Table of Contents

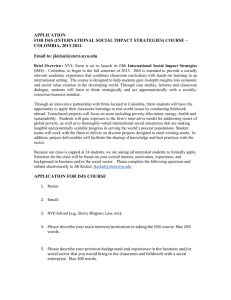

advertisement

Table of Contents Table of Contents ...................................................................................................................................... 1 1.0 Executive Summary ...................................................................................................................... 3 1.1. Business Problem ........................................................................................................................ 3 1.2. Results ......................................................................................................................................... 3 1.3. Recommendations ....................................................................................................................... 3 2.0 Introduction ................................................................................................................................... 5 2.1. Research Objectives .................................................................................................................... 5 2.2. Scope of the study ....................................................................................................................... 5 2.3. Response ..................................................................................................................................... 6 3.0 Method/Research Design .............................................................................................................. 7 3.1. Sampling Technique ................................................................................................................... 7 3.1.1. Sample size ......................................................................................................................... 7 3.1.2. Sample Characteristics ........................................................................................................ 7 3.2. Data Collection Method .............................................................................................................. 7 3.3. Measurement ............................................................................................................................... 7 3.4. Quantitative Analysis Procedures ............................................................................................... 8 3.4.1. Analytical Procedures ......................................................................................................... 8 3.4.2. Statistical Package .............................................................................................................. 8 3.4.3. Coding Procedures .............................................................................................................. 8 4.0 Results .......................................................................................................................................... 10 4.1. Measure of Price Sensitivity ..................................................................................................... 10 4.1.1. Subscription fees cut by half from current rates: .............................................................. 10 4.1.2. Free Subscription: ............................................................................................................. 11 4.1.3. Charging Subscription fees for online news sites: ............................................................ 12 4.2. Measure of Product Relevance to readers ................................................................................. 12 4.2.1. Topics read most ............................................................................................................... 12 4.2.2. More local news or event listings ..................................................................................... 12 4.2.3. Coupons and Good deals: ................................................................................................. 13 4.2.4. Importance of Multimedia Features: ................................................................................. 14 4.2.5. Use of blogs and Search Engines ...................................................................................... 14 4.3. Measure of Convenience........................................................................................................... 15 4.3.1. Newspapers convenient to read anytime........................................................................... 15 5.0 Lessons Learned and Limitations ............................................................................................. 17 5.1. Lessons Learned: ...................................................................................................................... 17 5.2. Research Limitations: ............................................................................................................... 17 6.0 Recommendations and Next Steps ............................................................................................ 19 6.1. Price cuts or price eliminations ................................................................................................. 19 6.2. Improve content and increase promotion of selected news areas ............................................. 19 6.3. Improve easier usage of the newspaper .................................................................................... 19 6.4. Strengthen relationships or increase business alliances with search engines ........................... 20 6.5. Other tested options .................................................................................................................. 20 7.0 Appendices ................................................................................................................................... 21 7.1. Exhibit 1: Survey Questions & Coding .................................................................................... 21 The NY Times NYU Stern School of Business 7.2. Exhibit 2: Example of multiple response analysis: ................................................................... 27 7.3. Exhibit 3: Convenience questions and summary (5 questions) ................................................ 28 7.4. Exhibit 4: Relevance questions and summary (8 questions) .................................................... 33 7.5. Exhibit 5: Price Sensitivity questions and summary (3 questions) ........................................... 38 7.6. Exhibit 6: Demographics questions and summary (5 questions) .............................................. 42 7.7. Exhibit 7: Psychographics questions and summary (6 questions) ............................................ 46 7.8. Exhibit 8: Summary of Exploratory Research Findings ........................................................... 49 7.8.1. Findings of Exploratory Research .................................................................................... 49 7.9. Exhibit 9: Qualitative Research Interview Guide ..................................................................... 51 7.9.1. Preparation of Quantitative Research Tool ....................................................................... 51 Four Investigators - Marketing Research 2 The NY Times 1.0 NYU Stern School of Business Executive Summary 1.1. Business Problem The New York Times seeks to raise revenues gained through its existing reader base. Potentially these revenues can be increased from advertising, where 80% of their current revenues originate, or from subscription fees, accounting for the remaining 20% of current revenues. Both print and online readers should be leveraged. 