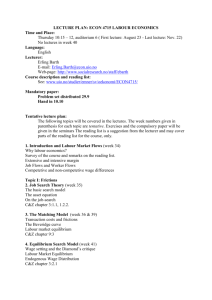

Marginal Efficiency of Capital

advertisement

John Maynard Keynes (1883 – 1946) Classical and Neoclassical Theory of Money and Employment Quantity theory of Money - Hume (and Locke) believed that no one would hold money except as a means of exchange to effect transactions since holding money otherwise would entail foregoing a return (e.g., interest) as an asset. They reiterated the quantity theory of money which stated that the price level was determined by the proportion between money and goods. This implied that money was ‘neutral’ since there was a dichotomy between money and real output. A change in money supply would change absolute prices but not change relative prices. - Ricardo argued that a change in the value of money (either due to a change in the cost of production of specie or a change in the quantity of inconvertible paper money) would merely change general prices in the same proportion with no relative and thus real effects. [Ricardo actually only accepted the quantity theory of money – a change in the supply of money changes general prices in the same proportion – for the case of inconvertible paper currency because it had no intrinsic value. He maintained in general that the quantity of money relationship between the quantity of money and the money’s value was the reverse, i.e., the quantity of money depended on its value]. Ricardo insisted moreover that “the interest for money … is not regulated by the rate at which the Bank [controlling the money supply] will lend … but by the rate of profit which can be made by the employment of capital, and which is totally independent of the quantity, or of the value of money. Whether a Bank lent one million, ten million, or a hundred millions, they would not permanently alter the market rate of interest; they would alter only the value of the money which they thus issued.” Full Employment Equilibrium - Classical and Neoclassical theorists believed that unemployment was essentially ‘frictional’ (caused by the movement from one job to another) in market economies and denied the existence of involuntary unemployment. They argued in real terms that the Marginal Product of Labour defined the Demand -1- John Maynard Keynes (1883 – 1946) for Labour and the equality of the Marginal Utility from wage goods and the marginal disutility of the effort of Labour defined the Supply of Labour and concluded that fluctuations in the real wage always brought the economy back to full employment equilibrium. MU SL = Marginal disutility of Labour MU W1 MU Wo w = W/P Lo L L1 SL w1 wo L - The Demand for wage goods at a given real wage rate is the Marginal Utility from the wage goods obtained from an additional unit of labour; it is downward sloping due to diminishing marginal utility The Marginal Disutility of Labour shows the marginal disutility from an additional unit of Labour The worker supplies the amount of labour for a given real wage where the Utility from the real wage due to an extra unit of labour equals the Disutility of that unit of labour. An increase in the real wage rate shifts up the marginal utility from the wage goods tracing out the labour supply function. The supply function is thus supposedly a function of the real wage independent of prices - The Demand for Labour is simply the marginal product of labour, which is again independent of prices. The equilibrium real wage rate is then the real wage rate that equates the quantity demanded of labour and the quantity supplied of labour. If the real -2- John Maynard Keynes (1883 – 1946) wage is higher than the equilibrium real wage (w1 below), unemployment is created because the quantity supplied is greater than the quantity demanded of labour. This situation can not last though because unemployment will cause the real wage to fall to the equilibrium real wage. This price mechanism (and for interest below) assumes competition among factors of production. W/P w1 w0 Equilibrium Real Wage UE Qd L0 Qs L Note that the equilibrium at full employment (Qs = Qd) is supposedly independent of the price level and thus of the quantity of money. - “Supply creates its own Demand (Say’s Law) - The act of production simultaneously creates an identical amount of Income so that there is always sufficient Income to purchase Output. The issue is though whether expenditure equals income because only then will all output be sold. Since Savings is unspent income, the sale of all goods depends upon the expenditure of savings. Savings must therefore be spent on Investment for equilibrium, i.e., the sale of all output. - The classical/neoclassical theory of interest (as a return to capital) is essentially the same, arguing that the Marginal Product of Capital determines the Demand for Capital as an inverse function of r (the real rate of interest) and the Supply of Capital or Savings is a positive function of the real interest rate due to the disutility of Savings (‘abstinence’ or ‘waiting’). -3- John Maynard Keynes (1883 – 1946) Equilibrium Real Interest Rate r Savings r1 r0 Investment Qd I0 Qs - I Not only is the real interest rate determined by the interaction of Savings and Investment but