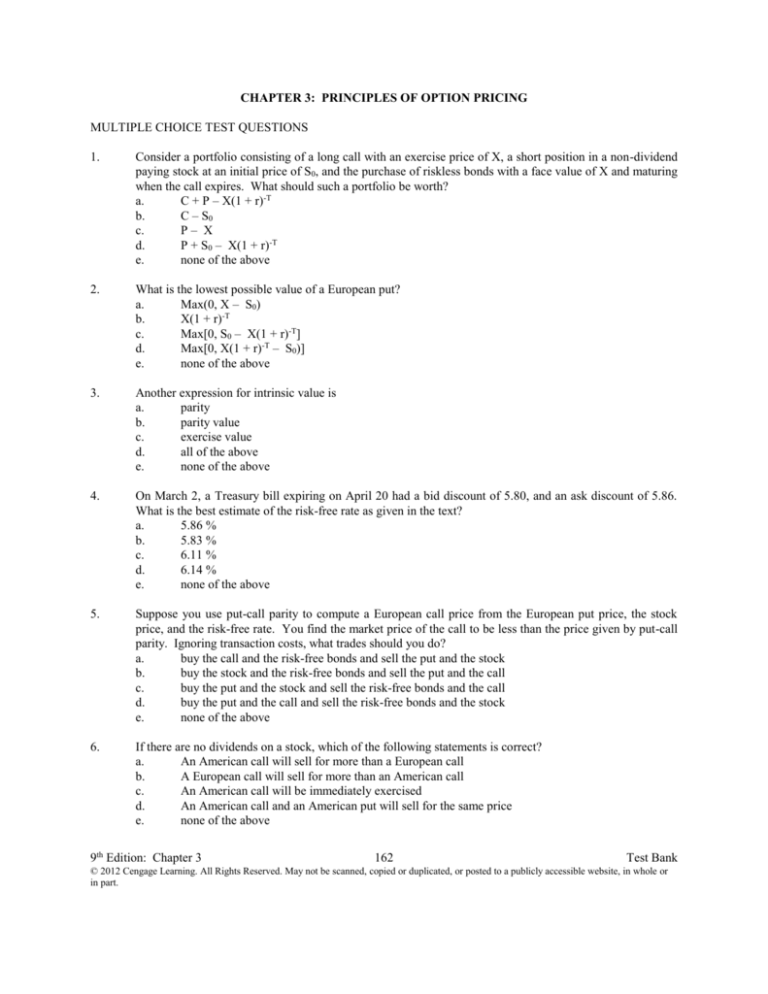

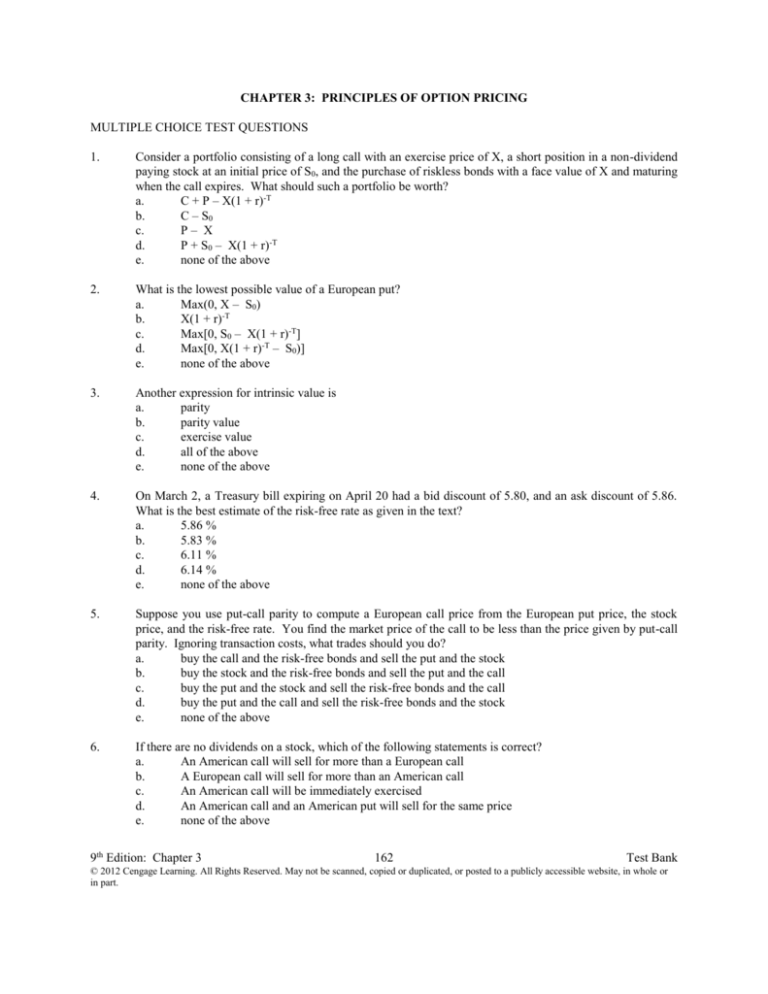

CHAPTER 3: PRINCIPLES OF OPTION PRICING

MULTIPLE CHOICE TEST QUESTIONS

1.

Consider a portfolio consisting of a long call with an exercise price of X, a short position in a non-dividend

paying stock at an initial price of S0, and the purchase of riskless bonds with a face value of X and maturing

when the call expires. What should such a portfolio be worth?

a.

C + P – X(1 + r)-T

b.

C – S0

c.

P– X

d.

P + S0 – X(1 + r)-T

e.

none of the above

2.

What is the lowest possible value of a European put?

a.

Max(0, X – S0)

b.

X(1 + r)-T

c.

Max[0, S0 – X(1 + r)-T]

d.

Max[0, X(1 + r)-T – S0)]

e.

none of the above

3.

Another expression for intrinsic value is

a.

parity

b.

parity value

c.

exercise value

d.

all of the above

e.

none of the above

4.

On March 2, a Treasury bill expiring on April 20 had a bid discount of 5.80, and an ask discount of 5.86.

What is the best estimate of the risk-free rate as given in the text?

a.

5.86 %

b.

5.83 %

c.

6.11 %

d.

6.14 %

e.

none of the above

5.

Suppose you use put-call parity to compute a European call price from the European put price, the stock

price, and the risk-free rate. You find the market price of the call to be less than the price given by put-call

parity. Ignoring transaction costs, what trades should you do?

a.

buy the call and the risk-free bonds and sell the put and the stock

b.

buy the stock and the risk-free bonds and sell the put and the call

c.

