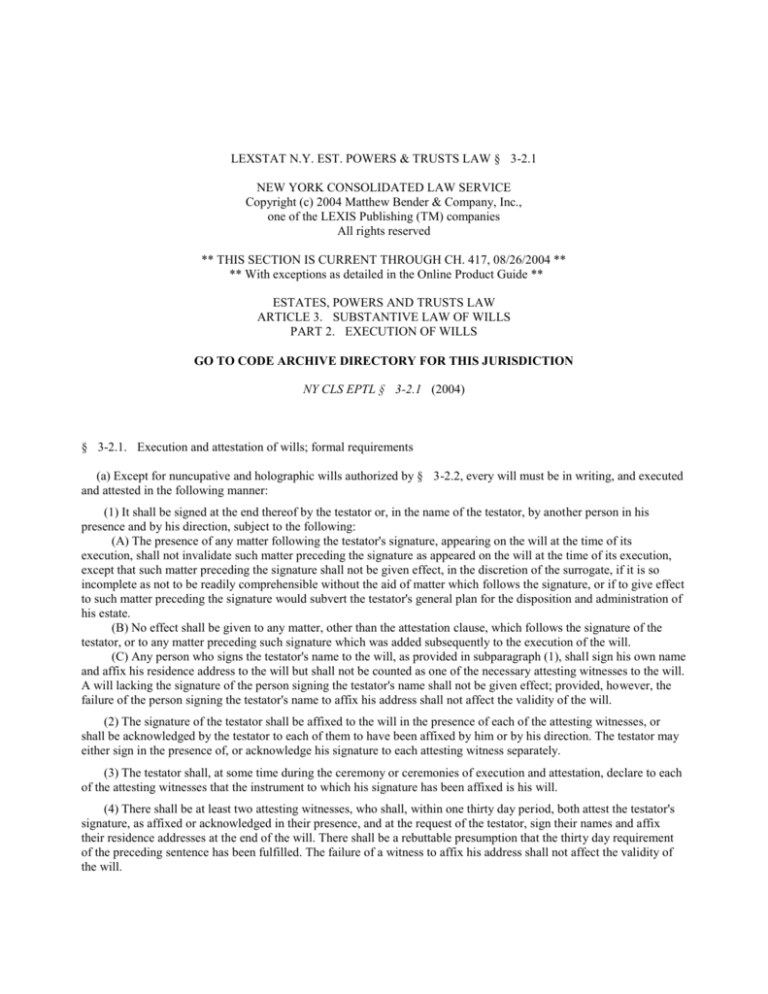

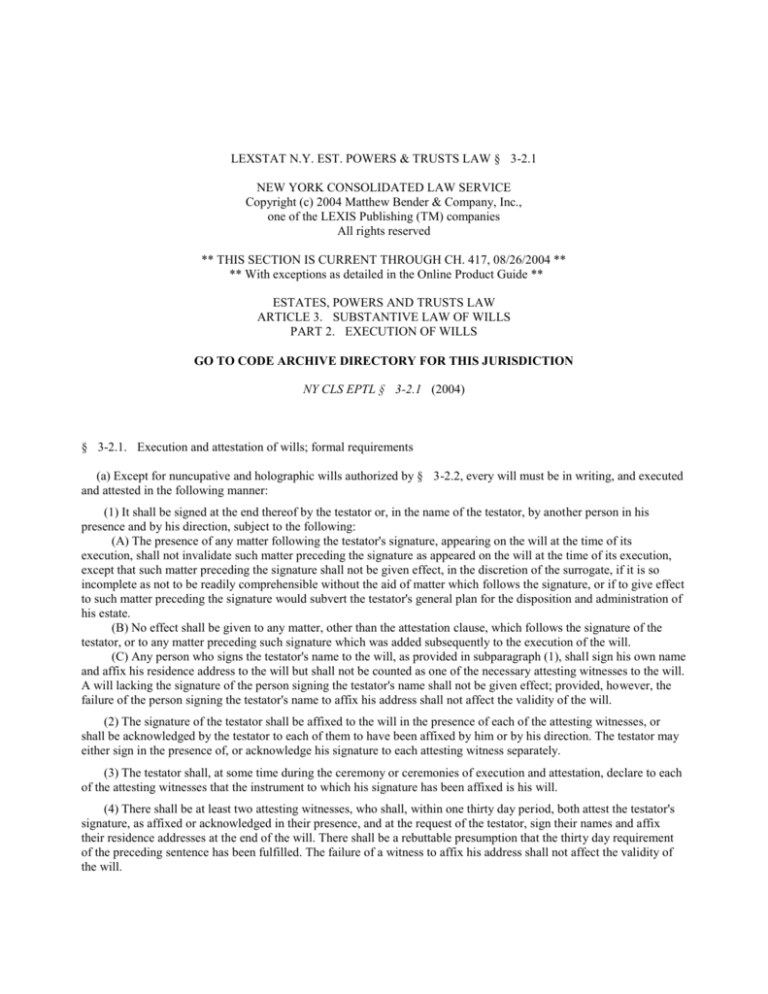

LEXSTAT N.Y. EST. POWERS & TRUSTS LAW § 3-2.1

NEW YORK CONSOLIDATED LAW SERVICE

Copyright (c) 2004 Matthew Bender & Company, Inc.,

one of the LEXIS Publishing (TM) companies

All rights reserved

** THIS SECTION IS CURRENT THROUGH CH. 417, 08/26/2004 **

** With exceptions as detailed in the Online Product Guide **

ESTATES, POWERS AND TRUSTS LAW

ARTICLE 3. SUBSTANTIVE LAW OF WILLS

PART 2. EXECUTION OF WILLS

GO TO CODE ARCHIVE DIRECTORY FOR THIS JURISDICTION

NY CLS EPTL § 3-2.1 (2004)

§ 3-2.1. Execution and attestation of wills; formal requirements

(a) Except for nuncupative and holographic wills authorized by § 3-2.2, every will must be in writing, and executed

and attested in the following manner:

(1) It shall be signed at the end thereof by the testator or, in the name of the testator, by another person in his

presence and by his direction, subject to the following:

(A) The presence of any matter following the testator's signature, appearing on the will at the time of its

execution, shall not invalidate such matter preceding the signature as appeared on the will at the time of its execution,

except that such matter preceding the signature shall not be given effect, in the discretion of the surrogate, if it is so

incomplete as not to be readily comprehensible without the aid of matter which follows the signature, or if to give effect

to such matter preceding the signature would subvert the testator's general plan for the disposition and administration of

his estate.

(B) No effect shall be given to any matter, other than the attestation clause, which follows the signature of the

testator, or to any matter preceding such signature which was added subsequently to the execution of the will.

(C) Any person who signs the testator's name to the will, as provided in subparagraph (1), shall sign his own name

and affix his residence address to the will but shall not be counted as one of the necessary attesting witnesses to the will.

A will lacking the signature of the person signing the testator's name shall not be given effect; provided, however, the

failure of the person signing the testator's name to affix his address shall not affect the validity of the will.

(2) The signature of the testator shall be affixed to the will in the presence of each of the attesting witnesses, or

shall be acknowledged by the testator to each of them to have been affixed by him or by his direction. The testator may

either sign in the presence of, or acknowledge his signature to each attesting witness separately.

(3) The testator shall, at some time during the ceremony or ceremonies of execution and attestation, declare to each

of the attesting witnesses that the instrument to which his signature has been affixed is his will.

(4) There shall be at least two attesting witnesses, who shall, within one thirty day period, both attest the testator's

signature, as affixed or acknowledged in their presence, and at the request of the testator, sign their names and affix

their residence addresses at the end of the will. There shall be a rebuttable presumption that the thirty day requirement

of the preceding sentence has been fulfilled. The failure of a witness to affix his address shall not affect the validity of

the will.

Page 2

NY CLS EPTL § 3-2.1

(b) The procedure for the execution and attestation of wills need not be followed in the precise order set forth in

paragraph (a) so long as all the requisite formalities are observed during a period of time in which, satisfactorily to the

surrogate, the ceremony or ceremonies of execution and attestation continue.

Legislative History:

Add, L 1966, ch 952, eff Sept 1, 1967, deriving from Dec Est Law § § 21, 22.

Sub (a), par 1, subpar (A), amd, L 1967, ch 686, § 12, eff Sept 1, 1967.

Sub (a), par 1, subpar (C), amd, L 1973, ch 618, eff Sept 1, 1973, applicable to all wills executed on or after such

date.

Sub (a), subpar (4), amd, L 1974, ch 181, eff Sept 1, 1974.

Sub (c), add, L 1967, ch 686, § 13, repealed, L 1974, ch 181, eff Sept 1, 1974.

Laws 1974, ch 181, § 3, provides as follows:.

§ 3. This act shall take effect on the first day of September next succeeding the date on which it shall have become

a law, provided, however, that any will which would have been valid under the law applicable before the effective date

of this act shall not be invalidated by reason of this act.

NOTES:

Explanatory Notes:

Revisers' Notes

[1974] These amendments were recommended by the Law Revision Commission. See Leg. Doc (1974) No. 65(D);

Leg. Doc. (1973) No. 65(D); Leg. Doc. (1972) No. 65(J). Their purpose is to clarify the requirement that in the

execution of a will the formalities be completed within a thirty-day period and to create a rebuttable presumption that

such requirement has been met.