adjustments of the real interest rate equate Savings and Investment. The Quantity of Money has no effect on the real interest rate since that is determined by real factors though the quantity of money may affect the level of the nominal interest rate as any other price (Fisher). - J.M. Keynes attacks these claims in the General Theory, arguing that the money is not neutral, the real wage rate does not adjust to ensure full labour employment, and the interest rate is determined by the supply and demand of money, not investment. He begins by noting that workers negotiate money wages not real wages (though their intent is an increase in real wages). Although they oppose decreases in money wages (which would decrease real wages), they do not usually react to a decreases in real wages due to a rise in prices. Hence, the supply of labour is not closely related to changes in real wages. Moreover, ‘classical’ economists admit that a fall in wages causes a fall in marginal costs and hence prices. Except in the short-run (where the fall in prices is less than the fall in wages) then, a fall in wages does not cause an adjustment because prices fall proportionately. Finally, Keynes questions why workers should bear the sole responsibility for bringing the economy back to full employment. Background -4- John Maynard Keynes (1883 – 1946) - Son of the economist, John Neville Keynes - Student at Cambridge (mathematics and economics) - Student of Marshall’s - He was a civil servant (Treasury), currency speculator, academic, and editor of - Member of the Bloomsbury group, an influential literary group including Leonard and Virginia Wolfe, Lytton Strachey, E.M. Forster, etc. - A superb writer and ‘celebrated wit and raconteur’ - He had an enormous impact through his Cambridge connections, work at the Treasury, editor, and man of letters. In particular, he was instrumental in Britain’s’ financing in both World Wars and helped develop the modern monetary system (Bretton Woods) in 1944. Publications 1913 – Indian Currency and Finance 1919 – Economics Consequences and the Peace 1921 – Treatise on Probability 1930 – Treatise on Money (introduced many of his later concepts) 1936 – General Theory of Employment, Interest, and Money The General Theory - Keynes argued that previous economists (which he called ‘classical’) were concerned with the distribution of social product not its amount since they assumed full employment output He showed that income moves to equilibrium but that it is not necessarily full employment income. Keynes did this by defining 1. Current Income in terms of wage units to a) eliminate the price level b) eliminate employment as a separate variable by expressing every income in terms of a unique employment 2. Aggregate Demand = the aggregate income expected by entrepreneurs (including that which they pass on) for each amount of direct employment that they give D = f(N) where N = employment -5- John Maynard Keynes (1883 – 1946) 3. Aggregate Supply - the relationship between the supply price and employment for entrepreneurs in the aggregate Z = (N) 4. Effective Demand - The income (Demand) where Aggregate Quantity Demanded equals Aggregate Quantity Supplied (the intersection of Aggregate Demand and Aggregate Supply) => maximum profit for the entrepreneurs => equilibrium Income (and Employment) - This contradicts the classical position which amounts to the view that Aggregate Supply equals Aggregate Demand for all levels of Income and Employment => Competition gives full employment Income. - Keynes then examines the size of national income (which determines employment) He specifies 4 endogenous variables – income, consumption, investment, and the rate of interest (employment, the fifth variable, is determined by income) – and one exogenous variable – quantity of money – determined by authorities Solution of the system depends upon three ‘psychological” laws 1. Propensity to Consume 2. Marginal Efficiency of Investment 3. Liquidity Preference and the identity Y = C + I which divides national income into consumption and investment Propensity to Consume - “The fundamental psychological law, upon which we are entitled to depend with great confidence both a priori from our knowledge of human nature and from the detailed facts of experience, is that men are disposed, as a rule and on average, to increase their consumption as their income increases, but not as much as the increase in their income.” (Ch. 8, III) -6- John Maynard Keynes (1883 – 1946) => Marginal Propensity to Consume is a function of Income (primarily) and is less than unity => Marginal Propensity to Consume “tells us how the next increment of output will be divided between consumption and investment” Since MPC < 1, equilibrium => that investment must be sufficient to absorb the excess of output over what the community chooses to consume when employment (income) is at a given level but this need not be full employment - Since I = Y – C and C = f(Y) => there is a unique Y (and I) for any given C determined by the multiplier (R.H. Kahn introduced the multiplier in 1931) => more importantly, a given I => C => Y What are the determinants of Investment and