Dec. 31, 2014 - National Association of Insurance Commissioners

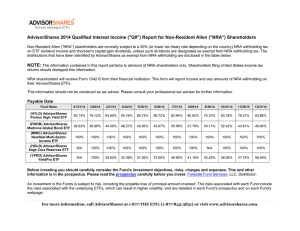

advertisement

To: Statutory Accounting Principles (E) Working Group From: Julie Gann (NAIC Staff) Re: ETF – Financial Data Summary as of Year-End 2014 Date: March 23, 2015 Staff Overview: This memorandum details the accounting for ETFs approved for “bond” or “preferred stock” reporting by the SVO as of Dec. 31, 2014. Per the analysis within, this memo highlights the inconsistencies that currently exist with the reporting of ETFs. Staff Recommendation: The following elements strongly support the need for separate reporting and a specific measurement method for ETF investments: 1. Inconsistencies in the Overall Measurement Method for Bond & Preferred Stock ETFs A. Some companies appear to have elected a reporting method (and reporting schedule) inconsistent with the guidance in SSAP No. 26 and/or SSAP No. 32. B. Elections for these companies have resulted with overstated asset valuations, increasing overall surplus, as well as general inconsistencies in reporting investments: Companies reported at actual cost, which was greater than fair value, when NAIC designation required the lower of amortized cost or fair value. Companies reported at fair value, which was greater than amortized cost, when the NAIC designation specified use of amortized cost. A minimum of 74 companies have elected to report approved ETFs on D-2-2. 2. Inconsistencies in the Reporting of NAIC Designations A. Some companies currently appear to use an NAIC designation that allows a preferred measurement method without verifying the designation. Companies are not filing with the NAIC. As noted within, 110 of the ETF bond investments were reported with an NAIC designation, when no NAIC designation exists. An additional 38 of the bond ETF investments were reported with an incorrect NAIC designation. By including ETFs on the Bond and Preferred Stock schedules, it is difficult to review and verify reporting designations, resulting with overstated assets under SAP. 3. There appears to be inconsistencies when and how amortization is reported, and for those reporting at fair value, there appear to be inconsistencies when unrealized valuation fluctuations are reported. (Often the amortization / unrealized fluctuations are nonexistent.) 4. Concerns regarding the potential impact to small companies may be overstated due to the limited number of Bond ETFs held by most companies. (75% of companies with Bond ETFs own 3 or less, 83% own 4 or fewer, and 89% own 5 or less). BOND ETFs – Overview: 122 ETFs are listed on the SVO Approved Bond Listing for 2014. In completing a search of the 2014 YE financials with ETFs included on the 2013 and 2014 SVO approved bond lists: o 58 ETFs (from the 2013 and 2014 listing) were identified as reported on Schedule D-1 o 54 of these ETFs were on the 2014 Approved Bond Listing. o 3 of these ETFs were on the 2013 Approved Bond Listing and NOT on the 2014 listing. The 58 ETFs were reported by 142 Insurers for 411 ETFs reported as bonds on Schedule D-1 for 2014. (The 3 ETFs incorrectly included were reported by 16 insurers.) NOTE – This search was only completed for the CUSIPS on the 2013 and 2014 SVO listings. There could be more ETFs incorrectly reported on D-1 that have not been identified. With the current reporting process it is not possible to separately identify ETFs without searching for specific CUSIP numbers. Few ETFs Comprise Most of D-1 ETF Investments: As noted below, the top 15 ETFs represent a large percentage 281 (68%) of the bond-reported ETFs. Number of ETFs Number of Companies Total Investments 2 ETFs Held by more than 30 Companies 66 ETF Investments 5 ETFs Held by 20-29 Companies 115 ETF Investments 8 ETFs Held by 10-19 Companies 100 ETF Investments 9 ETFs Held by 5-9 Companies 64 ETF Investments 20 ETFs Held by 2-4 Companies 52 ETF Investments 14 ETFS Held by Only 1 Company 14 ETF Investments 58 ETFs Total 411 ETF Investments 4 ETFs 1 Not Held Not Approved for 2014 2 Held by 3 Companies (6) 16 ETF Investments 1 Held by 10 Companies 55 ETFs Approved for 2014 395 ETF Investments Of the 54 approved 2014 ETFs reported on D-1 as bonds by some insurers, 29 of these ETFs were held by 74 other insurers, but those insurers reported them on D-2-2 as common stock using a fair value measurement with