1.2. Results Our research identified three general areas of decision drivers for increasing readership: price, relevance, and convenience. We found that in today’s era of free print, broadcast, and online news, readers are extremely price sensitive. Our readers, regardless of demographics and choice of news delivery method, would be more likely to subscribe if the news was less expensive. In improving product relevance, we found that current events, business and entertainment news were considered important for our reader base. In the area of online news sources, we found that the use of search engines to find news is very popular. Less popular is the use of multimedia, while the offering of blogs is irrelevant to our market. A focus on local news and events is considered important by women, but much less so by men. The use of news sources to find coupons and product news is more generally distributed across demographics, although used by a minority of readers. Older readers seem to appreciate the convenience and relaxation of browsing a newspaper anywhere, indicating a continuing role for this medium. We also found a broad interest in subscribing to print newspapers if they were more convenient to hold and use. 1.3. Recommendations The best way to raise readership appears to be price-driven. Increasing revenues from copy sale appears to be counter-productive, and should be abandoned as a strategy. Indeed, we recommend offering newspapers and news websites for free to encourage Top-of-Mind Awareness and gain the eyeballs required to maximize advertising revenues. Enhancing the popular news areas of current events, business and entertainment may help raise overall product interest, while additional emphasis into local news and events, particularly of interest to woman, is expected to result in higher product interest from that segment. The format of print newspapers should be changed to improve Four Investigators - Marketing Research 3 The NY Times NYU Stern School of Business convenience of use; presumably the easier use of online news sites, while untested in this research, may also improve loyalty and subscription numbers. In the area of online news, improvements in relationships with search engines should be made to increase the presence of the New York Times. This area should be further explored to determine methods of advertising effectively online even as readers access articles from a Google launch page rather than through a New York Times launch page. Multimedia was appreciated but not to an extent that we feel requires additional attention. Blogs and other envelope-pushing ideas seem unappreciated or immature at this time. Four Investigators - Marketing Research 4 The NY Times 2.0 NYU Stern School of Business Introduction An important aspect of revenue-generating activity on the part of newspaper companies is marketing themselves to marketers. That is, to convince potential advertisers that their newspaper is a productive place to spend marketing dollars. According to Euromonitor, the traditional newspaper industry earns 80% of its revenues from advertising, so every effort should be made to improve the image of this brand as a revenue generator for advertisers. A secondary question we asked is whether there is opportunity to increase direct subscription revenues from copy or web access, a hypothesis quickly rejected during our research. 2.1. Research Objectives The primary research objective was to find ways to increase the New York Times subscription readership, either online or paper based. With increased dedication to the New York Times from readers, the number of “eyeballs”, or active readers, can be promoted to advertisers to raise revenues from that channel. Potentially, increased subscription readership would also increase revenues from direct sales, although the price sensitivity of our product is one hypothesis to test. Results of our qualitative research helped us divide the primary research objective into three sub categories on which to focus our quantitative research: Price sensitivity Product relevance to readers Product convenience to readers. 2.2. Scope of the study The scope of the study was limited to our existing customer base, i.e. those who read the New York Times but who do not necessarily subscribe to it. There could be many ways to increase new readership, for example through broad marketing efforts, radical change of content, and marketing to niche segments. These and other methods of boosting new readership were outside the scope of our study. The research was designed to understand the how current readers could be transformed into subscribers, increasing their value both to ourselves and to our advertisers. Results of qualitative research further narrowed this scope to how price, relevancy, and convenience can be improved to attract subscribers. Four Investigators - Marketing Research 5 The NY Times NYU Stern School of Business 2.3. Response The responses suggested that today’s consumer is very demanding. They are price conscious, and at the same time want products that are relevant to their needs and convenient to their life style. They are not willing to pay subscription fees, however if the price for news is reduced or eliminated, they are willing to commit to our product through subscription. Newspapers offer the convenience to read the news anytime, especially valued by older readers; younger adults prefer to read news online. Search engines like Google and Yahoo are most widely used to search for news online. The comfort of holding a conveniently-sized newspaper was very important to respondents’ willingness to subscribe. Female respondents are somewhat more willing to subscribe if relevant factors like more local news is added, though this tested as generally irrelevant for men. Current events, entertainment and business are the most widely read news topics within our respondents. Coupons are not favored in general to be the reason for choosing a news source, however product deals and awareness are examined while reading news. Respondents were lukewarm towards the importance of multimedia, and do not consider blogs to be any factor in their willingness to subscribe online. Four Investigators - Marketing Research 6 The NY Times 3.0 NYU Stern School of Business Method/Research Design 3.1. Sampling Technique Our target population was those who read the New York Times but who do not necessarily subscribe to it. Because of time and cost constraints we chose a convenience non-probabilistic sample of NYU students, family and friends in New York and surrounding states. 3.1.1. Sample size The sample size for the qualitative portion of this study was 6. The sample size for the quantitative portion of this study was 95. Of those 95 respondents, five responses were invalid as the respondents abandoned the survey without completing it. Those invalid responses were not considered and a total of 90 responses were analyzed. 3.1.2. Sample Characteristics (Exhibit 7.6: demographics) Our quantitative sample set was 90, comprised of 49 females and 41 males. 96% of these respondents represented the 18-40 age group, 3% represented the 61 and over age group, and only 1% represented the 41-50 age group. The quantitative sample was highly educated as 51% carried a bachelor degree, 48% a masters degree, and 1% a doctoral degree. About 54% live in NYC, 18% in the suburbs of NYC, 21% in another city, and 1% rural. 3.2. Data Collection Method The quantitative survey data was collected through the surveymonkey.com website. A response request email was sent to almost 282 people, of whom 34% (95 individuals) responded. 