January 10, 2008

Zacks Research Digest

Research Associate: Richika Bhandari, M.Fin

Editor: Kinjel Shah, CA.

Sr. Ed: Ian Madsen, CFA, imadsen@zacks.com; 1-800-767-3771, x9417

www.zackspro.com

NPS Pharmaceuticals

111 N. Canal Street, Suite 1101

(NPSP - NASDAQ)

Chicago, IL 60606

$3.80

Note: All new or revised material since the last report is highlighted.

Reason for Report: Minor changes in estimates

Prev. Ed.: November 14, 2007; 3Q07 Earnings Update

Brokers’ Recommendations: Neutral: 100.0% (4 firms); Positive: 0.0% (0); Negative: 0% (0)

Brokers’ Target Price: $5.25 (↔ as the last edition; 3 firms)

Prev. Ed.: 5; 0; 0

Brokers’ Avg. Expected Return: 38.2%

Recent Events

On November 1, 2007, NPSP announced its 3Q07 financial results. The company reported total revenue

of $29.2 million and pro forma EPS of $0.28 per share in 3Q07.

Overview

Utah-based NPS Pharmaceuticals, Inc. (NPSP) is engaged in the discovery, development, and

commercialization of small molecules and recombinant proteins. The company’s products are primarily

used for the treatment of bone and mineral disorders, gastrointestinal disorders, and central nervous

system disorders. Its products include Calcilytic Compounds that are in Phase I stage; PREOS for the

treatment of osteoporosis; Cinacalcet HCl for Hyperparathyroidism and Parathyroid Carcinoma; and

Teduglutide, a Phase II stage product for short bowel syndrome or Crohn’s Disease. The company’s

website is http://www.npsp.com.

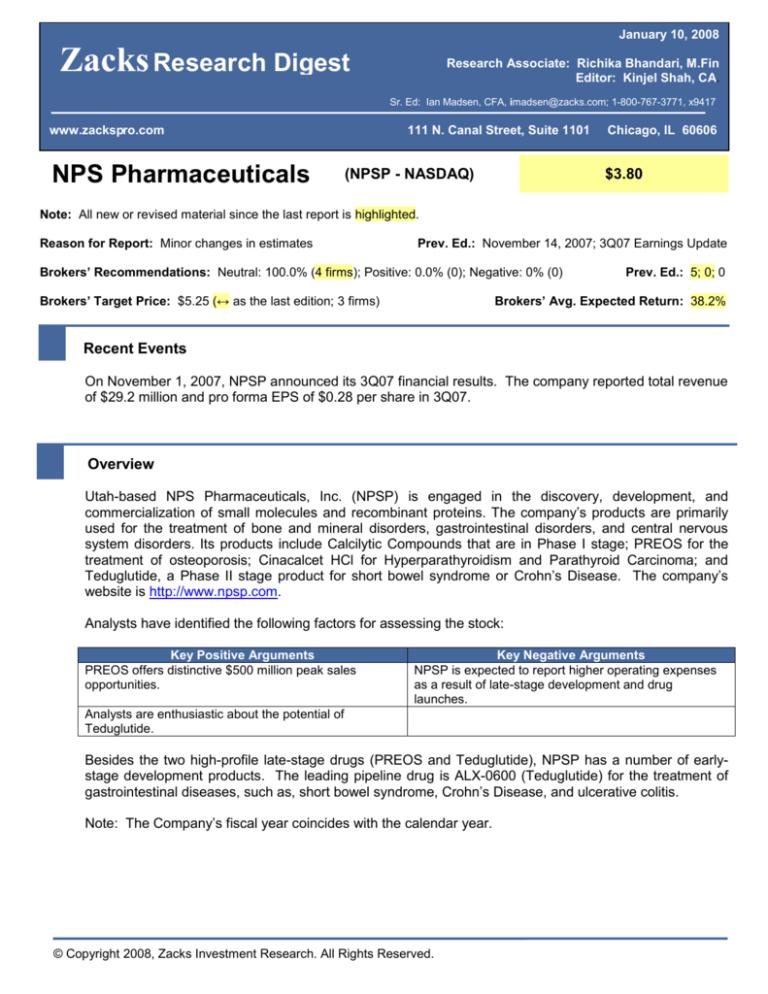

Analysts have identified the following factors for assessing the stock:

Key Positive Arguments

PREOS offers distinctive $500 million peak sales

opportunities.

