IC 2014 -13 - the United Nations

advertisement

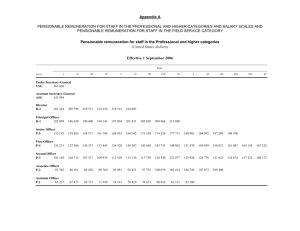

ST/IC/2014/13 United Nations Secretariat 24 April 2014 Information circular* To: Members of the staff From: The Assistant Secretary-General for Human Resources Management Revised salary scales for staff in the General Service and related categories at Headquarters Subject: 1. The current procedure for effecting interim adjustments to the salary scales for staff in the General Service and related categories at Head quarters calls for an adjustment in the net salaries of such staff by 90 per cent of the movement of the consumer price index (CPI) for New York. 2. The CPI for the month of February 2014 reflects a 1.09 per cent movement over the February 2013 index. In application of the above-mentioned procedure, the net salaries of staff in the General Service, Language Teacher, Public Information Assistant, Security Service and Trades and Crafts categories will be adjusted upward by 1.0 per cent, effective 1 March 2014. 3. In view of General Assembly resolution 68/253, the current rates of dependency and language allowances will remain unchanged. 4. The revised salary scales, which are contained in the annex to the presen t circular, will be implemented in the end of April 2014 payroll. * The present circular, which cancels and supersedes circular ST/IC/2013/11 dated 4 April 2013, will be in effect until further notice. 14-30980 (E) *1430980* 280414 ST/IC/2014/13 2/11 Annex Revised salary scales for staff in the General Service and related categories at Headquarters A. Salary scale for staff in the General Service category at Headquarters (United States dollars) Effective 1 March 2014 STEPS Level I II III IV V VI VII VIII IX X XI 14-30980 7 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 73 935 70 911 56 015 56 015 0 77 73 58 58 030 795 151 151 0 80 76 60 60 126 681 287 287 0 83 79 62 62 222 566 423 423 0 86 82 64 64 317 449 559 559 0 89 85 66 66 413 336 695 695 0 92 88 68 68 509 220 831 831 0 95 91 70 70 604 107 967 967 0 98 93 73 73 700 992 103 103 0 101 96 75 75 796 877 239 239 0 104 99 77 77 891* 762* 375* 375* 0* 6 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 66 248 64 019 50 711 50 711 0 69 66 52 52 042 522 639 639 0 71 69 54 54 836 025 567 567 0 74 71 56 56 630 551 495 495 0 77 74 58 58 425 155 423 423 0 80 76 60 60 219 759 351 351 0 83 79 62 62 013 363 279 279 0 85 81 64 64 807 968 207 207 0 88 84 66 66 601 571 135 135 0 91 87 68 68 396 176 063 063 0 94 89 69 69 190* 780* 991* 991* 0* 5 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 59 57 45 45 303 743 884 884 0 61 60 47 47 778 007 627 627 0 64 62 49 49 304 272 370 370 0 66 830 64 536 51 113 51 113 0 69 66 52 52 357 801 856 856 0 71 69 54 54 883 066 599 599 0 74 71 56 56 409 345 342 342 0 76 73 58 58 935 703 085 085 0 79 76 59 59 461 059 828 828 0 81 78 61 61 987 416 571 571 0 84 80 63 63 513* 773* 314* 314* 0* 4 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 53 52 41 41 416 096 528 528 0 55 54 43 43 550 146 107 107 0 57 56 44 44 684 195 686 686 0 59 58 46 46 818 245 265 265 0 62 60 47 47 093 294 844 844 0 64 62 49 49 381 343 423 423 0 66 64 51 51 670 393 002 002 0 68 66 52 52 958 442 581 581 0 71 68 54 54 246 493 160 160 0 73 70 55 55 535 541 739 739 0 75 72 57 57 823* 657* 318* 318* 0* 3 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 48 46 37 37 062 948 566 566 0 49 48 38 38 997 805 998 998 0 51 50 40 40 932 665 430 430 0 53 52 41 41 868 524 862 862 0 55 54 43 43 803 382 294 294 0 57 56 44 44 738 242 726 726 0 59 58 46 46 673 099 158 158 0 61 59 47 47 725 959 590 590 0 63 61 49 49 800 817 022 022 0 65 63 50 50 875 676 454 454 0 67 65 51 51 951* 534* 886* 886* 0* 2 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 43 258 42 321 34 011 34 011 0 45 44 35 35 008 006 306 306 0 46 45 36 36 758 688 601 601 0 48 47 37 