3.3. Measurement During our qualitative research, we determined three decision drivers affecting decisions on whether to subscribe to news. These drivers, price sensitivity, relevance and convenience, were quantitatively examined with 27 survey questions to learn patterns that can be applied to achieve our research objective. Specifically, we asked 5 demographics questions, 6 psychographics questions, 3 price sensitivity questions, 8 product relevance questions, and 5 product convenience questions. Of Four Investigators - Marketing Research 7 The NY Times NYU Stern School of Business these 27 questions, 2 were constructed as scale response, while 25 were constructed as nominal response. Further details on data measurement can be found in section 3.4.3, coding procedures. The main questions were: How would our respondents react if the price of either print or on-line subscription is reduced or eliminated? How can we gain Top-of-Mind Awareness with our consumer by improving the relevance of our product to their needs: flexible scheduling, online blogs, multimedia, and content? Would our consumers subscribe if the product is made more convenient, for example in the size of the paper or with the usage of wireless news. This includes examining how our respondents define convenience and how they relate convenience to news sources. 3.4. Quantitative Analysis Procedures 3.4.1. Analytical Procedures We used descriptive statistics, primarily tabulation, to determine by proportion what our respondents value. We used a cross tabulation of variables to gain further analytical insights. We have included graphs to illustrate our findings. On a few occasions we used inferential techniques such as Chi-Square after cross tabulation to determine differences between sample statistics and population parameters. 3.4.2. Statistical Package We used SPSS V14.0 by SPSS Inc. for quantitative analysis. 3.4.3. Coding Procedures The questionnaire consisted of twenty seven variables. Out of those twenty seven, five were multiple response questions and the remaining were categorical questions. Two categorical questions were measured on a continuum (income and age demographics), while the rest were measured nominally. Multiple Response variables were coded as dichotomies where the value of ‘1’ is used to count each response. For responses where users did not choose any values a default ‘0’ is used. There are total of five multiple response questions in the survey. The remaining twenty two categorical questions are coded by a single category. Exhibit 7.1 illustrates our coding procedure and documents coding for all questions. Four Investigators - Marketing Research 8 The NY Times NYU Stern School of Business For questions where users provided information for the category ‘Other’, an aggregate category was formed as individual responses varied significantly and were small compared to labeled responses. Four Investigators - Marketing Research 9 The NY Times 4.0 NYU Stern School of Business Results 4.1. Measure of Price Sensitivity Consumers had a strong positive reaction to newspaper subscription if the price is reduced. We chose three related cost variables that measured consumers’ behavior towards subscriptions. 4.1.1. Subscription fees cut by half from current rates: The first variable was to find out how consumers react if the price of a paper-based newspaper is reduced by half from its current rate. 54% (Exhibit 7.5) of the sample population stated they will subscribe to a newspaper if the cost is reduced by half. Since our sample population was mixed between males and females, we investigated any connection between gender and price sensitivity. According to our cross variable analysis of gender and price reduction by half we found that 53% of sampled females chose to subscribe with reduced prices compared to 56% of males. This suggests no linkage between gender and price sensitivity, proven using a chi square test. Ge nde r * Reduce by Half Crossta bul ation Count Gender Male Female Total Reduc e by Half Yes No 23 18 26 23 49 41 Total 41 49 90 A hypothesis test extrapolating this result to the greater population uses gender preference independent to the half price variable as our null hypothesis. Our alternative hypothesis was opposite to this null hypothesis, i.e. gender difference is dependant on the half-price variable. Choosing a chi square test to measure the difference of relationship between two nominal variables, the calculated value of Pearson Chi-Square for a degree of freedom 1 comes out to be 0.083. This is far below the table value of chi-square at 99% with 1 degree of freedom (6.63), indicating there is no connection between gender and the half-price variable. This idea is further examined and illustrated in Exhibit 7.5 Q12. Four Investigators - Marketing Research 10 The NY Times NYU Stern School of Business 4.1.2. Free Subscription: The next level of price sensitivity was to test the consumers’ reaction index to free subscriptions. As shown in Exhibit 7.5 and in the following graph, the consumer preference towards free subscription is very clear. To gain further insight, we ran similar cross tabulation and hypothesis tests between gender and For Free variables and obtained similar results. As shown in the chart and statistical examination below there are more females (90%) than males (83%) who will likely subscribe to a newspaper if it is offered for free. Ge nde r * For Free Crosstabulation Count For Free Yes Gender Female Male Total No 44 34 78 5 7 12 Total 49 41 90 Gender vs. Free Subscription Preference For Free Yes No 50 40 Count 30 20 10 0 Male Female Gender A Chi- Square test, however, found this difference not to be significant, indicating gender as independent of the preference for free subscriptions. The calculated value of 0.911 is less than the table value of 6.63 with degree of freedom 1 and p=0.01 (Exhibit 7.5). Four Investigators - Marketing Research 11 The NY Times 4.1.3. NYU Stern School of Business Charging Subscription fees for online news sites: The third test to measure the cost impact on subscription was through online subscription charges. The majority of our qualitative focus group favored online news compare to paper-based news. Since much common online news is free through many websites, we investigated how our respondents behave towards online subscriptions if their favorite news sites start charging fees. The graphs and statistics for this test, shown in Exhibit 7.4, show similar price sensitivity to those seen in the print cases, i.e. our sample is highly sensitive to cost. A chi-square test was used to rule out any connection between gender and price sensitivity for the online model as well. Gender * Online Charge Subs Crosstabulation Count Gender Male Female Total Online Charge Subs Do not use Yes No online news 12 26 3 11 35 3 23 61 6 Total 41 49 90 4.2. Measure of Product Relevance to readers 4.2.1. Topics read most As shown in Exhibit 7.4, current events, business, and entertainment are the topics read most by consumers. Section 5 describes some limitations on this result, but product focus on these areas, including exclusive features, can create a product preferred by our readers. 4.2.2. More local news or event listings As shown in Exhibit 7.4, 68% of survey respondents are not interested in subscribing either online or to paper-based news sources just because they provide more local news or events information, while 32% may be more likely to subscribe for this reason. We examined the demographics - specifically income level and gender - of those 32% respondents likely to subscribe for more local news and event information in order to discover a niche segment. Four Investigators - Marketing Research 12 The NY Times NYU Stern School of Business Le vel of Incom e * Subs For More Local New s Crosstabulation Count Level of Inc ome Under $20, 000 $20,000 - $50,000 $50,000 - $100,000 $100,000 + No Response Total Subs For More Loc al News Yes No 10 17 3 8 6 12 2 17 8 7 29 61 Total 27 11 18 19 15 90 The above table suggests that respondents who make under $20,000 and between $50,000 and $100,000 are more influenced to subscribe because of local news coverage. Further analysis, though, suggests the division is gender based more so than income based. This analysis (Exhibit 7.5: Level of income and Gender relationship) and the following table illustrate that females in general are more likely to subscribe for