Title: Founder`s Human Capital and High Technology New Venture

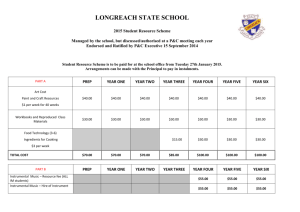

advertisement

Instrumental Value Theory and the Human Capital of Entrepreneurs Eli Gimmon and Jonathan Levie Eli Gimmon is a Lecturer at Tel-Hai Academic College, Israel and Jonathan Levie is a Reader in the Hunter Centre for Entrepreneurship, University of Strathclyde. The authors would like to thank the two anonymous reviewers and the editor of the Journal of Economic Issues for their comments. Abstract: Given the contribution of Schumpeterian entrepreneurship to technological progress and well-being, the accuracy of investment decisions by venture capitalists is a societal issue. Venture capitalists find the human capital of entrepreneurs difficult to assess. This paper employs instrumental value theory to assess the value of different human capital factors to the performance of new ventures. A meta-analysis of 29 previous empirical studies that examined the effect of founder’s human capital on new venture performance suggested that instrumental value theory holds promise as a guide for research on entrepreneurs’ human capital and new venture performance. It could also help venture capitalists to make better investment decisions, benefiting society in general. Keywords: instrumental value theory, entrepreneurship, human capital JEL Classification Codes: B25, B52, L26, M13, M21 In institutional economics, entrepreneurs are seen to play a critical role in the conversion of technological progress into economic development and human well-being (McDaniel 2003; 2005; Klein 1988). Although Alfred Marshall and Thorstein Veblen recognized this in the 19th century, Joseph Schumpeter (1934; 1943) was the first to describe the role of innovative entrepreneurs in the evolution of the economy in detail. Schumpeterian entrepreneurs disrupt the status quo by introducing new and better ways of doing things. This typically requires considerable investment of resources to succeed (see Javary 2004 for an example). For a new venture with little internal financial reserves to draw on, this means external funding. As Schumpeter himself pointed out, “credit is primarily necessary to new combinations” (Schumpeter 1934, 70). At the extreme end of Schumpeterian entrepreneurship are new ventures that are so innovative and asset-poor that conventional debt finance is not appropriate. A completely different form of funding is required, one that shares in the upside gain but also accepts the downside risk. This is venture capital. To illustrate how unusual this form of financing is, only around 8% of American start-up funding needs are met by venture capital (Reynolds 2007). Of the 2 million or so start-up attempts in the United States each year, only around 800 are invested in by venture capitalists, yet venture-capital-backed firms provide 8% of jobs in U.S. businesses (Shane 2008). Availability of external capital, then, is a critical institutional factor for Schumpeterian entrepreneurship. The accuracy of venture capitalists in picking which Schumpeterian entrepreneurs to back is a societal issue, since poor judgment will lead to a loss of the benefits that society can reap from technological progress. Not only will society not gain from the innovations these Schumpeterian entrepreneurs seek to introduce, but the venture capitalists will find their sources of capital drying up as their losses induce fund managers to invest their money elsewhere. Much decision-making in venture capital is based on intuition and herd behavior (Zider 1998). A wide range of evidence suggests that the accuracy of venture capitalists’ predictions is not high, with a small number of spectacular successes boosting the return rates of some funds and masking a low overall “hit” rate in the industry (Zacharakis and Meyer 2000). Indeed, following poor returns, investment in seed and early-stage private sector venture capital funding has been in relative decline recently, particularly in Europe (Jääskeläinen, Maula and Murray 2007). In summary, given the economic importance of Schumpeterian entrepreneurship and its dependence on substantial equity funding, investment choice by venture capitalists is worthy of attention, particularly given the interest of institutional economists in value and judgment. Venture capitalists invest based on their judgment of the human and social capital of the entrepreneur(s), the potential in the technology and the potential in the market (Zacharakis and Shepherd 2005). One of the most difficult issues for many venture capitalists is assessing the human capital of the founder (Levie and Gimmon 2008). Human capital (Becker 1975) has more generally been recognized as a key success factor in new venture performance (Stuart and Abetti 1987; Hart, Stevenson and Dial 1995). A surprising feature of the human capital literature is that there appears to be no ex-ante method of predicting which of the different forms of human capital commonly employed in the entrepreneurship literature, and by investors in new ventures, might be expected to have an effect on performance. 1 In other words, no commonly accepted theory is routinely used to sort or classify founder’s human capital factors exante as relevant or irrelevant to venture performance. We propose the use of instrumental value theory as interpreted by J. Fagg Foster (Tool 1993a; Ranson 2008) as a tool for ex-ante prediction of the effect of different forms of human capital on new venture performance. In this article, we test its ability to predict performance through a meta-analysis of published empirical studies of founder’s human capital and performance. We argue that the use of instrumental value theory is valid in this case because accurate choice of Schumpeterian entrepreneurs by venture capitalists is in the interests of society generally, not just venture capitalists. As Baldwin Ranson (2008) has remarked with specific reference to instrumental value theory, applicability is the final test of the correctness of theories. Although