France`s attractiveness in Europe

advertisement

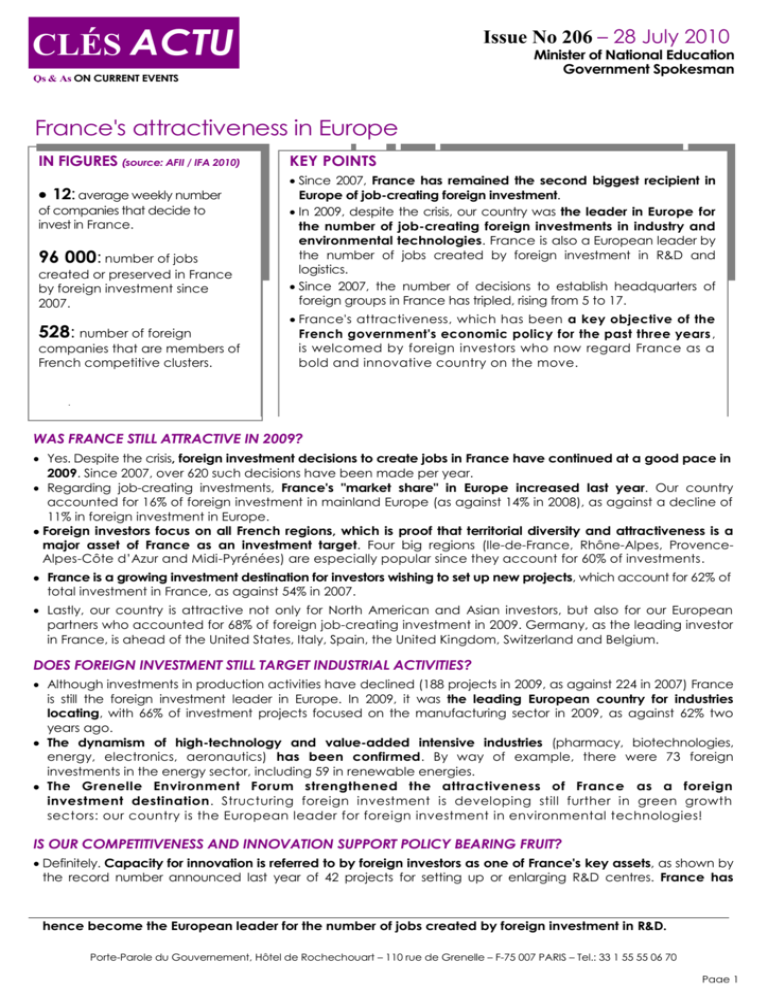

CLÉS ACTU Issue No 206 – 28 July 2010 Minister of National Education Government Spokesman Qs & As ON CURRENT EVENTS France's attractiveness in Europe IN FIGURES (source: AFII / IFA 2010) 12: average weekly number of companies that decide to invest in France. 96 000: number of jobs created or preserved in France by foreign investment since 2007. 528: number of foreign companies that are members of French competitive clusters. KEY POINTS Since 2007, France has remained the second biggest recipient in Europe of job-creating foreign investment. In 2009, despite the crisis, our country was the leader in Europe for the number of job-creating foreign investments in industry and environmental technologies. France is also a European leader by the number of jobs created by foreign investment in R&D and logistics. Since 2007, the number of decisions to establish headquarters of foreign groups in France has tripled, rising from 5 to 17. France's attractiveness, which has been a key objective of the French government's economic policy for the past three years , is welcomed by foreign investors who now regard France as a bold and innovative country on the move. WAS FRANCE STILL ATTRACTIVE IN 2009? Yes. Despite the crisis, foreign investment decisions to create jobs in France have continued at a good pace in 2009. Since 2007, over 620 such decisions have been made per year. Regarding job-creating investments, France's "market share" in Europe increased last year. Our country accounted for 16% of foreign investment in mainland Europe (as against 14% in 2008), as against a decline of 11% in foreign investment in Europe. Foreign investors focus on all French regions, which is proof that territorial diversity and attractiveness is a major asset of France as an investment target. Four big regions (Ile-de-France, Rhône-Alpes, ProvenceAlpes-Côte d’Azur and Midi-Pyrénées) are especially popular since they account for 60% of investments. France is a growing investment destination for investors wishing to set up new projects, which account for 62% of total investment in France, as against 54% in 2007. Lastly, our country is attractive not only for North American and Asian investors, but also for our European partners who accounted for 68% of foreign job-creating investment in 2009. Germany, as the leading investor in France, is ahead of the United States, Italy, Spain, the United Kingdom, Switzerland and Belgium. DOES FOREIGN INVESTMENT STILL TARGET INDUSTRIAL ACTIVITIES? Although investments in production activities have declined (188 projects in 2009, as against 224 in 2007) France is still the foreign investment leader in Europe. In 2009, it was the leading European country for industries locating, with 66% of investment projects focused on the manufacturing sector in 2009, as against 62% two years ago. The dynamism of high-technology and value-added intensive industries (pharmacy, biotechnologies, energy, electronics, aeronautics) has been confirmed. By way of example, there were 73 foreign investments in the energy sector, including 59 in renewable energies. The Grenelle Environment Forum strengthened the attractiveness of France as a foreign investment destination. Structuring foreign investment is developing still further in green growth sectors: our country is the European leader for foreign investment in environmental technologies! IS OUR COMPETITIVENESS AND INNOVATION SUPPORT POLICY BEARING FRUIT? Definitely. Capacity for innovation is referred to by foreign investors as one of France's key assets, as shown by the