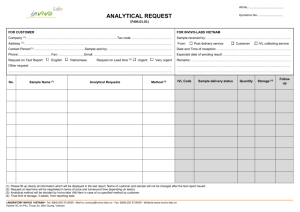

General information of phuc dien industrial Zone

General information of phuc dien industrial Zone

Company name: Nam Quang Investment &Development Infrastructure Joint Stock Company

Address Cam Phuc Commune, Cam Giang District, Hai Duong province

Tel: (0320) 752 261 Fax: (0320) 752 001

Ha Noi liaison office

Hand phone:

Email address

Project name

No. 386 Nguyen Van Linh Rd, Sai Dong Precint, Long Bien District,

Ha Noi, Vietnam

Tel: (84-4) 875 7965/1 Fax: (84-4) 875 7969

(84-4) 91 320 6222 info@quangminh-izone.com

Phuc Dien Industrial Zone

Location

Total area

Distance to Sea-ports,

Airport and major cities

Soil condition

Non-flooding area

One-door service

On the national highway No. 5 connecting Ha Noi and Hai Phong at

Cam Giang District, Hai Duong Province, Viet Nam.

87 ha.

- 60 km from Noi Bai Airport

- 40 km from Ha Noi Capital

- 60 km from Hai Phong Seaport

- 75 km from Quang Ninh - Cai Lan Seaport

Solid and ready filled-up, available to build the workshop

9 meters above sea level (MSL)

Nam Quang Investment & Development Infrastructure Joint Stock

Company will provide investors with Investment information, help

Investors to prepare necessary documents to apply for the Investment

Licence. Documents for Investment License including of:

1.

Application for Investment License

2.

The Charter of Investor

3.

Economic-Technical Appraisal

4.

Incorporation Contract (for Joint Venture Company)

5.

Bank Statement

6.

Land reservation Agreement with Nam Quang

7 . Others (Copy of Passport, Investor’s Certificate of Establishment)

Within 07 days from the date of receiving the completed documents. Time to obtain Investment

License

Land lease term up to May 8 th , 2052

1

Land rental with ready infrastructure

Workshops and offices

Other fees

Mode of payment

Infrastructure

Tax incentives negotiation (according to the total area to be rented as well as its location)

Standardized workshops and offices are built for rent or buy to meet the demand of investor.

* Industrial zone management fee : 0.20 USD/m2/year (Excude

VAT). This fee will be paid annually at the 1st month of every year.

* Waste water treatment fee, Electricity fee, Telephone charge :

According to the official rate to be paid to the Supplier.

♦

Lease term up to May 8 th , 2052

♦

Negotiable land rental

♦

Flexible terms of payment.

* Road : + Main road: 30m and 23.25m in width.

+ Branch road: 17.5m in width.

* Power supply: Electricity source with 110/35KV line runs along No.

5 National road will be supplied to the land border of all tenants.

* Fresh water supply: 4.000 m

3

/day.

* Waste water treatment: 3.872 m

3

/day.

* Telecommunication: 9-11 lines per 1 ha. Phuc Dien IZ shall be equipped with modern telecommunication system, meeting the communication demand of multi-services such as Internet, ADSL,

Video Conference, VOIP, Fax, etc.

+ According to Decree No. 164 & Decree No. 152 issued by Vietnam

Government (regulations on the Law of Corporate income tax)

+ According to Decree No. 24 and Decree No. 27 issued by Vietnam

Government (regulations on the Foreign Investment Law).

+ According to the Decree No. 51/1999/ND-CP issued by Vietnam

Government regulations on the Law of Investment Stimulation.

A.

Priorities from Vietnam Government:

1. Corporate income tax: (CIT) (it will be applied in the whole term of operation)

CIT

Rate

20%

Applicable term

10 years

Project description

Services projects

Exemption

02 years

Deduction of 50%

06 years

15%

10%

12 years

15 years

Manufacturing Enterprises

Export processing Enterprises

03 years

04 years

07 years

07 years

2

2. Oversea benefit remittance tax rate: 0%

3. Import tax:

♦ Exemption from import tax is applied for goods imported as fixed assets:

- Machinery, equipments.

- Raw materials and materials are imported to manufacture machinery, equipments of

Technological lines or to produce components, parts, spare parts, accessories of machinery, equipments.

- Specialized means of transportation, which are included in Technological process and means of transportation used for transporting employees (with 24 seats or more).

- Components, details, parts, spare parts, fittings, pattern mould and accessories accompanying the above mentioned machinery equipment and specialized transportation means.

- Construction materials that Vietnam is unable to produce.

* Exemption from import tax is applied for materials, accessories that are imported to produce export products or produce sub-products supplied to other Enterprises that directly produce export products.