Revisers' Notes

Source: DEL § § 21; 22.

Changes: Combined and revised.

Comments: This section combines and revises DEL § § 21 and 22 as follows:.

1. Another person is authorized to sign the testator's name at the end of the will but such act is required to be

performed in the presence of the testator. However, such person may not be counted as a necessary attesting witness to

the will. Eliminated is the provision in DEL § 22 that the failure of a witness to affix his name or address to the will

subjects him to a penalty.

2. Although the "end of the will" requirement is retained (see, Matter of Andrews, 162 NY 1; Matter of Whitney, 153

NY 259; Matter of O'Neil, 91 NY 516), subject to the specified exceptions, testator's failure to sign at the end will not

defeat the provisions preceding his signature which appeared on the will at the time of execution (cf. Matter of Winters,

302 NY 666); but any provisions following his signature or added prior to his signature subsequent to the time the will

was executed continue to be ineffective (see, Matter of Seveira, 205 App Div 686). This approach is followed in

England (15 & 16 Vict, c 24, § 1) and in Pennsylvania [Pa Stat Ann tit 20, § 180.2(1)].

3. Subparagraph (a)(2) makes explicit that the testator may execute the will or acknowledge his signature to each

witness separately (see, Hoysradt v Kingham, 22 NY 372).

4. Paragraph (b) is new, and is designed to make it clear that the formalities of execution need not follow the precise

order set forth in the section, so long as all formalities are observed during the "ceremony of execution" (cf. Jackson v

Jackson, 39 NY 153; but see, Matter of Jones, 157 Misc 847).

5. Paragraph (c), designed to promote the expeditious execution of wills, stablizes an area which had not been

clarified under case law (cf. Matter of Harty, 85 Misc 628, with Matter of Willenborg, 16 Misc 2d 419).

Treatises & Practice Guides:

Matthew Bender's New York Civil Practice:

1 Cox, Arenson, Medina, New York Civil Practice: SCPA PP 102.01, 103.03, 103.22, 103.56, 210.10; 2 Cox,

Arenson, Medina, New York Civil Practice: SCPA PP 1001.13, 1002.12; 3 Cox, Arenson, Medina, New York Civil

Practice: SCPA PP 1401.04, 1402.06, 1403.06, 1404.06, 1404.09, 1404.11, 1405.02, 1405.03, 1405.04, 1406.05,

1407.01, 1407.07, 1408.03; 4 Cox, Arenson, Medina, New York Civil Practice: SCPA PP 1709.05, 1710.02; 6 Cox,

Arenson, Medina, New York Civil Practice: SCPA PP 2302.04, 2507.03

Page 3

NY CLS EPTL § 3-2.1

2 Rohan, New York Civil Practice: EPTL PP 3-2.1[1] et seq

Matthew Bender's New York Practice Guides

New York Practice Guide: Probate and Estate Administration §

New York Practice Guide: Probate and Estate Administration §

New York Practice Guide: Probate and Estate Administration §

New York Practice Guide: Probate and Estate Administration §

New York Practice Guide: Probate and Estate Administration §

New York Practice Guide: Probate and Estate Administration §

New York Practice Guide: Probate and Estate Administration §

New York Practice Guide: Probate and Estate Administration §

New York Practice Guide: Probate and Estate Administration §

New York Practice Guide: Probate and Estate Administration §

3.02

3.03

3.04

3.05

6.10

8.06

8.08

11.08

11.15

11.17

Execution of Will

Attestation of Will

Conflict of Laws as to Will

Presumptions in Law as to the Will

Service of Process Forms

Nuncupative and Holographic Wills

Proof of Lost or Destroyed Will

Objections to Probate

Discovery

Decrees

Warren's Heaton on Surrogate's Court Practice:

Warren's Heaton on Surrogates' Court § 41.09 Proving the Will

Warren's Heaton on Surrogates' Court § 42.05 Due Execution

Warren's Heaton on Surrogates' Court § 42.08 Revocation

Warren's Weed New York Real Property (4th Ed):

11 Warren's Weed, PROOF § 2.25

Practice Forms:

Bender's Forms for the Civil Practice Form No. EPTL 3-2.1:1 et seq

11 Medina's Bostwick Practice Manual (Matthew Bender), Forms WILLS 101 et seq (wills)

See "FORMS" heading following "CASE NOTES", infra.

Related Statutes & Rules:

New York Code References:

This section referred to in § § 1-2.18, 3-2.2, 3-3.7, 3-4.6

Probate where one or more subscribing witnesses cannot be produced, CLS SCPA § § 1404, 1405

Proof of lost or destroyed will, CLS SCPA § 1407

Probate of will not allowed unless court is satisfied of validity, CLS SCPA § 1408

Proceeding for construction and determination of validity of will, CLS SCPA § 1420

Law Reviews & Journals:

Law Reviews:

Arenson, An Analysis of Certain Provisions of the Estates, Powers and Trust Law, 33 Brooklyn L Rev 425

1974 Survey of New York law: decedents' estates. 26 Syracuse LR 311

1975 Survey of New York law: decedents' estates. 27 Syracuse L Rev, No. 1, p. 329, 1976

1983 Survey of New York Law. 35 Syracuse Law Review p. 342

Jurisprudence:

57 NY Jur 2d, Evidence and Witnesses § 106

79 Am Jur 2d, Wills § § 6 et seq, 183 et seq, 199 et seq, 210 et seq, 232 et seq, 254 et seq, 283 et seq, 289 et seq,

313 et seq, 498 et seq, 510 et seq

20 Am Jur Legal Forms 2d, Wills, Forms 266:51 et seq

Annotations:

Authorization by trust instrument of investment of trust funds in nonlegal investments. 78 ALR2d 7

Incorporation in will of extrinsic document not in existence at date of will. 3 ALR2d 682

Codicil as reviving revoked will or codicil. 33 ALR2d 922

Interlineations and changes appearing on face of will. 34 ALR2d 619

Page 4

NY CLS EPTL § 3-2.1

Validity of will written on disconnected sheets. 38 ALR2d 477

"Attestation" or "Witnessing" of will, required by statute, as including witnesses' subscription. 45 ALR2d 1365

Failure of attesting witness to write or state place of residence as affecting will. 55 ALR2d 1053

Sufficiency of publication of will. 60 ALR2d 124

Effect of failure of attesting witness to observe testator's capacity. 69 ALR2d 662

Fingerprints as signature. 72 ALR2d 1267

Competency of named executor as subscribing witness to will. 74 ALR2d 283

What constitutes the presence of the testator in the witnessing of his will. 75 ALR2d 318

Sufficiency, as to form, of signature to holographic will. 75 ALR2d 895

Fact that instrument is designated or otherwise identified as a copy as affecting its status as will. 81 ALR2d 1112

Statute of limitations applicable in action to enforce, or recover damages for breach of, contract to make a will. 94

ALR2d 810

Validity of a will signed by testator with the assistance of another. 98 ALR2d 824

Validity of will signed by testator's mark, stamp, or symbol, or partial or abbreviated signature. 98 ALR2d 841

Wills: place of signature of attesting witness. 17 ALR3d 705

Competency, as witness attesting will, of attorney named therein as executor's attorney. 30 ALR3d 1361

Wills: when is will signed at "end" or "foot" as required by statute. 44 ALR3d 701

Effect upon testamentary nature of document of expression therein of intention to make more formal will, further

disposition of property, or the like. 46 ALR3d 938

Construction of reference in will to statute where pertinent provisions of statute are subsequently changed by

amendment or repeal. 63 ALR3d 603

Necessity that attesting witness realize instrument was intended as will. 71 ALR3d 877

Proper disposition under will providing for allocation of express percentages or proportions amounting to more or

less than whole of residuary estate. 35 ALR4th 788

What constitutes rejection of claim against estate to commence running of statute of limitations applicable to rejected

claims. 36 ALR4th 684

Effect of impossibility of performance of condition precedent to testamentary gift. 40 ALR4th 193

Electronic tape recording as will. 42 ALR4th 176

Sufficiency of evidence to support grant of summary judgment in will probate or contest proceedings. 53 ALR4th

561

Texts:

4 Frumer & Biskind, Bender's New York Evidence--CPLR § § 11.16, 15.09; 5 Frumer & Biskind, Bender's New

York Evidence--CPLR § § 23A.01, 23A.03, 23A.05, 23A.06; 6 Frumer & Biskind, Bender's New York Evidence--CPLR

§ 24.07

Case Notes

I. In General 1. Generally 2. Construction with other laws 3. What law governs 4. Strict compliance 5. Substantial

compliance 6. Non-compliance of compliance 7. Procedural matters 8. Evidence and burden of proof 9. Execution as

question of law or fact 10. Determination as to statutory compliance; substance of will 11. --Intent 12. --Capacity or

undue influence 13. Partial admission to probate

II. Testamentary Instruments and Dispositions 14. In general; time transfer effective 15. Delivery 16. Instrument

reserving title or incident thereof 17. Contract to make will 18. Letters and memos 19. Inter vivos trusts 20. Insurance

21. Forgiveness of debt 22. Mortgage provisions 23. Partnership or membership agreements 24. United States Savings

Bonds 25. Copies of instruments 26. Support agreements 27. Other instruments and dispositions

III. Signature of Testator 28. In general 29. Mistake 30. Initials 31. Mark 32. --Evidence and burden of proof 33.

Fingerprints 34. Device, emblem, or seal 35. Assistance in signing 36. Signature by agent

IV. Subscription at End 37. In general 38. Effect of subscription at beginning of instrument 39. Partial invalidity of

instrument 40. Codicils added after date of subscription 41. Misplacement as invalidating entire will; prior law 42.

