FY 2007 Mandate Request Submissions

advertisement

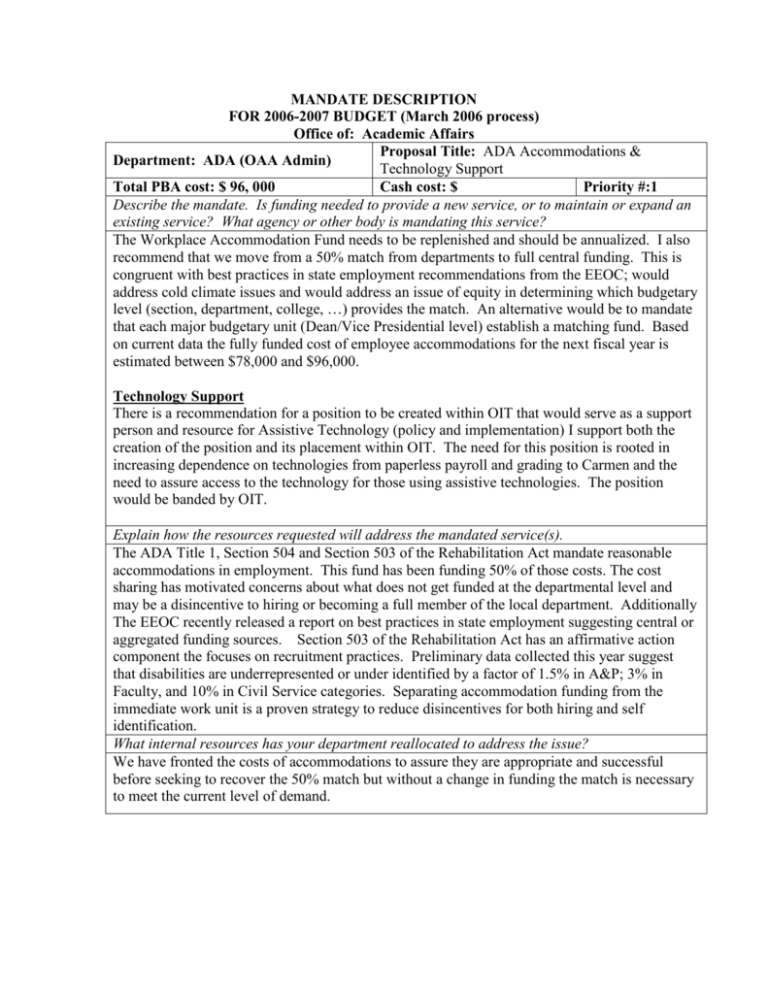

MANDATE DESCRIPTION FOR 2006-2007 BUDGET (March 2006 process) Office of: Academic Affairs Proposal Title: ADA Accommodations & Department: ADA (OAA Admin) Technology Support Total PBA cost: $ 96, 000 Cash cost: $ Priority #:1 Describe the mandate. Is funding needed to provide a new service, or to maintain or expand an existing service? What agency or other body is mandating this service? The Workplace Accommodation Fund needs to be replenished and should be annualized. I also recommend that we move from a 50% match from departments to full central funding. This is congruent with best practices in state employment recommendations from the EEOC; would address cold climate issues and would address an issue of equity in determining which budgetary level (section, department, college, …) provides the match. An alternative would be to mandate that each major budgetary unit (Dean/Vice Presidential level) establish a matching fund. Based on current data the fully funded cost of employee accommodations for the next fiscal year is estimated between $78,000 and $96,000. Technology Support There is a recommendation for a position to be created within OIT that would serve as a support person and resource for Assistive Technology (policy and implementation) I support both the creation of the position and its placement within OIT. The need for this position is rooted in increasing dependence on technologies from paperless payroll and grading to Carmen and the need to assure access to the technology for those using assistive technologies. The position would be banded by OIT. Explain how the resources requested will address the mandated service(s). The ADA Title 1, Section 504 and Section 503 of the Rehabilitation Act mandate reasonable accommodations in employment. This fund has been funding 50% of those costs. The cost sharing has motivated concerns about what does not get funded at the departmental level and may be a disincentive to hiring or becoming a full member of the local department. Additionally The EEOC recently released a report on best practices in state employment suggesting central or aggregated funding sources. Section 503 of the Rehabilitation Act has an affirmative action component the focuses on recruitment practices. Preliminary data collected this year suggest that disabilities are underrepresented or under identified by a factor of 1.5% in A&P; 3% in Faculty, and 10% in Civil Service categories. Separating accommodation funding from the immediate work unit is a proven strategy to reduce disincentives for both hiring and self identification. What internal resources has your department reallocated to address the issue? We have fronted the costs of accommodations to assure they are appropriate and successful before seeking to recover the 50% match but without a change in funding the match is necessary to meet the current level of demand. List other offices on campus that provide similar or related services. How will your department collaborate with these offices to prevent duplication of effort? In the past departments have been asked to pay 50% of the costs for accommodations. This has created climate issues; there are not established departmental budget lines due to the difficulty of predicting expenses on the departmental scale. Nor are there lines and clearly delineated processes at the College/Division level. Aggregated funding (preferably central) is a recommendation in from the EEOC. While I am proposing we end the cost sharing for formal accommodations we will continue to collaborate with departments on modifications to policy, practice and procedure. Additionally m my office is establishing stronger collaborations with OIT to cover the support of assistive technology and continues to work with outside agencies (vocational rehabilitation and NIH diversity Incentives) to supplement funding. Total Cost of Mandate Description Cost *Benefits at X% Admin.