applying instrumental value theory as an aid to ex-ante prediction might appear to violate Deweyan principles that context is key (Dewey 1939; Gordon 1990) and that instrumental value is dynamic (Klein 1988), we argue that by applying it in the narrow case of new venture performance, and remaining sensitive to alternative interpretations, some degree of useful generalization is possible. We find the instrumental criterion helpful as a way of ordering, as a first approximation, the value of different forms of human capital to Schumpeterian entrepreneurship, while recognizing that this approach has its critics. This study aims to make a contribution to instrumental value theory through illustrating its value in classifying human capital that is useful for predicting new venture performance. This is important because there are many forms of human capital, and a classification enables a theory-driven focus on the human capital that really matters in a particular context. The paper also answers a call for further meta-analysis in economics (Pressman and Montecinos 1996, 879). A third contribution is to suggest how the instrumental value framework can guide further research in areas that have not been addressed before, for example by separating out the instrumental and ceremonial value of social capital factors such as reputation. Instrumental Value Theory and New Venture Performance Veblen’s recognition of the importance of technological innovation to social progress, and how such progress can be hindered, is a central concern of institutionalism. One way in which progress can be hindered is what Clarence Ayres 2 (1961, 31) refers to as “ceremonial adequacy,” a kind of imitation of technological adequacy. He illustrated this with the following example: “The tribal medicine man purports to be altering the course of events in imitation of the tool activities by which technicians really do alter the course of events. Recognizing it makes possible a clear differentiation of technological reality from ceremonial fantasy, and so the real values from fancies, or pseudo values.” These ideas were built on by Foster and refined by Marc Tool into the notion of an instrumental value principle, with pre-defined ends: preservation of the species (“the continuity of human life”) and meritocracy (“non-invidious recreation of the community”), and means: “the instrumental use of knowledge” (Tool 1979, 293). As an aid to employing this principle in analysis, Bush and Tool (2003) introduced the concepts of instrumental value and ceremonial value. They define factors with “instrumental value” as tools or skills employed in the application of evidentially warranted knowledge to problem-solving processes. Ceremonial values “provide the standards of judgment for invidious distinctions, which prescribe status, differential privileges, and master-servant relationships, and warrant the exercise of power by one social class over another” (Bush 1987, 129). In other words, factors with “ceremonial value” are defined as status symbols or labels. Instrumental value theory in application, as proposed by Tool, has been criticized as ambiguous (Samuels 1995, 99), and as little more than value judgment based on two desirable conditions, when other equally desirable conditions might have been chosen instead (Gordon 1990). In turn, these criticisms have been refuted by Tool (1990) with the argument that the criteria of instrumental value theory are neither absolute nor eternal; they are normative objects of inquiry. Tool regarded the instrumental value principle “a product of inquiry and subject to revision or abandonment by further inquiry. It has no standing except as a construct for inquiry and as a tool for analysis and judgment. Its relevance is repeatedly tested by its incorporation in, and guidance of, inquiry and its use as a judgmental standard in problem solving . . . It is derived exclusively from the experience continuum of people and . . . it articulates what often has historically been meant by progress, reform, or betterment” (1110). Supporting this view, Bush has noted that a particular activity or behavior may have either instrumental or ceremonial significance, or sometimes it may possess both ceremonial and instrumental significance (Bush 1987). While the argument over the validity of the Bush/Tool approach to instrumental value theory has never been satisfactorily resolved, there is general agreement that what is instrumental in one context might be ceremonial in another. Thus, value judgments are context-dependent. For any particular context, a judgment that an attribute is 3 ceremonial or instrumental is continually subject to review as the priorities and knowledge of society changes. This should not prevent the application of instrumental value theory, but rather it makes any conclusions tentative and subject to review. For our purposes, the principal merit of the value dichotomy is that it forces us to ask “what is the instrumental value of this characteristic,” and not accept the face validity, so to speak, of a label. Instrumental value theory has been applied to a range of economic issues, including pricing in the international petroleum industry (Tool 1993b), the granting of intellectual property rights to innovators (Adkisson 2004), timber resource use in Maine (Welcomer and Haggerty 2007), and government and household deficits (Todorova 2007). Few attempts have been made to link institutional economics to non-cognitive human capital, that is, personal human resources rather than personality resources. One of these is Figart (2003), who examines institutional policies that provide non-invidious employment. While the original focus of Veblen (1899), appropriate to his time, is invidious distinctions between the leisure classes and the working classes, Deborah Figart elaborated on ceremonial distinctions based on gender, race-ethnicity, class identity, nationality, or sexual preferences. She employed the instrumental value theory to seek greater understanding of human capital