--Where nondispositive writings appear below subscription 43. --Where executors appointed below subscription 44.

Page 5

NY CLS EPTL § 3-2.1

Relation to attestation clause 45. Relation to witnesses' signatures 46. Subscription on back of will 47. Subscription in

margin or the like 48. Folded wills 49. Form wills 50. --Folded form wills 51. --Attached sheets

V. Signature in Presence of Witnesses 52. In general; sequence of events 53. Necessity that witnesses see testator's

signature 54. Necessity of contemporaneous signing 55. Effect of recitals in attestation clause 56. Evidence and burden

of proof

VI. Publication, Acknowledgment and Request to Witness 57. In general 58. Sequence of events 59. When

acknowledgment required 60. --When express acknowledgment not required 61. --Sufficiency of request 62.

Sufficiency of acknowledgment 63. --Request that witness act as such 64. --Acknowledgment to only one witness 65.

Effect of acknowledgment without subscription 66. Necessity that testator's signature be visible 67. Publication without

subscription or acknowledgment 68. Subscription or acknowledgment without publication 69. Sufficiency of

publication 70. --Time of publication 71. --Reading of will 72. Where testator acts through interpreter 73. Execution of

copies

VII. Subscription by Witnesses 74. In general 75. What constitutes end of will 76. --Form wills 77. Interested witnesses

78. Relation to attestation clause 79. Time of signing 80. Signature in each other's presence 81. Signing by or as notary

82. Signing by agent 83. Initials 84. Requirement of prior law as to address of witnesses

VIII. Incorporation by Reference 85. In general 86. Effect on validity of principal will 87. Particular instances where

incorporation not allowed 88. Instrument as extrinsic evidence 89. When incorporation allowed 90. --Particular

instances

IX. Integration 91. In general; sufficient integration 92. --Insufficient integration

X. Testimony of Witnesses 93. In general; liberal construction 94. Conflicting testimony; different witnesses 95.

Contradictory statement; same witness 96. Forgetful witness 97. Hostile witness 98. Interested witness 99. Deceased or

absent witness; probate allowed 100. --Probate denied 101. Disregarding testimony 102. Use of other evidence where

testimony unreliable 103. --Effect of attestation clause 104. --Attorney's testimony 105. --Ancient documents

XI. Attestation Clauses 106. In general; weight as evidence 107. Necessity of corroboration

XII. Other Evidence of Due Execution 108. In general; execution supervised by attorney 109. Oral declarations of

testator 110. Other factors considered

XIII. Lost or Destroyed Wills 111. In general; burden of proof 112. Draft or copy 113. Codicil 114. Oral testimony

XIV. Multiple Execution 115. In general

XV. Holographic or Nuncupative Wills 116. In general 117. Subscription at end 118. Signing in presence of witnesses

119. Publication, acknowledgment, and request to witnesses 120. Subscription by witnesses 121. Incorporation by

reference 122. Integration 123. Testimony of witnesses 124. Status of testator or circumstances of death

XVI. Compliance With Law of Testator's Domicile 125. In general; foreign state 126. Foreign country

XVII. Revocation by Writing or Partial Obliteration 127. In general 128. Later will 129. Codicil 130. Erasing or

crossing out 131. Interlineation 132. Cutting or tearing 133. Oral modification or revocation 134. Sustaining original or

unmodified portions of will

I. In General

1. Generally

Testamentary gifts have long been required to be in writing, except for nuncupative wills. Re Rubin's Will (1952)

280 AD 348, 113 NYS2d 70, adhered to 280 AD 864, 113 NYS2d 77 and affd 305 NY 288, 113 NE2d 424.

Page 6

NY CLS EPTL § 3-2.1

This section requires compliance in the following respects: (1) The will must be subscribed by testator at the end;

(2) such subscription must be affixed or acknowledged in the presence of the attesting witnesses; (3) at the time the

testator must declare the instrument as his will; (4) there must be more than a single witness; (5) each witness must sign

his name; (6) each witness' signature must be affixed at the end of the will; (7) this must be done at the request of the

testator. Re Andrews' Will (1949) 195 Misc 421, 88 NYS2d 32.

This section was designed to prevent fraud in the execution of wills, and its beneficial purpose should not be

thwarted by an unduly strict interpretation of its provisions, especially where there is no opportunity for fraud to have

been perpetrated. Re Will of Kobrinsky (1966) 51 Misc 2d 222, 273 NYS2d 156.

2. Construction with other laws

By the words "the will" as used in Surrogate's Court Act, § 278, it is intended to specify the last will and testament

speaking as of the time of the testator's death and found to have executed in accordance with the provisions of this

section at a time when the deceased possessed testamentary capacity and was free from fraud and undue influence. Re

Newcomb's Will (1952) 202 Misc 1020, 111 NYS2d 314.

Executor named in decedent's 1992 will, who was attorney and member of same firm as attorney who had drafted

will, was granted waiver of requirement under CLS SCPA § 2307-a that he produce decedent's written

acknowledgement of disclosure in order to be entitled to full statutory commission, where decedent had indicated that

she would make appointment to execute disclosure form and review her testamentary plan, but she became ill shortly

thereafter and did not make appointment before her death on January 16, 1997. In re Estate of Waldman (1997, Sur) 172

Misc 2d 130, 658 NYS2d 565.

3. What law governs

The public policy of this state prohibits the enforcement of an oral contract to make a will, and though a foreign

statute may be substantive, the law of New York governs. Hence, a complaint to enforce an oral agreement executed in

Florida to make a will in favor of the plaintiff was properly dismissed, although such an oral agreement was valid and

enforceable under Florida law. Rubin v Irving Trust Co. (1953) 305 NY 288, 113 NE2d 424.

Tentative trusts created in favor of the decedent's son are not affected by the provisions of this law, where said

provisions became effective subsequent to the creation of said trusts. Re Yarme's Estate (1933) 148 Misc 457, 266 NYS

93, affd 242 AD 693, 273 NYS 403.

Although the law in effect when a will is executed controls the form of such execution, the law in effect at the time

of the testator's death determines the meaning and effect of the will. Re Redmond's Will (1946, Sur) 60 NYS2d 316.

4. Strict compliance

The formalities of execution prescribed by this section must be strictly followed for the purpose of rendering it

certain that an instrument is the testator's will. Re Kenney's Will (1917) 179 AD 258, 166 NYS 478.

It has long been established that when the issue raised is solely as to the manner of the execution of a will and the

only inquiry is as to a compliance with the statutory requirements which fix an "inflexible" and determinative rule, that

in such case the intention of the testator is irrelevant and that of the legislature in the enactment of the rule prevails. Re

Peabody's Will (1952) 279 AD 826, 109 NYS2d 257 (1952).

The statute of wills must be strictly construed. Re Ditson's Estate (1941) 177 Misc 648, 31 NYS2d 468; Re

Winters' Will (1950) 277 AD 24, 98 NYS2d 312, affd 302 NY 666, 98 NE2d 477, remittitur den 302 NY 845, 100 NE2d

43.

5. Substantial compliance

A slight variance from the usual formality in the execution of a will, unattended by any other circumstances

throwing suspicion on the will, does not render such will invalid. Re Thompson's Will (1947) 189 Misc 873, 68 NYS2d

123, affd 274 AD 850, 81 NYS2d 923.

While the provisions of the statute are strictly enforced, their observance has never been reduced to any ironclad

ceremonial or ritualistic formula, and if the fair preponderance of evidence is sufficient to show substantial compliance

Page 7

NY CLS EPTL § 3-2.1

with the statute in the execution of the testamentary instrument, the instrument becomes eligible for admission to

probate, unaffected by mere surplusage. Re Douglas' Will (1948) 193 Misc 623, 83 NYS2d 641.

Although the observance of the formalities required by this section need not be in accordance with strict ritualistic

procedure, there must be a substantial compliance as to each and every one of the statutory requirements. Re Andrews'

Will (1949) 195 Misc 421, 88 NYS2d 32.

While this section was designed to prevent fraud, its beneficial purpose should not be subverted by overly strict

interpretation. Re Will of Dupin (1962) 36 Misc 2d 309, 232 NYS2d 381.

This section was designed to prevent fraud in the execution of a will and its beneficial purpose should not be

thwarted by an unduly strict interpretation of its provisions, especially where there is no opportunity for fraud to have

been perpetrated. Re Will of Kobrinsky (1966) 51 Misc 2d 222, 273 NYS2d 156.

Informality of paper does not prevent it from being given testamentary effect. Re Estate of Kenneally (1988) 139

Misc 2d 198, 528 NYS2d 314.