record number announced last year of 42 projects for setting up or enlarging R&D centres. France has hence become the European leader for the number of jobs created by foreign investment in R&D. Porte-Parole du Gouvernement, Hôtel de Rochechouart – 110 rue de Grenelle – F-75 007 PARIS – Tel.: 33 1 55 55 06 70 Page 1 CLÉS ACTU Qs & As ON CURRENT EVENTS The tripling of the R&D tax credit (CIR), the autonomy of universities and competitive cluster policy are reflective of the priority given by the Government to R&D and innovation. This policy is proving a success: 754 institutions controlled by 528 companies of foreign origin are members of competitive clusters. Of those institutions, 25% are of American origin, 13% of German origin and 8% from the UK. Membership of competitive clusters helps foreign companies gain a better foothold locally, encourages the locating of R&D centres in France and results in further financial contributions, value added and the arrival of new talents which directly benefit regional economies. IS FRANCE'S IMAGE CHANGING ABROAD? In the face of ever increasing competition among European countries to attract job-creating projects, attractiveness is a daily struggle. For three years now, the structural reforms conducted by the Government (Modernization of the Economy (LME) Act, abolition of the occupational tax (TP), introduction of the R&D tax credit (CIR), competitive clusters, measures to support economic immigration) have projected abroad the image of a bold, innovative France on the move. Our country has also showed itself to be forward-looking: the Grenelle 1 and 2 Acts enabled it to swiftly adopt green growth; the "Greater Paris" project is designed to build a showcase city of the 21 st century. France's image is further enhanced by the "Programme d’Investissements d’Avenir (PIA)" (Programme for Future Investment) worth €35 billion and focused on 5 strategic priorities for the competitiveness of tomorrow: 62% of the foreign leaders that were interviewed think that these choices help enhance France's attractiveness. Verbatim Nicolas Sarkozy: "France has many assets: a dynamic population growth, quality labour and the best infrastructure in Europe, it is reconciled with entrepreneurship and boasts successful companies. These assets are now recognized worldwide: France is the second biggest recipient of foreign investment in Europe." Christine Lagarde: "France's attractiveness will be an engine of economic recovery. The Government will leave no stone unturned to welcome foreign investors. There will be more investment through the implementation of the French national loan and the occupational tax reform; there will be more innovation through the tripling of the R&D tax credit (CIR)." (Minister for the Economy, Industry and Employment) Michel Mercier: "The crisis has compelled us to return to the basics of attractiveness. This policy has enabled us to withstand the crisis, but it will above all enable us to be a leading post-crisis investment destination." (Minister for Rural Affairs and Regional Development) Luc Chatel For further information visit the AFII/IFA website at www.invest-in-france.org/fr All Clés Actu back issues available at www.porte-parole.gouv.fr Porte-Parole du Gouvernement, Hôtel de Rochechouart – 110 rue de Grenelle – F-75 007 PARIS – Tel.: 33 1 55 55 06 70 Page 2 CLÉS ACTU Qs & As ON CURRENT EVENTS Annex: job-creating foreign investment projects in Europe in 2009 Source: Ernst & Young European Investment Monitor 2010. Page 3 Porte-Parole du Gouvernement, Hôtel de Rochechouart – 110 rue de Grenelle – F-75 007 PARIS – Tel.: 33 1 55 55 06 70 Page 4