Table of Contents

advertisement

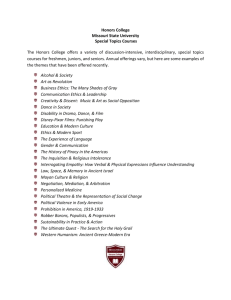

Table of Contents UNIT: CAPITALISM AND THE CORPORATION Issue: Can Capitalism Lead to Human Happiness? YES: Adam Smith, from An Inquiry Into the Nature and Causes of the Wealth of Nations (vols. 1 and 2b, 1869) NO: Karl Marx and Friedrich Engels, from The Communist Manifesto (1848) “If we will but leave self-interested people to seek their own advantage,” Adam Smith (1723–1790) argues, “the result, unintended by any one of them, will be the greater advantage of all. No government interference is necessary to protect the general welfare.” “Leave people to their own self-interested devices,” Karl Marx (1818–1883) and Friedrich Engels (1820–1895) reply, “and those who by luck and inheritance own the means of production will rapidly reduce everyone else to virtual slavery. The few may be fabulously happy, but all others will live in misery.” Issue: Is Risk the Best Theory for Capitalism? YES: Simon Johnson and James Kwak, from “The New World of Financial Risk,” Financial Executive (January/February 2009) NO: Barry Eichengreen, from “The Last Temptation of Risk,” The National Interest (May/June 2009, pp. 8–14) Simon Johnson and James Kwak argue that risk always has been and always will be a vital ingredient in the making of profits. They explain that when imprudent risks are taken whether in life or in business, the consequences can be harmful for many, not just the risk taker. The consequences of bad risks do not change their views on the value of risk in business. Barry Eichengreen believes that economists have overrated risk as the essential feature for a successful business. He believes much of the economic collapse of 2008 was caused by inappropriate risks that perhaps economic theories sanctioned, but should have never been practiced. Issue: Is Increasing Profits the Only Social Responsibility of Business? YES: Milton Friedman, from “The Social Responsibility of Business Is to Increase Its Profits,” The New York Times Magazine (September 13, 1970) NO: Peter Karoff, from “The First Rule of Corporate Social Responsibility Is Not What You Think,” Stanford Social Innovation Review (December 10, 2012) Milton Friedman argues that businesses have neither the right nor the ability to make social responsibility a priority. Profit making must be the priority. Businesses serve employees and customers best when they do their work with maximum efficiency. The only restrictions on the pursuit of profit that Friedman accepts are the requirements of law and the “rules of the game” (“open and free competition without deception or fraud”). Peter Karoff believes that even in the absence of legal requirements, businesses must ensure that their products are safe and healthy. They must be just, practicing fairness in their dealings with vendors, customers, employees, and fellow citizens. Like other citizens who have prospered, they may fairly be expected to “give back” to the community in return for its protections and encouragements, in the form of support for charity, the schools and colleges, and the arts. Issue: Can Ethics Codes Build “True” Corporate Ethics? YES: Eric Krell, from “How to Conduct an Ethics Audit: An Ethics Audit Can Reveal Gaps in Your Ethics Policies and Practices,” HR Magazine (April 2010, pp. 48–51) NO: Greg Young and David S. Hasler, from “Managing Reputational Risks: Using Risk Management for Business Ethics and Reputational Capital,” Strategic Finance (November 2010, pp. 37–46) Eric Krell finds that one of the major corporate goals of the human resource office is to build true corporate ethics. He believes this can be done with a code of ethics, through performance reviews, and with ethics audits. Through this process, employees’ good and corporate good can become the same. Greg Young and David S. Hasler believe that strengthening the role of ethical and reputational capital has been given the short shrift within corporations. It may be that one day ethics audits and ethics codes could be essential in building capital. However, they state that until management understands that poor ethics make for poor profits, business practices will continue to ignore the place of an ethics core within their organization. UNIT: CURRENT BUSINESS ISSUES Issue: Was the Financial Industry Responsible for the Economic Meltdown of 2008? YES: John C. Bogle, from “A Crisis of Ethic Proportions,” The Wall Street Journal (April 21, 2009) NO: Lloyd C. Blankfein, from “Causes and Consequences of the Financial Crisis,” Permanent Senate Subcommittee on Investigations (June 2010) John C. Bogle explains there has been a broad deterioration in traditional ethical standards in the commerce, business, and financial industry. Easy credit and securitization were not the causes of the collapse, he contends, but rather trust and trustworthiness were missing throughout the decline leading to 2008. Lloyd C. Blankfein, chief executive officer of Goldman Sachs at the time, explains to a Senate panel that his investment banking firm did not sound the “alarm” as soon as they should have when it appeared the financial collapse was imminent. Issue Should the Government Be Responsible to Bailout Financial Institutions to Avert an Economic Disaster? YES: Roger Lowenstein, from “Great Recession,” The End of Wall Street (Penguin Press, 2010, pp. 273–284) NO: Robert J. Samuelson, from “The Perils of Prosperity,” Newsweek (February 10, 2010), cited in The Great Inflation and Its Aftermath: The Past and Future of American Affluence (Random House, 2010) Roger Lowenstein details the collapse of the market of 2008 in a bleak excerpt from his book. The only ethical perspective for the American people to avoid