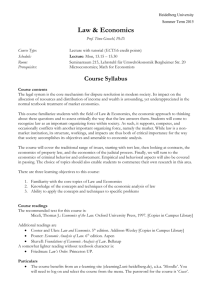

Reading List - UCSB Economics

advertisement

References by topic Social preferences and fairness Andreoni, James (1990), “Impure Altruism and Donations to Public Goods: A Theory of Warm Glow Giving,” Economic Journal, 100, 464-477. Bolton, Gary E. & Ockenfels, Axel (2000), “ERCA Theory of Equity, Reciprocity and Competition,” American Economic Review, 90, 166-193. Charness, Gary & Matthew Rabin (2002), “Understanding Social Preferences with Simple Tests,” Quarterly Journal of Economics, 117, 817-869. Charness and Rabin (2001), “Expressed Preferences and Behavior in Experimental Games,” literature review contained therein, available from my website. Dufwenberg, M. & Kirchsteiger, G. (1998), “A Theory of Sequential Reciprocity,” forthcoming in Games and Economic Behavior. Falk, A. & Fischbacher, U. (1998), “A Theory of Reciprocity,” forthcoming in Games and Economic Behavior. Fehr, Ernst & Schmidt, Klaus (1999), “A Theory of Fairness, Competition, and Cooperation, ” Quarterly Journal of Economics, 114, 817-868. Rabin, Matthew (1993), “Incooperating Fairness into Game Theory and Economics,” American Economic Review, 83, 1281-1302. Communication and deception Akerlof, A. (1970), “The Market for Lemons: Quality Uncertainty and the Market Mechanism,” Quarterly Journal of Economics, 85, 488-500. ***Brandts, J. & G. Charness (2003), “Truth or Consequences: An Experiment,” Management Science, 49, 116-130. Charness, G. (2000) “Self-serving Cheap Talk and Credibility: A Test of Aumann’s Conjecture,” Games and Economic Behavior 33, 177-194. ***Charness, G. & M. Dufwenberg (2003), “Promises & Partnership,” mimeo. Cooper, R., D. DeJong, R. Forsythe & T. Ross (1992), “Communication in Coordination Games,” Quarterly Journal of Economics, 107, 739-771. Crawford, V. (1998), “A Survey of Experiments on Cheap Talk,” Journal of Economic Theory, 78, 286-298. ***Gneezy, U. (2003) "Deception: The role of consequences," mimeo. Behavioral finance ***Benartzi, S. and R. Thaler (1995), “Myopic Loss Aversion and the Equity Premium Puzzle,” Quarterly Journal of Economics, 110, 75-92. 1 Biais, B., D. Hilton, K. Mazurier & S. Pouget (2002), “Psychological Dispositions and Trading Behavior,” forthcoming in Review of Economic Studies. ***Charness, G. and U. Gneezy (2003), “Portfolio Choice and Risk Attitudes: An Experiment,” mimeo. Daniel, K., D. Hirshliefer & A. Subramanyam (1998), “Investor Psychology and Security Market Under- and Over-reactions,” Journal of Finance, 53, 1839-1886. Fama, E. (1998), “Market Efficiency, Long-term Returns and Behavioral Finance,” Journal of Financial Economics, 49, 283-306. Gneezy, U. and J. Potters (1997), “An Experiment on Risk Taking and Evaluation Periods, Quarterly Journal of Economics, 112, 631-645. Hirshleifer, D. (2001), “Investor Psychology and Asset Pricing,” Journal of Finance, 56, 1533-1597. Lei, V., C. Noussair & C. Plott (2001), “Non-Speculative Bubbles in Experimental Asset Markets: Lack of Common Knowledge of Rationality vs. Actual Irrationality,” Econometrica, 69, 831-859. ***Odean, T. (1999), “Do Investors Trade too Much?,” American Economic Review, 89, 1279-1298. ***Smith, V., G. Suchanek & A. Williams (1988), “Bubbles, Crashes, and Endogenous Expectations in Experimental Spot Asset Markets,” Econometrica, 56, 1119-1151. Anthropology and evolution Camerer, C. and E. Fehr (2001), “Measuring social norms and preferences using experimental games: A guide for social scientists,” in Henrich, Boyd, Bowles, Gintis, Fehr, Camerer (editors) Foundations of Human Sociality: Ethnography and Experiments in 15 small-scale societies, forthcoming, Oxford University Press. Cosmides, L. and J. Tooby (1996), “Are humans good intuitive statisticians after all? Rethinking some conclusions from the literature on judgement under uncertainty,” Cognition, 58, 1-73 Henrich, J. (2001), “Cooperation, Reciprocity, and Punishment in Fifteen Small-scale Societies,” short version Henrich, J. & R. McElreath (2002), “Are Peasants Risk Averse Decision-Makers?,” Current Anthropology, 43, 172-181. 