Annual Report 2011/12 (Word Version)

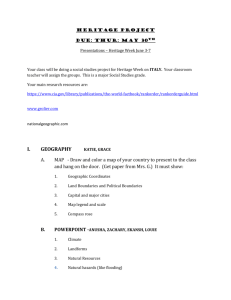

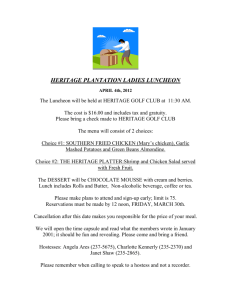

advertisement