a complete economic calamity was a government bailout. Robert J. Samuelson explains in an excerpt from his book that economies go boom and bust. He posits that in the future it is a better economic policy to allow an economy to naturally bust than to have government intervention. Issue: Are the Risks of Derivatives Manageable? YES: Yong Chen, from “A Not-So-Risky Business,” Pamplin (2010) NO: Thomas A. Bass, from “Derivatives: The Crystal Meth of Finance,” The Huffington Post (May 5, 2009) The unwise use of derivative instruments has nearly collapsed the U.S. and global stock markets recently. Promises have been made to regulate these far-reaching financial strategies. However, Yong Chen explains that financial derivatives are under attack as an important and ethical investment practice. This short article provides an explanation of the continuing national and global use of derivatives as safe instruments in hedge funds. The entire article can be found in the Journal of Financial and Quantitative Analysis (September 2011, pp. 1073–1106) under the title of “Derivatives Use and Risk Taking.” Thomas A. Bass claims the recent market failures were due in large part to mismanagement of these derivative investments. He compares the gambling risks associated with derivatives to the addictive drug crystal meth. In this article, he recommends widespread regulation of these instruments or no use of them at all. Issue: Is the Federal Reserve Good for Business? YES: Daniel Indiviglio, “Why We Need the Fed,” The Atlantic (January 14, 2011) NO: Robert Larson, “Fed Up: The Federal Reserve’s Balance Sheet Is Exploding on Both Sides,” Dollars and Sense (March/April 2011, pp. 20–24) Daniel Indiviglio explains that historically the Federal Reserve was introduced to stabilize the financial systems throughout the United States. This organization has numerous powers available to control interest rates and inflation. Ethically, for Indiviglio, the Federal Reserve is needed to maintain fairness and stability throughout the monetary system. Robert Larson argues that the Federal Reserve has outlived its usefulness. He believes that the organization makes money too easily and inexpensively available for the marketplace. He believes this creates artificial economic and ethical problems that could easily be solved if the Federal Reserve no longer existed. Issue: Is It Ethical for Big Pharmaceutical Companies to Discourage Generic Drugs’ Access to the Market? YES: Agnes Shanley, from “Legitimate Concerns over Patent Protection, Profits and Shareholder Value are Being Balanced by Ethics and Humanism,” Pharmaceutical Manufacturing (2005) NO: Arthur Caplan and Zachary Caplan, from “How Big Pharma Rips You Off,” CNN (April 25, 2013) Agnes Shanley argues that the enormous cost of developing a new drug justifies attempts to protect its exclusive access to the market after the patent has expired. Arthur Caplan and Zachary Caplan are skeptical of the “staggering cost” claims, and argue that consumers should have access to the generic version of the drug as soon as possible. UNIT: HUMAN RESOURCES: THE CORPORATION AND EMPLOYEES Issue: Does Blowing the Whistle Violate Company Loyalty? YES: Sissela Bok, from “Whistleblowing and Professional Responsibility,” New York University Education Quarterly (Summer 1980) NO: Robert A. Larmer, from “Whistleblowing and Employee Loyalty,” Journal of Business Ethics (vol. 11, 1992) Philosopher Sissela Bok asserts that although blowing the whistle is often justified, it does involve dissent, accusation, and a breach of loyalty to the employer. Robert A. Larmer argues, on the contrary, that putting a stop to illegal or unethical company activities may be the highest type of loyalty an employee can display. Issue: Is Employer Monitoring of Employee Social Media Justified? YES: Brian Elzweig and Donna K. Peeples, from “Using Social Networking Web Sites in Hiring and Retention Decisions,” SAM Advanced Management Journal (Autumn 2009, pp. 27–35) NO: Steven Greenhouse, from “Even if It Enrages Your Boss, Social Net Speech Is Protected,” The New York Times (January 21, 2013) Brian Elzweig and Donna K. Peeples write that although employers do need to be respectful of their employees’ privacy, they also have the responsibility to avoid negligent hiring and negligent retention. They find that the monitoring an employee’s, or a potential employee’s, social media is a viable way to avoid these potentially serious problems. This is not to say that an employer’s monitoring of social media should be without limits. Special care should be taken in respect to state privacy laws regarding the protection of employees outside of company time. Steven Greenhouse explains that new findings from the National Labor Relations Board state it is illegal for employers to fire employees based on social media posts. Often when an employee begins a job, part of the policy discussion revolves around social media use. In the majority of cases, the employee is told not to post materials that make the firm, the employer, and other employees appear in a bad light. It appears that many firms should begin rewriting their policy manuals based on the findings from the National Labor Relations Board as well as state law. Issue: Is CEO Compensation Justified by Performance? YES: Ira T. Kay, from “Don’t Mess with CEO Pay,” Across the Board (January/February 2006) NO: Edgar Woolard, Jr., from “CEOs Are Being Paid Too Much,” Across the Board (January/February 2006) Ira T. Kay, a consultant on executive compensation for Watson Wyatt Worldwide, argues that in general the pay of the CEO tracks the company’s performance, so in general CEOs are simply paid to do what they were hired to