local news than are men. Level of Income * Subs For More Local News * Gender Crosstabulation Count Gender Male Female Level of Income Total Level of Income Under $20,000 $20,000 - $50,000 $50,000 - $100,000 $100,000 + No Res ponse Under $20,000 $20,000 - $50,000 $50,000 - $100,000 $100,000 + No Res ponse Total 4.2.3. Subs For More Local News Yes No 2 6 1 3 2 8 0 13 2 4 7 34 8 11 2 5 4 4 2 4 6 3 22 27 Total 8 4 10 13 6 41 19 7 8 6 9 49 Coupons and Good deals: It was very important to discover how consumers feel about coupons and good deals in online news publications. Highlighting these offerings may be an important attractant for readers, and the results of this examination may be used to attract more advertisers and to Four Investigators - Marketing Research 13 The NY Times NYU Stern School of Business polish advertisement strategies. Our results show that 72% of our sample does not look for coupons in online news publications, while only 23% showed interest for coupons. Searching for deals and product information online shows more promising results for our advertisers, as 43% of our sample does look for these while reading online news. 53% of respondents never use online news as a source for finding good deals or product information. The remaining four percent of respondents do no use the online medium for news. Mining these results for market niches that can potentially be targeted shows that males earning over $50,000 do look for good deals while reading online news (Exhibit 7.3, Q18) as do females in the under $20,000 and in the $50,000-$100,00 income brackets. Our overall conclusion, though, is that there exists no particular market segment that might be interested in good deals from online news. The income range of positive respondents almost covers the entire sample income bracket, i.e. from under $20,000 to $100,000, with highly fragmented opinions. There is no obvious clustering pattern to support any hidden market segment. These results on the on-line use of coupons and deal-searching reflect findings from our qualitative focus group on the use of print-based newspapers for these reasons. Our qualitative research also indicated a minority of readers, belonging to no particular segment, use the newspaper for coupons and deal-searching. 4.2.4. Importance of Multimedia Features: As shown in Exhibit 7.4, the importance of multimedia features is distributed on three levels. 42% think it is not at all important while 42% and 9% respectively think it is somewhat and very important. If we collapse the somewhat and the very important categories we find that only 51% thinks multimedia plays a role while reading online news. 4.2.5. Use of blogs and Search Engines In the presence of functional search engines such as Google and Yahoo, we examined how many people read online news found through these types of search engines. Our research shows almost 80% of the population searches for news through either Google (49%) or Yahoo (30%) (Exhibit 7.4). Our examination of blogs as a feature through which users could share their views about certain news turned out to be unvalued, and 92% of our sample does not consider blogs a reason to subscribe to an online news portal. Four Investigators - Marketing Research 14 The NY Times NYU Stern School of Business 4.3. Measure of Convenience 4.3.1. Newspapers convenient to read anytime Although our qualitative work indicated that the majority of our respondents prefer to read online news, it was interesting to discover that 55% of our sample still believes newspapers provide the convenience to be read anytime and anywhere, whether traveling, in a public place, or otherwise with a few free minutes. However, 44% of our sample believes for one reason or another that convenience is not a reason they would prefer to read newspapers. We observed that one segment of our respondents value both the convenience and the relaxation that newspapers can provide, found by cross tabbing relaxing and factor of convenience variables. As shown below, there are 33 people who view newspapers as NewsPaper Convenient * Read to Relax Crosstabulation Read to Relax Yes NewsPaper Convenient No Total Yes 33 17 50 No 12 28 40 45 45 90 Total both convenient and relaxing, 28 people who think it is neither, and 29 people who think it is either convenient or relaxing. This tells us that newspapers have a market segment that still may prefer to read the paper version rather than the online version, which cannot now offer these benefits. Our further analysis of relax and convenience variables revealed that the older age group (29-40) feels more relaxation and convenience from newspapers compared to the younger age group (18-28), possibly segmenting the market for paperbased newspaper versus online news. Four Investigators - Marketing Research 15 The NY Times NYU Stern School of Business Age Group * NewsPaper Convenient * Read to Relax Crosstabulation Count NewsPaper Convenient Read to Relax Yes Yes Age Group 18-28 12 6 Total 18 29-40 18 6 24 41-50 1 0 1 60 and over 2 0 2 33 12 45 18-28 10 15 25 29-40 6 13 19 Total No Age Group 60 and over Total No 1 0 1 17 28 45 Another important convenience variable was how the population feels about the size of newspapers. As shown in Exhibit 7.3, 74% of the sample showed interest in subscribing to a newspaper if its size is convenient to hold while they are on train or in a café. We further analyzed this variable with age group to see how the population is related to the size convenience factor. Age Group * Convenient to Hold Crosstabulation Count Convenient to Hold Yes Age Group 18-28 33 10 Total 43 29-40 41-50 32 11 43 1 0 1 1 2 3 67 23 90 60 and over Total No The above chart shows that the sample from the 18-28 and 29-40 age groups showed interest in subscribing if the size of the paper is convenient to hold. An important thing to note is that the age group of 29-40 felt more-strongly that newspapers are convenient to read anytime and are a means of relaxation, but a broad demographic feels the size of the newspaper/ease of use would improve its appeal. Four Investigators - Marketing Research 16 The NY Times 5.0 NYU Stern School of Business Lessons Learned and Limitations 5.1. Lessons Learned: What we learned in this report, aside from the results, is the importance of understanding the industry. It was only after we understood the economics of the business that we could identify drivers that would change consumer behavior that would also achieve the objective of increasing revenues. The identification of advertising as such a major part of newspaper revenue was not immediately apparent until researched. Secondly, the importance of qualitative research was made apparent in our focus group. We entered that stage with many hypotheses and expected decision drivers, most of which were rejected almost unanimously by the focus group. Had we run quantitative surveying without qualitative work, time and money would have been wasted chasing bad ideas. 5.2. Research Limitations: One limitation of our study is the means by which our survey was implemented. We utilized the surveymonkey.com online tool, but one problem with Internet surveys is that there is no guarantee people doing the survey actually represent the intended respondent/audience. The population accessible using the Internet is also not representative of the newspaper reading world, as some people have no computer access or computer literacy. Another limitation of our study is the sample size utilized for the research survey and its accuracy for predicting future behavior for our target market. At the current time, print circulation for the New York Times is approximately 1.2 million while the online subscriber base is 270,0001. This results in a total figure of 1.5 million users, so clearly we did not consult every reader. More respondents would have improved the accuracy of our results. The largest limitation of our work, though, is the use of a single small convenience sample for both qualitative and quantitative portions of this project. Due to time, expense, and cooperation factors, our qualitative focus group consisted of a single demographic; young, educated adults. Furthermore, these same issues precluded us from conducting a second focus group to corroborate the findings discovered from the first. While our quantitative sampling was broader, it was still heavily skewed towards young educated adults. In addition, we did not screen our quantitative sample to their familiarity with the New York Times or mainstream newspapers in general. 