unrealized gains and losses for fluctuations. Of the 3 ETFs incorrectly reported on D-1 as bonds (not approved in 2014) by 16 insurers, the ETFs were held by 3 other insurers. Those insurers reported them on D-2-2 as common stock. Of the 3 ETFs incorrectly reported on D-1 as bonds (not approved in 2014) all but one insurer reported the ETF at amortized cost. If the ETFs had been reported correctly, they would have been on D-2-2 and reported at fair value. © 2015 National Association of Insurance Commissioners 2 NAIC Designations of ETF Investments: 37% of the 2014 approved ETFs reported on D-1 were reported with incorrect designations: NAIC Designation NR* None* Insurers Incorrectly Reporting Total ETFs 45 Insurers Incorrectly Reporting 6 ETFs 65 Insurers Incorrectly Reporting 19 ETFs 7 of 64 Insurers Incorrectly Reporting 4 6 ETFs Reported as 1 = 5 Insurers Reported as 4FE = 2 Insurers 10 of 70 Insurers Incorrectly Reporting 2 1 Reported as 1 = 8 Reported as 2FE = 2 21 of 151 Insurers Incorrectly Reporting 5 ETFs 19 ETFs Reported as 1FE = 19 Reported as 2FE = 2 148 ETF Investments Incorrectly Reported 37% of 395 ETF Investments 55 ETFs * An “NR” NAIC designation indicates that the investment had previously been filed (prior year) with the NAIC and obtained a designation, but it was not filed, and did not receive a designation for the 2014 reporting year. A “None” designation indicates that the investment has never been filed with the NAIC. Analysis of Bond-Reported ETF Investments by Company: 411 Reported ETF Investments at 142 Companies (2013 and 2014 Listing) o Same Number of Companies from 2013 with 58 fewer ETFs (468 ETFs in 2013) o 48% of Companies Reported Only ETF. 75% of Companies Reported 3 Or Less. Number of Companies Number of ETFs Owned 67 28 11 12 9 4 2 2 1 1 1 1 2 1 1 2 3 4 5 6 7 9 10 11 12 13 16 28 © 2015 National Association of Insurance Commissioners 3 324 ETFs (79%) Reported Are Within 16 States. (All other states had less than 10.) 183 ETFs (45%) Reported Are Within 5 States. State Number of ETFs Owned State Number of ETFs Owned TX AL IL OH NV NY AR PA 74 45 23 21 20 17 16 15 FL IN ME LA MT MO IA HI 15 14 13 11 10 10 10 10 166 ETFs (40%) Reported Are Within 6 Groups. Analysis of Bond-Reported ETFs - Measurement Method: 92 Companies Always Reported Actual Cost as the BACV (240 ETFs). o 4 P/C companies (4 ETFs) reported at Actual Cost when NAIC designation requires FV. 31 Companies consistently reported Fair Value as the BACV (65 ETFs). o 47 should have been reported at Amortized Cost under SSAP No. 26. 12 Companies With More Than One ETF Reported Based on ETF Designation (92 ETFs). 5 Companies did not report either Actual Cost or Fair Value as the BACV (11 ETFs). (One company with 28 ETFs mostly reported based on ETF designation, but had 7 ETFs that did not match either Actual Cost or FV.) 1 Company both Actual Cost and Fair Value matched the BACV (3 ETFs). Financial Impact – Companies that Reported ETFs at Actual Cost: 10 ETFs were reported at Actual Cost when the guidelines in SSAP No. 26 requires a Fair Value measurement pursuant to the NAIC designation. o 5 companies (P/C or Health), reported the ETF with a NAIC 4 designation, but still reported the ETF at amortized cost and not the lower of amortized cost or fair value: o 5 companies reported ETFs with an NAIC 1 designation, but the correct SVO assigned designation was a 4. As such, the ETF should have been reported at fair value: 16 ETFs were reported on D-1 at Actual Cost when they were not included on the approved SVO bond listing. These ETFs should have been reported on D-2-2 as common stock at fair value. For the 110 ETFs that were not submitted to the NAIC for a designation (noted as “NR” or without a designation in SVO database), it is not possible to identify at this time whether the company incorrectly reported the security at amortized cost. © 2015 National Association of Insurance Commissioners 4 Financial Impact – If All ETF’s Were Reported at Fair Value: (This analysis does not exclude the above-noted ETFs that should already be reported at fair value. If those had been excluded, the surplus impact would be even less.) Out of 110 Companies with an ETF that Could Move to Fair Value: For 92 companies, moving to Fair Value would have a negligible impact on Surplus. (Negligible is defined as a Surplus impact of 