6. Non-compliance of compliance

The public policy of this state prohibits the enforcement of an oral contract to make a will. And though the statute

may be substantive, the law of New York governs. Hence, a complaint to enforce an oral agreement executed in Florida

to make a will in favor of the plaintiff was properly dismissed although such an oral agreement was valid and

enforceable under Florida law. Rubin v Irving Trust Co. (1953) 305 NY 288, 113 NE2d 424.

An instrument which was neither executed nor attested in the manner required by this section is not entitled to

probate as a will. Re Cressey's Will (1961, 4th Dept) 12 AD2d 881, 210 NYS2d 210, affd 10 NY2d 918, 223 NYS2d

871, 179 NE2d 711.

Public policy dictates that the requirements of the statute of wills be carried out, and non-compliance therewith is

fatal to the validity of any act attempted. Re Foley's Will (1912) 76 Misc 168, 136 NYS 933.

A document, testamentary in character, but not executed with the formalities required by this section, cannot be

admitted to probate or serve to vary or revoke the terms of decedent's will. Re Estate of Voice (1963) 38 Misc 2d 779,

238 NYS2d 736, affd 19 AD2d 945, 245 NYS2d 310.

Trial court erred in denying summary judgment pursuant to N.Y. C.P.L.R. 3212 to the executor of an estate as to

two objections to a will, as the will was properly executed pursuant to N.Y. Est. Powers & Trusts Law § 3-2.1, and a

step-daughter of the decedent failed to show that the decedent lacked testamentary capacity; however, the trial court

properly denied summary judgment as to an objection claiming undue influence and fraud. In re Estate of Johnson

(2004, App Div, 3d Dept) 775 NYS2d 107.

Trial court erred in denying summary judgment pursuant to N.Y. C.P.L.R. 3212 to the executor of an estate as to

two objections to a will, as the will was properly executed pursuant to N.Y. Est. Powers & Trusts Law § 3-2.1, and a

step-daughter of the decedent failed to show that the decedent lacked testamentary capacity; however, the trial court

properly denied summary judgment as to an objection claiming undue influence and fraud. In re Estate of Johnson

(2004, App Div, 3d Dept) 775 NYS2d 107.

7. Procedural matters

A proceeding to vacate a probate decree on the ground that the will was not executed in conformity with this

section is not barred by the passage of twenty years where it was only recently discovered that the testator had made

references in his will to corporations established subsequent to the purported date of execution and attestion of the will.

Re Schell's Will (1947) 272 AD 210, 70 NYS2d 441, app den 272 AD 1081, 75 NYS2d 303 and app dismd 297 NY 599,

75 NE2d 270.

Suit brought to determine validity of codicils to will was a "special proceeding" subject to provision in dead man's

statute that upon trial of special proceeding the testimony of interested witnesses is barred. Re Will of Sheehan (1976,

4th Dept) 51 AD2d 645, 378 NYS2d 141.

Notwithstanding that the granting of summary relief in contested probate proceedings is relatively rare, summary

judgment would be granted where the proponents of the will made out a prima facie case for probate and where the

Page 8

NY CLS EPTL § 3-2.1

objectant failed to raise any issue of fact with respect to the alleged issues of will execution, capacity, and undue

influence or fraud. Re Estate of Witkowski (1981, 3d Dept) 85 App Div 2d 807, 445 NYS2d 639.

Proponents, draftsman and executor of decedent's will, and residuary legatee, should have been granted summary

judgment dismissing objections and admitting to probate decedent's last will and testament where it was uncontroverted

that draftsman announced to subscribing witnesses, in decedent's presence, that decedent was executing will, draftsman

requested subscribing witnesses to sign will in decedent's presence and with his silent permission and approval,

proponents showed that decedent possessed testamentary capacity at time he executed will, and will was not product of

fraud or undue influence. In re Estate of Frank (1998, 4th Dept) 249 App Div 2d 893, 672 NYS2d 556, app den (1998)

92 NY2d 807, 678 NYS2d 592, 700 NE2d 1228.

A petition to revoke letters testamentary was sufficient where it alleged fraud; petitioner was not required to show a

reasonable probability of success. Re Hinderson's Will (1956) 4 Misc 2d 559, 150 NYS2d 869, affd (2d Dept) 2 AD2d

682, 153 NYS2d 584.

In will contest, objectant who made generalized claim of lack of testamentary capacity and due execution would be

required to furnish bill of particulars as to which requirements of CLS EPTL § 3-2.1 (respecting execution and

attestation) were allegedly not complied with, and as to details of mental illness allegedly suffered by decedent;

although proponent has burden of proof concerning due execution and testamentary capacity, it was objectant who

placed those requirements at issue. Re Estate of Sheehan (1987) 137 Misc 2d 310, 520 NYS2d 342.

8. Evidence and burden of proof

Proponent of will for probate was on notice that burden of proving due execution was hers, despite Surrogate

Court's failure to include that requirement when it framed issues for trial, because burden of proving due execution is on

proponent of will under CLS EPTL § 3-2.1, which provides, among other requirements, that testator must publish to

attesting witnesses that document was his or her will. In re Estate of Pirozzi (1997, 3d Dept) 238 AD2d 833, 657 NYS2d

112.

Before a propounded document can be admitted to probate as a last will and testament, there must be shown to the

satisfaction of the surrogate not only that the same has been executed with the formalities but also that the person

alleged to have executed the same was free from the disqualifications set forth in § 10, as to real estate, and was

possessed of the qualifications prescribed by § 15 as to personal estate. Re King's Will (1915) 89 Misc 638, 154 NYS

238.

A will and two codicils must be admitted to probate although the second codicil revoked all former codicils, where

it is satisfactorily demonstrated that all the instruments were executed in conformity with this section by a competent

and uninfluenced testatrix. Re Glickman's Will (1939) 170 Misc 865, 11 NYS2d 379.

While the provisions of the statute are strictly enforced their observance has never been reduced to any ironclad

ceremonial or ritualistic formula, and if the fair preponderance of evidence is sufficient to show substantial compliance

with the statute in the execution of the testamentary instrument, the instrument becomes eligible for admission to

probate, unaffected by mere surplusage. Re Douglas' Will (1948) 193 Misc 623, 83 NYS2d 641.

There is no question but that, in a will contest, the burden of proof of due execution and testamentary capacity is

upon the proponent, and he is accordingly not entitled to demand a bill of particulars from the objector regarding those

matters notwithstanding the 1958 change in Rule 121-a of the Rules of Civil Practice. Re Lenfestey's Will (1961) 28

Misc 2d 302, 211 NYS2d 3.

At least in such case where the proponent stands to gain because of an alteration in the will, it is incumbent upon

him to demonstrate by a fair preponderance of evidence that the writing contained in the instrument was the same at the

date of its execution as at the time of probate as to all dispositive provisions. Re Lyons' Will (1947, Sur) 75 NYS2d 237.

The burden of proving that an instrument was executed in conformity with the provisions of this section rests upon

the proponent. Re Will of Nevins (1962, Sur) 231 NYS2d 586.

9. Execution as question of law or fact

Whether a will was drawn in the form prescribed by this section is a pure question of law. Re Brand (1918) 185

AD 134, 173 NYS 169, affd 227 NY 630, 125 NE 913.

Page 9

NY CLS EPTL § 3-2.1

On proceedings to probate a will in which certain issues were directed to be tried in surrogate's court before a jury,

it was error for the court to refuse to submit to the jury the question of whether the will was executed in compliance

with this section and to hold as a matter of law that the will had been properly executed, where the evidence introduced

as to the execution of the will was conflicting and raised a clear question of fact. Re Lawler's Will (1920) 195 AD 27,

185 NYS 726.

Objectant was not entitled to summary judgment disallowing probate of will where fact issue existed as to whether

attorney-draftsman merely guided physically infirm testatrix's hand when she executed her will or whether he actually

signed will in her stead. Re Grubert (1988, 2d Dept) 139 App Div 2d 741, 527 NYS2d 492.

10. Determination as to statutory compliance; substance of will

Surrogate's Court properly granted petitioner's motion for summary judgment admitting will to probate where he

offered deposition testimony, affidavit, and documentary evidence from attorney who met with decedent, prepared will,

and witnessed its execution, and although respondents submitted number of affidavits in opposition, none of affiants

had personal knowledge of decedent's capacity or of any undue influence or fraud actually exercised on decedent. In re

Estate of Dietrich (2000, 3d Dept) 271 AD2d 894, 706 NYS2d 763.

A will offered for probate, admittedly intended to be what in form and substance it purports on its face to be, is

entitled to probate, notwithstanding that the propounded paper was merely part of a scheme of the testator to deprive the

widow of her statutory share, in the execution of which scheme the testator, shortly before his death, executed the paper

propounded and thereafter executed a trust agreement whereby he undertook to place in the hands of trustees all of his

property except a nominal amount. Re Straus' Estate (1934) 154 Misc 31, 277 NYS 134, affd 245 AD 707, 281 NYS

995.

The nominated executor's objection to the probate of the instrument by the decedent's surviving spouse, who was

not mentioned or provided for in the document, on the ground that no assets will devolve under the instrument, is no bar

to probate if the instrument is executed in accordance with this section by a competent testator acting in pursuance of

his own volition. Re Tankelowitz's Will (1937) 162 Misc 474, 294 NYS 754.

