File

advertisement

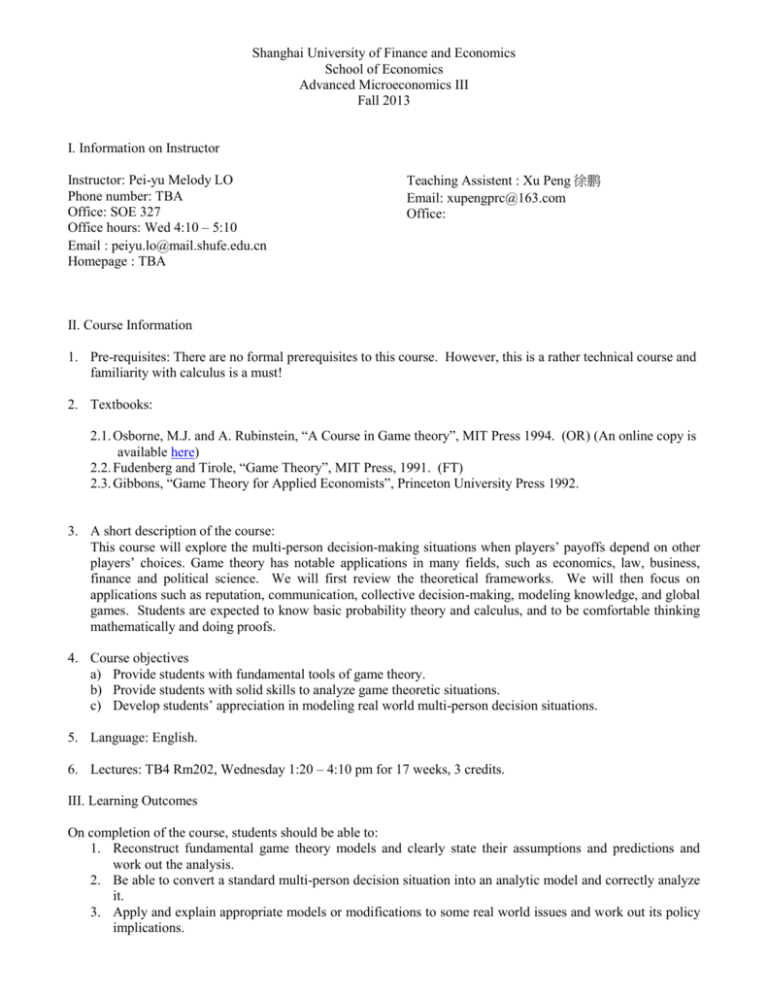

Shanghai University of Finance and Economics School of Economics Advanced Microeconomics III Fall 2013 I. Information on Instructor Instructor: Pei-yu Melody LO Phone number: TBA Office: SOE 327 Office hours: Wed 4:10 – 5:10 Email : peiyu.lo@mail.shufe.edu.cn Homepage : TBA Teaching Assistent : Xu Peng 徐鹏 Email: xupengprc@163.com Office: II. Course Information 1. Pre-requisites: There are no formal prerequisites to this course. However, this is a rather technical course and familiarity with calculus is a must! 2. Textbooks: 2.1. Osborne, M.J. and A. Rubinstein, “A Course in Game theory”, MIT Press 1994. (OR) (An online copy is available here) 2.2. Fudenberg and Tirole, “Game Theory”, MIT Press, 1991. (FT) 2.3. Gibbons, “Game Theory for Applied Economists”, Princeton University Press 1992. 3. A short description of the course: This course will explore the multi-person decision-making situations when players’ payoffs depend on other players’ choices. Game theory has notable applications in many fields, such as economics, law, business, finance and political science. We will first review the theoretical frameworks. We will then focus on applications such as reputation, communication, collective decision-making, modeling knowledge, and global games. Students are expected to know basic probability theory and calculus, and to be comfortable thinking mathematically and doing proofs. 4. Course objectives a) Provide students with fundamental tools of game theory. b) Provide students with solid skills to analyze game theoretic situations. c) Develop students’ appreciation in modeling real world multi-person decision situations. 5. Language: English. 6. Lectures: TB4 Rm202, Wednesday 1:20 – 4:10 pm for 17 weeks, 3 credits. III. Learning Outcomes On completion of the course, students should be able to: 1. Reconstruct fundamental game theory models and clearly state their assumptions and predictions and work out the analysis. 2. Be able to convert a standard multi-person decision situation into an analytic model and correctly analyze it. 3. Apply and explain appropriate models or modifications to some real world issues and work out its policy implications. IV. Assessment Assessment Problem sets Midterm Final Classroom particiation Weights 30% 30% 35% 5% There will be several problem sets, which will be due one week after being posted on my website. You can discuss your problem sets with your classmates, but you should not copy other people’s work. Late problem sets will not be accepted. The midterm is scheduled in class on Oct 23. There will be no make-up exams to replace midterms that have been missed. Students missing midterm will receive a grade of zero for the exam unless they provide documentation of illness. The final exam will focus on materials not covered in the midterm. V. Academic Conduct Academic dishonesty by the student code of conduct includes cheating on the assignments