buy the put and the stock and sell the risk-free bonds and the call

d.

buy the put and the call and sell the risk-free bonds and the stock

e.

none of the above

6.

If there are no dividends on a stock, which of the following statements is correct?

a.

An American call will sell for more than a European call

b.

A European call will sell for more than an American call

c.

An American call will be immediately exercised

d.

An American call and an American put will sell for the same price

e.

none of the above

9th Edition: Chapter 3

162

Test Bank

© 2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or

in part.

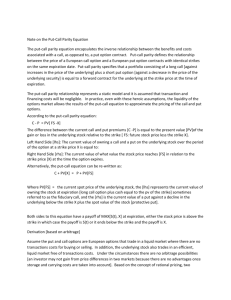

The following quotes were observed for options on a given stock on November 1 of a given year. These are

American calls except where indicated. Use the information to answer questions 7 through 20.

Calls

Puts

Strike

Nov

Dec

Jan

Nov

Dec

Jan

105

8.40

10

11.50

5.30

1.30

2.00

110

4.40

7.10

8.30

0.90

2.50

3.80

115

1.50

3.90

5.30

2.80

4.80

4.80

The stock price was 113.25. The risk-free rates were 7.30 percent (November), 7.50 percent (December)

and 7.62 percent (January). The times to expiration were 0.0384 (November), 0.1342 (December), and

0.211 (January). Assume no dividends unless indicated.

7.

What is the intrinsic value of the December 115 put?

a.

1.75

b.

0.00

c.

3.90

d.

3.00

e.

none of the above

8.

What is the intrinsic value of the November 105 put?

a.

0.30

b.

8.25

c.

8.50

d.

0.00

e.

none of the above

9.

What is the intrinsic value of the January 110 call?

a.