Key Negative Arguments

NPSP is expected to report higher operating expenses

as a result of late-stage development and drug

launches.

Analysts are enthusiastic about the potential of

Teduglutide.

Besides the two high-profile late-stage drugs (PREOS and Teduglutide), NPSP has a number of earlystage development products. The leading pipeline drug is ALX-0600 (Teduglutide) for the treatment of

gastrointestinal diseases, such as, short bowel syndrome, Crohn’s Disease, and ulcerative colitis.

Note: The Company’s fiscal year coincides with the calendar year.

November 1, 2007

© Copyright 2008, Zacks Investment Research. All Rights Reserved.

Revenue

Revenue for 3Q07 grew 190% y-o-y to $29.2 million from revenue of $10.1 million in 3Q06. Increased

revenues are primarily the result of higher royalty revenue earned from Amgen on sales of cinacalcet HCl

and increased product sales, royalty and milestone revenue earned from Nycomed on sales of Preotact.

Revenue ($ in

million)

Revenue

Digest High

Digest Low

2006A

1Q07A

2Q07A

3Q07A

4Q07E

2007E

2008E

2009E

$48.5

$48.5

$48.5

$10.0

$10.0

$10.0

$13.1

$13.1

$13.1

$29.1

$29.2

$29.0

$23.7↓

$46.7↓

$11.0

$80.2↓

$99.0↓

$68.0

$71.1↓

$79.0

$61.1

$84.7

$89.4

$80.0

The graphical representation of revenue segments is given below:

3Q07A Key Drugs

Preotact

Royalty

30%

Research

and

License

Revenue

70%

2008E Key Drugs

2007E Key Drugs

Preotact

Royalty

20%

Preotact

Royalty

7%

Research

and

License

Revenue

80%

Research

and

License

Revenue

93%

Specific Products

Note: Recent significant developments are noted for those products marked with an asterisk (*).

Sensipar

Indication: Hyperparathyroidism (HPT), a disease characterized by the over-secretion of parathyroid

hormone that results when calcium receptors fail.

Stage of Development: Mature, widely sold and distributed; Approval for chronic renal insufficiency

(CRI) also.

Zacks Investment Research

Page 2

www.zacksro.com

Partners: The drug is licensed to Kirin sale in Asia and to Amgen for sale in the rest of the world (ROW).

NPSP earns royalties from Sensipar.

PREOS

Indication: Osteoporosis

Stage of Development: NPSP has been advised by the FDA to conduct additional trials. PREOS has

been approved in the EU under the name Preotact.

Importance: PREOS is a recombinant human parathyroid hormone that plays a role in calcium

regulation and bone development. Peak PREOS sales, according to one analyst (Goldman), are

estimated to be $500 million.

Partners: NPSP and Nycomed have entered an agreement expanding and amending rights and

responsibilities under the Preotact license originally entered into in 2004. Under the new agreement,

Nycomed will gain the right to commercialize Preotact in all ex-US territories, excluding Japan, for which

NPS retains commercial rights, and Israel which is the subject of a pre-existing distribution agreement

with Israel-based Neopharm, Ltd. Upon registration and approval in the US, rights to Canada and

Mexico will revert to NPS. The agreement provides for the transfer of manufacturing responsibility from

NPSP to Nycomed for drug supply in its territories. Additionally, the agreement grants NPSP the right to

monetize the royalty stream from Preotact sales. As part of the manufacturing transfer, Nycomed will pay

NPSP $11 million for a significant portion of the existing bulk drug supply.

Regulatory Issues: On September 19, 2007, the drug was granted Orphan Drug Status for the

treatment of hypoparathyroidism. The company is currently supporting a two-year study with PREOS in

patients with hypoparathyroidism.

Competitors: PREOS faces direct competition from Forteo (LLY). The key for PREOS’s success will be

to differentiate the product from the black-box labeled Forteo (approved). Further, NPSP stated that the

PREOS injection may offer an advantage to Lilly’s Forteo since it does not require refrigeration for up to

seven days, and therefore, provides greater convenience. In contrast, Forteo is packaged as a pre-filled

syringe that requires refrigeration for storage. The improved convenience of the newer bisphosphonates,

like Roche/GlaxoSmithKline’s Boniva may prove to be highly competitive, especially if NPSP attempts to

target early stage osteoporosis patients.

Additional Studies: In line with the company’s new business plan of focusing on specialty indications,

NPSP announced it was supporting a Phase II trial of PREOS as a hormone replacement treatment for

hypoparathyroidism. The trial, initiated under an investigator IND, has enrolled 30 of 50 patients to date.

