091202

advertisement

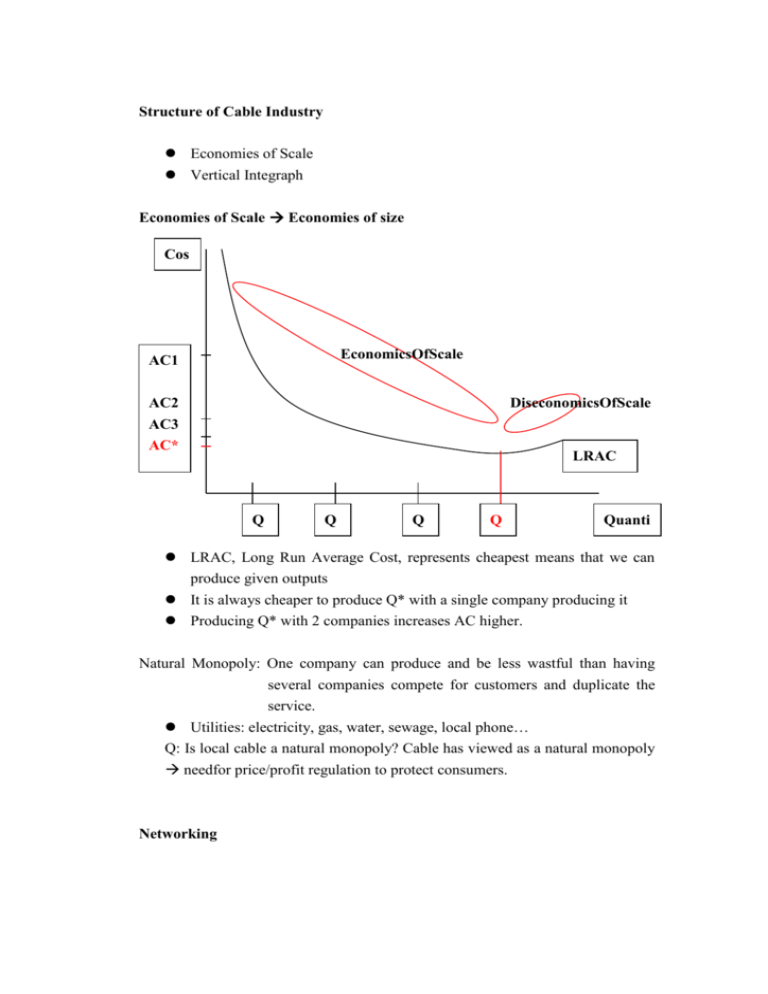

Structure of Cable Industry Economies of Scale Vertical Integraph Economies of Scale Economies of size Cos t AC1 AC2 AC3 AC* EconomicsOfScale DiseconomicsOfScale LRAC Q Q Q Q Quanti 1 2 3 * ty LRAC, Long Run Average Cost, represents cheapest means that we can produce given outputs It is always cheaper to produce Q* with a single company producing it Producing Q* with 2 companies increases AC higher. Natural Monopoly: One company can produce and be less wastful than having several companies compete for customers and duplicate the service. Utilities: electricity, gas, water, sewage, local phone… Q: Is local cable a natural monopoly? Cable has viewed as a natural monopoly needfor price/profit regulation to protect consumers. Networking AC/viewer There is room for multiple networks Q* Q (HH/viewers) At the local level, the cable system behaved as it was natural monopoly but, at the program networking level, there is a room for multiple networks because each networks can take advantages of enabling technologies and access to a wide audiences and, also, turn those potential audiences to actual audiences by charging them directly for accessing for the programs. It is not as limiting as a natural monopoly situation for the local cable system. Vertical Structure of Industry Several layers of the industry Stage 3: Exhibition/Retailing: Local Cable Systems Value Added Stage 2: Distribution (Networkings) Value Added Stage 1: Production of programs/software Sum of all the value added = Retail Price of a program Vertical Integration: If you are simultaneously involved in multiple stages, it is vertically integrated. Market concentration of Control: there is a concentration of ownership and control in relatively few hands Across Markets: National Market Chain ownership across markets National Monopoly ownership control and power: chains of local cable systems = Multiple System Owners, MSO: AT&T broadband, AOL TW How concentrate is cable ownership at the retail/exhibition level? Combined shares of AT&T and AOL TW exceeds 50% of the market. Very concentrated industry What is the origins of concentration of control? 1. Build the systems yourself: Internal Expansion 2. Acquire previously built facilities: Merger/Acquisition approach 3. Create Strategic Alliances via cooperation Formal cooperation sharing of monopoly power (possible cartel) Mergers and Acquisitions: Vertical Merger Stage3: Exhibition Stage2: Distribution Stage1: Production (Company A) (Company B) (Company C) Merger between A, B or B, C, or A, B, and C is Vertical Merger Moving toward consumer such as B acquiring A is Forward Merger Moving away from consumer such as B acquiring C is Backward Merger Horizontal Merger Stage 3: Company A Stage 2: Stage 1: company B company C company D Company Z If there is a merger among company A, B, C, and D (in the same level of play field), it is Horizontal merger. If company Z attempts to merge company A (not directly related and competitor to each other), it is Diagonal merger. It is also known as conglomerate mergers: there is no previous customer, supplier, competitor relationship between two parties. For Example, AT&T and TCI merger Conglomerate Merger AOL and TW merger Conglomerate Merger D.O.J (Department of Justice) Antitrust Div.: Strong ethic to disallow horizontal mergers especially among large companies. Protect a industry from Elimination of competition. D.O.J only occasionally will prosecute vertical mergers. D.O.J is virtually powerless in attacking/prosecuting conglomerate mergers. Move away from microeconomic impacts on competition and switch to a mindset that focuses on the macroeconomic impacts