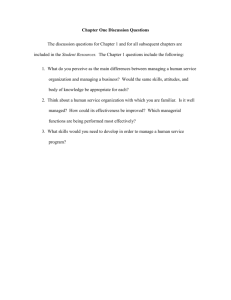

2016 (First, last name) (place, date) DECLARATION BY

advertisement

………………………. 2016 ………………..., …………………. (First, last name) (place, date) DECLARATION BY CANDIDATE FOR INDEPENDENT MEMBER OF THE SUPERVISORY BOARD OF KGHM POLSKA MIEDŹ S.A. I hereby declare that there are no statutory causes which would prevent me from being appointed and from fulfilling the function of member of the Supervisory Board of KGHM Polska Miedź S.A. with its registered head office in Lubin (hereafter „KGHM Polska Miedź S.A.” or „Company”), in particular those set forth in art. 18 and art. 387 of the Corporate Partnerships and Companies Code. I hereby declare that in respect of: 1. § 16 sec. 7 of the Statutes of KGHM Polska Miedź S.A. I meet the criteria for independence set forth below, arising from § 16 sec. 5 of the Statutes of the Company: a) I do not work for the Company, its divisions, or with a related entity of the Company, either as an employee or in any other legal relationship, b) I am not a member of the Supervisory Board or Management Board of an entity related to the Company, c) I am not a partner or shareholder controlling 5% or more of the votes at the General Meeting of the Company or at the General Shareholders Meeting of a related entity, d) I am not a member of the Supervisory Board or Management Board or an employee of an entity controlling 5% or more of the votes at the General Meeting of the Company or at the General Shareholders Meeting of a related entity, e) I am not a direct family member related by blood in an ascending or descending line, a spouse, brother or sister, a parent of a spouse or an adoptee of any of the persons mentioned above in points a) - d). In addition, in accordance with the corporate governance principles applied by KGHM Polska Miedź S.A. as set forth in the document „Code of Best Practice for WSE Listed Companies 2016” (hereafter „CBP”) I hereby declare that I meet the criteria for independence set forth in principle II.Z.4. of the CBP and in accordance with principle II.Z.5. of the CBP, in a situation wherein I am appointed to the Supervisory Board of the Company, I shall provide to the remaining members of the Supervisory Board and Management Board of the Company a statement declaring that I meet the criteria for independence set forth in principle II.Z.4 of the CBP**. I also hereby declare that I shall immediately inform the Company in writing of any change in meeting the criteria mentioned above, and should I fail to meet the criteria for independence set forth in principle II.Z.4 of the CBP** I will be further required to inform the members of the Supervisory Board and Management Board in writing of said fact. I hereby express/ do not express* my consent for the use of my personal data, and for the presentation of my candidacy and CV to the shareholders and Page 1 of 3 investors of KGHM Polska Miedź S.A. on the corporate website of KGHM Polska Miedź S.A. ----------------------------- --------------(signature) * cross off one ** Legal basis: Principles II.Z.4 and II.Z.5 of the Code of Best Practice for WSE Listed Companies 2016: II.Z.4. CBP. Annex II to the European Commission Recommendation of 15 February 2005 on the role of nonexecutive or supervisory directors of listed companies and on the committees of the (supervisory) board applies to the independence criteria of supervisory board members. Irrespective of the provisions of point 1(b) of the said Annex, a person who is an employee of the company or its subsidiary or affiliate or has entered into a similar agreement with any of them cannot be deemed to meet the independence criteria. In addition, a relationship with a shareholder precluding the independence of a member of the supervisory board as understood in this principle is an actual and significant relationship with any shareholder who holds at least 5% of the total vote in the company. II.Z.5. CBP. Each supervisory board member should provide the other members of the supervisory board as well as the company’s management board with a statement of meeting the independence criteria referred to in principle II.Z.4. Annex II to the Recommendation of the European Commission of 15 February 2005 on the role of non-executive or supervisory directors of listed companies and on the committees of the (supervisory) board: Profile of independent non-executive or supervisory directors 1. It is not possible to list comprehensively all threats to directors’ independence; the relationships or circumstances which may appear relevant to its determination may vary to a certain extent across Member States and companies, and best practices in this respect may evolve over time. However, a number of situations are frequently recognised as relevant in helping the (supervisory) board to determine whether a nonexecutive or supervisory director may be regarded as independent, even though it is widely understood that assessment of the independence of any particular director should be based on substance rather than form. In this context, a number of criteria, to be used by the (supervisory) board, should be adopted at national level. Such criteria, which should be tailored to the national context, should be based on due consideration of at least the following situations: a) not to be an executive or managing director of the company or an associated company, and not having been in such a position for the previous five years; b) not to be an employee of the company or an associated company, and not having been in such a position for the previous three years, except when the non-executive or supervisory director does not belong to senior management and has been elected to