Saving? Since Y = C + S and Y = C + I, => S = I in equilibrium (Although there is no necessary equality between an individual’s saving and investment, savings equals investment for society as a whole since individual saving as money (hoarding) is lent for investment) => Savings is determined by the psychological law (the propensity to consume) => Savings is a function of Income, not by the interest rate as the ‘classical’ economists assumed - Keynes criticized ‘classical’ economists for assuming that Investment and Savings were independent when both were related to Income => The interdependence of Investment and Savings makes it impossible for them to determine the interest rate Liquidity Preference - Keynes rejected ‘classical’ explanations of the rate of interest a) He rejected the position that the supply of and demand for loanable funds determined the rate of interest (short-run) b) He rejected time preference as the determinant of the rate of interest in the long-run -7- John Maynard Keynes (1883 – 1946) - Keynes argued that the rate of interest was essentially a monetary phenomenon determined by ‘liquidity preference’ and the exogenously (authorities) determined supply of money. - Keynes developed ‘liquidity preference’ from Marshall’s and the Cambridge cash balance approach to money as opposed to Fisher’s quantity equation of money (MV = PT) Cambridge Expression M = kPY M = demand for cash balances Y = level of Real Income P = Price Level k = proportion of real income held by the community in cash Since Fisher’s equation => M = PT/V, if kY = T/V, the two equations are identical. However, the Cambridge equation points beyond a quantity theory of money by emphasizing a) the income rather than the transactions dimension b) the choice of individuals to hold cash balances Keynes liquidity preference expressed demand for money as a positive function of transactions (level of income) demand and speculative demand. (He also discussed precautionary demand, which might be subsumed under transactions) Transactions demand was a pre-Keynesian concept that left money neutral, i.e., with no effect on real allocation. Keynes felt that speculative demand did not exist among preKeynesians. - Speculative Demand - the ‘uncertainty’ of the world made money an attractive asset. - uncertainty implied that money was not merely neutral - in particular, money was a better asset than a bond if interest rates rose since the rise in interest rates would decrease the value of the bond => demand for money was inversely related to the interest rate Equilibrium interest rate - determined by the interaction of the demand for money (positively related to income and negatively related to the interest rate) and the supply of money (determined by the authorities) -8- John Maynard Keynes (1883 – 1946) Marginal Efficiency of Capital - derived from “psychological expectation of future yield from capital assets” (Keynes’ emphasis on expectations contributed significantly to the development of expectations in more recent economic theory) - Investment => the purchase of “the right to the series of prospective net returns” expected from “the output” “during the life of the capital asset” - Marginal Efficiency of Capital - defined as the relation between the prospective yield of one more unit of capital asset and the cost of producing the unit of capital - the rate of discount that equates to zero the difference between present value of future net returns (revenues minus costs) and the cost today, i.e., the rate of discount which gives a present value of all revenues and costs equal to zero - can amalgamate the marginal efficiencies of individual capitals into a marginal efficiency of capital - Note: an increase in Investment will cause the Marginal Efficiency of Capital to decrease because increased competition due to increased investment causes the prospective yield to fall while increasing the cost of producing the capital. - K argued that businessmen will invest until the quantity demanded of capital (ME of capital) equals the cost of capital (the interest rate) - There is a long-term trend for the marginal efficiency of capital to decline since as communities become wealthier -> there are more savings at greater income and wealth -> “owing to the accumulation of capital being already large, the opportunities for investment are less attractive” - the interest rate could fall to compensate this but likely will not due to downward stickiness. - This tendency to a steady state of capital (within ‘a generation’ perhaps) is delayed if technological change (primarily) increase the Marginal Efficiency of Capital Keynes thus breaks with the pre-Keynesian assumption of full employment because -9- John Maynard Keynes (1883 – 1946) 1. Aggregate Supply = Aggregate Demand at only one equilibrium which is not necessarily at full employment 2. Saving = Investment in equilibrium but full employment I is unique and depends on the Marginal Efficiency of Investment and the interest rate 3. Lack of competition and the liquidity trap (an interest rate below which no investment occurs) mean that factor prices do not necessarily fall to ensure full employment. - 10 -