The surrogate has no discretion to refuse to admit to probate a will or codicil executed in compliance with this

section by one possessing testamentary capacity and under no undue influence. Re Strickland's Will (1939) 172 Misc

976, 16 NYS2d 666.

A will, although missing a page, could be admitted to probate where the missing page contained nothing more than

boiler-plate legalisms and the instrument's dispositive provisions were complete without regard to the missing page, the

instrument as executed constituted a full testamentary scheme encompassing distribution of decedent's entire estate

without resort to the language contained on the missing page, and it was incumbent upon the court to effectuate duly

executed instruments which incorporate a decedent's entire dispositive scheme. Re Estate of Hall (1983) 118 Misc 2d

1052, 462 NYS2d 154.

11. --Intent

It has long been established that when the issue raised is solely as to the manner of the execution of a will and the

only inquiry is as to a compliance with the statutory requirements which fix an "inflexible" and determinative rule, that

in such case the intention of the testator is irrelevant and that of the Legislature in the enactment of the rule prevails Re

Peabody's Will (1952) 279 AD 826, 109 NYS2d 257.

Intention is not to be considered when passing upon the formal statutory requirements in the execution of wills, and

there is no exception with respect to instruments wholly written in the testator's hand. Re Robinson's Will (1951) 201

Misc 439, 103 NYS2d 967.

While, in proceedings to construe wills, the primary principle is to discover and carry into effect intention of the

decedent, no such rule can be invoked in construction of this section. Re Will of Moeser (1964) 42 Misc 2d 1017, 249

NYS2d 443.

In determining whether there has been a compliance with this section, it is the legislature's intention and not that of

the testator which is controlling. Re Rothstein's Will (1952, Sur) 112 NYS2d 716.

Page 10

NY CLS EPTL § 3-2.1

While the intention of the testator is paramount in the interpretation of a will after its admission to probate, that rule

cannot be invoked in the construction of the statute regulating the execution thereof. Re Begun's Will (1953, Sur) 123

NYS2d 782.

12. --Capacity or undue influence

Surrogate's Court was justified in allowing hearing to determine whether attorney-legatee exercised undue

influence over testatrix in discussions surrounding preparation of her will, even though attorney-legatee did not actually

draft will, where drafting attorney prepared will primarily on basis of attorney-legatee's memo outlining testatrix's assets

and testamentary wishes, which named attorney-legatee and his family members as potential beneficiaries. Re

Henderson (1992) 80 NY2d 388, 590 NYS2d 836, 605 NE2d 323.

Inference of undue influence which arises when attorney has drafted will in which he is beneficiary should not

automatically be applied where attorney-legatee has had professional relationship with testator but was not attorney who

drafted will. Re Henderson (1992) 80 NY2d 388, 590 NYS2d 836, 605 NE2d 323.

If a testatrix was mentally incompetent at the time of executing a codicil, subsequent restoration to competency, no

matter how long continued, does not give efficacy to the void codicil unless after restoration to competency there was a

republication of the instrument in the manner required by this section. Re Strong's Will (1917) 179 AD 539, 166 NYS

862.

A mere showing of opportunity and even of a motive to exercise undue influence does not justify a submission of

that issue to the jury, unless there is in addition evidence that such influence was actually utilized. Re Will of Haggart

(1969, 4th Dept) 33 AD2d 124, 307 NYS2d 18, affd 27 NY2d 900, 317 NYS2d 370, 265 NE2d 779.

In determining whether nursing home operator had exercised undue influence upon a very old and ill man and

caused him to change his will, the jury could have considered, among other things, whether there was a long standing

relationship of trust and confidence between the deceased and his former attorney, and that by uttering slanders and

denigrating the attorney's honesty and integrity, the nursing home operator had been able to separate them and, thereby,

deprive deceased of his counsel; whether there was a close relationship between the decedent and the nursing home

operator and whether she exploited his fraility for her own personal gain; and whether she was either directly or

indirectly instrumental in having another attorney selected to prepare decedent's final will. Thus it was error to have

removed the question of undue influence from the consideration of the jury. Re Burke (1981, 2d Dept) 82 App Div 2d

260, 441 NYS2d 542.

The burden is on a contestant of a will to establish undue influence by a fair preponderance of the evidence. Thus,

in a proceeding to contest a will on the ground of undue influence over the testatrix by her son, it was improper to deny

the probate of her will, and that ruling would be reversed, where, although her son had exercised control over her

activities in her final days, there was no evidence that she was under his influence; he was living with her and taking

care of her physical needs; he was her only surviving son; her doctor testified that she was mentally very strong; all of

the witnesses to her will testified to her awareness, social presence and obvious mental clarity; and her son was the

natural object of her bounty. Re Estate of Klitgaard (1981, 3d Dept.) 83 AD2d 651, 442 NYS2d 590.

Probate of a will was properly denied on the ground of undue influence of decedent's sister where a prior will left

the estate to a daughter who cared for decedent during the last three years of his life, and where a subsequent will,

naming the sister as residuary beneficiary, was executed in the hospital by decedent while he was close to death, and

while he was in the presence of his sister, who had stated to other persons that it was her intention to influence him. Re

Estate of O'Donnell (1982, 3d Dept) 91 App Div 2d 698, 457 NYS2d 609.

In contested probate proceeding, court erred in removing question of undue influence by proponent from

consideration of jury since jury could have found that confidential relationship existed between testatrix, woman of

advanced years, and proponent, who drafted her will, in which he was named sole beneficiary, especially where

evidence showed that proponent had control over all of testatrix' assets and was managing her financial affairs; although

proponent had offered explanation as to why testatrix had executed will in his sole favor, such testimony merely created

fact question for jury as to whether proffered explanation was adequate. Re Bach (1987, 2d Dept) 133 App Div 2d 455,

519 NYS2d 670.

Jury verdict which found existence of undue influence in execution of will and denied probate was supported by

trial testimony that (1) testator was about 90 years old at time he executed will, that he suffered from number of

physical infirmities consistent with his age, that he was "upset," "in space," and "beaten individual" at time of execution

Page 11

NY CLS EPTL § 3-2.1

of will, and (2) proponent of will was overbearing and treated testator in condescending manner, significantly limited

amount of time testator spent with other family members, and did not permit testator to talk about will. Re Estate of

Callahan (1989, 2d Dept) 155 AD2d 454, 547 NYS2d 113.

In probate proceeding, court properly determined, as matter of law, that will had been properly executed and that

testatrix had not been unduly influenced by her daughter, absent showing that bequest to daughter and exclusion of son

was due to anything other promptings of affection motivated by ties of attachment arising from consanguinity; mere

showing of opportunity (and even motive) to exercise undue influence does not justify submission of issue to jury

unless there is additional evidence that undue influence was actually used. In re Posner (1990, 2d Dept) 160 AD2d

943, 554 NYS2d 666, app den 76 NY2d 710, 563 NYS2d 61, 564 NE2d 671, reconsideration dismd 77 NY2d 940, 569

NYS2d 614, 572 NE2d 55.

Inference of undue influence was not created in situation where attorney who served as testatrix's long-time

counselor received bequest but did not draft will. Re Henderson (1991, 2d Dept) 175 AD2d 804, 572 NYS2d 932, app

gr 79 NY2d 757, 583 NYS2d 192, 592 NE2d 800 and revd on other grounds, app dismd, summary judgment den, in part

80 NY2d 388, 590 NYS2d 836, 605 NE2d 323.

Objectors were not entitled to summary judgment on basis of incompetence of decedent at time of execution of

will, despite affidavit of physician who examined decedent shortly before execution of will, diagnosed decedent as

suffering from senile dementia, and concluded that decedent was not competent to execute will, where affidavit of

physician who had not examined defendant explained that senile dementia is not condition which necessarily renders

person incompetent at all times and is often characterized by periods of lucid behavior during which person would be

competent to execute will, and there was evidence by attesting witnesses as to execution of will. In re Estate of Ruso

(1995, 3d Dept) 212 AD2d 846, 622 NYS2d 137.

New York does not recognize cause of action for tortious interference with prospective inheritance. Vogt v

Witmeyer (1995, 4th Dept) 212 AD2d 1013, 622 NYS2d 393.

Although inference of undue influence, requiring beneficiary to explain circumstances of bequest, arises when

beneficiary under will was in confidential or fiduciary relationship with testator and was involved in drafting of will, no

such inference arises where there is no evidence that fiduciary-legatee had any direct or indirect involvement in

preparation or execution of testamentary instruments offered for probate. Cordovi v Karnbad (In re Estate of Bartel)

(1995, 1st Dept) 214 AD2d 476, 625 NYS2d 519.

Decedent possessed testamentary capacity, even though she suffered periods of disorientation and confusion at time

of her hospitalization, where she was alert and understood what was taking place when will was executed, and she was

aware of natural objects of her bounty and nature and extent of her property. In re Margolis (1995, 2d Dept) 218 AD2d

738, 630 NYS2d 574, app den 88 NY2d 802, 644 NYS2d 689, 667 NE2d 339.