the (supervisory) board in the context of a system of workers’ representation recognised by law and providing for adequate protection against abusive dismissal and other forms of unfair treatment; c) not to receive, or have received, significant additional remuneration from the company or an associated company apart from a fee received as non-executive or supervisory director. Such additional remuneration covers in particular any participation in a share option or any other performance-related pay scheme; it does not cover the receipt of fixed amounts of compensation under a retirement plan (including deferred compensation) for prior service with the company (provided that such compensation is not contingent in any way on continued service). d) not to be or to represent in any way the controlling shareholder(s) (control being determined by reference to the cases mentioned in Article 1(1) of Council Directive 83/349/EEC (1)); e) not to have, or have had within the last year, a significant business relationship with the company or an associated company, either directly or as a partner, shareholder, director or senior employee of a body having such a relationship. Business relationships include the situation of a significant supplier of goods or services (including financial, legal, advisory or consulting services), of a significant customer, and of organisations that receive significant contributions from the company or its group; f) not to be, or have been within the last three years, partner or employee of the present or former external auditor of the company or an associated company; g) not to be executive or managing director in another company in which an executive or managing director of the company is non-executive or supervisory director, and not to have other significant links with executive directors of the company through involvement in other companies or bodies; Page 2 of 3 h) not to have served on the (supervisory) board as a non-executive or supervisory director for more than three terms (or, alternatively, more than 12 years where national law provides for normal terms of a very small length); i) not to be a close family member of an executive or managing director, or of persons in the situations referred to in points (a) to (h); 2. The independent director undertakes (a) to maintain in all circumstances his independence of analysis, decision and action, (b) not to seek or accept any unreasonable advantages that could be considered as compromising his independence, and (c) to clearly express his opposition in the event that he finds that a decision of the (supervisory) board may harm the company. When the (supervisory) board has made decisions about which an independent nonexecutive or supervisory director has serious reservations, he should draw all the appropriate consequences from this. If he were to resign, he should explain his reasons in a letter to the board or the audit committee, and, where appropriate, to any relevant body external to the company.” (1) Official Journal of the European Communities, L 193, 18 July 1983, page 1. The most recent change in the Directive was by Directive 2003/51/EC of the European Parliament and of the Council (Official Journal of the European Communities, L 178, 17 July 2003, page 16). Other principles of the Code of Best Practice for WSE Listed Companies 2016: II.Z.6. CBP. The supervisory board should identify any relationships or circumstances which may affect a supervisory board member’s fulfilment of the independence criteria. An assessment of supervisory board members’ fulfilment of the independence criteria should be presented by the supervisory board according to principle II.Z.10.2. II.Z.7. CBP. Annex I to the Commission Recommendation referred to in principle II.Z.4 applies to the tasks and the operation of the committees of the Supervisory Board. Where the functions of the audit committee are performed by the supervisory board, the foregoing should apply accordingly. II.Z.8. CBP. The chair of the audit committee should meet the independence criteria referred to in principle II.Z.4. II.Z.9. CBP. To enable the supervisory board to perform its duties, the company’s management board should give the supervisory board access to information on matters concerning the company. II.Z.10. In addition to its responsibilities laid down in the legislation, the supervisory board should prepare and present to the ordinary general meeting once per year the following: II.Z.10.1. an assessment of the company’s standing including an assessment of the internal control, risk management and compliance systems and the internal audit function; such assessment should cover all significant controls, in particular financial reporting and operational controls; II.Z.10.2. a report on the activity of the supervisory board containing at least the following information: - full names of the members of the supervisory board and its committees; - supervisory board members’ fulfilment of the independence criteria; - number of meetings of the supervisory board and its committees in the reporting period; - self-assessment of the supervisory board; II.Z.10.3. an assessment of the company’s compliance with the disclosure obligations concerning compliance with the corporate governance principles defined in the Exchange Rules and the regulations on current and periodic reports published by issuers of securities; II.Z.10.4. an assessment of the rationality of the company’s policy referred to in recommendation I.R.2 or information about the absence of such policy. II.Z.11. The supervisory board should review and issue opinions on matters to be decided in resolutions of the general meeting. Page 3 of 3