development. A second example, from the field of entrepreneurship (Gimmon 2006), explores how investors appeared to invest in entrepreneurs who did not have the relevant knowledge and experience of growing a new venture, but did have high credentials and awards from academia. These academic credentials did not predict subsequent performance, when relevant knowledge and experience (which did predict subsequent performance) were controlled for. This paper employs instrumental value theory to assess the value of different human capital resources1 of venture founders in terms of their likely effect on subsequent venture performance. In other words, we use instrumental value theory as a thinking device to work through the likely effect of different types of human capital on new firm performance. We then test whether this method is better than chance (the simplest alternative means) by conducting a meta-analysis of different studies of human capital and new venture performance. This represents our attempt at an instrumental evaluation, or an assessment of the effectiveness of the instrument used to achieve the purpose relative to some alternative means (Gordon 1990). Using this theory we can posit that any specific type of founder’s human capital has instrumental value if it contains the means and abilities for enhancing performance of the founder’s venture. 4 Bush and Tool’s concept of “ceremonial value” is worth defining in this context. If a particular type of founder’s human capital does not contain the means and abilities for enhancing performance of the founder’s venture, but is nevertheless used in practice as a measure of human capital, and expected by third parties in society such as financial investors to influence performance, then in the Bush/Tool formulation of instrumental value that characteristic has ceremonial value. While ceremonial criteria are generally seen in the institutionalist tradition as invidious from a societal perspective, John Meyer and Brian Rowan (1977, 351) suggested that (c)eremonial criteria of worth . . . are useful to organizations: they legitimate organizations with internal participants, stockholders, the public, and the state . . . The incorporation of structures with high ceremonial value, such as those reflecting the latest expert thinking or those with the most prestige, makes the credit position of an organization more favorable. Loans, donations, or investments are more easily obtained. While this may be true for the organization, it is not true for society in general. Once performance becomes disconnected from means and abilities, and becomes dependent on ceremonial, tribute-paying, and rent-seeking, then productive entrepreneurship becomes unproductive (Baumol 1990) and the provision of resources such as venture capital to the entrepreneurial function becomes needlessly inefficient from a societal perspective. In summary, instrumental value theory would appear to be a useful tool to identify which human capital factors might affect new venture performance and which might not. A Test of Instrumental Value Theory As Foster pointed out, “the building of a generalization and the process of verification through application [are] not separate, nor can either exist without the other” (Foster 2007, 88). In this spirit, a meta-analysis of previous empirical studies of human capital and venture performance was conducted to assess the value of instrumental value theory in classifying ex-ante the instrumental value of different forms of founder’s human capital. Meta-analyses are still relatively 5 rare in the economic literature, despite Steven Pressman and Veronica Montecinos’ (1996, 879) call for meta-analysis as a way of breaking down barriers between different schools of thought and extracting further understanding from existing empirical work. Meta-analysis is a set of statistical procedures designed to accumulate results across independent studies that address a related set of research questions (Hunter, Schmidt and Jackson 1982). The accumulation of results across different studies provides more accurate representation of the population relationship than is provided by individual study estimators. Meta analysis derives generalization and practical simplicity from studies that are not the same by ignoring distinctions among the studies that make no important difference (Glass, McGaw and Smith 1981). We identified 12 different human capital factors of new ventures’ founders that had been proposed in previous empirical studies as affecting the performance of their ventures. We then used instrumental value theory to classify each factor as having instrumental value or not in this context. After this, we noted the extent to which each of these factors actually predicted venture performance in those studies. We expected the founder’s human capital factors that were classified ex-ante as having instrumental value to positively affect venture performance and the founder’s human capital factors that were classified ex-ante as not having instrumental value to have no effect on venture performance. Finally, we tested the outcomes using a statistical test to confirm that the difference in proportions of factors judged ex ante to be instrumental or not and factors found ex post to affect performance or not were not due to chance. This methodology ensured that we would not succumb to tautology, in other words that we would not define our constructs on the basis of outcomes. Founder’s Human Capital Resources Following an extensive literature search, we reviewed 29 empirical studies of new venture performance that included human capital variables. These studies represent all significant, cited, empirical work on the relationship between founder’s human capital and new venture performance up to early 2007. The reviewed studies are (by chronological order of year of publication): Rothwell et al. (1974); Cooper and Bruno (1977); Maidique and Hayes (1984); Maidique (1986); Stuart and Abetti (1987); Goslin (1987); Perry, Meredith and Cunnington (1988); Dubini (1990); Bruderl, Preisendorfer and Zeigler (1992); Reynolds (1993); Cooper, Gimeno-Gascon and Woo (1994); Lussier (1995; Lussier 6 and Pfeifer 2001); Yusuf (1995); Hart, Stevenson and Dial (1995); Bamford, Dean and McDougall (1996); Low and Abrahamson (1997); Gartner, Star and Bhat (1998); Gadenne (1998); Shepherd, Douglas and Shanley (2000); Baum, Locke and Smith (2001); Shane and Stuart (2002); Kakati (2003); Florin Lubatkin and Schulze (2003); Brown and Hanlon (2004); Lee and Lee (2004); Schwartz, Harms, and Grieshuber (2005); Lee and Chang (2005), Gimmon (2006), Hsu (2007). These studies tested the performance of new ventures as measured by monetary indicators (such as growth of sales profits), or by market share, or if these kinds of indicators were premature then performance was indicated by survival versus discontinuity of the venture. All of these criteria for performance are commonly used in the literature of entrepreneurship as measures of venture performance; each has flaws and no one measure has emerged as the best measure of performance for new ventures. Most of the studies used quantitative techniques to analyze the data, which was either primary data of a chosen sample or secondary data. A human capital factor was considered to affect venture performance if multivariate statistical analysis showed an independent (that is, controlling for other factors) association with a p value of .05 or less, a cutoff value that is commonly used in the social sciences to identify associations that are highly likely (in a statistical sense) to be systematic. The 29 studies covered a wide range of industry sectors in developed economies, and over one third of the cohorts (11) were in high technology sectors. Upon reviewing these 29 studies, we classified all their tested individual variables that measured different aspects of founder’s human capital into as few types as possible by comparing the definitions of the variables. We preserved the original terminology used in the literature as far as possible. This resulted in 12 different types being identified. These 12 founder’s human capital factors are (in alphabetical order) as follows: 1. Academic titles (doctor or professor) 2. Age 3. Education 4. Entrepreneurial mind-set — this is a commonly used term in the literature for a wide range of entrepreneurial personality, culture and sense factor constructs. 5. Ethnicity 6. Founder’s team compatibility 7 7. Gender 8. General management experience 9. Industry-related experience 10. Learning ability 11. Parent(s) were entrepreneurs 12. Start-up experience Next, using instrumental value theory, we categorized these 12 human capital factors as having instrumental value or not having instrumental value in the context of new venture performance. Instrumental value relates to tools and skills that are employed in the application of knowledge to problem-solving processes (Bush 1983, 37). These tools and skills are resources containing the required means and abilities for achieving the goals or leading to the desired results. Instrumental value “is rooted in causal comprehension of events and consequences” (O’Hara and Tool 1998, 7). Contextualizing this general definition, human capital factors having instrumental value would be those that are applied in problem-solving processes containing the means and abilities for enhancing venture performance, which are those tools and skills containing the required means and abilities for achieving the founder’s goals for the new venture. Looked at in this way, the factors listed above that possess these qualities are easily identifiable. They are those that denote relevant skills, knowledge or experience, such as prior industry experience, management experience, start-up experience (provided learning had taken place), founding team compatibility (this would facilitate the application of relevant experience and knowledge of different team members), learning ability (since venture creation is an iterative process) and perhaps aspects of education, and entrepreneurial mind-set, where relevant. We labeled these as having “instrumental value,” and following the theory we predicted that all of these should have positively affected venture performance in all empirical studies. All other factors were classified by default as not having instrumental value. As pointed out by Bush and Tool, certain characteristics of individuals have no instrumental value but may nevertheless be valued by society. This can result in a misallocation of resources, a central concern of instrumental value theorists (Tool 1993b). We note that some of these non-instrumental factors, which Bush and Tool might label “ceremonial” by virtue of their value by society, might correlate weakly with certain instrumental factors, such as relevant experience or social capital (Honig, 8 Lerner and Raban 2006; Baron and Markman 2000). If the effects of these underlying factors of instrumental value are not controlled for in assessment of human capital, these “ceremonial” factors might be interpreted by others (including providers of finance and researchers) as signals of instrumental value. As an example, “education” might be measured using metrics of instrumental value, for example training in a relevant technology or management skill, or with a proxy measure, such as “academic title,” which might well have no instrumental value independent of its association with education. “Parents were entrepreneurs” may be a weak proxy for entrepreneurial mindset or industry, general management, or start-up experience. “Age” is often used as a proxy for experience, ability, and physical condition (Cooper and Gimeno-Gascon 1992). However, youth can have high ceremonial value in some societies and old age can have high ceremonial value in others. “Gender” can transmit very different ceremonial messages in different cultures, as well as being a weak proxy for experience (Lerner, Brush and Hisrich 1997; Carter et al. 2007). These examples serve to illustrate the value of instrumental