* In case of investment project in lists of the most preferential investment, exemption from import tax is applied for materials within 05 years since the project comes into operation.

* In case of investment project in manufacturing electronic, mechanic, electronic components, accessories exemption for import tax is applied for material within 05 years since the project comes into operation.

4. VAT : VAT Exemption is applied to:

+ Machinery, equipment, specialized transportation means of Technology line or construction materials unable to produce in Vietnam that are imported as fixed assets.

+ Materials imported to produce sub-products for other Enterprises that directly produce export products.

+ Materials & goods imported to produce the export products.

B.

Priorities from People’s Committee of Hai Duong Province

: Beside the favor of Government, i.

Hai Duong is also treat with special attention in:

Favor of land rental rate and land rental exemption, reduction : To be exempted from land rental for 10 years and given a reduction of 50% of land rental for 10 following years.

Favor of Corporate Income tax (CIT) : Exemption from CIT for the first 02 (two) years and ii.

iii.

reduction 50% CIT for the following 01 year since the year Enterprises has to pay tax.

Favor of loan interest rate and service charges of Banks and credit institutions :

- Favor of loan interest rate and financial lending interest rate for investors: Reduction 10%

3

interest rate from the rate applied for common clients when Enterprises take loans from local

Commercial Bank. iv.

- Favor of Banking service charges: Reduction 10% - 15% of charge rate of information provision for risk prevention.

Subsidy of expenses for job training of local labors : If Enterprises has demand for training its owned local labor, local authorities will subsidize 50% training expenses (maximum one million Vietnam Dong per one labor for the whole training course). This amount is given to v.

vi.

Job training Center of the Province to train labor for Enterprises.

Favor of advertisement : Reduction 50% of the advertisement cost on local radio station,

Newspaper and Television for 03 years since the Enterprises comes into operation.

Administrative procedure : to facilitate investors to Industrial Parks, Hai Duong has practiced the structure “One -door service” by establishing the Unit for Industrial Parks

Management to issue investment license and give guidance for fast and effective clearing of procedures.

C.

Priorities from Nam Quang:

Nam Quang provides all tenants free of charge the following services: the Investment License, Stamp,

Tax code, Import-export code, construction verification certificate, and other legal documents to establish new Enterprises in Vietnam.

Labor force

: Nowadays, in parallel with the rapid growth of the country’s economy, the quantity and quality of Phuc Dien’s labor force is improving greatly, meeting the demand of domestic and foreign

Investors. Inhabitants of Hai Duong Province is more than 1.7 million, in which over 60% of population is under 35 years old.

Education and school : Multiple system of Universities, colleges, technical schools and vocational training centers which trained skilled technical workers holding 3/7 degree, major in mechanics, electricity, machine operation and construction,...

Should you have any further questions, please do not hesitate to contact us at the address as follows:

Representative Office: Nam Quang Investment and Development Infrastructure Joint Stock Company

Address : No. 386 Nguyen Van Linh Rd, Sai Dong Precint, Long Bien District, Ha Noi, Vietnam

Tel : (84- 4) 875 7965/1

Contact person: Mr. Tran Anh Tuan

Email: info@quangminh-izone.com

Fax : (84- 4) 875 7969

HP : 0912229200 or 0913206222

NAM QUANG INVESTMENT AND DEVELOPMENT INFRASTRUCTURE

JOINT STOCK COMPANY

Address: Phuc Dien Industrial Zone, Cam Giang District, Hai Duong Province, Vienam

Tel/Fax: (84-320) 752 261 Fax: (84-320) 752 001

4

Price in phuc dien industrial zone

4.1.

Infrastructure Management Fee : USD 0.20/m2/year (it does not include VAT). This fee shall be paid annually in advance at the first month of every year for the entire duration of the lease

Term beginning from the date of handing over the land to the Lessee by the Lessor. This cost can be adjusted every 02 years period with the price of each adjustment is not over

15% of the latest previous one.

4.2.

Electricity charge : The Lessee will pay electricity charges to The Lessor according to their real usage. The electricity charges will be applied according to common price as stipulated by The

Lessor in the Industrial Park.

4.3.

Fresh water charge : The Lessee will pay fresh water charges to The Lessor according to their real usage. The fresh water charges will be applied according to common price as stipulated by

The Lessor in the Industrial Park.

4.4.

Waste water treatment : The waste water treatment fee which The Lessee has to pay to The

Lessor monthly will be applied according to common price as stipulated by Lessor in the

Industrial Park. The volume of waste water is counted equal to 80% (eighty percent) of fresh water The Lessee uses per month.

4.5.

Telecommunication and fax, …: The Lessee directly pays the Telecommunication charges to the Supplier.

Note : The Price of Water, power, telephone, fax… could be changed according to the regulation of the competent Authorities.

5