Patients in the trial receive PREOS every other day for two years.

PREOS Sales

2006A

2007E

2008E

2009E

Est. Growth

$2.7M

$6.8M

$10.6M

$15.8M

-

Pipeline Drugs

Teduglutide (ALX-0600/Gattex)

Indication: Gastrointestinal disorders

Stage of Development: Phase II/III trial

Zacks Investment Research

Page 3

www.zacksro.com

Importance: Teduglutide is a propriety glucagon-like peptide 2 (GLP-2) compound, which is under

development by NPSP for gastrointestinal disorders. Preclinical studies have indicated that treatment

with GLP-2 could produce significant increases in both the mass and absorption of surface area on the

cell lining of the small intestine. NPSP has genetically altered key amino acid sequences of Teduglutide

to increase biological activity. The drug has potential for the treatment of gastrointestinal diseases, such

as Crohn’s Disease (CD), ulcerative colitis (UC), inflammatory bowel syndrome, intestinal mucositis, and

short bowel syndrome (SBS).

Partners: NPSP and Nycomed entered into a partnership for the development and commercialization of

Gattex outside North America. Under the terms of the partnership agreement, Nycomed will pay the

company $25 million up-front payment balance due and receive licensing rights to develop and

commercialize Gattex outside the US, Canada, and Mexico for the treatment of gastrointestinal disorders.

NPSP will retain the right to develop and commercialize Gattex in North America.

In addition to the $35 million total up-front payment, NPS has the potential to earn up to $150 million in

payments related to the attainment of certain regulatory milestones for the SBS indication, the successful

development of new indications, and the achievement of sales-based milestones. Additionally, the

agreement provides for double-digit royalties on Gattex sales in the Nycomed territories. The agreement

also provides for development cost-sharing equally for indications which are pursued jointly.

Additional Studies: NPSP is also conducting preclinical studies with teduglutide as a potential

treatment for chemotherapy-induced gastrointestinal mucositis in cancer patients and necrotizing

enterocolitis in preterm infants.

New Data: On October 11, 2007, NPSP reported topline results from the Phase III study of Gattex in

which 83 patients with short bowel syndrome (SBS) received a low dose of Gattex or placebo. The goal

of the study was a reduction in parenteral nutrition, or being fed intravenously, of at least 20%. The

company claimed Gattex showed a highly statistically significant reduction compared with placebo in the

low dose group. The criteria required, however, that the results for the high-dose group show statistical

significance before the results for the low-dose group could be considered. However, given the drug's

orphan designation in SBS and the statistically strong and clinically meaningful findings in the low-dose

group, the company intends to meet with the FDA to discuss the path to regulatory approval for Gattex.

Metabotropic glutamate receptors (mGluRs)

Indication: For central nervous system disorders

Stage of Development: Phase I trial

Partners: NPSP has ended its collaboration with AstraZeneca to discover and develop drugs targeting

metabotropic glutamate receptors (mGluRs). AstraZeneca agreed to pay NPSP $30 million to acquire

the assets related to the companies' research collaboration to discover and develop the compounds.

NPSP intends to use the proceeds to support further development of its late-stage product pipeline.

Under the terms of the agreement, NPSP will no longer provide research support or maintain interests in

any drugs developed and marketed under the program. The company will instead focus on its late-stage

pipeline products, including osteoporosis drug Preos and gastrointestinal disorders drug Gattex.

Calcilytics 751689

Indication: Osteoporosis

Stage of Development: In Phase II study with the investigational Calcilytic compound 751689 in postmenopausal women with osteoporosis.

Zacks Investment Research

Page 4

www.zacksro.com

Partners: NPSP and its partner, GlaxoSmithKline (GSK), are developing small molecule oral Calcilytics

for the treatment of osteoporosis. NPSP is eligible to receive milestone payments from GSK, and retains

rights to co-promote in North America.

Regulatory Issues: NPSP has received the approval of cinacalcet hydrochloride by the Japanese

Pharmaceuticals and Medical Devices Agency for the treatment of secondary hyperparathyroidism. As a

result, NPSP will receive a milestone payment plus royalties from Kirin Pharma, a wholly owned

subsidiary of Kirin Holdings, which will market the drug in Japan. Kirin has licensed cinacalcet from

NPSP for development and commercial sale in Japan, China, North and South Korea, and Taiwan.