1 NY Times Four Investigators - Marketing Research 17 The NY Times NYU Stern School of Business Aspects of our sampling limitation have a broad influence of our results. For example, we found three areas of news to be of interest – these may have been very different with a different demographic. Other aspects, for example price sensitivity or coupon usage, may also be very different in the broad market. With this research we can make suggestions on broad areas of product improvement, but specific price points, news topic interest, and other factors of newspaper usage should be investigated with laboratory experiments, focus groups, and further quantitative study before action is taken. Four Investigators - Marketing Research 18 The NY Times 6.0 NYU Stern School of Business Recommendations and Next Steps Based on the results of our research we have four major recommendations for increasing the number of subscribers of the New York Times: 6.1. Price cuts or price eliminations The results of this investigation have demonstrated that it is likely that the overall population will be more inclined to subscribe or otherwise commit to a newspaper if prices are reduced or eliminated. The main generator of revenues in this industry is advertising2, and this research shows it would be advisable to sacrifice the price per copy in order to increase customer base and, therefore, increase the value to the advertisers. Advertisers would be more willing to pay a higher price for advertisement space in the publication. 6.2. Improve content and increase promotion of selected news areas Current events, Business news and Entertainment news have been identified as the most preferred sections for the readers of newspapers. We therefore recommend the improvement of these sections in terms of quality of content and/or number of stories per issue, especially on the online site, to build a strong reputation that would ultimately attract more readers interested in these issues. Another consequence of this initiative will be the reinforcement of the loyalty of the current readers who will appreciate the improvement in their favorite sections. A caveat to this recommendation is explained in Section 5.2. 6.3. Improve easier usage of the newspaper The portability characteristic of a newspaper is important for its readers as it defines where they can read a publication and how much time they can devote to this activity. For example, during the qualitative research some respondents declared that they like to read newspapers in the subway, and a newspaper that is easier to carry and read would be more attractive to them. The quantitative data supports the idea that convenience is an important factor of preference, with 74% of the respondents showing a strong preference for more portable newspapers. Therefore, we recommend exploration of new size formats to increase the possibility of attracting more readers. 2 80% according to Euromonitor International Four Investigators - Marketing Research 19 The NY Times NYU Stern School of Business 6.4. Strengthen relationships or increase business alliances with search engines A strong majority of our sample declared that they use online search engines as a source to find news. Therefore we believe that the New York Times has to reinforce its business alliances with the search engines most used by readers, Yahoo! and Google, in order to increase its top of mind awareness. For example, the Times could establish an agreement to make the headlines of the newspaper the first ones in the search results of those search engines, increasing the probability of clicks to the website and the awareness of the Times as an online source of news. In addition, the company can research for new channels to improve the advertising exposure in the search engines. Google AdWords and the Sponsor Results in Yahoo! are right now the traditional ways to place advertisement in these sites and generate traffic. With the evolution of technology it’s possible that in the future more personalized and precise advertisement can be offered as a result of a search. Moreover, the format of these advertisements can be modified to be more appealing to the possible customers. Until now the format of this type of advertisement is done only in text bases, not including images or animations. 6.5. Other tested options Additional options tested and rejected by our respondents include the bundling of news delivery with magazines, directed coupons, and other products or services. Further investment in multimedia or blogs also tested as unnecessary. Four Investigators - Marketing Research 20 The NY Times 7.0 NYU Stern School of Business Appendices 7.1. Exhibit 1: Survey Questions & Coding ABOUT YOUR SOURCES OF INFORMATION 1. During a typical week, when do you read the news? Records Daily Weekdays Weekends Some weekdays Never Coding 1 2 3 4 5 2. What time do you prefer to read the news? Records Spread out throughout my day Early in the morning only After work Late at night Other (please specify) Coding 1 2 3 4 5 3. Which of the following two news topics do you read most? (Multiple Response Analysis) Records Local news Current events Politics Business Sports Entertainment Technology Health Other (please specify) Coding 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No Four Investigators - Marketing Research 21 The NY Times NYU Stern School of Business 4. To which of the following news sources you currently subscribe? (free or paid subscription) (Multiple Response Analysis) Records Online news publisher Weekday print-based newspapers Weekend print-based newspapers Weekly print-based newspapers None Other (please specify) Coding 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 5. If you currently receive delivery of print-based newspapers, do you pay a subscription fee? Records Yes No I do no receive delivery Coding 1 2 3 6. If you are registered for online news, do you pay a subscription fee? Records Yes No I am not registered Coding 1 2 3 7. Are you concerned about privacy and sharing personal information tied to subscription? Records Coding Yes 1 No 2 QUESTIONS ABOUT PAPER-BASED NEWSPAPERS 8. Why would you/do you subscribe to a newspaper? (Multiple Response Analysis) Records To read everyday news To read stories exclusive to my newspaper To find new products or services To find good deals for products or services To find coupons To support a cause or a viewpoint of a newspaper Four Investigators - Marketing Research Coding 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 22 The NY Times NYU Stern School of Business 9. One reason I get newspapers is because they are convenient to read at any time. Records True False Coding 1 2 10. I read newspapers to relax. Records Coding True 1 False 2 11. Would you be more likely to purchase a newspaper that was more convenient to hold while reading, for example, on a train or in a café. Records Coding Yes 1 No 2 12. If the subscription fees of your favorite printed newspaper were reduced by half from their current rate, would you subscribe? Records Coding Yes 1 No 2 13. If you received your favorite printed newspaper for free, would you sign up for delivery? Records Coding Yes 1 No 2 ONLINE BASED NEWS 14. Do you routinely go online to read news: Records Yes No Coding 1 2 15. Where