teaching art as a home based business

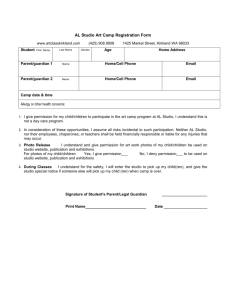

advertisement

NAEA convention LLL presentation 2010---- Barbara Reser, presenter TEACHING ART AS A HOME BASED BUSINESS by Barb Reser ART EDUCATION STUDIO (www.arteducationstudio.com) I am from Topeka, Kansas and have a home based business teaching art. I taught visual art in elementary and secondary public schools, then decided instead of hauling art supplies all over my county in my van, taking my sons to sports practice, guitar lessons, etc. I had all the materials at home to do the same thing. I go to a group home (mostly Veterans) once a week, and teach 4 classes of homeschoolers one day a week. The rest of the time I provide art instruction, flexibly scheduling students in my home based studio. My youngest student is 5 years old, my oldest is 82 years old. FIRST A DISCLAIMER---- I am not a lawyer, accountant, or web designer. These are my observations, research and personal experiences. STARTING THE BUSINESS As I researched starting a home-based business, I found the Small Business Administration website very helpful. I used the self-assessment tool (http://www.sba.gov/assessmenttool/index.html ). I also researched Art education franchises (Abrakadoodle, Kidzart, Monart , etc) I decided that Art Education Studio would be a sole proprietorship. The advantages of a sole proprietorship are: -the individual represents the business, ease of tax preparation, and low start-up costs There is no ONE way to search for conflicting business names. I “Googled” the name, and checked the “fictitious name registry “ (Doing Business As) with my county clerk’s office. I also checked http://www.business.gov/register/business-name/dba.html, on the SBA website. I arrived at my business logo by doing about 30 thumbnail sketches, showing them to my son, who has good design sense, then whittled the sketches down to a few, at which point I made my choice. Zoning approval could be as simple as filling out an application for a homebased business permit, or as complicated as a public hearing. If I sold supplies, I would have needed a vendor’s license. I don’t sell supplies, so I just had to pay $50 for my initial permit, and a $10 per year renewal. Market research was my next step in forming the business. Market research involved finding direct and indirect competition. Although a business plan is necessary if borrowing startup money from a bank, I didn’t borrow from a lending institution (I borrowed around $2000 from our personal account). I prepared a business plan anyway. There are numerous websites that give information about creating a business plan. Here are a few: SMALL BUSINESS ADMINISTRATION (SBA) http://www.sba.gov/smallbusinessplanner/plan/writeabusinessplan/index.html MY OWN BUSINESS http://www.myownbusiness.org/s2/ ENTREPRENEUR http://www.entrepreneur.com/businessplan/ I found these books helpful in forming Art Education Studio: ART TEACHING BUSINESS by Tanya Freedman HOME-BASED BUSINESS FOR DUMMIES by Paul and Sarah Edwards I found these websites helpful in forming Art Education Studio: http://www.business.gov/start/home-based/ http://video.about.com/webdesign/Choose-and-Register-a-Domain.htm#t http://www.homebiztools.com/guides.htm http://smallbusiness.dnb.com/specialty-businesses/home-based-business/3347-1.html RUNNING THE BUSINESS Art Education Studio has about 600 sq.ft. , approx.. 350 sq.ft. in the work room with a large table and stools , some shelving, and my desk. The “back” room is for storage and clean up. When I started the business, my inventory consisted of materials and supplies I already had, and purchased others from Dick Blick. Since Dick Blick ships free on orders over $200, I keep a running list of needed items on my desk, and when it looks like $200 worth, I place an order. I also use coupons for discounts at Michaels and Hobby Lobby. Art Education Studio has debit card and checkbook though my local bank, and a credit card . (I got a low interest rate from researching Consumer Reports.) Scheduling is flexible. Some students come once a week, some every other week, and some just give me a call when they have a school project or gift to work on. Some students pay each time they come, some pay monthly, and others I send a statement every couple months (I keep a file for each student on my computer.) When a person calls , I ask them if they have access to the internet, then give them the website URL (www.arteducationstudio.com). I explain that my instruction is basic drawing and design tips and tricks. I set up what I call a “tour” (no charge) to meet me and look around the studio, then set up some kind of schedule. I have a scheduling book by the phone. Here are some financial considerations: Art Education Studio is cash based. I keep a ledger on my desk to record income, and keep receipts in a box to record expenses. At tax time I fill out these forms: Schedule 1040- (on family 1040) Schedule SE--Self Employment Tax Schedule C--Profit or Loss from Business My tax guy doesn’t even take “part of home for business--square footage, utilities, etc. for his homebased accounting business. As far as printing goes, I have a business card, but haven’t found the need for much else. Insurance for the home-based business is a “rider” to our homeowners insurance, and costs around $500 for the year. After starting the business with some marketing mistakes, I now advertise through the phone book-- (AT&T yellow pages (@$300/yr) and an ad in our church bulletin (@$250/yr) . I also have a small sign on my mailbox, and word-of-mouth advertising. There are numerous ways to build a website. My son, Evan learned web design in high school, and helped me. At one time I updated the website with student artwork photos, but now keep them as an album on the Art Education Studio page on Facebook. Overall, I am very happy to have a home-based business teaching visual art. Art Education Studio is not a huge money-maker, but doing art and teaching art is my passion, and I enjoy it very much. Contact information: BARB RESER breser1@cox.net 785-478-9458