Gershon 2012

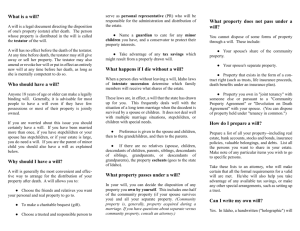

advertisement