0.00% to 0.43%.) o Only 30 of these 92 companies would have a surplus impact of 0.10% or greater. o Most (65) would have a surplus impact of less than 0.10%. o Moving to Fair Value would result in a surplus benefit for 22 of these 92 companies. For 10 companies, moving to Fair Value would have a surplus impact of approximately 0.47% to less than 0.85%. For four of these companies, moving to FV would result in a surplus benefit. For 8 companies, moving to Fair Value would have over a 0.98% impact to surplus. (Three with a positive surplus impact.) Financial Impact – 87 ETF’s Already Reported at Fair Value: For 47 of the ETF investments reported at fair value, under the requirements in SSAP No. 26, the ETF should have been reported at amortized cost. For 15 of these investments, by reporting at fair value, the company reported an improved surplus position. For 41 of the ETF investments reported at fair value, the NAIC designation required a fair value measurement under SSAP No. 26 (Non-AVR filer with NAIC designation below 2.) Financial Impact – 5 Companies Did Not Report Either Fair Value or Actual Cost: For two insurers, there was no unrealized valuation or amortization recorded for these ETFs. These investments were purchased at various times beginning in 2010 through June 2014. For three insurers, the ETF was amortized to reflect an Amortized Cost. (This is the expected treatment under SSAP No. 26.) However, it is uncertain how the company calculated the amortization value. Financial Impact – 1 Company had 3 ETFs Whose BACV Equaled Both FV and Actual Cost: For 2 of the investments, an unrealized valuation adjustment was recorded. These ETFs were acquired in 2010 and 2013. Staff is uncertain how this valuation adjustment was determined. For the third ETF, the investment was acquired in February 2014, without any valuation adjustment or amortization recorded. Actual Cost $752,515 $595,503 $2,025,158 Fair Value $752,515 $595,503 $2,025,158 © 2015 National Association of Insurance Commissioners 5 BACV $752,515 $595,503 $2,025,158 Designation 1 1 1 Bond Reporting Inconsistencies – NAIC Designation Under the guidelines of the Purposes and Procedures Manual of the NAIC Investment Analysis Office, the concept for an “FE” designation does not apply to ETFs. The ETF bond-like determination requires an assessment by the SVO of the composition of the fund’s portfolio both for the purposes of ascertaining that bond flows would be produced (bond-like determination) and the quality level of the cash flow that would be produced (designation of the bond like instrument). CRPs have unique rating processes for ETFs concerned only with the credit risk component. 71 ETF investments (by 23 companies) were incorrectly reported with an “FE” designation. (55 reported as 1FE, 13 reported as 2FE, and 3 reported as 4FE.) In comparing company reported NAIC designations for the same ETFs, 11 ETFs were identified with different designations. In reviewing the detail for these 11 ETFs, concerns on the compliance with NAIC filing requirements has been noted. Detail of those 11 ETFs is provided below. However, as a result of these findings, NAIC staff reviewed all of the 2014 SVO approved ETFs and found a multitude of errors in which it appears that several companies are not verifying NAIC designations for ETFs – and it is uncertain how companies support their reported designations. 464287242 464288513 464288620 464288638 18383M654 46431W507 72201R775 78464A375 78464A417 78468R408 Companies Reporting NAIC 1 1 4 2 4 1 1 2 5 1 2 Companies Reporting NAIC 2 36 0 1 (as FE) 20 2 8 1 1 0 - Companies Reporting NAIC 4 23 15 5 Notes Actual NAIC Designation A B C D E F G H I J 2 4 Not Filed 2 2 2 Not Approved Not Filed 4 Not Filed A – 464287242 – With an NAIC 1, instead of an NAIC 2, the ETF would have still been reported at amortized cost. However, by reporting as an NAIC 1, the entity received a lower RBC charge. B – 464288513 – All companies designating as “1” are health filers who reported the ETF at actual cost. If they had reported the correct NAIC 4 designation, the ETF would have been required to be reported at FV. In reviewing the financial detail, FV was less than actual cost in all instances, and if reported correctly, the company would have reported the lesser amount (and decreased surplus). Additionally, these securities would have