Part II: Short Answer and Quantitative Applications

advertisement

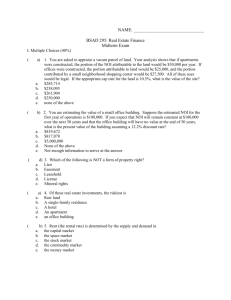

Part I. The following multiple choice questions are worth 4 points each. Provide the single best response. 1. Which of the following expenses would NOT be included in an operating statement used to calculate net operating income in the income approach to value? a. b. c. d. e. 2. A property produces a first year NOI of $24,000. Because of the long economic life of the building, the income is considered a perpetuity that will grow at 2.5% a year. Using a discount rate of 11.5%, what value has the property? a. b. c. d. e. 3. $266,667 $208,695 $258,947 $342,857 Insufficient information is provided to allow a clear answer A property is purchased for $15 million. Financing is obtained with a 75% loan-to-value ratio with annual payments of $1,179,000. The property produces an NOI of $1.4 million. What is this property’s equity dividend rate? a. b. c. d. e. 4. Property taxes Flood insurance Liability insurance Maintenance and repairs New roof 5.89% 9.33% 37.33% 7.86% 8.64% A property produces a first year NOI of $100,000 that is expected to grow by 4% per year. If the property is expected to be sold at the end of year 3, what is the expected sales price based on a capitalization rate of 9.5% applied to the 3rd year’s NOI? (Hint: think V=I/R) a. b. c. d. e. $1,219,000 $1,095,158 $1,138,526 $1,116,737 $1,257,992 5. Of the appraisal methods considered in class, which is the most appropriate for estimating the value of a single-family dwelling? a. b. c. d. e. 6. When considering a home purchase, which of the following measures is most meaningful to the homebuyer? (There is a SINGLE best response!) a. b. c. d. e. 7. Cost approach Income approach Sales comparison approach Equity dividend rate Debt service coverage ratio Debt service coverage ratio Equity dividend rate Monthly debt service Annual CFBT Annual CFAT An investment property yields cash flows after debt service of $3,000, $4,000 and $48,000 in each of the next three years. This is good. It is the love of money, and not money standing alone, that is at the root of all evil. Given that you have decided that money is OK, what is the maximum you would you pay for the investment assuming you had borrowed $50,000 and require a pre-tax return on your equity of 20%? (Remember V=D+E). Use the Cash Flow keys!! You are just calculating the present value to the equity investor of these three equity cash flows (these are the cash flows before tax, and the final cash flow is, we assume, the cash flow after the property’s sale. We are ignoring all income and capital gain taxes in this example.) CF0 = 0 CO1 = 3,000 FO1 = FO2 = FO3 =1 CO2 = 4,000 CO3 = 48,000 CPT NPV, I = 20, NPV = 33,055 Add the NPV, that is the value of the equity, add it to the debt! V = D + E = 50,000 + 33,055 = 83,055 a. b. c. d. e. 8. $33,055 $100,000 $83,055 $133,055 $50,000 A C corporation has all of the following characteristics except: a. b. c. d. e. Limited liability to shareholders Liquidity of ownership interests Centralized and efficient management Pass through of tax benefits to shareholders Life in perpetuity And part I from another exam: 1. From an investment standpoint, a major disadvantage of most real property is that it (A) is very liquid (B) can be depreciated (C) is often heavily leveraged, leading to special risks of default (D) is too difficult to record an ownership interest 2. Which of the following sets of cash flows attract real estate investors? (A) net operating income, debt service and cash flows after tax (B) special tax deferral, tax sheltering and tax avoidance programs (C) mortgage deductions, operating income streams and taxes (D) rental income streams, tax shelters and capital gains 3. To cope with asbestos found in an office building, the EPA suggests which of the following actions? (A) complete removal of all asbestos containing materials (B) removal of only friable asbestos (C) painting over, or sealing off, asbestos containing materials (D) instigate a management plan that involves training personnel, cleaning practices, and monitoring the air 4. Under the Endangered Species Act, a "taking" includes a11 of the following EXCEPT (A) the killing of any wildlife listed as endangered (B) destroying food that may be used by endangered species . (C) habitat modifications that impair behavioral patterns of an endangered species (D) habitat modifications where an endangered species may live in the future 5. Depreciation, or cost recovery, as a deduction is allowed on which of the following assets? (A) land used for business purposes (B) a personal residence (C) a business computer used for personal purposes (D) a personal car used for business purposes 6. The total amount of taxes assessed on real property is determined by the taxing authority's (A) budget requirements (B) estimate of property subject to tax (C) annual appraisal of all property (D) assessed value of taxable property 7. The 1986 Tax Act requires depreciation for residential property to be taken over a period of (A) 19 years (B) 27.5 years (C) 39 years (D) its useful life to the taxpayer 8. When an existing building is acquired, an allocation must be made between the value of the land and the value of the building because (A) land is not depreciable (B) capital gain attributed to the land is not subject to tax at time of disposition (C) the building is not eligible for depreciation (D) the land may exceed the building in value 9. Personal property is eligible for depreciation deductions only if (A) it has a life in excess of five years (B) it is purchased in the first quarter of the tax year (C) it meets ADR Guideline requirements (D) it is used for business purposes 10. Something that maintains a property but does not increase its useful life is identified by the IRS as (A) an improvement (B) a replacement (C) an addition (D) a repair 11. For tax purposes, capital gain is the difference between the property's adjusted basis of value and the (A) initial basis of value (B) pay-off of the mortgage loan balance (C) realized selling price (D) market value Part II: Short Answer and Quantitative Applications Number one below is worth ten points. Numbers 2-8 are worth 7 points each. This is a 103-point exam. Provide a complete response in the space provided. 