2 Henrich, J. (2000), “Does culture matter in economic behavior? Ultimatum game bargaining among the Machiguenga,” American Economic Review, 90, 973-979 (also, long version from website) Henrich, J., R. Boyd, S. Bowles, C. Camerer, H. Gintis, R. McElreath and E. Fehr (2001) “In search of Homo economicus: Experiments in 15 Small-Scale Societies,” American Economic Review, 91, 73-79. Henrich, Joseph & Natalie Smith (forthcoming), “Comparative experimental evidence from Machiguenga, Mapuche, Huinca & American populations shows substantial variation among social groups in bargaining and public goods behavior,” in Foundations of Human Sociality: Ethnography and Experiments in 15 small-scale societies, edited by Henrich, J., R. Boyd, S. Bowles, H. Gintis, E. Fehr and C. Camerer, Oxford University Press. Mehta, J., C. Starmer, C. and R. Sugden (1994), “The Nature of Salience – an Experimental Investigation in Pure Coordination Games,” American Economic Review, 84, 658-673 Emotions, punishment, and identity ***Akerlof, G. & R. Kranton (2000). “Economics and Identity,” Quarterly Journal of Economics, 115, 715-753. Charness, G. and D. Levine (2003), “The Road to Hell: An Experimental Study of Intentions,” mimeo Fehr, E. and S. Gachter (2000), “Cooperation and Punishment in Public Goods Experiments,” American Economic Review, 90, 980-994. ***Fehr, E. and S. Gachter (2002), “Altruistic Punishment in Humans,” Nature, 415, 137-140. ***Henrich, J. and R. Boyd (2001), “Why people punish defectors,” Journal of Theoretical Biology, 208, 103-119. Kirchsteiger, G., L. Rigotti & A. Rustichini (2001), “Your Morals are Your Mood,” mimeo. Loewenstein, G. (1996), “Out of control: visceral influences on behavior,” Organizational Behavior and Human Decision Processes, 65, 272-92. ***Loewenstein, G. (2000), “Emotions in economic theory and economic behavior,” American Economic Review: Papers and Proceedings, 90, 426-32. Intertemporal choice and self-control 3 ***Laibson, D. (1997), “Golden Eggs and Hyperbolic Discounting,” Quarterly Journal of Economics, 112, 443-478. Lowenstein, G. and J. Elster (1992), Choice over Time, New York: Russell Sage Foundation. Loewenstein, G. and Thaler, R. (1989), “Anomalies: Intertemporal Choice,” Journal of Economic Perspectives, 3, 181-193. ***O’Donoghue, T. and Rabin, M. (1999), “Doing it Now or Later,” American Economic Review, 89, 103-124. O'Donoghue, T. & M. Rabin (1999), “Incentives for procrastinators,” Quarterly Journal of Economics, 114, 769-816. Prelec, D. and G. Loewenstein (1998), “The Red and the Black: Mental Accounting of Savings and Debt,” Marketing Science, 17, 4-28. ***Thaler, R., D. Kahnemann, J. Knetsch (1992), “Intertemporal Choice,” in The Winner’s Curse, New York: The Free Press. Adaptive Learning ***Camerer, C. & T.-H- Ho (1999), “Experience-Weighted Attraction Learning in Normal Form Games,” Econometrica, 67, 827-874. Crawford, V. (1995), “Adaptive Dynamics in Coordination Games,” Econometrica, 63, 103-143. ***Erev, I. & A. Roth (1998), “Predicting How People Play Games: Reinforcement Learning in Experimental Games with Unique, Mixed Strategy Equilibria,” American Economic Review, 88, 848-81. Fudenberg, D. and D. Levine, Theory of Learning in Games, MIT Press, but can also be downloaded at http://levine.sscnet.ucla.net ***Nagel, Rosemarie (1995), “Unravelling in Guessing Games: An Experimental Study,” American Economic Review, 85, 1313-26. Roth, A. and Erev, I. (1995), “Learning in Extensive-form Games: Experimental Data and Simple Dynamic Models in the Intermediate Term,” Games and Economic Behavior, 8, 164-212. ***Selten, R. (1991), “Evolution, Learning & Economic Behavior,” Games & Economic Behavior 3, 3-24. Stahl, D. (1996), “Boundedly Rational Rule Learning in a Guessing Game,” Games and Economic Behavior, 16, 303-330 4 Other readings Anderson, L. & C. Holt (1997), "Information Cascades in the Laboratory", American Economic Review 87, 847-862. Anderson, S. & S. Martin (eds.) (2000), Special issue on experimental methods in industrial organization, International Journal of Industrial Organization 18. Andreoni, J. & L. Vesterlund (2001), "Which is the fair sex? Gender differences in altruism", Quarterly Journal of Economics, vol. 116, 293-312. Apesteguia, Jose, Martin Dufwenberg & Reinhard Selten (2003), Blowing the whistle, Discussion Paper 9/2003, Bonn Graduate School of Economics. Banerjee, A. (1992) "A Simple Model of Herd Behavior", Quarterly Journal of Economics 107, 797-817. Baumeister, Roy F., Stillwell, Arlene M. and Heatherton, Todd F. (1995), "Personal Narratives about Guilt: Role in Action Control and Interpersonal Relationships", Basic and Applied Social Psychology 17, 173–98. Bikhchandani, S., D. Hirschleifer & I. Welch (1992), "A Theory of Fads, Fashion, Custom, and Cultural Change as Informational Cascades ", Journal of Political Economy 100, 992-1026. Bosman, R., & Winden, F., van, (2002), Emotional hazard in a power-to-take game experiment. The Economic Journal 112, 147-169. Camerer, C (1997), "Progress in Behavioral Game Theory", Journal of Economic Perspectives 11, 167-88. Chamberlain, E. (1948), "An Experimental Imperfect Market", Journal of Political Economy 56, 95-101. Cox, J. (2004), “How to Identify Trust and Reciprocity,” Games and Economic Behavior 46, 260-81. Cox, J. & D. Friedman, “A Tractable Model of Reciprocity and Fairness,” Working Paper 02-04, Department of Economics, University of Arizona. Cox, J. & V. Sadiraj (2001), “Risk Aversion and Expected Utility Theory: Coherence for Smalland Large-Stakes Gambles,” Working Paper 01-03, Department of Economics, University of Arizona. Cox, J. V. Smith & J. Walker (1988), "Theory and Individual Behavior of First Price Auctions," Journal of Risk and Uncertainty, March, 61-99. Davis, D. & C. Holt (1993), Experimental Economics, Princeton University Press. Dufwenberg, Martin (2002), Marital investment, time consistency & emotions. Journal of Economic Behavior and Organization 48, 57-69. Dufwenberg, Martin and Gneezy, Uri (2000), Measuring beliefs in an experimental lost wallet game, Games and Economic Behavior 30, 163-182. Dufwenberg, M. & Kirchsteiger, G. (2000), Reciprocity and wage undercutting (with Georg Kirchsteiger), European Economic Review 44, 1069-78. 5 Dufwenberg, M, T Lindqvist & E Moore (2003) Bubbles & experience: An experiment on speculation, Working Papers in Economics 2003:1, Stockholm University. Elster, J. (1998), "Emotions and Economic Theory", Journal of Economic Literature 36, 47-74. Fehr, E. & A. Falk (2002), Psychological Foundations of Incentives, European Economic Review 46, 687-724. [Ernst Fehr’s Josef Schumpeter Lecture, Annual Meeting of the EEA 2001] Fehr, Ernst & Simon Gächter (2000), “Fairness and Retaliation: The Economics of Reciprocity,” Journal of Economic Perspectives 14, 159-191. Fehr, E., Kirchsteiger, G. & Riedl, A. (1993), "Does Fairness Prevent Market Clearing? An Experimental Investigation", Quarterly Journal of Economics 108, 437-460. Fershtman, C. & U. Gneezy (2001) "Discrimination in a Segmented Society: An Experimental Approach”, Quarterly Journal of Economics, February, 351-377. Forsythe, R., F. Nelson, G. Neumann & J. Wright, "Anatomy of an Experimental political Stock Market", American Economic Review 82, 1142-1161. Frederick, S., G. Loewenstein & T. O'Donoghue (2002), Time Discounting and Time Preference: A Critical Review, Journal of Economic Literature XL, 351-401. Friedman, M. (1953), Essays in Positive