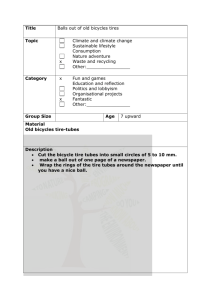

natural resources

advertisement

AB 1239 Page 1 Date of Hearing: April 27, 2015 ASSEMBLY COMMITTEE ON NATURAL RESOURCES Das Williams, Chair AB 1239 (Gordon) – As Amended April 21, 2015 SUBJECT: Tire recycling: California tire regulatory fee SUMMARY: Establishes the Tire Recycling Incentive Program (TRIP) Act to provide incentives for tire recycling activities in California. Establishes a new tire regulatory fee, set by the Department of Resources Recycling and Recovery (CalRecycle), to cover its regulatory costs associated with waste and used tire management. EXISTING LAW: 1) Pursuant to the California Integrated Waste Management Act of 1989, establishes a state policy goal that 75% of solid waste generated be diverted from landfill disposal by 2020. 2) Establishes the California Tire Recycling Act (Act), which: a) Requires a person who purchases a new tire to pay a California tire fee of $1.75 for each new tire purchased in the state. One dollar of which is deposited into the Tire Recycling Fund for oversight, enforcement, and market development grants relating to waste tire management and recycling. The remaining $0.75 is deposited into the Air Pollution Control Fund for programs and projects that mitigate or remediate air pollution caused by tires. b) Reduces the fee on January 1, 2024 to $0.75 per tire, to be deposited into the Tire Recycling Fund. c) Authorizes CalRecycle to award grants, loans, subsidies, and rebates and pay incentives for various purposes related to reducing landfill disposal of waste tires. d) Requires CalRecycle to adopt a Five Year Plan, which must be updated every two years, that establishes goals and priorities for the waste tire program. e) Defines "waste tire generator" as any person whose act or process produces any amount of waste or used tires, or causes a waste or used tire hauler to transport those waste or used tires, or otherwise causes waste or used tires to become subject to regulation. THIS BILL establishes the TRIP, which: 1) Requires CalRecycle to establish a tire recycling incentive program to award payments to eligible recipients, as determined by CalRecycle, in the following manner: a) To cities, counties, other local government agencies, and school districts to fund construction projects that use recycled tires. b) To state and local government agencies, including regional park districts, to fund disability access projects at parks and bikeways. AB 1239 Page 2 c) To a private manufacturer who produces a consumer product using recycled tires in California. 2) Requires CalRecycle to award $2 for every 12 pounds of crumb rubber used by the eligible recipient and authorizes CalRecycle to adjust this amount if it determines the adjustment would further the purposes of CalRecycle's tire program. 3) Requires CalRecycle to annually allocate $30 million for the Program, unless or until the California tire fee becomes less than $1.75. 4) Requires any waste tire generator to pay a California tire regulatory fee at an amount to be determined by CalRecycle pursuant to the following: a) For a waste tire generator that is a retail seller of new tires to end purchasers at an amount sufficient to generate revenues equivalent to the reasonable regulatory costs incurred by CalRecycle for audits, inspections, administrative costs, adjudications, manifesting, registration, and other regulatory activities regarding the generators, but not to exceed $1.25 per tire. Authorizes CalRecycle to establish different fees based on the type of retail seller depending on the nature of the activity, number of tires generated, and other appropriate factors. b) For a waste tire generator that is not a retail seller at an amount sufficient to generate revenues equivalent to the reasonable regulatory costs incurred by CalRecycle for audits, inspections, administrative costs, adjudications, manifesting, registration, and other regulatory activities regarding the generators. Authorizes CalRecycle to establish different fees based on the type of retail seller depending on the nature of the activity, number of tires generated, and other appropriate factors. c) Specifies that the "aggregate amount" of the regulatory fees shall not exceed the aggregate reasonable regulatory costs incurred by CalRecycle. 5) Requires the waste tire generator to remit the regulatory fee quarterly. 