0.00

b.

8.30

c.

3.75

d.

5.00

e.

none of the above

10.

What is the intrinsic value of the November 115 call?

a.

1.50

b.

0.00

c.

2.80

d.

1.75

e.

none of the above

11.

What is the time value of the December 105 put?

a.

1.30

b.

8.30

c.

0.00

d.

7.00

e.

none of the above

9th Edition: Chapter 3

163

Test Bank

© 2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or

in part.

12.

What is the time value of the November 115 put?

a.

1.75

b.

2.80

c.

1.10

d.

0.00

e.

none of the above

13.

What is the time value of the November 110 call?

a.

0.00

b.

4.40

c.

1.15

d.

3.25

e.

none of the above

14.

What is the time value of the January 115 call?

a.

5.30

b.

0.00

c.

3.50

d.

1.70

e.

none of the above

15.

What is the European lower bound of the December 105 call?

a.

9.86

b.

0.00

c.

8.25

d.

9.26

e.

none of the above

16.

What is the European lower bound of the November 115 call?

a.

1.44

b.

0.00

c.

1.75

d.

2.06

e.

none of the above

17.

From American put-call parity, what are the minimum and maximum values that the sum of the stock price

and December 110 put price can be?

a.

101.81 and 102.87

b.

2.50 and 113.25

c.

116.038 and 117.10

d.

7.125 and 110

e.

none of the above

18.

The maximum difference between the January 105 and 110 calls is which of the following?

a.

11.50

b.

4.92

c.

5.00

d.

4.0

e.

none of the above

9th Edition: Chapter 3

164

Test Bank

© 2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or

in part.

19.

Suppose you knew that the January 115 options were correctly priced but suspected that the stock was

mispriced. Using put-call parity, what would you expect the stock price to be? For this problem, treat the

options as if they were European.

a.

113.73

b.

123.23

c.

121.23

d.

112.77

e.

none of the above

20.

Suppose the stock is about to go ex-dividend in one day. The dividend will be $4.00. Which of the

following calls will you consider for exercise?

a.

November 115

b.

November 110

c.

December 115

d.

all of the above

e.

none of the above

21.

The time value of an option is also referred to as the

a.

synthetic value

b.

strike value

c.

speculative value

d.

parity value

e.

none of the above

22.

Which of the following is the lowest possible value of an American call on a stock with no dividends?

a.

Max(0, S0 – X(1 + r)-T)

b.

S0

c.

Max(0, S0 – X)

d.

Max(0, S0 (1 + r)-T – X)

e.

none of the above

23.

Which of the following is the lowest possible value of an American put on a stock with no dividends?

a.

X(1 + r)-T

b.

X

c.

Max(0, X(1 + r)-T – S0)

d.

Max(0, X – S0)

e.

none of the above

24.

The difference between a Treasury bill's face value and its price is called the

a.

time value

b.

discount

c.

coupon rate

d.

bid

e.

none of the above

25.

Which of the following statements about an American call is not true?

a.

Its time value decreases as expiration approaches

b.

Its maximum value is the stock price

c.

It can be exercised prior to expiration

d.

It pays dividends

e.

none of the above

9th Edition: Chapter 3

165

Test Bank

© 2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or

in part.

26.

Given a longer-lived American call and a shorter-lived American call with the same terms, the longer-lived

call must always be worth

a.

at most the value of the shorter-lived call

b.

at least as much as the shorter-lived call

c.

exactly the same as the shorter-lived call

d.

the shorter-lived call discounted to the length of the longer-lived call

e.

none of the above

27.

Which of the following inequalities correctly states the relationship between the difference in the prices of

two European calls that differ only by exercise price

a.

(X2 – X1)(1 + r)-T ≥ Ce(S0,T,X1) – Ce(S0,T,X2)

b.

(X2 – X1) ≥ Ce(S0,T,X2) – Ce(S0,T,X1)

c.

(X2 – X1)(1 + r)-T ≥ Ce(S0,T,X1) + Ce(S0,T,X2)

d.

(X2 – X1) ≥ Ce(S0,T,X1) – Ce(S0,T,X2)

e.

none of the above

28.