value theory in sharpening value judgment. With instrumental value theory, the dangers of proxy measures are revealed. In summary, the founder’s human resources employed in previous studies of new venture performance that we considered to have instrumental value are (in alphabetical order): education; entrepreneurial mind-set; founder’s team compatibility; general management experience; industry related experience; learning ability; and start-up experience. Those considered as not having instrumental value were: academic titles; age; ethnicity, gender; and parents were entrepreneurs. Our next step was to identify which factors significantly enhanced new venture performance in all the studies in the meta-analysis, and to analyze any patterns that emerged from a comparison of instrumental and noninstrumental factors. The results of this analysis are reported in the next section. Results Table 1 cross-tabulates the factors and studies used in the meta-analysis and for each study, the table shows whether each factor was measured and if so whether it was found to significantly enhance new venture performance. Insert Table 1 about here 9 As Table 1 shows, only half of these factors have been tested by more than a handful of studies, and only two of these, education and founding team compatibility, show overwhelming consensus on an effect. We return to the issue of model specification below. Table 2 presents the pattern of ex-ante classification of human capital using instrumental value theory and ex-post classification of those human capital factors that enhanced performance and those that did not. Meta-analysis of the findings of the 29 previous empirical studies tends to support our a-priori classification. Of the total of 85 tests of independent effects of one of these factors on performance, 69 were on factors we classified ex-ante as instrumental, and 16 were on factors we classified ex-ante as not instrumental. Of the 69 tests on instrumental factors, 53 were significant and 16 were not, a ratio of 3.3:1. Of the 16 tests on non-instrumental factors, 8 were significant and 8 were not, a ratio of 1:1. Insert Table 2 about here In all, over three-quarters of the tests on instrumental value factors showed significant independent effects, while only half of the tests on non-instrumental value factors showed significant independent effects. A statistical chi-square test of all significant and non-significant factors in the 29 previous studies confirmed that the probability of finding this pattern due to chance, assuming the tests were all independent, was 0.0318, or around 3 in 100. This is within the p < .05 cut-off traditionally deemed in the social sciences as evidence of a systematic association between variables when employing statistical tests. This test assumes independence of observations (in this case, each test of an independent effect counts as one observation). Our test violates this assumption since each observation is nested in one of 29 different multivariate analyses, each of which in turn varies by number of factors and number of non-human capital factor control variables employed. Another option would be to choose a series of comparisons of one instrumental factor and one non-instrumental factor at random, test for significance, repeat, and test the pattern that emerges. A series of ten such tests using a table of random numbers and Fisher’s exact test drew ten successive non-significant results. This does not support the case that using instrumental value theory would produce a better than chance prediction ex-ante. 10 This result prompted us to reflect the patterns in Table 2 back on the patterns in Table 1. We found that every study that tested for effects of non-instrumental factors failed to test all instrumental factors with which these noninstrumental factors might reasonably be expected to correlate weakly. In other words, the independent effects or separate influences of the factors we classified as non-instrumental were not fully revealed by these studies. For example, the Reynolds 1993 study measures gender effects without measuring management experience. It finds gender to have a significant effect. The Cooper, Gimeno-Gascon, and Woo 1994 study, Lussier 1995 study and Lussier and Pfeifer 2001 study measure parental effects without measuring start-up experience. They find parental effects to be significant. The Schwartz, Harms, and Grieshuber 2005 study finds age and gender to be significant factors, but it only includes two out of the seven instrumental value factors in its model. While it is not possible to know what the results of these studies would have been had they measured all 12 human capital factors instead of some of them, instrumental value theory would lead us to suggest that at least some of the significant results for non-instrumental value factors may be due to non-measurement of weakly correlating instrumental factors. In Table 2, the non-instrumental factor with the greatest proportion of significant to non-significant studies is gender. The effect of gender on venture performance has been much studied. Possible explanations for women’s apparent lower rate of success in growing new businesses include gender differences in choice of industry, a lower average quantity of industry, management and start-up experience due to different labor market experiences associated with gendered family responsibilities, and different socialization experiences of males and females resulting in a lower quantity and/or quality of instrumental social capital among female entrepreneurs (Lerner, Brush and Hisrich 1997; Manolova et al. 2007). Although gender discrimination by lenders has also been suggested as a cause (Cooper, GimenoGascon and Woo 1994, 389), studies suggest that the independent effect of the gender of loan applicants is modest (Carter et al. 2007). Again, this literature suggests that had researchers controlled for instrumental factors, thereby measuring the independent effects of factors we classified as non-instrumental, their