1. a) We contrasted real estate and security markets. Define market efficiency and list 5 market imperfections that may lead to real estate market inefficiencies. See your class notes, and the text at the beginning of chapter 1. b) Contrast the imperfections above in real estate markets to the capital markets. Is the stock or real estate market more efficient? Is the real estate market becoming more or less efficient? How? See your class notes, and the text at the beginning of chapter 1. 2. Use the following information in problems 2 – 6. You are considering a 14,000 square foot property purchase; it is 80% leased right now, and is expected to be 90% leased in year 2 and 100% leased in year 3. It rents for $10 per square foot each year. Operating expenses are expected to be 35% of receipts. Assume a $900,000 purchase price with 75% financing over 20 years at 7% with monthly payments. What is this property’s cash flow before taxes in year1? 675,000 = PV 20 * 12 = N 7 / 12 = I/Y CPT PMT = $5,233 / month = $62,799 / yr 14,000 SF Yr 1 80% leased = 11,200 SF Yr 2 90% leased = 12,600 SF Yr 3 100% leased=14,000SF x $10 = $112,000 x $10 = $126,000 x $10 = $140,000 Operating expenses = 35% of receipts. Subtract debt service to get CF. Yr 1 $112,000 x .65 = $72,800 - $62,799 = $10,001 Yr 2 $126,000 x .65 = $81,900 - $62,799 = $19,101 Yr 3 $140,000 x .65 = $91,000 - $62,799 = $28,201 3. Provide an amortization table for the first 3 months of the property’s mortgage. Include principal and interest payments for each of the first 3 months, with loan balances at the end of each month. See class and BA II Plus Review Sheet (on the Principles of Finance class link) Month 1?, P1 = 1, P2 = 1, BAL after one payment is $673,704 PRN with first payment is $1,296 INT with first payment is $3,938 4. Using the information above, calculate the first year’s cash flows after tax. Use a 40% ordinary tax rate. Assume depreciation the first year of 2.461% (from a set of IRS depreciation tables) of the depreciable basis for this commercial property. CFAT = CFBT – Tax, Tax = (NOI – INT – DEPR) Tax Rate NOI, from number 2 above, is $72,800, DEPR = .02461 x (.8 x 900,000) = $17,719 INT = ? 675,000 = PV 20 * 12 = N 7 / 12 = I/Y CPT PMT = $5,233 P1 = 1, P2 = 12, INT = $46,741 Tax = $(72,800 – 17,719 – 46,741).4 = $3,336 CFAT = CFBT from problem 2 – this tax bill = $10,001 - $3,336 = $6,665 5. Calculate the property’s equity dividend rate before taxes for the first year. Now, calculate the property’s debt coverage ratio using the first year’s data. What “story” do each of these two measures “tell.” Who uses each measure, and how do they use them? EDR = CFBT/Equity = 10,001/225,000 = 10,001/(.25 x 900,000) = 4.44% 6. What ownership form would you encourage as you and your closest friend buy this property. Assume you both have families and other properties and 7-figure net worths. Now, in general, what are the advantages and disadvantages of the form you chose. Be specific! And some additional practice questions from another exam! 1. What three main criteria are used to judge a wetlands area? Wetlands vegetation Anaerobic soil conditions Under water most of the time 2. A property is available for $1 million. It has an NOI of $75,000. What is the implied cap rate? 75,000/1m = .075, as CR = NOI/Value 3. The Sub-Prime dilemma. In four or five sentences, describe this dilemma. You will want to mention two or three key ideas. At the center of the start of the Great Recession were the defaults of myriad borrowers whose home mortgage terms changed after 3-5 years, or whose loans should not have been made in the first place. In the first case, the borrower with subpar credit or even favorable credit between 2000 and 2006 might have selected a loan with 4% terms for three years and a $900 payment, only to confront an increased interest rate to perhaps 7% or 8% and a $1,500 payment several years later. The first loan terms might have been only marginally affordable; the repriced loan sent the borrowers into default, and contributed to the contagion that snowballed in the late 2000’s to contribute to the real estate/financial crisis. In the second case, borrowers with no favorable credit history could merely attest, between 2002 and 2007, to a certain income and be granted a costly “subpar” mortgage covering 90% or more of the purchase price of an otherwise unaffordable home. Expecting to resell the home in 6-36 months, the homebuyer confronted with a failing real estate market after 2006 often simply walked away, adding yet more fuel to the - subprime, Great Recession, residential real estate market collapse - fire. Other factors were at play, but these patterns were at the center of the “sub-prime” dilemma. 4. If Betty and Bob bought a house with a $200,000 mortgage three years ago at 5%, and the rate is changing to 9% over the remaining years today, what is the change in their mortgage payment? Assume a 30 year amortization period with the original loan, and a 27 year period with the refinancing, to make the numbers comparable. Just provide a number. Original payment is: 200,000 PV, 360 N, 5/12 = I/Y, CPT PMT = $1,074 BAL after three years (P1 = 1, P2 = 36, or with the PMT in your calculator, just type in 36 N, CPT FV = 190,687 Refinance 190,687 at 9%, for 27 x 12 = N, and the new PMT = $1,570