37 508 372 896 896 0 50 49 39 39 258 055 191 191 0 52 50 40 40 008 738 486 486 0 53 52 41 41 758 421 781 781 0 55 54 43 43 508 104 076 076 0 57 55 44 44 258 787 371 371 0 59 57 45 45 008* 469* 666* 666* 0* 1 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 38 38 30 30 40 39 31 31 472 654 949 949 0 42 41 33 33 055 175 121 121 0 43 42 34 34 639 696 293 293 0 45 44 35 35 223 217 465 465 0 46 45 36 36 807 739 637 637 0 48 47 37 37 391 260 809 809 0 49 48 38 38 974 782 981 981 0 51 50 40 40 558* 302* 153* 153* 0* 931 132 777 777 0 14-30980 Dependency allowances (US$ net per annum): 2 083 a 2 217 b Child Except for the first dependent child of a single, widowed or divorced staff member a b c Language allowances (to be included in pensionable remuneration) (US$ net per annum): First language Second language 2 268 1 134 2 879 a 3 246 b Dependent spouse 3 336 a 3 562 b Secondary dependant 1 257 a 1 307 b 1 318 c This lower amount will apply only with respect to staff members for whom the allowance becomes payable on or after 1 Septembe r 2006. This higher amount will apply only with respect to staff members for whom the allowance becomes payable prior to 1 September 2006. This higher amount will apply only with respect to staff members for whom the allowance becomes payable prior to 1 June 2004. Increments: salary increments within the levels shall be awarded an nually on the basis of satisfactory service. * Long-service step: Step XI at levels G-3 to G-7, step X at level G-2 and step IX at level G-1 are long-service steps. The qualifying criteria for in-grade increases to the long-service step are as follows: • • The staff member should have had at least 20 years of service within the United Nations common system and 5 years of service at the top regular step of the current grade The staff member’s service should have been satisfactory Gross salaries have been derived through the application of staff assessment to total net salaries. Gross salaries are establishe d for purposes of separation payments and as the basis for calculating tax reimbursements whenever United Nations salaries are taxe d. Gross pension: Gross pensionable salaries have been derived through application of staff assessment to net pensionable salaries. Gross pensi onable is the basis for determining Pension Fund contributions under article 25 of the Regulations of the United Nations Joint Staff Pension Fund and for determining pension benefits. Total net: Total net remuneration is the sum of the non-pensionable component and the net pensionable salary. Net pension: Net pensionable is that part of net salary which is used to derive the gross pensionable salary. Net pensionable salary is the total net salary less the non-pensionable component, i.e., 100 per cent of total net salaries. NPC: Non-pensionable component is that part of net salary excluded from application of st aff assessment in determination of the gross pensionable salary. The non-pensionable component has been established at 0 per cent. 3/11 ST/IC/2014/13 Gross: ST/IC/2014/13 4/11 B. Salary scale for staff in the Language Teacher category at Headquarters (United States dollars) Effective 1 March 2014 STEPS Level Language Teacher I II III IV V VI VII VIII IX X XI XII* (Gross) 80 345 83 180 86 014 88 849 91 684 94 519 97 354 100 188 103 023 105 858 108 693 111 528 (Gross pension) 76 867 79 512 82 158 84 804 87 449 90 095 92 740 95 386 98 032 100 677 103 323 105 968 (Total net) 60 438 62 394 64 350 66 306 68 262 70 218 72 174 74 130 76 086 78 042 79 998 81 954 (Net pension) 60 438 62 394 64 350 66 306 68 262 70 218 72 174 74 130 76 086 78 042 79 998 81 954 0 0 0 0 0 0 0 0 0 0 0 0 (NPC) Increments: salary increments within the level shall be awarded annually on the basis of satisfactory service. Work schedule: the yearly schedule of work consists of three terms of 13 weeks