Decedent possessed testamentary capacity where he understood nature and consequences of executing will, he

understood extent of his property and to whom he was devising it, and his rationale for bequests he made was expressed

in will itself. In re Estate of Richtman (1995, 2d Dept) 221 AD2d 640, 634 NYS2d 197, app den 87 NY2d 810, 642

NYS2d 858, 665 NE2d 660.

Mere showing of opportunity, and even of motive to exercise undue influence, is insufficient to invalidate will in

absence of additional evidence that such influence was actually exercised. In re Estate of Richtman (1995, 2d Dept) 221

AD2d 640, 634 NYS2d 197, app den 87 NY2d 810, 642 NYS2d 858, 665 NE2d 660.

Surrogate's Court properly set aside jury's verdict that testatrix lacked testamentary capacity where objectants never

refuted testimony of subscribing witnesses that testatrix was alert, and of sound mind, memory, and understanding at

time of will execution, objectants offered testimony of neurologist who never knew testatrix and who never treated her,

and his opinion was speculative and contradicted by testimony of proponents' witnesses, including expert testimony. In

re Estate of Tracy (1995, 2d Dept) 221 AD2d 643, 634 NYS2d 198, motion to dismiss app den (NY App Div, 2d Dept)

1995 NY App Div LEXIS 12469 and app den 87 NY2d 811, 644 NYS2d 144, 666 NE2d 1058.

Sufficient issues of fact warranted submission of issue of undue influence over 94-year-old testator to jury where

(1) one week after he was admitted to nursing home, his son (will's proponent) drove testator to lawyer's office where

will was executed naming son sole beneficiary, (2) son did not notify his sister (testator's other child) and acted against

advice of testator's physician, and (3) inference was raised that son had convinced testator that sister had

Page 12

NY CLS EPTL § 3-2.1

misappropriated money from testator's accounts and therefore should not benefit from inheritance. In re Estate of Itta

(1996, 2d Dept) 225 AD2d 548, 638 NYS2d 759.

Proponents were not entitled to summary judgment to dismiss objection to will based on lack of testamentary

capacity where there was minimal evidence of testator's competence, and fact issue was raised by psychiatrist's affidavit

based on testator's extensive writings. In re Estate of Warsaski (1996, 1st Dept) 228 AD2d 275, 644 NYS2d 37.

Surrogate's Court properly admitted evidence of certain events which occurred after execution of will as relevant in

determining whether petitioner had executed undue influence on testator and bearing on testator's testamentary capacity

at time of execution of purported will. In re Estate of Steinhardt (1996, 2d Dept) 228 AD2d 685, 644 NYS2d 970.

Testator was victim of undue influence by proponent, one of testator's 4 siblings, where, inter alia, testator spent

last months of his life in proponent's home confined to bed, taking various pain medications, and in "confused" and

"weak and shaky" state, proponent was not close to testator for most of their lives, proponent actively insulated testator

from relatives and threatened to put testator in nursing home if he did not "agree" not to see those relatives, and attorney

who drafted will was proponent's long-time family attorney and had no prior dealings with testator. In re Panek (1997,

4th Dept) 237 AD2d 82, 667 NYS2d 177.

Last will and testament was properly admitted to probate where there was no evidence that testator would have

changed his will if he knew of objectant's whereabouts, will indicated that reason for objectant's disinheritance was lack

of contact between testator and objectant for more than 29 years prior to execution of will, and claim that drafter's

fraudulent intent was inferable from his self-interest in maintaining business account controlled by objectant's deceased

brother was so speculative as to constitute no evidence of fraud at all. In re Estate of Castagnello (1997, 1st Dept) 239

AD2d 281, 658 NYS2d 848.

Preliminary executrix's successful efforts to have herself appointed as decedent's guardian only months before he

executed first of 3 codicils did not collaterally estop her from arguing that decedent had testamentary capacity when he

executed codicils, because finding of incapacity under CLS Men Hyg Art 81 is based on different factors from those

involved in finding of testamentary capacity. In re Estate of Colby (1997, 1st Dept) 240 AD2d 338, 660 NYS2d 3, app

den 91 NY2d 801, 666 NYS2d 563, 669 NE2d 533.

Although decedent was susceptible to undue influence, burden in probate proceeding never shifted to preliminary

administratrix/guardian to show freedom from undue influence where there was no evidence of her involvement in

drafting of testamentary instruments, and objectants' evidence of undue influence was negligible; mere opportunity for

undue influence does not mean that it was exercised. In re Estate of Colby (1997, 1st Dept) 240 AD2d 338, 660 NYS2d

3, app den 91 NY2d 801, 666 NYS2d 563, 669 NE2d 533.

In probate proceeding, Surrogate's Court properly granted summary judgment dismissing objection that decedent's

niece and nephew, who were among residuary legatees under will, had exercised undue influence on decedent where

they seldom visited decedent, had no control over her daily activities or financial affairs, and did not participate in

making of will, decedent contacted executor to make new will before niece and nephew visited her, and opponents of

will doubted validity of their own objection. In re Estate of Buchanan (1997, 3d Dept) 245 App Div 2d 642, 665 NYS2d

980, app dismd without op (1998) 91 NY2d 957, 671 NYS2d 717, 694 NE2d 886.

Mere proof that decedent suffered from old age, physical infirmity, and chronic, progressive senile dementia when

will was executed was not necessarily inconsistent with testamentary capacity and did not alone preclude finding

thereof; proper inquiry was whether she was lucid and rational when will was made. In re Estate of Buchanan (1997, 3d

Dept) 245 App Div 2d 642, 665 NYS2d 980, app dismd without op (1998) 91 NY2d 957, 671 NYS2d 717, 694 NE2d 886.

In probate proceeding, Surrogate's Court properly denied motion to set aside jury verdict finding that decedent had

testamentary capacity when will was executed, even though she suffered from old age, physical infirmity, and chronic,

progressive senile dementia, where executor testified that decedent invited him to her home for purpose of changing her

will, that decedent explained her reasons for doing so and corrected drafting error before executing new will in presence

of executor, his wife, and his secretary, and that decedent was rational and of sound mind, executor's testimony was

corroborated by his wife and secretary, physician who treated decedent for osteoporosis testified that he noted no defect

in her mental state until 4 months after execution of will, decedent's ophthalmologist testified similarly, and although

there was contrary expert testimony by psychiatrist and neurologist, they never examined decedent but based their

opinions almost exclusively on her medical records. In re Estate of Buchanan (1997, 3d Dept) 245 App Div 2d 642, 665

NYS2d 980, app dismd without op (1998) 91 NY2d 957, 671 NYS2d 717, 694 NE2d 886.

Page 13

NY CLS EPTL § 3-2.1

In probate proceeding, Surrogate's Court properly denied motion to set aside jury verdict finding that decedent had

testamentary capacity when will was executed where allegations of juror misconduct were based solely on hearsay, and

juror injected only her personal experiences, rather than outside material, into deliberations. In re Estate of Buchanan

(1997, 3d Dept) 245 App Div 2d 642, 665 NYS2d 980, app dismd without op (1998) 91 NY2d 957, 671 NYS2d 717, 694

NE2d 886.

Court properly denied summary judgment dismissing objection alleging lack of testamentary capacity where, near

time will was executed, decedent's medical records showed diagnosis of delirium, with symptoms of confusion,

disorientation, and significant mental impairment, and will purportedly devised property which had already been

transferred at time will was executed. In re Estate of Spangenberg (1998, 2d Dept) 248 AD2d 543, 670 NYS2d 48.

Court erred in granting proponents' motion for summary judgment dismissing objections to probate of will where

there was sufficient circumstantial evidence of fraud and undue influence to warrant trial on those issues, especially

where testator's daughter had both motive an opportunity to exert undue influence over testator and to commit fraud,

and testator's disinherited son was formerly shut out of testator's life by testator's daughter. In re Estate of Delyanis

(1998, 2d Dept) 252 AD2d 585, 676 NYS2d 219.

Objectants in probate proceeding did not raise triable issue of fact as to decedent's testamentary capacity where (1)

attorney who drafted will testified that decedent was explicit and specific as to what she wanted in her will, (2) 3

attorneys who witnessed will testified that, based on decedent's demeanor, responses to questions, and conversations,

she was mentally competent to execute will, and (3) decedent's stockbroker testified that decedent controlled her

financial affairs and made her own investment decisions until her death. In re Musso (2000, 2d Dept) 273 AD2d 391,

711 NYS2d 331.

Decedent knew nature and extent of her property and natural objects of her bounty, and she did not disregard tax

consequences of her new will, even though she refused to discuss her assets with her attorney, where she stated that she

might consider later revision of will involving trust but that she would advise him of her decision. In re Musso (2000,

2d Dept) 273 AD2d 391, 711 NYS2d 331.

Decedent was competent to make will where (1) her contesting son had not seen her for 5 years before her death,

(2) son offered virtually no factual testimony to support his conclusory assertions that she was "kind of childish acting,

senile acting [and] [s]he couldn't remember things," and that she "[s]eemed like a five year old at times," and (3) her

attorney testified that he was with her for over 2 hours on day that her will was prepared, that she was mentally alert and

responsive to all of his questions, and that "[s]he was as I've known her for over 20 years." In re Estate of Sweetland

(2000, 3d Dept) 273 AD2d 739, 710 NYS2d 668.