& Prof. Assistive Technology Staff (OIT costing) Total PBA One-Time Cash 32.2% Classified 39.6% Grad Associate 10.4% Student Wages 1.5% Operating $96,000 Equipment Total $96,000 *Composite rates are conservative estimates for planning purposes only; actual rates will be available at a later date. MANDATE DESCRIPTION FOR 2006-2007 BUDGET (March 2006 process) Office of Enrollment Services and Undergraduate Education Department: Office of the University Proposal Title: Compliance with House Bill 95 – Registrar Transfer Articulation Total PBA cost: $ 39,660 Cash cost: $ Priority #: 2 Describe the mandate. Is funding needed to provide a new service, or to maintain or expand an existing service? What agency or other body is mandating this service? H.B. 95 mandated that the Board of Regents develop guidelines for all state institutions to allow for the easy transfer (and acceptance) of credit between schools. This involves creation of a centralized clearinghouse (“hub”) that allows for credit exchange of a specific set of courses. Individual institutions will need to adapt to a universal course equivalency system, which will provide the foundation for a supplemental transcript of Transfer Articulation Guides (TAG’s). The Registrar’s Office will play a significant role in both complying with the new regulations and developing processes that allow courses to easily transfer. Additionally, we will play a role in educating departments and colleges on the new requirements. Explain how the resources requested will address the mandated service(s). The resources will support the addition of one FTE Program Assistant role in the Office of the University Registrar. This role will specialize in creating, then maintaining, the support systems needed for Ohio State to comply, including education, systematic changes and processing changes. What internal resources has your department reallocated to address the issue? In addition to the new staff position, we will redeploy portions of existing staff time to assist in the project. This mandate will change the way that we deliver services in our Transfer Credit Center and all of the staff in that area will be involved in implementing the changes. Additionally, we will support the equipment, training and supplies/services needs for this new staff position and for the project overall. List other offices on campus that provide similar or related services. How will your department collaborate with these offices to prevent duplication of effort? While this touches every academic department and this new role will benefit the entire campus, OUR is responsible for coordinating and processing the evaluation of transfer credit for incoming undergraduate students. Toward this goal, OUR works extensively with departments, colleges, other institutions, and UAFYE. Description Total Cost Cost *Benefits at X% Total PBA Admin.& Prof. Program Asst $30,000 9,660 32.2% $39,660 Classified 39.6% Grad Associate 10.4% Student Wages 1.5% Operating Equipment Total $39,660 *Composite rates are conservative estimates for planning purposes only; actual rates will be available at a later date. One-Time Cash MANDATE DESCRIPTION FOR 2006-2007 BUDGET (March 2006 process) Office of: Department: Office of Minority Proposal Title: Increase Recruitment Staff for Affairs FFP Total PBA cost: $42,965.00 Cash cost: $ Priority #: 3 Describe the mandate. Is funding needed to provide a new service, or to maintain or expand an existing service? What agency or other body is mandating this service? Increase support for the revised, now more heavily labor-intensive selection process for admitting students to the Freshman Foundation Program (FFP). We have already increased staff to serve the added work required in the Morrill Scholars Program (MSP) by revisions subsequent to the Michigan decisions, and now seek to fund changes also required by the Michigan cases in FFP. The Office of Legal Affairs advises us that these additional revisions are needed. Annual rate Request: $41,000 for one full-time professional ($32,500 in salary plus benefits). Explain how the resources requested will address the mandated service(s). We are at risk of failing to meet legal requirements in the post-Michigan environment. What internal resources has your department reallocated to address the issue? None List other offices on campus that provide similar or related services. How will your department collaborate with these offices to prevent duplication of effort? We work closely with the Office of Student Financial Aid and Undergraduate Admissions. Total Cost of Mandate Description Cost *Benefits at X% Total PBA One-Time Cash $32,500.00 10,465.00 32.2% 42,965.00 Admin.