results for non-instrumental factors might have been different. Conclusion 11 In this study, instrumental value theory was employed to provide better assessment of founder’s human capital and to facilitate a deeper understanding of the contribution of founder’s personal resources to venture performance. The usefulness of the theory in addressing the research questions posed is demonstrated by the correct prediction of 72% of associations between different forms of human capital and performance in a meta-analysis of 29 empirical studies. Secondly, it suggests that those studies that found significant effects for factors we classified ex-ante as non-instrumental may have done so because of under-specification of their models. We conclude that much better specification of models is required if empirical research on human capital and new venture performance is to progress. The classification should also be of value to investors as they seek to assess the human capital of founders. Some founders may wish to offset weaknesses in their instrumental human capital by displaying high levels of “ceremonial” capital. As a specific example, one could imagine a scenario where an entrepreneur who does not have the relevant knowledge and experience of growing a new high technology venture would present his high credentials and awards in different fields in order to convince investors he is capable of growing a successful new venture. Time-poor investors can be tempted to take assessment shortcuts, such as assuming that a high technology new venture founder with an academic title has the necessary technical experience without actually checking this (Levie and Gimmon 2008). Utilizing instrumental value theory could help investors to better predict new venture performance. For example, when a Boston Venture Capitalist says “entrepreneurs from Ottawa get attention” (Mason, Cooper and Harrison 2002, 274), he is using the founders’ origin as a proxy for attributes related to their human and social capital. Instrumental value theory would guide financial investors to check founders’ human and social capital more directly. Finally, the use of instrumental value theory in this context would benefit society, by directing resources more accurately to founders with high instrumental human capital. This would increase the rate of Schumpeterian entrepreneurship and, as a result, technological progress. Limitations and Further Research In this article we considered only human capital factors and not social capital factors. Further work could address this issue. Instrumental value theory would classify social capital that is employed in new venture creation and management as instrumental. However, it warns us that, just as in the case of human capital, the use of status symbols as proxies for 12 social capital could misallocate resources. For example, scientist-founders can bring reputation to the venture (Murray 2004), and reputation influences investors (Harrison, Cooper and Mason 2004). Certain commonly used measures of reputation in business, such as the perceived prestige of the founder’s alma mater in the United States, honors such as a Nobel Prize in the United States or a knighthood in the United Kingdom, or army rank such as a retired general in Israel, appear from an instrumental value theory perspective to be ceremonial in nature; they may or may not correlate with instrumental factors such as the quality of the founder’s social network or technical skills. As Peteraf (1993, 187) has pointed out, “a brilliant Nobel Prize winning scientist may be a unique resource, ( . . . but . . . m)anagers should ask themselves if his productivity has to do, in part, with the specific team of researchers of which he is a part.” We suggest further research could apply the theory of instrumental value to founder’s social capital and tease out the ceremonial value of “reputation” from its instrumental value. We predict that if the instrumental factors of human and social capital are fully controlled, the ceremonial nature of status symbols will in turn be fully revealed. Note 1. We employ the term “resource” in the same way as resource-based theory employs it as something potentially valuable to the firm and which might contribute to its competitive advantage (Alvarez and Busenitz 2001, 756). References Adkisson, Richard V. “Ceremonialism, Intellectual Property Rights, and Innovative Activity.” Journal of Economic Issues 38, 2 (2004): 459-66. Alvarez, Sharon and Lowell Busenitz. “The Entrepreneurship of Resource-Based Theory.” Journal of Management 27 (2001): 755-75. Ayres, Clarence E. Toward a Reasonable Society – The Values of Industrial Civilization. Austin: University of Texas Press, 1961. Bamford, Charles E.R., Thomas J. Dean and Patricia P. McDougall. “Initial Founding Conditions and New Firm Performance: A longitudinal study integrating predictors from multiple perspectives.” In Frontiers of Entrepreneurship Research, edited by Paul D. Reynolds, Sue Birley, John E. Butler, William D. Bygrave, Per Davidsson, William B. Gartner and Patricia P. McDougall, pp. 465-79. Wellesley, MA: Babson College, 1996. Baron, Robert A. and Gideon Markman. “Beyond Social Capital: How social skills can enhance entrepreneurs’ success.” Academy of Management Executive 14, 1 (2000): 106-17. Baum, Robert J., Edwin A. Locke and Kenneth G. Smith. “A Multidimensional Model of Venture Growth.” Academy of Management Journal 44, 2 (2001): 292-303. 