Economics, University of Chicago Press. Friedman, D. and Sunder, L (1994), Experimental Methods, A Primer for Economists, Cambridge U.P. Geanakoplos, John, Pearce, David & Stacchetti, Ennio (1989), "Psychological Games and Sequential Rationality", Games and Economic Behavior 1, 60-79. Gigerenzer, G. (1991), "How to Make Cognitive Illusions Disappear: Beyond 'Heuristics and Biases", European Review of Social Psychology 2, 83-115. Gigerenzer, G. (1996), "On Narrow Norms and Vague Heuristics: A Reply to Kahneman and Tversky", Psychological Review 3, 592-596. Goranson, Richard E. and Berkowitz, Leonard (1966), "Reciprocity and Responsibility Reactions to Prior Help", Journal of Personality and Social Psychology 3(2), 227-232. Gneezy, U. & A. Rustichini "A Fine is a Price," (2000) Journal of Legal Studies, vol. XXIX, part 1, 1-18. Gneezy, U. & A. Rustichini (2000) "Pay Enough or Don't Pay At All," Quarterly Journal of Economics, August, 791-810. Gneezy, U., M. Niederle & A. Rustichini (2003) "Performance in competitive environments: Gender differences," Quarterly Journal of Economics, August, 1049-1074. Gneezy, U. (2003) "The W effect of incentives," mimeo, University of Chicago GSB. Greenberg, Martin S. and Frisch, David M. (1972), "Effect of Intentionality on Willingness to Reciprocate a Favor", Journal of Experimental Social Psychology 8, 99111. 6 Grether, D. & C. Plott (1979), "Economic Theory of Choice and the Preference Reversal Phenomenon", American Economic Review 69, 623-638. Güth, W. & M. Yaari (1992), "Explaining reciprocal behavior in simple strategic games: An evolutionary approach", Ch. 2 in Explaining process and change: Approaches to evolutionary economics (U. Witt, ed.), Univ. of Michigan Press, Ann Arbor, 23-34. Harrison, Glenn (1989), "Theory and Misbehavior of First-Price Auctions," American Economic Review 79, 749-762. [See also the follow-up exchange in the AER vol. 82, with comments by Friedman; Kagel & Roth, Cox, Smith & Walker; Merlo & Schotter, and Harrison]. Hoffman, Elizabeth, McCabe, Kevin and Smith, Vernon L. (1996), ”Social Distance and Other-Regarding Behavior in Dictator Games”, American Economic Review 86(3), 653660. Huck,-Steffen & Jörg Oechssler (1999), "The Indirect Evolutionary Approach to Explaining Fair Allocations", Games-and-Economic-Behavior 28, 13-24. Huck,-Steffen, Hans-Theo Normann & Jörg Oechssler (1999), "Learning in Cournot Oligopoly--An Experiment", Economic-Journal 109, pages C80-95. Huck,-Steffen, Hans-Theo Normann & Jörg Oechssler (2000), “Does information about competitors' actions increase or decrease competition in experimental oligopoly markets?”, International Journal of Industrial Organization. 18, 39-57. Isaac, R. M. & J. M. Walker (1985) Information and Conspiracy in First Price Auctions, Journal of Economic Behavior & Organization 6, 139-59. Kagel, J. & A. Roth (eds.) (1995), The Handbook of Experimental Economics, Princeton University Press. Kahneman, D. & A. Tversky (1996), "On the Reality of Cognitive Illusions", Psych. Review 3, 582-92. Kirchsteiger, G. (1994), "The role of Envy in Ultimatum Bargaining", Journal of Economic Behavior and Organization 25, 373-3980. Kirchsteiger, G., M. Niederle & J. Potters (1998), "The Endogenous Evolution of Market Institutions", CentER Discussion paper No. 9867. Loewenstein, G. (1999), "Experimental Economics from the Vantage Point of Behavioural Economics", Economic Journal 109, F25-34. Lucking-Reiley, David (1999) “Using Field Experiments to test Equivalence Between Auction Formats: Magic on the Internet,” American Economic Review 89, 1063-1079. McKelvey, R. & T. Palfrey (1995) "Quantal Response Equilibria for Normal Form Games," Games and Economic Behavior 10, 6-38. Moreno, Diego & John Wooders (1996) "Coalition-Proof Equilibrium," Games and Economic Behavior 17, 80-112. Moreno, D & J Wooders (1998) "An Experimental Study of Communication and Coordination in Noncooperative Games," Games and Economic Behavior 24, 47-76. 