4-1

Module 4 Financial Statement Analysis and Interpretation

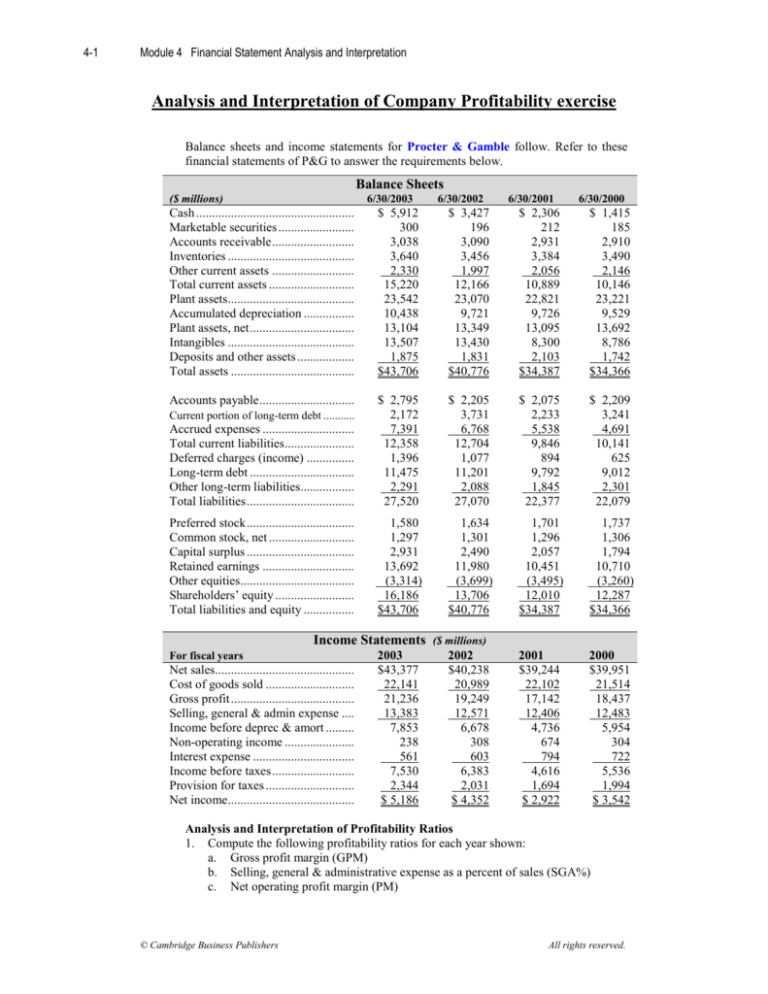

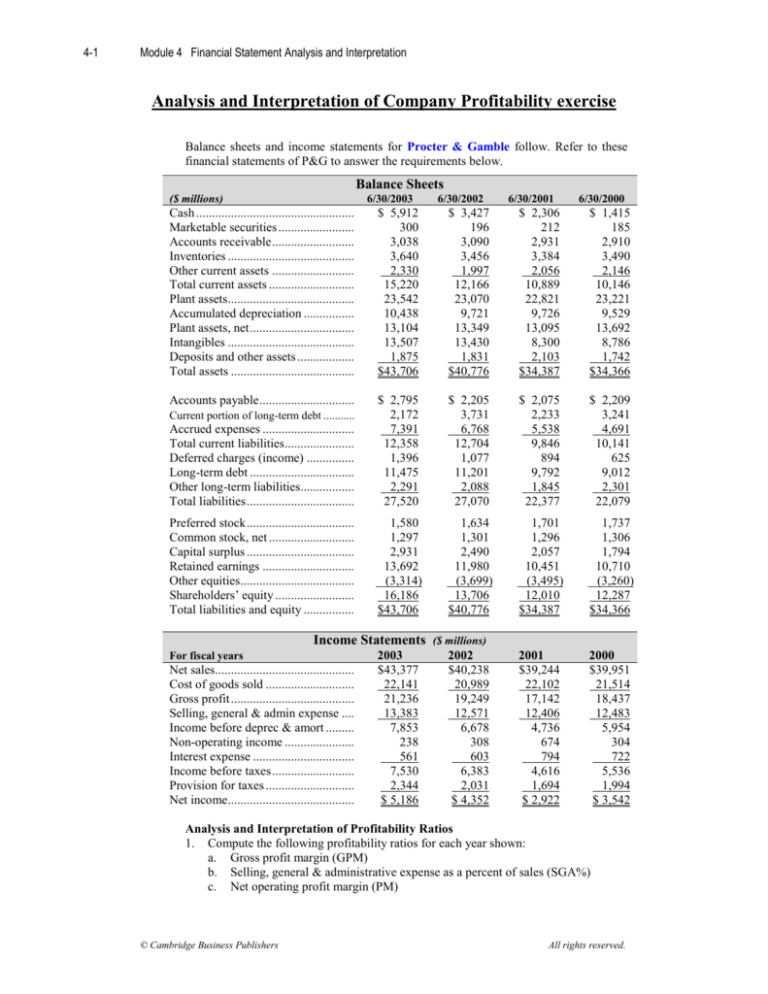

Analysis and Interpretation of Company Profitability exercise

Balance sheets and income statements for Procter & Gamble follow. Refer to these

financial statements of P&G to answer the requirements below.

Balance Sheets

($ millions)

6/30/2003

6/30/2002

6/30/2001

6/30/2000

Cash .....................................................

Marketable securities ...........................

Accounts receivable .............................

Inventories ...........................................

Other current assets .............................

Total current assets ..............................

Plant assets...........................................

Accumulated depreciation ...................

Plant assets, net ....................................

Intangibles ...........................................

Deposits and other assets .....................

Total assets ..........................................

$ 5,912

300

3,038

3,640

2,330

15,220

23,542

10,438

13,104

13,507

1,875

$43,706

$ 3,427

196

3,090

3,456

1,997

12,166

23,070

9,721

13,349

13,430

1,831

$40,776

$ 2,306

212

2,931

3,384

2,056

10,889

22,821

9,726

13,095

8,300

2,103

$34,387

$ 1,415

185

2,910

3,490

2,146

10,146

23,221

9,529

13,692

8,786

1,742

$34,366

Accounts payable .................................

Accrued expenses ................................

Total current liabilities .........................

Deferred charges (income) ..................

Long-term debt ....................................

Other long-term liabilities....................

Total liabilities .....................................

$ 2,795

2,172

7,391

12,358

1,396

11,475

2,291

27,520

$ 2,205

3,731

6,768

12,704

1,077

11,201

2,088

27,070

$ 2,075

2,233

