Brisbane Adopted Infrastructure Charges Resolution (No.4) 2014

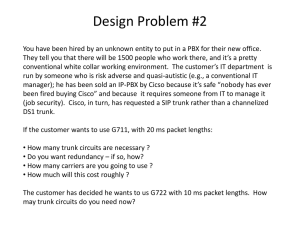

advertisement