or exams; plagiarizing; altering; forging, or misusing a University academic record; taking, acquiring, or using test materials without faculty permission; and acting alone or in cooperation with another to enhance a grade, etc. A minimum penalty for academic dishonesty is a grade of zero. Other penalties may include a F in course and a complaint to university authorities so that they act consequently with the corresponding university policy. VI . Course Schedule (tentative) Week 1 6 Topic Normal Form Games: finding NE, existence and properties of NE, dominance and rationalizability Sept 11 Extensive form games with perfect information: definitions, backward induction, subgame perfect NE, alternating offer bargaining games. Sept 18 Repeated games: perfect monitoring, Sept 25 Repeated games: imperfect and public monitoring Oct 2 Strategic form games with incomplete information: Bayesian Nash equilibrium, mechanism design and implementation Oct 9 Modeling Knowledge 7 Oct 16 Optimal selling mechanism and Auction theory 8 Oct 23 Midterm 2 3 4 5 Date No 4 reading OR 2.1 – 2.3, Ch 3, 4 FT 1,2 OR Ch 6, 7 FT Ch 3,4 OR Ch 8, FT Ch 5, FT Ch 5 OR Ch 10, FT Ch 6, 7 OR Ch 5 “Rationality and Knowledge, ” in Advances in Economics and Econometrics (Proceedings of the Seventh World Congress of the Econometric Society) Vol 1, edited by Kreps, David M. and Kenneth F. Wallis. Cambridge, England: Cambridge University Press (1997) “Auction Theory” by Vijay Krishna; Milgrom and Weber (1982), Riley and Samuelson (1981), 9 10 Oct 30 Nov 6 Auction Theory --- continued Extensive Games with imperfect information: perfect Bayesian NE, signaling games and refinements 11 Nov 13 Reputation formation 12 13 Nov 20 Nov 27 Reputation formation --- continued Global games and its applications 14 Dec 4 Strategic communication – cheap talk 15 Dec 11 16 Dec 18 Strategic communication – verifiable information and sender commitment Applications to Political economy 17 Dec 25 Final Oct 23 OR 11, 12 FT Ch 8, G Ch4 Bikhchandani et al. (1992) FT Ch 9, Kreps and Wilson (1982), Fudenberg & Levine (1989), Horner (2002), Ely and Valimaki (2003), "Global Games: Theory and Applications," in Advances in Economics and Econometrics (Proceedings of the Eighth World Congress of the Econometric Society), edited by M. Dewatripont, L. Hansen and S. Turnovsky. Cambridge, England: Cambridge University Press (2003) Carlsson and Van Damme (1993) Abreu and Brunnermeier (2003) Crawford & Sobel (1982), Battaglini (2002), Morris (2001), Ottaviani & Sorrensen (2006), Morgan and Stocken (2003), Chakraborty and Harbaugh (2010), Milgrom (1981), Seidmann and Winter (1997), Gentzkow and Kamenica Becker and Stigler (1974), Myerson (2010) VII.. References 1. Battaglini, M. (2002), “Multiple Referrals and Multidimensional Cheap Talk,” Econometrica, 70, 13791401. 2. Bikhchandani, S., Hirshleifer, D. and Welch, I. (1992), “A Theory of Fads, Fashion, Custom, and Cultural Change as Informational Cascades,” Journal of Political Economy, 100(5). 