaume.andrieux89@gmail.com School IUP Caen julien.cocault@gmail.com Normandie Université de Lille 1 ghirisha@gmail.com Université de emeline.ozhan@etu.univorleans.fr Orléans Fund name O'Fund Key words Balanced investment strategy, European exposure, Benchmark (50%Eurostoxx 50 + 50%EuroMTS New EU Index), Austrian Liquidity cycle. *The O’Fund is located in Luxemburg and complies with the CSSF legislation and the UCITS IV directive. Fund Objective/Description O’Fund – Du Goofre Asset Management aims at providing a positive return over the long run by investing in equities and fixed income securities that are traded on a regulated stock exchange and that may be considered as eligible assets by the UCITS IV (2009/65/EC) directive. The objective of the fund is to gain exposure on the North American economy by investing in companies having their registered office or undertaking a preponderant part of their business activities in the United States. The strategy pursued is a balanced investment strategy. The strategic allocation will be defined on a monthly basis by the asset managers thanks to economic ratios that will define the liquidity of stocks and bonds markets. The asset with the most attractive upside will be over weighted. The use of derivatives will be limited to hedging purposes and will not, in any case, be used for speculation. Naked short selling, as specified in the UCITS directive will simply be prohibited. Even though a specific asset class will be over weighted in the fund, diversification and concentration ratio will be respected. The Reference Currency of the Fund is the Dollar. Investment universe The fund may invest in equities and fixed income securities that are operating in North American or having their head office located in such countries. The use of derivatives is allowed for hedging purposes. Data request To be able to back test the strategy, investment managers will need the prices of each underlying of the S&P 500 as well as the prices of each underlying of the Dow Jones 20 Bond Index. To define the liquidity cycle, the 3 Months Treasury Bills yield, the Dow Jones 20 Bond Index, the 30 year Government (USA) Bond Yield, the capacity utilization ratio, the industrial production ratio, the USA unemployment ratio, the CPI Inflation rate, the Quarterly GDP and the Commodity Research Bureau Index over the period will also be needed. It sounds on the good track. Just a little discrepancy between your investment universe (US markets) and your Benchmark (European indexes). I understand you already have all the data collection needed. 3. Pandore Pandore Investment Investment team #1 (names of the #2 group participants #3 + email of the #4 correspondent Pandore A Vincent Bilard Colin Gloeckler Dylan Janet bilard.v@gmail.com colin@gloeck.com dylanjanet@gmail.com AgroParisTech ENSEA McGill, Canada Guillaume Ducongé guillaume.duconge@live.fr Dauphine Key words MVP, Momentum. Fund Objective/Description Research a Minimum Variance Portfolio using equities, bonds and commodities. Investment universe Data request Equities, gov-bonds, commodities. CAC40 components from 2000, French 5Y yield from 2000, Fund objective sounds good. You may face an important issue if you consider 5Y bond in your investment universe : since a minimum variance portfolio is carried out, it’s likely that the 5 Y bond will act as an anchor in your model and there is litlle chance to allocate assets to riskier one. But go forward, and you will see. May be you will have, in a second step, to define a more homogenous investment universe. 4. Stoic Investment Company name Group name Investment team (names of the group participants + email of the correspondent #1 Vincent Minichetti #2 Franck Sebakhi #3 Hatim Benlemlih #4 name University of Reading f.sebakhi@gmail.com ESTP hatim.belemlih@gmail.com INSA Lyon initial school / email univertity mvincent89@gmail.com Fund name Stoic Investment Key words Balanced Portfolio - Long Short Equity Portfolio - HFT Fund Objective/Description Investment universe Data request The idea behind Stoic Investment is to stay in the safe zone in case of global equity meltdown. We secure our investment with commodities such as gold and silver inversely correlated with equities. We will try to catch the upside in the commodities market (precious metals). And aswell with governement bonds which will again secure a minimum return on investment. We will use Dynamic trading (HFT) to catch variable opportunities intraday and enhance global return of our fund. Equity, Commodities, Fixed Income S&P500(5 years) Gold (5years) Silver (5years), UK Gov Bonds Mat 1Year (5years) Your investment universe is not precise enough. Your key words let suppose that you are going to manage equities. Your fund objective suggests you will use indexes and your data request is unclear. As I mentioned in the last session, you can only trade once a day. Hence, you won’t be able to implement HFT in your strategy. 