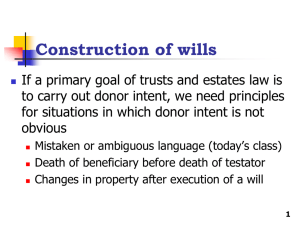

Gershon 2012

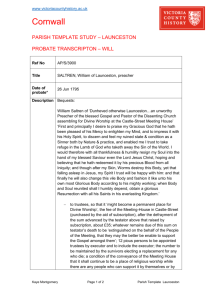

advertisement