3. Becker and Sitgler (1974), “Law Enforcement, Malfeasance, and Compensation of Enforcers,” The Journal of Legal Studies, 3 (1), pp. 1-18. 4. Carlsson, H. and E. van Damme (1993), “Global Games and Equilibrium Selection,” Econometrica, 61, 989-1018. 5. Chakraborty, A., and R. Harbaugh (2010), “Persuasion by Cheap Talk,” American Economic Review, 100(5), 2361-2382. 6. Dekel, E. and M. Piccione (2000), “Sequential Voting Procedures in Symmetric Binary Elections,” Journal of Political Economy, 108, 34.55. 7. Ely, J. and J. Välimäki (2003), “Bad Reputation,” Quarterly Journal of Economics, 118, pp. 785-814. 8. Fudenberg, D. and D. Levine (1989), “Reputation and Equilibrium Selection in Games with a Patient Player,” Econometrica, 57, 759-778. 9. Gentzkow, M., and E. Kamenica, “Bayesian Persuasion,” American Economic Review, 101(6). 10. Horner (2002), “Reputation and Competition,” American Economic Review, 92 (2002), 644-663. 11. Kamenica, E., and M. Gentzkow (2011), “Bayesian Persuasion,” working paper. 12. Kreps, D., P. Milgrom, J. Roberts, and R. Wilson (1982), “Rational Cooperation in the Finitely Repeated Prisoners.Dilemma,” Journal of Economic Theory, 27, 245-52. 13. Kreps, D. and R. Wilson (1982), “Reputation and Imperfect Information,” Journal of Economic Theory, 27, 253-279. 14. Krishna, Vijay (2002), Auction Theory, Academic Press. 15. Milgrom, P. R. (1981), “Good News and Bad News: Representation Theorems and Applications,” Bell Journal of Economics, 12(2), 380-391. 16. Milgrom and Roberts (1982), “Predation, reputation and entry deterrence,” Journal of Economic Theory, 27, 280-312. 17. Milgrom, Paul and Robert Weber (1982) “A Theory of Auctions and Competitive Bidding,” Econometrica, 50. 18. Morgan, J. and P. Stocken (2003): “An Analysis of Stock Recommendations,” RAND Journal of Economics, 34, 183.203. 19. Morris, S. (2001), “Political Correctness,” Journal of Political Economy, 109, 231.265. 20. Morris, S. and H. Shin, “Unique Equilibrium in a Model of Self-Fulfilling Attacks,” American Economic Review 88 (1998), 587-597. 21. Myerson, R. (2010), “Moral Hazard in High Office and the Dynamics of Aristocracy,” working paper. Downloadable at http://home.uchicago.edu/rmyerson/research/power.pdf 22. Ottaviani, M. and P. N. Sorensen (2006a), “Professional advice,” Journal of Economic Theory, 126, 120.142. 23. Ottaviani, M. and P. N. Sorensen (2006b), “Reputational Cheap Talk,” RAND Journal of Economics, 37, 155.175. 24. “Global Games: Theory and Applications,” in Advances in Economics and Econometrics (Proceedings of the Eighth World Congress of the Econometric Society), edited by M. Dewatripont, L. Hansen and S.Turnovsky.Cambridge, England: Cambridge University Press (2003). 25. Riley, John and W. Samuelson (1981), “Optimal Auction,” American Economic Review, 71, 381-392. 26. Seidmann, D. J., and E. Winter (1997), “Strategic Information Transmission with Verifiable Messages,” Econometrica, 65(1), 163-170.