13 Baumol, William J. “Entrepreneurship: Productive, Unproductive, and Destructive.” Journal of Political Economy 98, 5 (1990): 893-921. Becker, Gary S. Human Capital – A Theoretical and Empirical analysis with Special Reference to Education. Chicago: The University of Chicago Press, 1975. Brown, Travor C. and Dennis Hanlon. “Validation of Key Behaviours for Effective Entrepreneurship.” Paper presented at the Babson-Kauffman Entrepreneurship Research Conference, Glasgow, Scotland. June 3-5, 2004. Bruderl, Joseph, Peter Preisendorfer and Rolf Ziegler. “Survival Chances of Newly Founded Business Organizations.” American Sociological Review 57, 2 (1992): 227-42. Bush, Paul D. “The Exploration of the Structural Characteristics of a Veblen-Ayres-Foster Defined Institutional Domain.” Journal of Economic Issues 17, 1 (1983): 35-66. ———. “The Theory of Institutional Change.” Journal of Economic Issues 21, 3 (1987): 1075-116. Bush, Paul D. and Marc Tool. “Foundational Concepts for Institutionalist Policy Making.” In Institutional Analysis and Economic Policy, edited by Marc R. Tool and Paul D. Bush, pp.1-46. Bostron/Dordrecht/London: Kluwer Academic Publishers, 2003. Carter, Sara, Eleanor Shaw, Wing Lam and Fiona Wilson. “Gender, Entrepreneurship, and Bank Lending: The Criteria and Processes used by Bank Loan Officers in Assessing Applications.” Entrepreneurship Theory & Practice 31, 3 (2007): 427-44. Cooper, Arnold. C. and Albert V. Bruno. “Success among High-Technology Firms.” Business Horizons 20, 2 (1977): 16-23. Cooper, Arnold and F. Javier Gimeno-Gascon. “Entrepreneurs, Processes of Founding, and New-Firm Performance.” In The State of the Art of Entrepreneurship, edited by Donald Sexton and John Kasarda, pp. 301-40. Boston: PWS-Kent Publishing Company, 1992. Cooper, Arnold, F. Javier Gimeno-Gascon and Carolyn Y. Woo. “Initial Human and Financial Capital as Predictors of New Ventures Performance.” Journal of Business Venturing 9, (1994): 371-95. Dewey, John. Theory of Valuation. Chicago: The University of Chicago Press, 1939. Dubini, Paola. “Assessing New Ventures Success.” In Building European Ventures, edited by Sue Birley, pp. 179-195. Amsterdam: Elsevier, 1990. Figart, Deborah M. “Policies to Provide Non-invidious Employment.” In Institutional Analysis and Economic Policy, edited by Marc R. Tool and Paul D. Bush, pp. 379-409. Boston/Dordrecht/London: Kluwer Academic Publishers, 2003. Florin, Juan, Michael Lubatkin and William Schulze. “A Social Capital Model of High-Growth Ventures.” Academy of Management Journal 46, 3 (2003): 374-84. Foster, John Fagg. "John Fagg Foster's Contribution to Scientific Inquiry." Available on the web site of the University of Missouri-Kansas City under the caption of readings: http://cas.umkc.edu/econ/Institutional/Readings/Foster/foster%20square%202.pdf, 2007. Accessed 27 May 2009. Gadenne, David. “Critical Success Factors for Small Business: An Inter-industry Comparison.” International Small Business Journal 17, 1 (1998): 3656. Gartner, William.B., Jennifer A. Starr and Subodh Bhat. “Predicting New Ventures Survival: An Analysis of ‘Anatomy of a Start-Up,’ Cases from INC. Magazine.” Journal of Business Venturing 14, 2 (1998): 215-32. 14 Gimmon, Eli. Founder’s Human Capital and High Technology New Venture Survivability. Ph.D. diss., University of Strathclyde, Glasgow, Scotland. 2006. Glass, Gene V., Barry McGaw and Mary Lee Smith. Meta-Analysis in Social Research. Beverly Hills and London: Sage Publications, 1981. Gordon, Wendell C. “The Role of Tool's Social Value Principle.” Journal of Economic Issues 24, 3 (1990): 879-86. Goslin, L.N. Characteristics of Successful High-Tech Start-up Firms. In Frontiers of Entrepreneurship Research, edited by Neil C. Churchill, John A. Hornaday, Bruce A. Kirchhoff, O.J. Krasner and Karl H. Vesper, pp. 452-63. Wellesley, MA: Babson College, 1987. Harrison, Richard T., Sarah.Y. Cooper and Colin M. Mason. “Entrepreneurial activity and the Dynamics of Technology-based Cluster Development: The case of Ottawa.” Urban Studies 41 (2004): 1045-070. Hart, Myra M., Howard Stevenson and Jay Dial. “Entrepreneurship: A Definition Revisited.” In Frontiers of Entrepreneurship Research, edited by William D. Bygrave, Barbara J. Bird, Sue Birley, Neil C. Churchill, Michael G. Hay, Richard H. Keeley and William E. Wetzel, Jr., pp. 89-95. Wellesley, MA: Babson College, 1995. Honig, Benson, Miri Lerner and Yoel Raban. “Social Capital and the Linkages of High-Tech Firms to the Military Defense System: Is there a Signaling Mechanism?” Small Business Economics 27, 4-5 (2006): 419-37. Hunter, John, Frank Schmidt and Gregg Jackson. Meta-Analysis: Cumulating research findings across studies. Beverly Hills CA: Sage, 1982. Hsu, David H. “Experienced entrepreneurial founders, organizational capital, and venture capital funding.” Research Policy 36, 5 (2007): 723-741. Jääskeläinen, Mikko, Markku Maula and Gordon Murray. “Profit Distribution and Compensation Structures in Publicly and Privately Funded Hybrid Venture Capital Funds.” Research Policy 36, 7 (2007): 913-29. Javary, Michèle. “Evolving Technologies and Market Structures: Schumpeterian Gales of Creative Destruction and the United Kingdom Internet Services Providers’ Market.” Journal of Economic Issues 38, 3 (2004): 629-57. Kakati, Munin. “Success Criteria in High-tech New Firms.” Technovation 23 (2003): 447-457. Klein, Philip A. “Changing Perspectives on the Factors of Production.” Journal of Economic Issues 22, 3 (1988): 795-809. Lee, Jangwoo and Sunghun Lee. “Failure Factors of New Technology-Based Ventures According to the Growth Stages.” In Frontiers of Entrepreneurship Research, edited by Shaker A. Zahra, Candida G. Brush, Per Davidsson, James Fiet, Patricia G. Greene, Richard T. Harrison, Miri Lerner, Colin Mason, G. Dale Meyer, Jeffrey Sohl and Andrew Zacharakis, pp.1-14. Wellesley, MA: Babson College, 2004. Lee, Hyunsuk and Sooduck Chang. “Environmental Jolts, Internal Buffers, and Failures Versus Survivals of High-technology Based Ventures.” Paper presented at Babson-Kauffman Entrepreneurship Research Conference, Boston, MA. June 2005. Lerner, Miri, Candida Brush and Robert Hisrich. “Israeli Women Entrepreneurs: An Examination of Factors affecting Performance.” Journal of Business Venturing 12 (1997): 315-39. Levie, Jonathan and Eli Gimmon. “Mixed Signals: Why investors may misjudge first time high technology founders.” Venture Capital: A Journal of Entrepreneurial Finance 10, 3 (2008): 233-56. Low, Murray B. and Eric Abrahamson. “Movements, bandwagons, and clones: Industry evolution and the entrepreneurial process.” Journal of Business Venturing 12 (1997): 435-57. Lussier, Robert N. “A Nonfinancial Business Success Versus Failure Prediction model for Young Firms.” Journal of Small Business Management 33, 1 (1995): 8-20. 