Ports - Mid Shore Regional Council

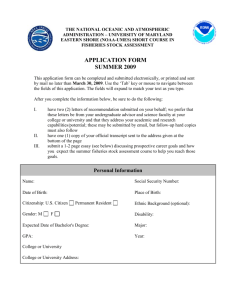

advertisement