5. Eurostoxx Systematic fund Company name Investment team (names of the group participants + email of the correspondent Group name #1 DORFMANN maxime_dorfmann@hotmail.com DAUPHINE #2 BEHAR #3 ROSO colin.behar@gmail.com #4 name email roso.harold@gmail.com DAUPHINE DAUPHINE initial school / univertity Fund name Eurostoxx Systematique Fund Options; Moving Average; Performance; Market signal; Cash Key words investment The objective of the fund is to capture market signals through the SX5E moving average. If the signal is positive we are long ATM call Fund on the SX5E in order to leverage the fund, if the signal is negative, Objective/Description we sell call to get premiums that we will invest at EONIA. The time horizon is between two and four years Investment universe Call 5X5E SX5E closing prices since 2000. Vsotx index prices ;SX5E Call ATM Data request closing price 1M 3M 6M in order to backtest. EONIA fixings This fund description does not correspond to the guidelines. You have to consider a wider investment universe in order to get finally a diversified portfolio (10 securities minimum). 6. EMER Fund Company name BBLT Investments Christopher christopher@bender.fr #1 BENDER Investment team bucher.julie90@gmail.com #2 Julie BUCHER (names of the group participants Pernelle pernelle.lombard@hotmail.fr #3 + email of the LOMBARD correspondent lisaturk@hotmail.com #4 Lisa TURK Fund name EMER Globe Key words - Trend following - Global macro - Value investing Telecom Business School University Assas University Dauphine University Dauphine The objective of EMER Globe is to invest in emerging markets to take advantage of the high potential of reward attached to superior Fund growth prospects of industries in emerging countries. As a result we Objective/Description recognize that these investments come with a higher risk, therefore we place strong emphasis on the assessment and mitigation of such risks to guarantee secure returns for our investors. Investment universe Emerging markets indices and stocks picking in diverse industries among which: telecom, energy, consumer, health. Data request Historical quotes of firms included in MSCI Emerging Markets ETF First of all, you have been very late to send me your term sheet. You have to be more responsive. As far as your investment universe is concerned, it seems you want to invest in stocks with a global macro view and then you favor value investing with trend following approaches : this looks in some way inconsistent. Now, you have to define your objective more precisely your objective by setting a benchmark. 7. TRM Company name TRM #1 LEVY Yoni Investment team (names of the group #2 TROGMAN Dolev participants + email #3 PAVARD Ambre of the #4 name correspondent yonilevy@msn.com dolev3@msn.com ambre_p@msn.com email DAUPHINE DAUPHINE DAUPHINE initial school / univertity Fund name KECEF Key words Long/Short strategy ( Buy selection of equities/Sell index) Fund Objective/Description We want to find the best 10% equities of the FTSE100. We build criterias , in order to buy the best selection and to sell the index.The goal is to win the spread. This is a long term strategy. Investment universe Data request Equites FTSE100, each equitiy of the FTSE100 FTSE 100 since 2000, each equity of the FTSE 100 since 2000. You do not need to implement a long short strategy if your benchmark is the FTSE 100. Since the benchmark weights are considered as the neutral position, every underweight in your portfolio will have the same effect as a short position in a total return fund. Nevertheless, if you absolutely want to consider a long/short strategy where the benchmark could be the money market index, you will have to define risk constraint in absolute terms and therefore calculate the relevant SRRI. Do you get the data on individual stocks of the FTSE 100 Index? Could you precise the criteria you would like to use in selecting stocks and the data set you get?