Suppose that you observe a European option on a currency with an exchange rate of S0 and a foreign riskfree rate of . Which of the following inequalities correctly expresses the lower bound of the call?

a.

Ce(S0,T,X) ≥ Max[0,S0(1 + )-T + X(1 + r)-T]

b.

Ce(S0,T,X) ≥ Max[0,S0 - X(1 + )-T]

c.

Ce(S0,T,X) ≥ Max[0,S0(1 + )-T - X]

d.

Ce(S0,T,X) ≥ Max[0,S0(1 + )-T – X(1 + r)-T]

e.

none of the above

29.

A situation in which early exercise of an American put can be justified is

a.

bankruptcy

b.

merger

c.

if X exceeds S0 by greater than any transaction costs.

d.

both a and b

e.

both a and b and c

30.

The effect of volatility on a call/put’s price is

a.

decreased price due to decreased possible losses

b.

nominal volatility will not noticeably effect a call/put’s price

c.

increased price due to increased possible gains

d.

decreased price due to increased possible losses

e.

none of the above

9th Edition: Chapter 3

166

Test Bank

© 2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or

in part.

CHAPTER 3: PRINCIPLES OF OPTION PRICING

TRUE/FALSE TEST QUESTIONS

T

F

1.

An option can be priced at less than zero because it can potentially generate a large profit

for its owner.

T

F

2.

The concept of the intrinsic value does not apply to European calls prior to expiration

because they cannot be exercised immediately.

T

F

3.

The maximum value of a call is the stock price.

T

F

4.

The difference between an American call's price and its intrinsic value is called the time

value because the call can be exercised at any time.

T

F

5.

If one portfolio always provides a return at least as high as another portfolio, then that

portfolio will have a price no less than that of the other portfolio.

T

F

6.

Put-call parity is a relationship that can be used to provide the price of both a European

put and call simultaneously.

T

F

7.

The lower bound of a European call on a non-dividend paying stock is lower than the

intrinsic value of an American call.

T

F

8.

An American call should be exercised early when the stock price is extremely high and is

expected to fall.

T

F

9.

An American put might be exercised early even when there are no dividends on the

underlying stock.

T

F

10.

Holding everything else constant, call options are more expensive in periods of high

interest rates.

T

F

11.

Holding everything else constant, put options are more expensive in periods of high

interest rates.

T

F

12.

High volatility is bad for option holders because it increases the probability that the

option will expire out-of-the-money.

T

F

13.

The lower bound of a European put on a non-dividend paying stock is lower than the

intrinsic value of an American put.

T

F

14.

Holding everything else constant, a longer-term European put is always worth more than a

shorter-term European put.

T

F

15.

The lower the exercise price, the more valuable the call option.

T

F

16.

The spread between the prices of two European puts, alike in all respects except exercise

price, cannot exceed the difference in their exercise prices.

T

F

17.

The time value of a call is greatest when the stock price is very high.

th

9 Edition: Chapter 3

167

Test Bank

© 2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or

in part.

T

F

18.

Even if there are no dividends on the stock, American put-call parity will not be the same

as European put-call parity.

T

F

19.

If an option portfolio generates a zero cash flow at expiration and a positive cash flow

today, an arbitrage opportunity is available.

T

F

20.

An American call on a non-dividend paying stock will be worth more than a European

call on that same stock.

T

F

21.

Transactions to exploit pricing errors in the put-call parity relationship are called

conversions and reversals.

T

F

22.

The gain from the early exercise of an American put is X(1 + r) -T – S0.

T

F

23.

At expiration the call price must converge to the stock price.

T

F

24.

A stock is equivalent to a long call, short put and long risk-free bond.

T

F

25.

Selling short a risk-free bond is equivalent to borrowing.

T

F

26.

At expiration, the value of a European call is ST – X.

T

F

27.

The value of a European call is higher for lower strike prices.

T

F

28.

The price of a call option is directly related to interest rates.

T

F

29.

The difference between two American put options with different strike prices is less than

or equal to the dollar difference between the strike prices, the higher strike price minus

the lower strike price.

T

F

30.

The put-call parity rule for American options is stated as equalities.

9th Edition: Chapter 3

168

Test Bank

© 2012 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or

in part.