Decedent's will was not product of fraud or undue influence, even though proponent son continued to live with and

care for decedent after his 5 siblings moved away from home, where testimony of those contesting siblings distilled to

their unsubstantiated belief that will must have been result of proponent son's undue influence because decedent could

not and would not have done anything without his permission. In re Estate of Sweetland (2000, 3d Dept) 273 AD2d 739,

710 NYS2d 668.

Surrogate's Court improperly found that decedent's will was product of undue influence or fraud where, inter alia,

petitioner merely showed that decedent was "infirm" and "sickly" at time that he executed his will, there was no support

for petitioner's accusations as to respondent's purported efforts to ingratiate himself to decedent, and, at very most,

petitioner showed opportunity and motive on respondent's part to effect disposition in his favor. In re Estate of

D'Agostino (2001, 3d Dept) 284 AD2d 857, 728 NYS2d 234.

The surrogate has no discretion to refuse to admit to probate a will or codicil executed in compliance with this

section by one possessing testamentary capacity and under no undue influence. Re Strickland's Will (1939) 172 Misc

976, 16 NYS2d 666.

A will, made by a person who was in all respects competent to make it, was acting under no restraint, and executed

it in accordance with the provisions of § 21, will be admitted to probate as the last will and testament of the decedent,

valid to pass both real and personal property. Re Lewis' Estate (1948) 193 Misc 183, 80 NYS2d 757.

Uncontested finding of probate court that testator was of sound mind and competent to execute his will would not

prevent beneficiary from challenging validity of deed executed on that same day by decedent, prior to his death, as well

as raising and litigating issue of grantor's state of mind. Re Will of Turner (1976) 86 Misc 2d 132, 382 NYS2d 235.

Page 14

NY CLS EPTL § 3-2.1

In probate proceeding, objectants were entitled to trial on issue of whether will, which left bulk of state to hospital,

was product of undue influence, where attorney draftsman represented hospital in its legal matters and served as

chairman of board of directors, notwithstanding that request was made to attorney's charity. In re Estate of Edel (1999,

Sur) 182 Misc 2d 878, 700 NYS2d 664.

13. Partial admission to probate

The surrogate may admit to probate part of a will duly executed and refuse probate to a part thereof not duly

executed if they are severally separable, independent and concrete. Re Foley's Will (1912) 76 Misc 168, 136 NYS 933.

II. Testamentary Instruments and Dispositions

14. In general; time transfer effective

Whether or not an instrument is testamentary in character and therefore subject to the requirements of § 21, is

dependent upon whether or not it confers a present right upon a beneficiary or whether it is to have no effect until the

death of the maker. Re Deyo's Estate (1943) 180 Misc 32, 42 NYS2d 379; Speaker v Keating (1941, DC NY) 36 F Supp

556, revd on other grounds (CA2 NY) 122 F2d 706.

Inter vivos transfers to a trustee not testamentary in character could not be probated. Re Gardner's Will (1959) 16

Misc 2d 641, 184 NYS2d 932.

The law does not require that a will or testament be in any particular form. The character of the instrument must be

determined by the dispositions which it makes. Re Dash's Will (1953, Sur) 120 NYS2d 621.

15. Delivery

While the element of delivery essential to a valid gift may be fulfilled by delivery to a third person in behalf of the

donee, the handing of the property to an agent of the donor for delivery to the donee, as here, is insufficient to bequeath

personalty. Re Hilliard's Estate (1935) 154 Misc 872, 278 NYS 675.

Where decedent delivered the assignment of certain mortgages to his attorney with instructions to in turn deliver

them to two named nephews at decedent's death, and testator subsequently reassigned part of the mortgages and

discharged others, there was no gift in trust or causa mortis or inter vivos, but rather a testamentary disposition, which

was invalid for want of compliance with this section. Re Fitzpatrick's Estate (1940, Sur) 17 NYS2d 280.

16. Instrument reserving title or incident thereof

Daughters of a decedent cannot claim title to a mortgage by virtue of the assignment thereof or to furniture by

virtue of a bill of sale, where both instruments reserved title in the decedent until his death and were, therefore,

testamentary in character, and not having been executed in the form required for the execution of a will, were void. Re

Peno's Estate (1927) 128 Misc 718, 221 NYS 205.

Two documents whereby decedent conveyed bonds to his sisters, reserving the right to revoke, were void as

attempted testamentary dispositions, not executed in accordance with this section. Re Will of Flamenbaum (1957) 6

Misc 2d 122, 159 NYS2d 887.

Instruments are not testamentary in character, requiring formal execution as wills, because an insured, reserving the

right to revoke trusts in whole or in part and retaining control of the insurance policies making up the sole assets of the

trusts, enters into an agreement with a beneficiary of the policies as to manner of distribution of proceeds thereof after

his death. Re Kent's Trust (1961) 28 Misc 2d 196, 212 NYS2d 657.

17. Contract to make will

A contract to make or to refrain from altering a will amounts for all practical purposes to a testamentary disposition.

If enforceable, it is little different from a will and, as often as not, will result in the complete subversion or nullification

of a will executed in accordance with the stringent requirements surrounding the making of such an instrument. Hence,

an oral agreement executed in Florida to make a will in favor of plaintiff was not enforceable in New York although

such an agreement was valid and enforceable under Florida law. Rubin v Irving Trust Co. (1953) 305 NY 288, 113

NE2d 424.

Page 15

NY CLS EPTL § 3-2.1

Use of plural pronouns throughout joint will, such as "we" declare this "our" last will and "we" give "our" property,

constitutes substantial indication that binding contract was formed. Re Estate of Warych (1976, 3d Dept) 55 AD2d 700,

389 NYS2d 49.

Although there was no express prohibition in joint will precluding survivor from disposing of remaining property

by later will, language contained in joint will "to use, have and to dispose of during the lifetime of either of us" strongly

indicated that joint will was intended to be binding contract. Re Estate of Warych (1976, 3d Dept) 55 AD2d 700, 389

NYS2d 49.

A joint reciprocal will executed by the decedent and his wife was not a contract between the parties and the

decedent was free to do anything that he wished with his real and personal property, where the will contained the

provision that the survivor was to receive all the property of the estate of whatever kind or nature absolutely and without

any condition or limitation whatsoever, and where no subsequent provision appeared that demonstrated a clear intention

to make the will contractually binding upon the parties; the court also properly declined to admit extrinsic evidence

concerning the intent of the parties at the time the will was executed, since the terms of the will were not ambiguous.

Re Estate of Wierzbieniec (1983, 4th Dept) 93 App Div 2d 978, 461 NYS2d 653.

18. Letters and memos

Where will directed disposal of personal property in accordance with memorandum to be left in one of specified

places and in absence of memorandum disposal to be at discretion of niece, but memorandum found was unattested and

therefore not open to probate, property passed to niece under the will. Re Estate of Salmon (1965) (1st Dept) 24 AD2d

962, 265 NYS2d 373.

Codicil would be admitted to probate where it was in form of letter written in decedent's hand which stated that it

was codicil to decedent's will and which closed with words "Love Mother." Re Estate of Kenneally (1988) 139 Misc 2d

198, 528 NYS2d 314.

A letter written by decedent to her brother at the time of a loan which she made to him, stating that if anything

happened to the decedent, the brother was to have the money outright, is ineffective as a will bequeathing to him the

amount of the indebtedness, since the writing was not executed in accordance with this section. Re Fry's Will (1946,

Sur) 65 NYS2d 831.

Letters of a decedent may not be used as a will or codicil and the court cannot create a disposition for a testator who

has failed to make one as provided by law Re Cuff's Will (1953, Sur) 118 NYS2d 619.

19. Inter vivos trusts

Supreme Court judgment which incorporated stipulation, executed by settlor and all other parties concerned in

original trust instrument, and instructed trustees as to disposition of trust fund was an application of doctrine of cy pres

to inter vivos charitable trust and constituted an "amendment", rather than a termination, of trust within statute relating

to wills, and thus provision of settlor's will effectively poured over residuary estate to inter vivos charitable trust. Re

Estate of Nurse (1974) 35 NY2d 381, 362 NYS2d 441, 321 NE2d 537.

There is no necessity for execution in the manner required for a will of a trust instrument executed in the donor's

lifetime which distributes during his lifetime all his interest in the trust property in the event he predeceases his wife,

with remainder to appointees or distributees of the wife, notwithstanding the trust was otherwise not to take effect until

death of the settlor. Re Kent's Trust (1961) 28 Misc 2d 196, 212 NYS2d 657.

20. Insurance

Where the payee of a matured life policy did not elect the option as contained and prescribed in the policy and the

mode of settlement but elected quarterly interest payments, rather than payments payable at the end of each year as

prescribed in the policy, the transaction was not invalid as an attempt at testamentary disposition. Hall v Mutual Life

Ins. Co. (1953) 282 AD 203, 122 NYS2d 239, affd 306 NY 909, 119 NE2d 598.

Instruments are not testamentary in character, requiring formal execution as wills, because an insured, reserving the

right to revoke trusts in whole or in part and retaining control of the insurance policies making up the sole assets of the

trusts, enters into an agreement with a beneficiary of the policies as to manner of distribution of proceeds thereof after

his death. Re Kent's Trust (1961) 28 Misc 2d 196, 212 NYS2d 657.