do you routinely use computers? (Multiple Response Analysis) Four Investigators - Marketing Research 23 The NY Times Records At home 1=Yes, 0=No At work On the go (wireless) I do not use a computer At school NYU Stern School of Business Coding 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 16. Would you be more likely to register to an online news site because it provides more local news or event listings? Records Coding Yes 1 No 2 17. Do you use coupons from your favorite online news sites? Records Always Sometimes Rarely Never I do not use online news Coding 1 2 3 4 5 18. Do you look for new products or good deals for products in advertisements within your favorite online news sites? Records Always Sometimes Rarely Never I do not use online news Coding 1 2 3 4 5 19. How important are multimedia features (videos, sounds, etc) when reading online news? Records Very important Somewhat important Not at all important I do not use online news Four Investigators - Marketing Research Coding 1 2 3 4 24 The NY Times NYU Stern School of Business 20. Would you be more likely to register to an online news site because it provides blogs to let you share your own views? Records Yes No Coding 1 2 21. If your favorite online news site charged a subscription fee, would you subscribe? Records Yes No I do not use online news Coding 1 2 3 22. Do you search online for current news topics using the following Internet portals: (Multiple Response Analysis) Records Yahoo Google AOL Ask.com I don’t search for news this way Other (please specify) Coding 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No 1=Yes, 0=No TELL US ABOUT YOU 23. Are you: Records Male Female Coding 1 2 24. Please select your age group: Records Under 18 18-28 29-40 41-50 51-60 60 and over Four Investigators - Marketing Research Coding 1 2 3 4 5 6 25 The NY Times NYU Stern School of Business 25. Select the highest level of education you have completed: Records High School Bachelors Masters Doctorate Other (please specify) Coding 1 2 3 4 5 26. Do you live in: Records New York City A suburb of New York City Another city Another suburb A rural area Coding 1 2 3 4 5 27. Please indicate your current income level: Records Under $20,000 $20,000 - $50,000 $50,000 - $100,000 $100,000 + No response Four Investigators - Marketing Research Coding 1 2 3 4 5 26 The NY Times NYU Stern School of Business 7.2. Exhibit 2: Example of multiple response analysis: Question 8: Why would you/do you subscribe to a newspaper? 1) To read everyday news 2) To read stories exclusive to my newspaper 3) To find new products or services 4) To find good deals for products or services 5) To find coupons 6) To support a cause or a viewpoint of a newspaper Possible Answers: Record# Q8 1) (1,2,3) 2) (2,3,5) 3) (2) Record# 1 2 3 Q8_Everyday 1 0 0 Q8_ExcNew 1 1 1 Q8_NewProd 1 1 0 Q8_Deals 0 0 0 Q8_Coup 0 1 0 Q8_Cause 0 0 0 Example of a categorical question: Question# 27: Please indicate your current income level 1) Under $20,000 2) $20,000 - $50,000 3) $50,000 - $100,000 4) $100,000 + 5) No response Record# 1 2 3 Q_27 Response 2 1 4 Four Investigators - Marketing Research 27 The NY Times NYU Stern School of Business 7.3. Exhibit 3: Convenience questions and summary (5 questions) Convenience Q1: During a typical week when do you read the news? Statistics Reading News Freq N Valid Missing 90 0 Reading News Freq Valid Daily Weekdays Weekends Some weekdays Total Frequency 52 6 4 28 90 Percent 57.8 6.7 4.4 31.1 100.0 Valid Percent 57.8 6.7 4.4 31.1 100.0 Cumulative Percent 57.8 64.4 68.9 100.0 Reading News Freq Daily Weekdays Weekends Some weekdays Four Investigators - Marketing Research 28 The NY Times NYU Stern School of Business Convenience Q2: What time do you prefer to read news? Reading Time Valid Spread throughout the day Early morning only Frequency 58 Percent 64.4 Valid Percent 64.4 Cumulative Percent 64.4 94.4 27 30.0 30.0 After work 2 2.2 2.2 96.7 Late night 3 3.3 3.3 100.0 90 100.0 100.0 Total Reading Time Spread throughout the day Early morning only After work Late night Convenience Q9: One reason I get newspapers is because they are convenient to read at any time. Newspaper Convenient to read anytime Frequency Valid Yes 50 No 40 Total 90 Percent Valid Percent 55.6 Cumulative Percent 55.6 55.6 44.4 44.4 100.0 100.0 100.0 Four Investigators - Marketing Research 29 The NY Times NYU Stern School of Business NewsPaper Convenient Yes No Convenience Q10: I read newspapers to relax. Read to Relax Valid Frequency 45 Percent 50.0 Valid Percent 50.0 Cumulative Percent 50.0 No 45 50.0 50.0 100.0 Total 90 100.0 100.0 Yes Read to Relax Yes No Four Investigators - Marketing Research 30 The NY Times NYU Stern School of Business Relationship exploration of income level with relaxation and convenience factors: Level of Income * Newspaper Convenient * Read to Relax Cross-tabulation Count Read to Relax NewsPaper Convenient Yes Yes Level of Income Under $20,000 12 3 15 $20,000 - $50,000 3 2 5 $50,000 - $100,000 4 4 8 $100,000 + 9 3 12 No Response 5 0 5 33 12 45 3 9 12 $20,000 - $50,000 5 1 6 $50,000 - $100,000 7 3 10 $100,000 + 0 7 7 No Response 2 8 10 17 28 45 Total No Level of Income Total No Under $20,000 Total Convenience Q11: Would you be more likely to purchase a newspaper that was more convenient to hold while reading, for example, on a train or in a café. Convenient to Hold Frequency Valid Percent Valid Percent Cumulative Percent Yes 67 74.4 74.4 74.4 No 23 25.6 25.6 100.0 Total 90 100.0 100.0 Four Investigators - Marketing Research 31 The NY Times NYU Stern School of Business Convenient to Hold Ye sN o Four Investigators - Marketing Research 32 The NY Times NYU Stern School of Business 7.4. Exhibit 4: Relevance questions and summary (8 questions) Relevance Q3: Two news topics do you read most? Case Summary Cases Valid N Missing Percent N newstopics(a) 90 100.0% a Dichotomy group tabulated at value 1. Total Percent 0 N Percent .0% 90 Responses N Percent 26 10.5% 57 23.1% 26 10.5% 55 22.3% 16 6.5% 37 15.0% 15 6.1% 8 3.2% 7 2.8% 247 100.0% Percent of Cases 28.9% 63.3% 28.9% 61.1% 17.8% 41.1% 16.7% 8.9% 7.8% 274.4% 100.0% $newstopi cs Frequencies News a Topics Locals News Current Events Political News Business Sports Entertainment Technology Health Arts Total a. Dic hot omy group tabulated at value 1. Relevance Q16: Would you be more likely to register to an online news site because it provides more local news or event listings? Subs For More Local News Frequency Valid No 61 Yes 29 Total 90 Four Investigators - Marketing Research Percent 67.8 Valid Percent Cumulative Percent 67.8 67.8 32.2 32.2 100.0 100.0 100.0 33 The NY Times NYU Stern School of Business Subs For More Local News Percent 60 40 20 0 No Yes Subs For More Local News Relevance Q17: Do you use coupons from your favorite online news sites? Use Coupons Online Valid Never Rarely Sometimes Do not use online news Total Frequency 65 15 6 4 90 Percent 72.2 16.7 6.7 4.4 100.0 Valid Percent 72.2 16.7 6.7 4.4 100.0 Cumulative Percent 72.2 88.9 95.6 100.0 Use Coupons Online 80 Percent 60 40 20 0 Never Rarely Sometimes Do not use online news Use Coupons Online Four Investigators - Marketing Research 34 The NY Times NYU Stern School of Business Relevance Q18: Do you look for new products or good deals for products in advertisements within your favorite online news sites? Look for Deals Online Valid Never Rarely Sometimes Do not use online news Always Total Frequency 48 29 9 3 1 90 Percent 53.3 32.2 10.0 3.3 1.1 100.0 Cumulative Percent 53.3 85.6 95.6 98.9 100.0 Valid Percent 53.3 32.2 10.0 3.3 1.1 100.0 Look for Deals Online 60 50 Percent 40 30 20 10 0 Never Rarely Sometimes Do not use online news Always Look for Deals Online Relationship exploration of income level with product information searching and gender factors: Level of Income * Look for Deals Online * Gender Crosstabulation Count Look for Deals Online Gender Male Female Always Level of