incurred a higher RBC charge. (All are in the same group.) C – 464288620 – This ETF was not filed with the SVO. All companies that hold this ETF are not in compliance with the NAIC filing requirements. D – 464288638 – Although the designation change from 1 to 2 would not result with a change in measurement method, by reporting the 1 designation, the companies received a lower RBC charge. E – 18383M654 – In 2014 the actual designation was an NAIC 2. This ETF was on the approved listing for 2014, but has been removed for 2015. As such, if still held in the first quarter of 2015, the security should be reported as common stock with a fair value measurement. © 2015 National Association of Insurance Commissioners 6 F – 46431W507 – Although the designation change from 1 to 2 would not result with a change in measurement method, by reporting the 1 designation, the company received a lower RBC charge. G – 72201R775 – This ETF is not approved for bond reporting in 2014. For 2013 reporting, it was noted as an NAIC 2. For 2014, this ETF should have been reported as common stock at fair value. H – 78464A375 – This ETF was not filed with the SVO. All companies that hold this ETF are not in compliance with NAIC filing requirements. (2 companies reported the security as an “FE”.) I – 78464A417 – The company that designated as NAIC 1, instead of NAIC 4, is a life company. Under the provisions of SSAP No. 26, companies subject to AVR are not required to report at lower of cost or fair value until designated as NAIC 6. However, this company still received a lower RBC charge. J – 78468R408 – One company designating as 1 was a property filer, the other was a health filer. Despite the NAIC 1 designation (which is to be reported at amortized cost under SSAP No. 26), the health filer reported the ETF at fair value. The property filer reported the ETF at actual cost. With the proper designation, the ETF would have been required to be reported at FV, and would have resulted with a decrease to surplus. For both companies that reported at NAIC 1, instead of NAIC 4, they received a lower RBC charge. PREFERRED STOCK ETFs – Overview: In completing a search of the 2014 YE financials with ETFs included on the 2013 and 2014 SVO approved preferred stock lists: o 2 ETFs approved by the SVO were identified as reported on Schedule D-2-1 o 1 ETF – approved for bond reporting – was included on Schedule D-2-1. NOTE – This search was only completed for the CUSIPS on the 2013 and 2014 SVO listings. There could be more ETFs incorrectly reported on D-2-1 that have not been identified. With the current reporting process it is not possible to identify ETFs without searching for specific CUSIP numbers. The 3 ETFs were reported by 43 Insurers: 3 SVO Approved ETFs Reported by 43 Companies on the Preferred Stock Schedule: o o o 1 ETF Owned by 32 Companies – 464288687 1 ETF Owned by 1 Company – 464289479 1 ETF Owned by 10 Companies – 73936T565 ETF 464288687 – 20 Companies Reported at FV; 12 Companies Reported at Actual Cost o 5 Companies noted an NAIC 1 designation (4 reported at FV, 1 at Actual Cost) o 27 Companies noted an NAIC 2 designation (16 reported at FV, 11 at Actual Cost) Per the SVO, the correct NAIC designation for this ETF is P2. ETF 73936T565 – 9 Companies Reported at FV; 1 Company Reported at Actual Cost o 7 Companies noted an NAIC 1 Designation (all reported at Actual Cost – P/C companies) o 3 Companies noted and NAIC 3 Designation (2 reported at FV, 1 at Actual Cost) © 2015 National Association of Insurance Commissioners 7 Per the SVO, this security has never been filed by the SVO. As such, all of the companies reporting this security are not in compliance with the SVO filing requirements. ETF 464289479 – Company Reported at Actual Cost (Noted as an NAIC 1) Per the SVO, this ETF is approved for Bond Reporting. The Company incorrectly classified this ETF on the Preferred Stock schedule. Financial Impact – Companies that Use Actual Cost as BACV: In ALL instances, moving to Fair Value would have a negligible impact to surplus. The greatest surplus impact would have been 0.14%, followed by 0.05%, 0.03%, 0.02% and 0.01%. In only 3 companies, moving to fair value would have decreased surplus. The other 10 companies would have a surplus benefit if they had reported at fair value. © 2015 National Association of Insurance Commissioners 8