Page 16

NY CLS EPTL § 3-2.1

Clauses in life insurance contracts on the life of a decedent's son transferring ownership of the policies from

decedent to his son upon the death of decedent create a third-party beneficiary contract, performable at death, and, like

many similar instruments, contractual in nature, which provide for the disposition of property after death, they need not

conform to the requirements of the statute of wills (EPTL 3-2.1); these clauses are not testamentary dispositions but

valid contractual conditions and, therefore, must be given full force and effect. Re Estate of Alvord (1979) 99 Misc 2d

367, 416 NYS2d 196.

An insurance contract is a form of testamentary substitute and the terms and conditions contained therein are

enforceable without regard to the statute of wills. Re Estate of Alvord (1979) 99 Misc 2d 367, 416 NYS2d 196.

21. Forgiveness of debt

A purported cancellation of note owed by the appellant to the decedent was forgiveness of debt by attempted

testamentary disposition which fails for lack of testamentary formalities required by this section. Re Cary's Estate

(1942) 263 AD 348, 33 NYS2d 232.

A recording officer should not accept for filing a certificate of discharge of mortgage making a gift of the balance

due, effective upon mortgagee's death, to the mortgagors of the unpaid balance of the mortgage, although such an

instrument may be recorded as purporting to discharge the mortgage without notation of record that it is in fact

discharged. 1964 Ops Atty Gen Feb 26.

22. Mortgage provisions

A clause in an extension agreement of a bond and mortgage, which provides that "in the event of the death of the

party of the first part (the mortgagee) prior to the 7th day of March, 1940, the interest is to be paid one-half to brother of

the party of the first part and one-half to the heirs of the deceased sister of the party of the first part and the principal

paid the same at the time of maturity," constitutes an attempted testamentary disposition in violation of this section and

is void. McCarthy v Pieret (1939) 281 NY 407, 24 NE2d 102, reh den 282 NY 800, 27 NE2d 207.

Paper which conferred on mortgagor the right upon death of the mortgagee to cancel mortgage and recited the

consideration therefor, was non-testamentary in character. Love v Tames (1954, Sup) 135 NYS2d 609.

23. Partnership or membership agreements

Investment club agreement transferring decedent's share to his wife at his death was not invalid as an attempted

testamentary disposition. Re Will of Hillowitz (1968) 22 NY2d 107, 291 NYS2d 325, 238 NE2d 723.

An agreement which provided that in the event of the death of one partner, the surviving partner had the sole right

to purchase the full interest in the partnership of the deceased for the sum of $ 100 was valid and enforceable, and not

testamentary in character. Gabay v Rosenberg (1968, 2d Dept) 29 AD2d 653, 287 NYS2d 451, affd 23 NY2d 747, 296

NYS2d 795, 244 NE2d 267.

A Partnership agreement executed in compliance with the statutory provisions and testamentary in character would

be admitted to probate as a will although the certificate signed by the witnesses did not describe the instrument as such

or state that the decedent declared the same to be such. Re Dash's Will (1953, Sur) 120 NYS2d 621.

24. United States Savings Bonds

United States Savings Bonds purchased in the name of the decedent and "payable on death" to a named beneficiary

remain nevertheless the property of the estate, inasmuch as a decedent retained the right to cash the bonds during his

lifetime and accordingly the designation of the beneficiary represented a testamentary disposition, invalid because not

executed in compliance with this section. Deyo v Adams (1942) 178 Misc 859, 36 NYS2d 734.

Designation of beneficiaries on the face of United States Savings Bonds to whom the proceeds thereof are payable

on the death of the owner does not constitute a testamentary disposition of property requiring compliance with the

formalities of this section, since the present interest passes to the beneficiary insofar as the owner cannot substitute a

second beneficiary during the lifetime of the original beneficiary without surrendering the bonds for redemption. Re

Deyo's Estate (1943) 180 Misc 32, 42 NYS2d 379.

Page 17

NY CLS EPTL § 3-2.1

United States Savings Bonds become the property of the named beneficiary upon the death of the owner in

accordance with the regulations of the Secretary of the Treasury, notwithstanding that such constitutes a testamentary

disposition in violation of this section, since the Federal Government although normally having no constitutional power

to regulate testamentary dispositions, may make such regulations as to War Bonds under its emergency war powers.

Re Karlinski's Estate (1943) 180 Misc 49, 43 NYS2d 40.

Where a testator during his lifetime purchased non-transferable United States Savings Bonds which he had

registered in his own name, payable on death to named beneficiaries, the beneficiaries acquired at the time of purchase a

present interest therein which was not revocable by testator and accordingly such registration was therefore not a

testamentary act to be performed pursuant to this section. Re Kalina's Will (1945) 184 Misc 367, 53 NYS2d 775, app

dismd 270 AD 761, 59 NYS2d 525.

25. Copies of instruments

The law does not require that a will be written by any particular marking device, and, where it appears that a carbon

copy was the only instrument executed by testator, the fact that it is a copy rather than the original impression does not

affect its eligibility for probate. Estate of Saxl (1961) 32 Misc 2d 481, 222 NYS2d 765.

26. Support agreements

A provision in a separation agreement which was entered into as proposed basis for fixing the extent of the wife's

right to support and as limiting the husband's obligations toward her, could not be considered testamentary in character

requiring execution as required for a will, merely because it contained provisions concerning her rights in a leasehold of

residence property then standing in the name of the husband which could, and did, expire long before the husband's

death. Re Estate of Robinson (1963) 39 Misc 2d 43, 240 NYS2d 48.

An arrangement in which decedent's sister was made nominee owner of decedent's property and was given an oral

promise that she would be taken care of after the decedent's death was not a valid testamentary disposition. Rubin v

Kurzman (1977, SD NY) 436 F Supp 1044.

27. Other instruments and dispositions

A custodian agreement executed by the decedent and a bank whereby the latter was constituted the mere agent of

the decedent during his lifetime to administer certain funds is ineffective insofar as it purports to establish a

testamentary trust for the benefit of the decedent's wife upon his death and to dispose of the corpus of the trust upon the

death of the life beneficiary, since the instrument did not create an inter vivos trust and was not executed in accordance

with the provisions of this section. Re Ihmsen's Estate (1938) 253 AD 472, 3 NYS2d 125.

Designation of a beneficiary for the payment of a death benefit under the New York State Teacher's Retirement

System does not constitute an invalid attempt to make a will. Moyer v Dunseith (1943) 180 Misc 1004, 46 NYS2d 360,

affd 266 AD 1008, 45 NYS2d 126.

A document, though signed and witnessed by the testatrix, could not be considered as impressing a personal trust

on executors who, by her will, were given absolute discretion in distribution of her personal belongings among members

of the family, particularly where the instrument expressing her wishes and desires as to how such items should be

distributed among particular relatives was not executed until after the will had been ratified and confirmed by a later

codicil. Re Estate of Voice (1963) 38 Misc 2d 779, 238 NYS2d 736, affd 19 AD2d 945, 245 NYS2d 310.

Two wills were treated as duplicate originals, although they were not truly identical, where second will was English

translation of first will which was executed in Hebrew, both wills were duly executed under CLS EPTL § 3-2.1, and

dispositive provisions of both will were identical. In re Estate of Rosenak (2000, Sur) 184 Misc 2d 807, 710 NYS2d 813.

III. Signature of Testator

28. In general

Execution of will was not invalid on ground that decedent declared document to be his will before, rather than after,

he signed it. In re Estate of Bernatowicz (1996, 4th Dept) 233 AD2d 838, 649 NYS2d 625.

Page 18

NY CLS EPTL § 3-2.1

There is a presumption of proper execution where the signatures of testator and the witnesses together with the

attestation clause are proper on their face. Re Will of Zipkin (1956) 3 Misc 2d 396, 153 NYS2d 783.

Will can be signed with initials, testator's mark or any lines visible on paper. Re Estate of Kenneally (1988) 139

Misc 2d 198, 528 NYS2d 314.

Where codicil ends with word which indicates testatrix' relationship to beneficiaries, rather than with name,

statutory requirement is satisfied iftestatrix intended it to be her signature. Re Estate of Kenneally (1988) 139 Misc 2d

198, 528 NYS2d 314.

A propounded instrument which is not subscribed by the testator, although containing an attestation clause and

signed by two subscribing witnesses may not be probated. Re Kurtz' Will (1946, Sur) 64 NYS2d 749.

29. Mistake

A will which was otherwise executed with the required formalities was admissible to probate even though the

decedent and his wife, intending to execute mutual wills at a common execution ceremony, each executed by mistake

the will intended for the other, where there was no question of the decedent's testamentary capacity, or his intention and

belief that he was signing his last will and testament, and where except for the obvious differences in the names of the

donors and beneficiaries on the wills, they were in all other respects identical. Re Snide (1981) 52 NY2d 193, 437

NYS2d 63, 418 NE2d 656, on remand (3d Dept) 80 AD2d 276, 439 NYS2d 690.

In a probate proceeding, the wills of a husband and wife were properly admitted to probate where they were

identical but for the names of the spouses, each spouse having mistakenly executed the will drawn for the other. Re

Estate of Snide (1981, 3d Dept) 80 App Div 2d 276, 439 NYS2d 690.