& Prof. 1 Full Time Classified 39.6% Grad Associate 10.4% Student Wages 1.5% Operating Equipment Total *Composite rates are conservative estimates for planning purposes only; actual rates will be available at a later date. MANDATE DESCRIPTION FOR 2006-2007 BUDGET (March 2006 process) Office of Enrollment Services and Undergraduate Education Department: Office of Student Financial Proposal Title: Increased Verification Percentage Aid Total PBA cost: $ 39,088 Cash cost: $ 5,000 Priority #: 4 Describe the mandate. Is funding needed to provide a new service, or to maintain or expand an existing service? What agency or other body is mandating this service? Being a Quality Assurance (QA) Institution, the percentage of students required to have their financial aid application data verified is determined using the Department of Education’s QA Analysis Tool. The outcome of this year’s analysis requires us to increase the number of students verified by 25%. Explain how the resources requested will address the mandated service(s). 2 FTE will be required to meet this increased volume and maintain processing standards. What internal resources has your department reallocated to address the issue? 4 staff members assigned to other duties will be trained on verification policies and procedures and will spend 25% of their time each on verification. This is being done to not only address the increased volume, but to provide professional development for the 4 staff members. List other offices on campus that provide similar or related services. How will your department collaborate with these offices to prevent duplication of effort? No other office is responsible for the verification of financial aid application data. Description Admin.& Prof. Classified 1 FTE, Information Associate Total Cost Cost *Benefits at X% $28,000 $11,088 32.2% 39.6% Total PBA $39,088 Grad Associate 10.4% Student Wages 1.5% Operating Equipment Total $39,088 *Composite rates are conservative estimates for planning purposes only; actual rates will be available at a later date. One-Time Cash MANDATE DESCRIPTION FOR 2006-2007 BUDGET (March 2006 process) Office of: Office of Human Resources Proposal Title: Ohio Dept. of Health Department: Child Care Center Requirements Total PBA cost: Cash cost: $40,000 Priority #: 5 Describe the mandate. Is funding needed to provide a new service, or to maintain or expand an existing service? What agency or other body is mandating this service? Today, the Child Care Center is an essential element in the work and school lives of approximately 500 student, staff and faculty families. Given an estimated new enrollment each year of 200 families, the program will directly impact at least 4,300 families over the next 20 years. The indirect impact on the work life of these students, staff and faculty has been measured in research and demonstrates increased productivity and satisfaction, and decreased absenteeism. The Child Care Center is facing a year with expected and unexpected cost increases at the same time accreditation standards are requiring smaller group sizes which equates to a reduction in revenue. In addition to ongoing costs such as the estimated annual salary and benefits increase ($185,000), an increase in utility costs ($13,000), and the loss of tuition due to lower group sizes required for nationally accredited programs ($120,000), there is the one-time cost of $40,000 to meet the Health Department requirements for the use of commercial kitchen equipment. These result in a need for an additional $358,000 income for the FY 07 budget. Explain how the resources requested will address the mandated service(s). The funding requested will be used to