Other Pipeline Drugs

NPSP’s partner, Jannsen, is continuing clinical development on glycine reuptake inhibitors (GlyT-1).

Jannsen is conducting Phase I studies for schizophrenia. Under the agreement, Jannsen will pay NPSP

milestone payments of up to $20.5 million and royalties.

NPSP selected 156 as a candidate for preclinical development from its anti-epileptics program. 156 is a

D-serine analog, which the company plans to develop for epilepsy, neuropathic pain, and other central

nervous system disorders.

Please refer to the Zacks Research Digest spreadsheet on NPSP for further details on revenue.

Margins

The cost of goods and royalties was $2.0 million in 3Q07. NPSP pays a royalty to Brigham and

Women’s Hospital on net Sensipar sales, which was initially 1% of Amgen’s net sales for Sensipar.

Research and development expenses for 3Q07 declined 61% to $5.4 million versus $13.7 million for

the same period of 2006. The decline was primarily due to decreased clinical development activity for

PREOS, reductions in personnel, and associated cash and stock compensation, and lower pre- approval

manufacturing expenses associated with PREOS, offset by higher pre-approval manufacturing expenses

associated with Gattex. According to the Zacks Research Digest, R&D expenses in 3Q07 were $5.4

million versus $13.7 million in 3Q06, a decrease of 60.9% y-o-y.

Selling, general and administrative expenses for 3Q07 declined 23% to $5.7 million versus $7.5

million for the same period in 2006. This decrease is primarily due to reductions in personnel and

associated cash and stock compensation. According to the Zacks Research Digest, SG&A expenses in

3Q07 were $5.7 million versus $7.5 million in 3Q06, a decrease of 23.3% y-o-y.

Restructuring charges for 3Q07 were $1.0 million versus $2.2 million for the same period in the prior

year. Restructuring charges in 2007 relate primarily to initiatives to restructure operations announced in

March 2007, while restructuring charges in 2006 related to initiatives to restructure operations announced

in June 2006.

Excluding the net proceeds generated by new business development activities and financial transactions

executed in 2007, NPSP expects to have a 2007 cash burn in the range of $70 to $80 million, a decrease

from the earlier guidance of $80 to $90 million. The company reiterated guidance for 2008 cash burn of

$35-$45 million.

Zacks Investment Research

Page 5

www.zacksro.com

Margins

Gross

Operating

Pretax

Net

2006A

1Q07A

2Q07A

3Q07A

4Q07E

2007E

2008E

2009E

92.5%

-170.0%

-210.7%

-210.7%

80.1%

-88.1%

-140.2%

-140.2%

83.4%

-55.1%

-97.8%

-97.8%

93.0%

61.1%

35.9%

35.9%

92.4%↓

63.0%↑

32.1%↑

32.1%↑

87.7%↑

20.8%↑

-11.0%↑

-11.0%↑

85.7%↑

11.0%↑

-21.1%↓

-21.1%↓

85.6%

8.2%

-19.7%

-19.7%

Please refer to the Zacks Research Digest spreadsheet for more details on margin estimates.

Earnings per Share

NPSP reported net income for 3Q07 of $14.1 million, or $0.28 per share, a 162.2% y-o-y reduction from

its net loss in 3Q06 of $21.1 million, or $0.45 per share. The reduction in net loss reflects the 2007

restructurings which called for aggressive expense reduction measures, increased revenues from

royalties and product sales, and gains from the sale of fixed assets. According to the Zacks Research

Digest, proforma EPS in 3Q07 was $0.21 versus ($0.43) in 3Q06, an increase of 148.8% y-o-y.

EPS

Digest High

Digest Low

Digest Avg.

2006A

1Q07A

2Q07A

3Q07A

4Q07E

2007E

2008E

2009E

($2.04)

($2.43)

($2.31)

($0.30)

($0.30)

($0.30)

($0.27)

($0.29)

($0.28)

$0.28

$0.16

$0.21

$0.59

($0.13)

$0.16

$0.19

($0.50)

($0.19)

($0.18)

($0.51)

($0.31)

$0.03

($0.69)

($0.30)

Please refer to the Zacks Research Digest spreadsheet for more details on margin estimates.

Target Price/Valuation

The average Zacks Digest price target provided by the analysts is $5.25 (↔ as the previous report). The

price targets range from $4.75 (Lehman) to $6.00 (Jefferies). Two firms lowered their target prices after

the 3Q07 earnings release.