5,538

9,846

894

9,792

1,845

22,377

$ 2,209

3,241

4,691

10,141

625

9,012

2,301

22,079

Preferred stock .....................................

Common stock, net ..............................

Capital surplus .....................................

Retained earnings ................................

Other equities.......................................

Shareholders’ equity ............................

Total liabilities and equity ...................

1,580

1,297

2,931

13,692

(3,314)

16,186

$43,706

1,634

1,301

2,490

11,980

(3,699)

13,706

$40,776

1,701

1,296

2,057

10,451

(3,495)

12,010

$34,387

1,737

1,306

1,794

10,710

(3,260)

12,287

$34,366

2001

$39,244

22,102

17,142

12,406

4,736

674

794

4,616

1,694

$ 2,922

2000

$39,951

21,514

18,437

12,483

5,954

304

722

5,536

1,994

$ 3,542

Current portion of long-term debt ..............

Income Statements ($ millions)

For fiscal years

Net sales...............................................

Cost of goods sold ...............................

Gross profit ..........................................

Selling, general & admin expense .......

Income before deprec & amort ............

Non-operating income .........................

Interest expense ...................................

Income before taxes .............................

Provision for taxes ...............................

Net income...........................................

2003

$43,377

22,141

21,236

13,383

7,853

238

561

7,530

2,344

$ 5,186

2002

$40,238

20,989

19,249

12,571

6,678

308

603

6,383

2,031

$ 4,352

Analysis and Interpretation of Profitability Ratios

1. Compute the following profitability ratios for each year shown:

a. Gross profit margin (GPM)

b. Selling, general & administrative expense as a percent of sales (SGA%)

c. Net operating profit margin (PM)

© Cambridge Business Publishers

All rights reserved.