Income Total Level of Income Under $20,000 $20,000 - $50,000 $50,000 - $100,000 $100,000 + No Res ponse Under $20,000 $20,000 - $50,000 $50,000 - $100,000 $100,000 + No Res ponse Total Four Investigators - Marketing Research 0 0 0 1 0 1 Sometimes 0 1 3 0 0 4 1 1 1 2 0 5 Rarely 4 0 3 6 2 15 7 1 3 1 2 14 Never 4 3 4 5 3 19 11 5 4 3 6 29 Do not use online news 0 0 0 1 1 2 0 0 0 0 1 1 Total 8 4 10 13 6 41 19 7 8 6 9 49 35 The NY Times NYU Stern School of Business Relevance Q19: How important are multimedia features (videos, sounds, etc) when reading online news? Importance of Multimedia Valid Not at all important Somewhat important Very important Do not use online news Total Frequency 42 38 8 2 90 Percent 46.7 42.2 8.9 2.2 100.0 Valid Percent 46.7 42.2 8.9 2.2 100.0 Cumulative Percent 46.7 88.9 97.8 100.0 Importance of Multimedia 50 Percent 40 30 20 10 0 Not at all important Somewhat important Very important Do not use online news Importance of Multimedia Relevance Q20: Would you be more likely to register to an online news site because it provides blogs to let you share your own views? Subs Online due to Blogs Valid No Yes Total Frequency 83 7 90 Percent 92.2 7.8 100.0 Four Investigators - Marketing Research Valid Percent 92.2 7.8 100.0 Cumulative Percent 92.2 100.0 36 The NY Times NYU Stern School of Business Subs Online due to Blogs 100 Percent 80 60 40 20 0 No Yes Subs Online due to Blogs Relevance Q22: Do you search online for current news topics using the following Internet portals: Case Summary Cases Missing N Percent 0 .0% Valid N $news Searcha 90 Percent 100.0% Total N 90 Percent 100.0% a. Dichotomy group tabulated at value 1. $newsSea rch Fre que ncie s News a Search Total News Search t hr Yahoo News Search t hr Google News Search t hr AOL News Search t hr Ask.c om Do not Search News Ot her ways to Search Responses N Percent 40 30.3% 65 49.2% 2 1.5% 2 1.5% 17 12.9% 6 4.5% 132 100.0% Percent of Cases 44.4% 72.2% 2.2% 2.2% 18.9% 6.7% 146.7% a. Dichot omy group tabulated at value 1. Four Investigators - Marketing Research 37 The NY Times NYU Stern School of Business 7.5. Exhibit 5: Price Sensitivity questions and summary (3 questions) Price Q12: If the subscription fees of your favorite printed newspaper were reduced by half from their current rate, would you subscribe? Reduce by Half Valid Yes No Total Frequency 49 41 90 Percent 54.4 45.6 100.0 Valid Percent 54.4 45.6 100.0 Cumulative Percent 54.4 100.0 Reduce by Half 60 50 Percent 40 30 20 10 0 Yes No Reduce by Half A hypothesis test extrapolating this result to the greater population uses gender preference independent to the half price variable as our null hypothesis. Our alternative hypothesis was opposite to this null hypothesis, i.e. gender difference is dependant on the half-price variable. Choosing a chi square test to measure the difference of relationship between two nominal variables, the calculated value of Pearson Chi-Square for a degree of freedom 1 comes out to be 0.083. This is far below the table value of Chi-Square at 99% with 1 degree of freedom (6.63), indicating there is no connection between gender and the halfprice variable. The null hypothesis (gender independent of half-price variable) was accepted since a calculated value of 0.083 is less than 6.63. “A null hypothesis is rejected if calculated value is greater than the table value” (p463, Introduction to Marketing Research, 8th edition by Aaker, Kumar and Day). Four Investigators - Marketing Research 38 The NY Times NYU Stern School of Business This hypotheses gave us 99% confidence to suggest that the overall population will likely increase in subscriptions if the price is reduced by half from its current rate with no relation between gender and this offer. Chi-Square Tests Value .083b .006 .083 Pearson Chi-Square Continuity Correction a Likelihood Ratio Fis her's Exact Test Linear-by-Linear As sociation N of Valid Cases df 1 1 1 .082 As ymp. Sig. (2-sided) .773 .940 .773 1 Exact Sig. (2-sided) Exact Sig. (1-sided) .833 .470 .775 90 a. Computed only for a 2x2 table b. 0 cells (.0%) have expected count less than 5. The minimum expected count is 18. 68. Price Q13: If you received your favorite printed newspaper for free, would you sign up for delivery? For Free Valid Yes No Total Frequency 78 12 90 Percent 86.7 13.3 100.0 Valid Percent 86.7 13.3 100.0 Cumulative Percent 86.7 100.0 Chi-Square Tests Pearson Chi-Square Continuity Correction a Likelihood Ratio Fis her's Exact Test Linear-by-Linear As sociation N of Valid Cases Value .911b .414 .908 .901 df 1 1 1 1 As ymp. Sig. (2-sided) .340 .520 .341 Exact Sig. (2-sided) Exact Sig. (1-sided) .369 .259 .342 90 a. Computed only for a 2x2 table b. 0 cells (.0%) have expected count less than 5. The m inim um expected count is 5. 47. Four Investigators - Marketing Research 39 The NY Times NYU Stern School of Business For Free 100 Percent 80 60 40 20 0 Yes No For Free Price Q21: If your favorite online news site charged a subscription fee, would you subscribe? Online Charge Subs Valid No Yes Do not use online news Total Frequency 61 23 6 90 Percent 67.8 25.6 6.7 100.0 Valid P erc ent 67.8 25.6 6.7 100.0 Cumulative Percent 67.8 93.3 100.0 Online Charge Subs Percent 60 40 20 0 No Yes Do not use online news Online Charge Subs Four Investigators - Marketing Research 40 The NY Times NYU Stern School of Business Chi-Square Te sts Pearson Chi-Square Lik elihood Ratio Linear-by-Linear As soc iation N of Valid Cases Value .665a .664 2 2 As ymp. Sig. (2-sided) .717 .717 1 .622 df .244 90 a. 2 c ells (33.3%) have ex pec ted c ount les s than 5. The minimum expected count is 2.73. Four Investigators - Marketing Research 41 The NY Times NYU Stern School of Business 7.6. Exhibit 6: Demographics questions and summary (5 questions) Demographics Q23: Gender Gender Valid Female Male Total Frequency 49 41 90 Percent 54.4 45.6 100.0 Valid Percent 54.4 45.6 100.0 Cumulative Percent 54.4 100.0 Gender 60 50 Percent 40 30 20 10 0 Female Male Gender Demographics Q24: Age Group: Age Group Valid 18-28 29-40 60 and over 41-50 Total Frequency 43 43 3 1 90 Percent 47.8 47.8 3.3 1.1 100.0 Four Investigators - Marketing Research Valid Percent 47.8 47.8 3.3 1.1 100.0 Cumulative Percent 47.8 95.6 98.9 100.0 42 The NY Times NYU Stern School of Business Age Group 50 Percent 40 30 20 10 0 18-28 29-40 60 and over 41-50 Age Group Demographics Q25: Level of Education Completed: Educa tion level Valid Bachelors Masters Doctorate Total Frequency 46 43 1 90 Percent 51.1 47.8 1.1 100.0 Valid Perc ent 51.1 47.8 1.1 100.0 Cumulative Percent 51.1 98.9 100.0 Education level 60 50 Percent 40 30 20 10 0 Bachelors Masters Doctorate Education level Four Investigators - Marketing Research 43 The NY Times NYU Stern School of Business Demographics Q26: Residence: Resident Valid NYC Another city Suburb of NYC Another suburb rural area Total Frequency 49 19 16 5 1 90 Percent 54.4 21.1 17.8 5.6 1.1 100.0 Valid Percent 54.4 21.1 17.8 5.6 1.1 100.0 Cumulative Percent 54.4 75.6 93.3 98.9 100.0 Resident 60 50 Percent 40 30 20 10 0 NYC Another city Suburb of NYC Another suburb rural area Resident Demographics: Q27: Income Level: Level of Income Valid Under $20,000 $100,000 + $50,000 - $100,000 No Res ponse $20,000 - $50,000 Total Frequency 27 19 18 15 11 90 Four Investigators - Marketing Research Percent 30.0 21.1 20.0 16.7 12.2 100.0 Valid Percent 30.0 21.1 20.0 16.7 12.2 100.0 Cumulative Percent 30.0 51.1 71.1 87.8 100.0 44 The NY Times NYU Stern School of Business Level of Income 30 25 Percent 20 15 10 5 0 Under $20,000 $100,000 + $50,000 $100,000 No Response $20,000 - $50,000 Level of Income Relationship exploration of income level with gender and age group factors: Age Group * Level of Income * Gender Crosstabulation Count Gender Male Female Age Group Total Age Group Total 18-28 29-40 41-50 60 and over 18-28 29-40 Under $20,000 4 4 0 0 8 13 6 19 Four Investigators - Marketing Research $20,000 $50,000 