All the four firms reporting have assigned Neutral ratings to the stock and, significantly, none of the firms

have assigned a Positive or a Negative rating to the stock.

Rating Distribution

Positive

Neutral

Negative

Avg. Target Price

Digest High

Digest Low

No. of analysts with target

price/Total

0.0%

100.0%

0.0%

$5.25

$6.00

$4.75↓

3/4

Please refer to the Zacks Research Digest spreadsheet on NPSP for further details on valuation.

Zacks Investment Research

Page 6

www.zacksro.com

Capital Structure/Solvency/Cash Flow/Governance/Other

As of September 30, 2007, the company had 46.4 million shares outstanding and $302.2 million in cash,

cash equivalents and marketable investment securities versus $146.2 million as of December 31, 2006.

The FY07 cash balance guidance was increased to a new range of $130 to $140 from a prior range of

$$65 to $75 million, primarily due to reduced cash burn, recent transactions and gains on facilities sales.

On July 3, 2007, as part of its effort to restructure and consolidate operations, NPSP announced the sale

of its former headquarters in Salt Lake City, Utah to the University of Utah and the closing of the sale of

its Mississauga, Ontario pilot manufacturing and laboratory facility to Transglobe Property Management

Services LTD. The Ontario, Canada facility sale will net approximately $4 million. The company will

receive approximately $21 million from the sale of its Utah facility and associated equipment. NPS

recently purchased the Salt Lake City facility for $20 million in order to exit from the long-term lease

obligation of the sale-leaseback transaction it had entered in 2006. NPSP plans to vacate the Salt Lake

facility and additional research laboratories it leases at the MaRS Centre in Toronto and consolidate its

operations at a new headquarters location in Bedminster, New Jersey later this year.

November 1, 2007

Potentially Severe Problems

There are none other than those discussed in other sections of this report.

November 1, 2007

Long-Term Growth

Long-term growth is always difficult to calculate on small loss making biotechnology companies. Hence

none of the firms have provided a long-term growth rate. One analyst (Goldman) believes both Sensipar

and PREOS offer separate $500 million peak sales opportunities. The profitability to NPSP should be

higher on PREOS as analysts expect the royalty rate (should NPSP sign a co-promotion alliance) to be

roughly 20%, instead of the current 10% deal with Amgen. The company has filed the NDA for PREOS

after the European filing. Teduglutide offers another $500 million opportunity, but it is admittedly still in

mid-stage development. Though the possibility of positive Teduglutide data in Crohn’s Disease remains

a wildcard, analysts cannot predict when data will be forthcoming.

Without PREOS, brokerage firms see a few catalysts for the company as most of the pipeline products

either represent relatively smaller market opportunities (i.e. Teduglutide for short bowel syndrome), or are

still in Phase II studies or earlier stages of development. Although the company receives royalties on

Sensipar sales from Amgen, these royalty payments are passed through to bondholders of a nonrecourse bond that was secured by Sensipar.

November 1, 2007

Individual Analyst Opinions

POSITIVE RATINGS

None

Zacks Investment Research

Page 7

www.zacksro.com

NEUTRAL RATINGS

Goldman – Neutral ($5) – November 2, 2007. INVESTMENT SUMMARY: The firm increased its target

price from $5 to $6 but maintains a Neutral rating.

Jefferies – Hold ($5) – November 5, 2007. INVESTMENT SUMMARY: The firm decreased its target

price from $7 to $5 and downgraded the stock from Buy to Hold as it is concerned that Gattex may face a

high hurdle at the FDA, given recent pivotal trial results.

J.P. Morgan – Neutral – November 1, 2007. INVESTMENT SUMMARY: The firm is cautious about

approval of Gattex in the US and therefore remains on the sidelines anticipating further clarity later this

year.

Lehman – Equal Weight ($4.75) – November 2, 2007. The firm decreased its target price from $7 to

$4.75. INVESTMENT SUMMARY: The firm states that NPSP has made significant progress in

addressing balance and extending cash flows but remains apprehensive about approvability of the lead

product Gattex following mixed data in SBS.

NEGATIVE RATINGS

None

DROPPED COVERAGE

Oppenheimer – January 8, 2008. The firm has ceased coverage on the stock due to the analyst's

departure.

Research Associate: Richika Bhandari

Copy Editor: Sudipta Mukherjee

Content Ed: Vivek Singh

Zacks Investment Research

Page 8

www.zacksro.com