each. There is a summer recess and there ar e scheduled breaks between terms. Leave taken during the recess and the breaks in excess of the annual leave entitlement provided in the Staff Rules is treated as special leave with pay. Dependency allowances (US$ net per annum): Child Except for the first dependent child of a single, widowed or divorced staff member a b c 2 083 a 2 217 b 2 879 a 3 246 b Dependent spouse 3 336 a 3 562 b Secondary dependant 1 257 a 1 307 b 1 318 c This lower amount will apply only with respect to staff members for whom the allowance becomes payable on or after 1 Septembe r 2006. This higher amount will apply only with respect to staff members for whom the allowance be comes payable prior to 1 September 2006. This higher amount will apply only with respect to staff members for whom the allowance becomes payable prior to 1 June 2004. 14-30980 14-30980 Language allowances: not entitled. * Long-service step: The qualifying criteria for in-grade increases to the long-service step are as follows: • • The staff member should have had at least 20 years of service within the United Nations common system and 5 years of service at the top regular step of the current grade The staff member’s service should have been satisfactory Gross: Gross salaries have been derived through the application of staff assessment to total net salaries. Gross salaries are establ ished for purposes of separation payments and as the basis for calculating tax reimbursements whenever United Nations salaries are taxed. Gross pension: Gross pensionable salaries have been derived through application of staff assessment to net pensionable salaries. Gross pensi onable is the basis for determining Pension Fund contributions under article 25 of the Regulations of the United Nations Joint Staff Pension Fund and for determining pension benefits. Total net: Total net remuneration is the sum of the non-pensionable component and the net pensionable salary. Net pension: Net pensionable is that part of net salary which is used to derive the gross pensionable salary. Net pensionable salary is th e total net salary less the non-pensionable component, i.e., 100 per cent of total net salaries. NPC: Non-pensionable component is that part of net salary excluded from application of staff assessment in determination of the gross pensionable salary. The non-pensionable component has been established at 0 per cent. ST/IC/2014/13 5/11 ST/IC/2014/13 6/11 C. Salary scale for staff in the Public Information Assistant category at Headquarters (United States dollars) Effective 1 March 2014 STEPS Level Tour Coordinator/Supervisor and Briefing Assistant a I II III IV V (Gross) 64 754 68 149 71 545 74 941 78 336 (Gross pension) 62 676 65 720 68 762 71 840 75 006 (Total net) 49 680 52 023 54 366 56 709 59 052 (Net pension) 49 680 52 023 54 366 56 709 59 052 0 0 0 0 0 (Gross) 56 778 59 220 61 783 64 401 67 020 (Gross pension) 55 319 57 667 60 013 62 359 64 708 (Total net) 44 016 45 823 47 630 49 437 51 244 (Net pension) 44 016 45 823 47 630 49 437 51 244 0 0 0 0 0 (Gross) 52 115 54 345 (Gross pension) 50 837 52 982 (Total net) 40 565 42 215 (Net pension) 40 565 42 215 0 0 (NPC) Public Information Assistant II and Tour Coordinator (NPC) Public Information Assistant I (NPC) a Includes Briefing Assistant as at 1 September 1991. Reserve guides are paid by the day in accordance with the above rates. Increments: salary increments within the levels shall be effective on the first day of the pay period in which satisfactory service requirements are completed, as follows: Public Information Assistant I Public Information Assistant II 6 months 12 months No increments shall be paid in the case of staff members whose service will cease during the month in which the increment would ordinarily have been due. 14-30980 14-30980 Dependency allowances (US$ net per annum): 2 083 a 2 217 b Child Except for the first dependent child of a single, widowed or divorced staff member a b c 2 879 a 3 246 b Dependent spouse 3 336 a 3 562 b Secondary dependant 1 257 a 1 307 b 1 318 c This lower amount will apply only with respect to staff members for whom the allowance becomes payable on or after 1 September 2006. This higher amount will apply only with respect to staff members for whom the allowance becomes payable prior to 1 September 2006. This higher amount will apply only with respect to staff members for whom the allowance becomes payable prior to 1 June 2004. Language allowances: not entitled. Gross: Gross salaries have been derived through the application of staff assessment to total net salaries. Gross salaries are established for purposes of separation payments and as the basis for calculating tax reimbursements whenever United Nations salaries are taxed. Gross pension: Gross pensionable salaries have been derived through application of staff assessment to net pensionable salaries. Gross pensionable is the basis for determining Pension Fund contributions under article 25 of the Regulations of the United Nations Joint Staff Pensio n Fund and for determining pension benefits. Total net: Total net remuneration is the sum of the non-pensionable component and the net pensionable salary. Net pension: Net pensionable is that part of net salary which is used to derive the gross pensionable salary. Net pensionable salary is th e total net salary less the non-pensionable component, i.e., 100 per cent of total net salaries. NPC: Non-pensionable component is that part of net salary excluded from application of staff assessment in determination of the gross pensionable salary. The non-pensionable component has been established at 0 per cent. ST/IC/2014/13 7/11 ST/IC/2014/13 8/11 D. Salary scale for staff in the Security Service category at Headquarters (United States dollars) Effective 1 March 2014 STEPS Level I II III IV V VI VII VIII IX X XI 14-30980 7 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 98 93 72 72 020 348 634 634 0 101 96 75 75 809 883 248 248 0 105 100 77 77 597 418 862 862 0 109 103 80 80 386 952 476 476 0 113 107 83 83 174 564 090 090 0 116 111 85 85 962 356 704 704 0 120 115 88 88 751 147 318 318 0 124 118 90 90 539 128 328* 937 122 728* 932 93 546* 932 93 546* 0 0* 6 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 90 86 67 67 826 654 670 670 0 94 89 70 70 355 944 105 105 0 97 93 72 72 884 233 540 540 0 101 96 74 74 413 524 975 975 0 104 99 77 77 942 814 410 410 0 108 103 79 79 471 105 845 845 0 112 106 82 82 000 394 280 280 0 115 109 84 84 529 119 058* 921 113 450* 715 87 150* 715 87 150* 0 0* 5 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 83 79 62 62 593 907 679 679 0 86 82 64 64 872 964 942 942 0 90 86 67 67 152 023 205 205 0 93 89 69 69 432 082 468 468 0 96 92 71 71 712 139 731 731 0 99 95 73 73 991 199 994 994 0 103 98 76 76 271 257 257 257 0 106 101 78 78 551 109 830* 315 104 373* 520 80 783* 520 80 783* 0 0* 4 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 76 73 57 57 254 062 615 615 0 79 75 59 59 261 867 690 690 0 82 78 61 61 268 671 765 765 0 85 81 63 63 275 476 840 840 0 88 84 65 65 283 279 915 915 0 91 87 67 67 290 085 990 990 0 94 89 70 70 297 889 065 065 0 97 92 72 72 304 100 312* 693 95 498* 140 74 215* 140 74 215* 0 0* 3 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 71 68 54 54 172 423 109 109 0 73 70 55 55 532 539 737 737 0 75 72 57 57 891 724 365 365 0 78 74 58 58 251 925 993 993 0 80 77 60 60 610 126 621 621 0 82 79 62 62 970 327 249 249 0 85 81 63 63 329 527 877 877 0 87 83 65 65 688 729 505 505 0 90 85 67 67 048 930 133 133 0 92 88 68 68 407 131 761 761 0 94 90 70 70 767* 331* 389* 389* 0* 2 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 63 61 49 49 804 832 025 025 0 65 63 50 50 938 