15 Lussier, Robert N. and Sanja Pfeifer. “A Crossnational Prediction Model for Business Success.” Journal of Small Business Management 39, 3 (2001): 228-39. Maidique, Modesto A. “Key Success Factors in High-technology Ventures.” In The Art and Science of Entrepreneurship, edited by Donald L. Sexton and Raymond W. Smilor, pp. 169-180. Cambridge, MA: Ballinger Publishing Company, 1986. Maidique, Modesto A. and Robert H. Hayes. “The Art of High Technology Management.” Sloan Management Review 25, 2 (1984): 17-28. Manolova, Tatiana, Nancy M. Carter, Ivan M. Manev and Bojidar S. Gyoshev. “The Differential Effect of Men and Women Entrepreneurs’ Human Capital and Networking on Growth Expectancies in Bulgaria.” Entrepreneurship Theory & Practice 31, 3 (2007): 407-26. Mason, Colin, Sarah Cooper and Richard Harrison. “The Role of Venture Capital in the Development of High Technology Clusters: The Case of Ottawa.” In New Technology Based Firms in the New Millennium, Vol. II, edited by Wim During, Ray Oakey and Seleema Kauser, pp. 261-278. Oxford, UK: Pergamon, 2002. McDaniel, Bruce A. “Institutional Destruction of Entrepreneurship through Capitalist Transformation.” Journal of Economic Issues 37, 2 (2003): 495501. ———. “A Contemporary View of Joseph A. Schumpeter’s Theory of the Entrepreneur.” Journal of Economic Issues, 39 2 (2005): 485-89. Meyer, John and Brian Rowan. “Institutionalized Organizations: Formal Structure as Myth and Ceremony.” American Journal of Sociology 83 (1977): 340-63. Murray, Fiona. “The Role of Academic Inventors in Entrepreneurial Firms: Sharing the Laboratory Life.” Research Policy 33 (2004): 643-59. O'Hara, Phillip A. and Marc R. Tool. “The contribution of Paul Dale Bush to Academic Freedom and Institutional Economics.” In Institutionalist Method and Value, Vol. I, edited by Sasan Fayazmanesh and Marc Tool, pp. 1-18. Cheltenham, UK: Edward Elgar, 1998. Perry, Chad, G.G. Meredith and H.J. Cunnington. “Relationship between Small Business Growth and Personal Characteristics of Owner/Managers in Australia.” Journal of Small Business Management 26, 2 (1988): 76-9. Peteraf, Margaret F. “The Cornerstone of Competitive Advantage: A Resource-based View.” Strategic Management Journal 14, 3 (1993): 179-91. Pressman, Steven and Veronica Montecinos. “Economics and Society: A Review Essay.” Journal of Economic Issues 30, 3 (1996): 877-84. Ranson, Baldwin. “Confronting Foster’s Wildest Claim: ‘Only the Instrumental Theory of Value Can be Applied!’” Journal of Economic Issues 42, 2 (2008): 537-44. Reynolds, Paul D. “High Performance Entrepreneurship: What Makes It Different?” In Frontiers of Entrepreneurship Research, edited by Neil C. Churchill, Sue Birley, Jerome Doutriaux, Elizabeth J. Gatewood, Frank S. Hoy and William E. Wetzel, pp. 88-101. Wellesley, MA: Babson College, 1993. ———. Entrepreneurship in the United States: The Future is Now. New York: Springer, 2007. Rothwell, R., C. Freeman, A. Horlsey, V.T.P. Jervis, A.B. Robertson, and J. Townsend. “SAPPHO Updated – Project SAPPHO Phase II.” Research Policy 3 (1974): 258-91. Samuels, Warren J. “The Instrumental Value Principle and its Role.” In Institutional Economics and the Theory of Social Value: Essays in Honor of Marc R. Tool, edited by Charles M.A. Clark, pp. 97-112. Boston: Kluwer Academic Publishers, 1995. Schumpeter, Joseph A. The Theory of Economic Development. Cambridge, MA: Harvard University Press, 1934. 16 ———. Capitalism, Socialism and Democracy. London: George Allen & Unwin, 1943. Schwartz, Erich J., Reiner Harms and Eva Grieshuber. “New Venture Performance: Initial and Emerging Factors – A Longitudinal Approach.” Paper presented at Babson-Kauffman Entrepreneurship Research Conference, Boston, MA. June 2005. Shane, Scott. The Illusions of Entrepreneurship. New Haven, CT: Yale University Press, 2008. Shane, Scott and Toby Stuart. “Organizational Endowments and the Performance of University Start-ups.” Management Science 48, 1 (2002): 154-70. Shepherd, Dean A., Evan J. Douglas, and Mark Shanley. “New Venture Survival: Ignorance, External Shocks, and Risk Reduction Strategies.” Journal of Business Venturing 15 (2000): 393-410. Stuart, Robert and Pier A. Abetti. “Start-up Ventures: Toward the prediction of Initial Success.” Journal of Business Venturing 2 (1987): 215-30. Todorova, Zdravka. “Deficits and Institutional Theorizing About Households and the State.” Journal of Economic Issues 41, 2 (2007): 575-82. Tool, Marc. R. The Discretionary Economy: A Normative Theory of Political Economy. Santa Monica, CA: Goodyear, 1979. ———. “Instrumental Value an Eternal Verity? A Reply to Wendell Gordon.” Journal of Economic Issues 24, 4 (1990): 1109-121. ———. “The Theory of Instrumental Value: Extensions, Clarifications.” In Institutional Economics: Theory, Method, Policy, edited by Marc Tool, pp. 119159. Boston: Kluwer Academic Publishers, 1993a. ———. “Pricing and Valuation.” Journal of Economic Issues 27, 2 (1993b): 325-34. Veblen, Thorstein B. The Theory of the Leisure Class. New York: The modern Library, 1899. Welcomer, Stephanie A. and Mark E. Haggerty. “Tied to the Past – Bound to the Future: Ceremonial Encapsulation in Maine Woods Land Use Policy.” Journal of Economic Issues 41, 2 (2007): 383-90. Yusuf, Attahir. “Critical Success Factors for Small Business: Perceptions of South Pacific entrepreneurs.” Journal of Small Business Management 33, 2 (1995): 68-73. Zacharakis, Andrew L. and G. Dale Meyer. “The Potential of Actuarial Decision Models: Can they improve the Venture Capital Decision?” Journal of Business Venturing 15 (2000): 323-46. Zacharakis, Andrew L. and Dean A. Shepherd. “A Non-additive Decision Aid for Venture Capitalists’ Investment Decisions.” European Journal of Operational Research 162 (2005): 673-89. Zider, Bob. “How Venture Capital Works.” Harvard Business Review 76, 6 (1998): 131-39. 17