7 Charles Mullin & David Reiley (2004) "Recombinant Estimation for Normal-Form Games, with Applications to Auctions and Bargaining", forthcoming in Games and Economic Behavior. Ockenfels, Axel & Reinhard Selten (2003) Impulse balance equilibrium and feedback in first price auctions, mimeo, University of Cologne. Osborne, M. & A. Rubinstein (1998), "Games with Procedurally Rational Players", American Economic Review 89, 834-847. Plott, Charles R. (1987), "Dimensions of Parallelism: some Policy Applications of Experimental Methods," in Laboratory Experimentation in Economics: Six Points of View, Alvin E. Roth (ed.), New York, Cambridge University Press. Plott, C. (1989), ”An Updated Review of Industrial Organization: Applications of Experimental Economics,” in Handbook of Industrial Organization, vol II, R. Schmalensee and R. Willig (eds.), Amsterdam: North Holland, 1989. Rabin, M. (1998), "Psychology and Economics", Journal of Economic Literature 36, 1146. Rabin, Matthew (2000b): “Risk Aversion and Expected Utility Theory: A Calibration Theorem,” Econometrica 68, 1281-92. Rabin, M. & J. Schrag (1998), "First Impressions Matter: A Model of Confirmatory Bias", Quarterly Journal of Economics, February issue, 37-82. Rapoport, A. & Amaldoss,W. (2000) Mixed strategies and iterative elimination of strongly dominated strategies: an experimental investigation, Journal of Economic Behavior and Organization 42, 483–521. Roth, Alvin E (1988), Laboratory Experimentation in Economics: A Methodological Overview, Economic Journal, 98(393), 974-1031. Roth, Alvin E (1994), Lets Keep the Con out of Experimental Economics: A Methodological Note, Empirical Economics; 19(2), 279-89. Roth, A.E. & X. Xing (1994) "Jumping the Gun: Imperfections and Institutions Related to the Timing of Market Transactions," American Economic Review 84, 992-1044. Roth, Alvin E. and Axel Ockenfels "Last-Minute Bidding and the Rules for Ending Second-Price Auctions: Evidence from eBay and Amazon Auctions on the Internet," American Economic Review 92, 1093-1103. Rubinstein, A. (1998), Modeling Bounded Rationality, MIT Press. Rubinstein, A. (2001), A Theorist's View of Experiments, European Economic Review 45, 615-628. Selten, R. (1997), "Features of Experimentally Observed Bounded Rationality", Presidential address at the 1997 EEA meeting in Toulouse, Discussion paper B-421, Sonderforschungsbereich 303, University of Bonn. Selten, R., A. Sadrieh & K. Abbink (1995), “Money Does Not Induce Risk Neutral Behavior, but Binary Lotteries Do Even Worse,” Discussion Paper No. B-343, University of Bonn. 8 Smith, V. (1962), "An Experimental Study of Competitive Market Behavior", Journal of Political Economy 70, 111-37. Smith, Vernon (1976), Experimental Economics: Induced Value theory, American Economic Review (P&P), 66, 274-279. Smith, V. (1982), Microeconomics as an Experimental Science, American Economic Review 72 , 923-955. Smith, V., G. Suchanek & A. Williams (1987), "Bubbles, Crashes and Endogenous Expectations in Experimental Spot Asset Markets," Econometrica 56, 1119-51. Starmer, Chris (2000) Developments in non-expected utility theory: the hunt for a descriptive theory of choice under risk, Journal of Economic Literature, 332-382. Tversky, A. & D. Kahneman (1974), Judgment under uncertainty: Heuristics and biases, Science 185, 1124-31. Van Huyck, J., R. Battalio & R. Beil (1990), "Tacit Coordination Games, Strategic Uncertainty, and Coordination Failure", American Economic Review 80, 234-248. Walker, J., V. Smith & J. Cox, "Inducing Risk-Neutral Preferences: An Examination in a Controlled Market Environment," Journal of Risk and Uncertainty 3, 5-24. Weibull, J. W. (2002), Testing game theory, mimeo, Boston University. 9