purchase commercial grade dishwashers for both Child Care Center locations so that the kitchens will pass Health Department inspections. What internal resources has your department reallocated to address the issue? Currently, the estimated tuition income for FY06 is $2.8 million. Beginning in FY07, tuition increases are scheduled to become effective on a calendar year to match the benefits year and not precede annual salary increases in October. This new timeline increases tuition for only 6 months of FY07, therefore the increase would need to be over 25%. Receiving the one-time $40,000 budget request would enable the Child Care Center to implement a more reasonable tuition increase for families for FY 07. List other offices on campus that provide similar or related services. How will your department collaborate with these offices to prevent duplication of effort? There is no duplication of effort. Total Cost of Mandate Description Admin.& Prof. Classified Grad Associate Student Wages Operating Equipment Cost *Benefits at X% Total PBA One-Time Cash 32.2% 39.6% 10.4% 1.5% Commercial grade kitchen $40,000 $40,000 Total $40,000 $40,000 *Composite rates are conservative estimates for planning purposes only; actual rates will be available at a later date. MANDATE DESCRIPTION FOR 2006-2007 BUDGET (March 2006 process) Office of: Office of Human Resources Department: OHR Proposal Title: Postage Rate Increase Total PBA cost: $ 3,000 Cash cost: $ Priority #: 6 Describe the mandate. Is funding needed to provide a new service, or to maintain or expand an existing service? What agency or other body is mandating this service? FY07 will be a year of many financial challenges for the Office of Human Resources. Some of the factors contributing to these challenges are the anticipated and unanticipated costs of the move to Gateway, the internal reorganization to create a new consulting services model (a move to upgrade our talent and our customer effectiveness with no new funding), new accreditation standards for the Child Care Center, a significant increase in utility costs for the Child Care Center, the requirement to contribute to the SIS project, the lack of central funding commitment for our leadership development programs (for which our cash is running out) and the usual need to reallocate funds for staff raises. The combination of all of the above is enough to hammer the budget of an office like ours, where the university at large continues to expect new services and projects. Thus, when an additional item “piles on”, like increased postage, we have no pockets in which to search. The USPS raised postage rates January 2006. We are requesting funds to cover the additional costs of the increase. Explain how the resources requested will address the mandated service(s). The requested funding will cover the estimate increase in postage costs for FY07 due to the USPS rate increase. What internal resources has your department reallocated to address the issue? OHR is requesting $3,000 for increased USPS rates. This seems like an insignificant amount, and most years it would be, however, with the multiple financial challenges OHR is facing even this amount makes a difference. Past fiscal year redirections for part of the annual salary and benefits increases have already caused us to eliminate positions. Supply, training, professional development, and travel budgets are already at a bare minimum. Receiving the $3,000 for postage would allow us to maintain funds for training and professional development that are much needed for staff going into the new consulting model. List other offices on campus that provide similar or related services. How will your department collaborate with these offices to prevent duplication of effort? There is no duplication of effort. Total Cost of Mandate Description Cost *Benefits at X% Total PBA One-Time Cash Admin.& Prof. 32.2% Classified 39.6% Grad Associate 10.4% Student Wages 1.5% Operating Postage $3,000 $3,000 Equipment Total $3,000 $3,000 *Composite rates are conservative estimates for planning purposes only; actual rates will be available at a later date.