4-2

Module 4 Financial Statement Analysis and Interpretation

2.

d. Net profit margin.

Your results in part 1 should have revealed an increase in net profit margin.

a. Is this increase due to an increase in the gross profit margin or a decrease in

selling, general, & administrative expense, or both? Provide evidence and

explain your answer.

b. Consider how much control that companies have or do not have over gross

profit margins. What factors must exist to allow them to increase selling prices

of their products? In what ways can they improve gross profit margins by

lowering product manufacturing costs? Explain.

c. What are the usual components of selling, general and administrative expense

for a company like Procter and Gamble? For which of these components are

companies likely able to achieve expense reductions? To what extent are these

expense reductions a short-term gain at the cost of long-term performance?

Explain.

Analysis and Interpretation of Asset Turnover Ratios

1. Compute the following turnover ratios for 2001 through 2003:

a. Accounts receivable turnover and the average collection period.

b. Inventory turnover and average inventory days outstanding.

c. Plant asset turnover.

2. Results from part 1 should reveal a slight improvement in receivables turnover

from 2001 to 2003. How can a company like P&G realize an improvement in this

ratio? Explain.

3. Results from part 1 should reveal no discernable improvement in inventory

turnover from 2001 to 2003. How can a manufacturer like P&G realize an

improvement in its inventory turnover? Explain.

4. Results from part 1 should reveal a slight decline in plant asset turnover from 2001

to 2003. Why is this ratio so difficult for companies to impact? Can you think of

ways in which a company can achieve an improvement in this ratio? Explain.

Disaggregation and Interpretation of Company ROE

1. Compute the following for 2001 through 2003:

a. Net operating profit margin (PM).

b. Return on net operating assets (RNOA).

c. Financial leverage (LEV).

d. Net borrowing costs (NBC)

e. Spread

f. Return on equity (ROE).

g. ROE from the formula: ROE = RNOA + (LEV×Spread). Confirm that this

amount equals that computed in part f.

2. Drawing on results from part 1, does P&G depend more on operations (RNOA) or

financial leverage to drive its ROE? Explain.

3. Drawing on results from part 1, is P&G’s level of ROE sufficient to attract capital?

Explain. What benchmark do you believe is appropriate in answering that

question? Explain.

Analysis and Interpretation of Liquidity and Solvency Measures

1. Compute its current ratio and quick ratio for 2001 through 2003. Do the trends, if

any, in these ratios indicate that P&G is becoming more or less liquid? Use

computations to support your analysis and inferences.

2. Compute P&G’s financial leverage (LEV) and times interest earned for 2001

through 2003. Do these ratios indicate that P&G is becoming more or less solvent?

Explain.

3. A well-known model of financial distress is Altman’s Z-score. Altman’s Z-

score uses multiple ratios to get a predictor of distress. This predictor classifies

or predicts the likelihood of bankruptcy or nonbankruptcy. Five financial ratios

© Cambridge Business Publishers

All rights reserved.

4-3

Module 4 Financial Statement Analysis and Interpretation

makeup the Z-score:

X1 = Working capital / Total assets

X2 = Retained earnings / Total assets

X3 = Earnings before interest and taxes / Total assets

X4 = Shareholders’ equity / Total liabilities

X5 = Sales / Total assets.

In brief, X1 reflects liquidity, X2 reflects cumulative profitability that has been

retained, X3 reflects profitability, X4 reflects financial leverage, and X5

reflects total asset turnover.

The Altman Z-score is computed as:

Z-score = (0.717 × X1) + (0.847 × X2) + (3.107 × X3) + (0.420 × X4) + (0.998 ×

X5)

The Z-score is then interpreted as follows:

Z-score < 1.20

high probability of bankruptcy

Z-score > 2.90

low probability of bankruptcy

1.20 ≤ Z-score ≤ 2.90

gray or ambiguous area.

Compute the Altman Z-Score of P&G for 2003. Does this score indicate any concerns

about P&G’s solvency? Explain.

© Cambridge Business Publishers

All rights reserved.