742 497 497 0 68 65 51 51 071 654 969 969 0 70 67 53 53 204 565 441 441 0 72 69 54 54 338 475 913 913 0 74 71 56 56 471 403 385 385 0 76 73 57 57 604 391 857 857 0 78 75 59 59 738 380 329 329 0 80 77 60 60 871 368 801 801 0 83 79 62 62 004 356 273 273 0 85 81 63 63 138 343 745 745 0 1 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 56 55 43 43 685 227 947 947 0 58 56 45 45 468 941 266 266 0 XII 87 83 65 65 271 332 217 217 0 XIII 89 85 66 66 404* 319* 689* 689* 0* 14-30980 Dependency allowances (US$ net per annum): 2 083 a 2 217 b Child Except for the first dependent child of a single, widowed or divorced staff member a b c Language allowances (to be included in pensionable remuneration) (US$ net per annum): First language Second language 2 268 1 134 2 879 a 3 246 b Dependent spouse 3 336 a 3 562 b Secondary dependant 1 257 a 1 307 b 1 318 c This lower amount will apply only with respect to staff members for whom the allowance becomes payable on or after 1 Septembe r 2006. This higher amount will apply only with respect to staff members for whom the allowance becomes payable prior to 1 September 2006. This higher amount will apply only with respect to staff members for whom the allowance becomes payable prior to 1 June 2004. Increments: salary increments within the levels shall be awarded annually on the basis of satisfactory service. * Long-service step: Step IX at levels S-4 to S-7, step XI at level S-3 and step XIII at level S-2 are long-service steps. The qualifying criteria for in-grade increases to the long-service step are as follows: • • The staff member should have had at least 20 years of service within the United Nations common system and 5 years of service at the top regular step of the current grade The staff member’s service should have been satisfactory Gross: Gross salaries have been derived through the application of staff assessment to total net salaries. Gross salaries are establ ished for purposes of separation payments and as the basis for calculating tax reimbursements whenever United Nations salaries are taxed. Gross pension: Gross pensionable salaries have been derived through application of staff assessment to net pensionable salaries. Gross pensi onable is the basis for determining Pension Fund contributions under article 25 of the Regulations of the United Nations Joint Staff Pension Fund and for determining pension benefits. Total net: Total net remuneration is the sum of the non-pensionable component and the net pensionable salary. Net pension: Net pensionable is that part of net salary which is used to derive the gross pensionable salary. Net pensionable salary is the total net salary less the non-pensionable component, i.e., 100 per cent of total net salaries. NPC: Non-pensionable component is that part of net salary excluded from application of staff assessment in determination of the gross pensionable salary. The non-pensionable component has been established at 0 per cent. ST/IC/2014/13 9/11 ST/IC/2014/13 10/11 E. Salary scale for staff in the Trades and Crafts category at Headquarters (United States dollars) Effective 1 March 2014 STEPS Level I II III IV V VI VII* TC-8 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 90 86 67 67 586 429 504 504 0 93 89 69 69 716 347 664 664 0 96 92 71 71 846 266 824 824 0 99 95 73 73 977 184 984 984 0 103 98 76 76 107 103 144 144 0 106 101 78 78 238 021 304 304 0 109 103 80 80 368 940 464 464 0 TC-7 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 84 81 63 63 939 163 608 608 0 87 83 65 65 890 914 644 644 0 90 86 67 67 841 666 680 680 0 93 89 69 69 791 418 716 716 0 96 92 71 71 742 171 752 752 0 99 94 73 73 693 922 788 788 0 102 97 75 75 643 674 824 824 0 TC-6 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 79 75 59 59 293 899 712 712 0 82 78 61 61 064 482 624 624 0 84 81 63 63 835 066 536 536 0 87 83 65 65 606 