2 2 0 0 4 6 1 7 Level of Income $50,000 $100,000 $100,000 + 3 4 7 6 0 1 0 2 10 13 3 1 5 5 8 6 No Res ponse 0 5 0 1 6 7 2 9 Total 13 24 1 3 41 30 19 49 45 The NY Times NYU Stern School of Business 7.7. Exhibit 7: Psychographics questions and summary (6 questions) Psychographics Q4: To which of the following news sources you currently subscribe? (free or paid subscription) $newssource Frequencies News a Source Responses N Percent 55 41.4% 26 19.5% 17 12.8% 8 6.0% 20 15.0% 7 5.3% 133 100.0% Online News W eekday P rint W eekend P rint W eekly Print None Ot her Total Percent of Cases 61.1% 28.9% 18.9% 8.9% 22.2% 7.8% 147.8% a. Dic hot omy group tabulated at value 1. Psychographics Q5: If you currently receive delivery of print-based newspapers, do you pay a subscription fee? Do You Pa y Print Subs Valid Frequency Do not receive delivery 49 Yes 32 No 9 Total 90 Percent 54.4 35.6 10.0 100.0 Valid Percent 54.4 35.6 10.0 100.0 Cumulative Percent 54.4 90.0 100.0 Psychographics Q6: If you are registered for online news, do you pay a subscription fee? Do You Pa y Online Subs Valid No Not registered Yes Total Frequency 51 25 14 90 Percent 56.7 27.8 15.6 100.0 Four Investigators - Marketing Research Valid Percent 56.7 27.8 15.6 100.0 Cumulative Percent 56.7 84.4 100.0 46 The NY Times NYU Stern School of Business Do You Pay Online Subs 60 50 Percent 40 30 20 10 0 No Not registered Yes Do You Pay Online Subs Psychographics Q8: Why would you/do you subscribe to a newspaper? $subsRea son Fre que ncie s Reason for a Subsc ribing W hy W hy W hy W hy W hy W hy Subs Subs Subs Subs Subs Subs Everyday news Exc lus Stories New Prod Good Deals Coupons Supp Cause Total Responses N Percent 79 57.7% 27 19.7% 9 6.6% 9 6.6% 8 5.8% 5 3.6% 137 100.0% Percent of Cases 87.8% 30.0% 10.0% 10.0% 8.9% 5.6% 152.2% a. Dichot omy group t abulated at value 1. Psychographics Q14: Do you routinely go online to read news: Routinely Read Online Valid Yes No Total Frequency 79 11 90 Percent 87.8 12.2 100.0 Four Investigators - Marketing Research Valid Percent 87.8 12.2 100.0 Cumulative Percent 87.8 100.0 47 The NY Times NYU Stern School of Business Routinely Read Online 100 Percent 80 60 40 20 0 Yes No Routinely Read Online Psychographics Q15: Where do you routinely use computers? $placecompuse Frequencies Place Comp a is Used Total Us e Comp Us e Comp Us e Comp Us e Comp at Home at Work Wireless at School Responses N Percent 79 46.7% 65 38.5% 19 11.2% 6 3.6% 169 100.0% Percent of Cases 87.8% 72.2% 21.1% 6.7% 187.8% a. Di chotomy group tabulated at value 1. Four Investigators - Marketing Research 48 The NY Times NYU Stern School of Business 7.8. Exhibit 8: Summary of Exploratory Research Findings 7.8.1. Findings of Exploratory Research The findings of our focus group research were surprising and interesting since our respondents generally did not want to subscribe to hard-copies of a newspaper under any of our proposed packages. Out of the six panelists, only one currently subscribes at all (to the Sunday New York Times), and no respondents were inclined to subscribe further. “I subscribe to the Sunday Times because I find it relaxing to spend my Sunday morning reading it” - Will Our group generally reads news online, offering us a hypothesis to test how to increase the number of customers reading newspapers daily either online or in print. It is important to recognize that both online and print based news have associated subscription models, and these models may or may not require subscription fees. “I get all my information online – I can’t read the paper during work” - Eva Further exploratory findings indicate that our group was generally reluctant to pay fees for news, either subscription or otherwise, since they can find so much information for free online. “There are so many sources out there, if one starts to hassle me I just go to another” - Virgilio They also generally enjoy the searchable aspects of online news – if a story is interesting, they can immediately search for related stories to expand their knowledge of the subject. “I read all my news online. If an article is interesting, I can immediately search for more stories about the topic” - Liz One group member enjoys the leisure of casually reading the paper, but he was in the minority in this group. Two group members enjoy scanning the advertisements and coupons, but this benefit is not enough for them to subscribe. “I like looking for good deals” - Kurt Another revealed hypothesis was the importance of content in the decision to choose a news source. “I want to know what’s going on in my area” - Liz The major theme among all focus group respondents was that it is almost impractical for them to read and carry large newspapers; they prefer to read customized and personalized news that is available online. “If I want to find something, I go online. I don’t think a newspaper has the stuff I want.” - Kevin Four Investigators - Marketing Research 49 The NY Times NYU Stern School of Business They wanted to hear different opinions and were reluctant to accept information from any single, potentially biased, newspaper. The Internet provides such options as Google news, offering aggregate news from different sources. “I prefer to read news from many sources to get many viewpoints. I can read about the same event from the viewpoint of the New York Times, the Jerusalem Post, and Aljazeera, then make up my own mind” – Kevin Four Investigators - Marketing Research 50 The NY Times NYU Stern School of Business 7.9. Exhibit 9: Qualitative Research Interview Guide Introductory Questions: Sources of news information, competition to newspapers 1) How do gather the news daily? 2) Which methods do you think are more efficient? 3) In the case of the newspapers, which ones do you read? Why? How often? Why don’t you read it more often? Have you tried other local newspapers? 4) How often do you buy newspapers? 5) Where do you buy your newspapers? About their perception of the New York Times 6) Do you read the NY Times? 7) Do you use the value added portions of the paper (non-news). 8) Why/ why not? How often? To the respondents who are subscribers: 9) What made you decided to subscribe to that newspaper? 10) Did you consider subscribing to others newspapers? 11) What were the principal features that attracted to this subscription? 12) Do you get special offers for being a subscriber? Discounts? 13) Why do you think there are still people who want to purchase a newspaper in the newsstand? 14) What do you think about subscriptions to internet versions of newspapers? To the respondents who are not subscribers: 15) Why do you prefer not to be a subscriber? 16) Have you ever been or have considered becoming a subscriber? 17) Would you purchase more/subscribe if cheaper? 18) Would you purchase more/subscribe if more non news-value? Offer examples – coupons, etc. 19) Would you purchase more/subscribe if it was bundled with other goods and services? – Offer examples – magazines, etc. 20) Would you purchase more/subscribe if you could customize delivery? 21) Other ideas? 7.9.1. Preparation of Quantitative Research Tool Our quantitative research will focus on increasing New York Times subscriptions, including online and print editions. The topic of subscription fees is important, since maximum overall revenue may be gained by minimizing subscription costs. The usage of Internet-based news retrieval is also important, as our exploratory research indicates this represents a major channel of advertising revenue. Overall the next research steps must examine measurable methods of increasing reader eyeballs. The number of subscriptions Four Investigators - Marketing Research 51 The NY Times NYU Stern School of Business and any associated news usage data should be sufficient to convince advertisers that the popularity and coverage of the New York Times is worth their advertising dollars. Four Investigators - Marketing Research 52