6) Makes corresponding changes to the provision of law that replaces current law on January 1, 2024. FISCAL EFFECT: Unknown COMMENTS: 1) Author's statement: AB 1239 by Assembly Member Gordon and Speaker Atkins will help expand the state's tire recycling infrastructure to reduce greenhouse gases, create jobs, and cut the statewide and local costs associated with tire pile cleanup. AB 1239 proposes to establish a Tire Recycling Incentive Program to provide an incentive payment for end-users of recycled tires (including local governments that use tires as rubberized pavement as well as manufacturers who produce products using AB 1239 Page 3 recycled tires.) AB 1239 will also give CalRecycle the authority to increase the state tire fee to cover the costs of regulating waste tires (in an amount not to exceed $1.25/tire.) 2) Tire management in California. According to CalRecycle, approximately 40 million waste tires are generated in California every year. CalRecycle's diversion goal is 90%; according to the California Waste Tire Market Report: 2013, California has achieved an overall diversion rate of 87.3%. Of the of the 40.8 million tires generated: 12.3 million were exported (for fuel or reuse); 7.9 million were recycled as ground rubber; 0.5 million were used in civil engineering projects; 6.6 million were reused (either sold as used tires or retreaded); 8.2 million were used as tire derived fuel in cement kilns or at co-generation facilities; 1.2 million were used as cover at landfills; and, 5.3 million were disposed in landfills. CalRecycle's "affiliated goals" to achieve its 90% diversion rate for tires are: 1) develop long-term, sustainable, and diversified market demand for California tire-derived products; 2) ensure the protection of public health, safety, and the environment while developing a safe and high-quality supply infrastructure to meet that demand; and, 3) foster information flow and technology and product development so that environmental protection and diversion goals are achieved with supply and demand in balance. CalRecycle is in the process of adjusting its waste tire market development programs, in accordance with its Five Year Plan, to more effectively focus CalRecycle resources on diversifying and expanding markets. CalRecycle has also indicated a long-term vision of increasing tire recycling, rather than just diversion. Specifically, CalRecycle has begun crafting a new incentive program that would differentiate incentive payments, with higher payments going to "preferred end-users" that recycle waste tires into new products such as rubberized asphalt concrete, moderate payments for end uses such as tire-derived aggregate, and lower payments for less-preferred non-disposal management such as energy generation. CalRecycle's analysis of past grants indicates that about 25% of the total sales of Californiaproduced tire-derived products were supported by grants, while about 12.5% of California crumb rubber sold to paving applications was supported by CalRecycle paving grants. In order to achieve CalRecycle's long-term goals for tire recycling, it is in the process of redirecting approximately half of its budget for the Tire Derived Product Grant Program to a new Tire Incentive Program that will focus on promoting new tire-derived product development and shift established product manufacturers to use of ground rubber from other feedstock. CalRecycle is also replacing the Tire-Derived Product Business Assistance Program, which offered a wide variety of assistance to manufacturers, with a new Tire Outreach and Market Analysis (TOMA) program. TOMA will focus exclusively on outreach and education to promote tire-derived products. This bill is consistent with the direction and recommendations of CalRecycle's 2015 Five Year Plan. 3) Suggested amendments. This bill contains a number of drafting issues that inadvertently resulted in provisions that are not consistent with the intent of the author. In order to address these issues, the committee may wish to adopt the following amendments: AB 1239 Page 4 a) Strike references to "waste tire generator" and clarify that the regulatory fee is assessed on retail sellers of new tires. b) Strike out lines 3 through 13 on page 6 of the bill to clarify that there is one regulatory fee. c) Delete the provision that grants CalRecycle the authority to establish different fees for different sellers. d) Clarify that the amount of the one regulatory fee shall not exceed CalRecycle's reasonable regulatory costs. e) Make the corresponding changes to the provisions of the bill that will become effective on January 1, 2024. REGISTERED SUPPORT / OPPOSITION: Support Californians Against Waste California Association of Local Conservation Corps California League of Conservation Voters California State Association of Counties Don’t Waste LA Project Environmental Action Committee of West Marin Los Angeles Alliance for a New Economy WILDCOAST Opposition None on file Analysis Prepared by: Elizabeth MacMillan / NAT. RES. / (916) 319-2092