650 448 448 0 90 86 67 67 377 233 360 360 0 93 88 69 69 148 816 272 272 0 95 91 71 71 919 401 184 184 0 TC-5 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 73 70 55 55 670 664 832 832 0 76 73 57 57 257 065 617 617 0 78 75 59 59 843 479 402 402 0 81 77 61 61 430 893 187 187 0 84 80 62 62 017 307 972 972 0 86 82 64 64 604 720 757 757 0 89 85 66 66 191 134 542 542 0 TC-4 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 68 65 51 51 041 622 948 948 0 70 67 53 53 448 779 609 609 0 72 69 55 55 855 936 270 270 0 75 72 56 56 262 141 931 931 0 77 74 58 58 670 387 592 592 0 80 76 60 60 077 632 253 253 0 82 78 61 61 484 878 914 914 0 TC-3 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 62 60 48 48 400 565 056 056 0 64 62 49 49 633 566 597 597 0 66 64 51 51 867 569 138 138 0 69 66 52 52 100 571 679 679 0 71 68 54 54 333 572 220 220 0 73 70 55 55 567 575 761 761 0 75 72 57 57 800 643 302 302 0 TC-2 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 57 55 44 44 004 536 183 183 0 58 57 45 45 912 370 595 595 0 60 59 47 47 880 205 007 007 0 62 61 48 48 926 039 419 419 0 64 62 49 49 972 874 831 831 0 67 64 51 51 019 708 243 243 0 69 66 52 52 065 542 655 655 0 TC-1 (Gross) (Gross pension) (Total net) (Net pension) (NPC) 51 50 40 40 719 459 272 272 0 53 52 41 41 461 133 561 561 0 55 53 42 42 203 807 850 850 0 56 55 44 44 945 481 139 139 0 58 57 45 45 686 156 428 428 0 60 58 46 46 459 828 717 717 0 62 60 48 48 328 503 006 006 0 14-30980 14-30980 Dependency allowances (US$ net per annum): 2 083 a 2 217 b Child Except for the first dependent child of a single, widowed or divorced staff member a b c Language allowances (to be included in pensionable remuneration) (US$ net per annum): First language Second language 2 268 1 134 2 879 a 3 246 b Dependent spouse 3 336 a 3 562 b Secondary dependant 1 257 a 1 307 b 1 318 c This lower amount will apply only with respect to staff members for whom the allowance becomes payable on or after 1 Septembe r 2006. This higher amount will apply only with respect to staff members for whom the allowance becomes payable prior to 1 September 2006. This higher amount will apply only with respect to staff members for whom the allowance becomes payable prior to 1 June 2004. Increments: salary increments within the levels shall be awarded annually on the basis of satisfactory service. * Long-service step: The qualifying criteria for in-grade increases to the long-service step are as follows: • • The staff member should have had at least 20 years of service within the United Nations common system and 5 years of service at the top regular step of the current grade The staff member’s service should have been satisfactory Gross: Gross salaries have been derived through the application of staff assessment to total net salaries. Gross salaries are established for purposes of separation payments and as the basis for calculating tax reimbursements whenever United Nations salaries are taxed. Gross pension: Gross pensionable salaries have been derived through application of staff assessment to net pensionable salaries. Gross pensionable is the basis for determining Pension Fund contributions under article 25 of the Regulations of the United Nations Joint Staff Pensio n Fund and for determining pension benefits. Total net: Total net remuneration is the sum of the non-pensionable component and the net pensionable salary. Net pension: Net pensionable is that part of net salary which is used to derive the gross pensionable sa lary. Net pensionable salary is the total net salary less the non-pensionable component, i.e., 100 per cent of total net salaries. NPC: Non-pensionable component is that part of net salary excluded from application of staff assessment in determination o f the gross pensionable salary. The non-pensionable component has been established at 0 per cent. ST/IC/2014/13 11/11