do—bring up the price of the stock to increase shareholder wealth. Edgar Woolard, Jr., a former CEO himself, holds that the methods by which CEO compensation is determined are fundamentally flawed, and he suggests some significant changes. Issue: Will Robots Help the American Worker? YES: Jeffrey R. Young, from “The New Industrial Revolution: A Coming Wave of Robots Could Redefine Our Jobs. Will That Redefine Us?” The Chronicle Review (March 29, 2013, pp. B7–B9) NO: Mark Kingwell, from “The Barbed Gift of Leisure,” The Chronicle Review (March 25, 2013, pp. B13–B16) Jeffrey R. Young explains that automation is cheap and efficient. Although technology’s increasing versatility may take some jobs away from humans, robots primarily will absorb the drudgery that humans may be glad to be rid of. He foresees a future of increased leisure and creativity for us. Mark Kingwell focuses on what it means to be human rather than machine and to live in a culture and community with other human beings. He argues that we are used to deriving much of the meaning of our lives from our work, and wonders what individuals might do with their leisure time. UNIT: CONSUMER ISSUES Issue: Should Advertising Directed at Children Be Restricted? YES: Stephanie Clifford, from “A Fine Line When Ads and Children Mix,” NewYorkTimes.com (February 14, 2010) NO: Patrick Basham and John Luik, from “A Happy Meal Ban Is Nothing to Smile About” (November 9, 2010), cato.org Stephanie Clifford cites studies that show that advertising for children is often barely distinguishable from regular programming. She cites harm that can come to children through advertising that seems more promotion than fact to the child. Patrick Basham and John Luik find no credence in studies linking harms to child-directed advertising. They cite research that contends that advertising has little effect on the market associated with children. Issue: Should We Require Labeling for Genetically Modified Food? YES: Gary Hirshberg, from “Why Labeling Makes Sense” (2013), Just Label it.com NO: Cameron English, from “GMO Foods: Why We Shouldn’t Label (Or Worry About) Genetically Modified Products” (2012), PolicyMic.Com Gary Hirshberg claims that the consumers’ interests in knowing where their food comes from does not necessarily have to do with the chemical and nutritional properties of the food. Kosher pastrami, for instance, is identical to the nonkosher product, and dolphinsafe tuna is still tuna. But we have an ethical and personal interest in knowing the processes by which our foods arrive on the table. He argues that the demand for a label for bioengineered foods is entirely legitimate. Cameron English points out that as far as the law is concerned, only the nutritional traits and characteristics of foods are subject to safety assessment. Labeling has been required only where health risks exist, or where there is danger that a product’s marketing claims may mislead the consumer as to the food’s characteristics. Breeding techniques have never been subject to labeling, nor should genetic engineering techniques, English claims. UNIT: GLOBAL OBJECTIVES Issue: Should Patenting Genes Be Understood as Unethical? YES: Jeffrey A. Rosenfeld and Christopher E. Mason, from “The Supreme Court Should Invalidate the Patent on Human DNA,” The Washington Post (April 5, 2013) NO: Annabelle Lever, from “Ethics and the Patenting of Human Genes,” The Journal of Philosophy, Science and Law (vol. 1, November 2001) Jeffrey Rosenfled and Christopher Mason argue that the patenting of genes is unethical and that reexamination of gene patenting is necessary. By citing the example of Jonas Salk and polio, they find that overall health is harmed through the patent process when the results are expensive drugs, research, and procedures. Annabelle Lever contends that gene patenting is already pervasive and has brought much good to overall medical research and human health. She believes the overall public good is improved when researchers are rewarded for their innovations. Issue: Is Hydrofracking a Safe Practice? YES: Danny Hakim, from “Gas Drilling Is Called Safe in New York.” The New York Times (January 3, 2013) NO: Ben Goldfarb, from “Hydrofracking Poses Serious Risks to Human Health,” Policymic (May 2012) Danny Hakim reports that the New York Health Department will be issuing a report claiming that the practice of hydrofracking is safe as it is practiced in the state of New York; after significant pressure from the drilling industry and landowners, the moratorium on hydrofracking was lifted for the Southern Tier of the state in the summer of 2012. Ben Goldfarb disagrees, citing a recently released Environmental Protection Agency report that links hydraulic fracturing to contaminated well-water in Wyoming. He also points out that an abundance of clean water is needed for the process—a commodity which is scarce in the western United States. Issue: Should the World Continue to Rely on Oil as a Major Source of Energy? YES: Red Cavaney, from “Global Oil Production about to Peak? A Recurring Myth,” World Watch (January–February 2006) NO: James Howard Kunstler, from The Long Emergency (Grove/Atlantic, 2005) Red Cavaney, president and chief executive officer of the American Petroleum Institute, argues that recent revolutionary advances in technology will yield sufficient quantities of available oil for the foreseeable future. James Howard Kunstler contends that the peak of oil production, Hubbert’s Peak, was itself the important turning point in our species’ relationship to petroleum. Unless strong conservation measures are put in place, the new scarcity will destroy much that we have come to expect in our lives. Issue: Does the 2012 Wal-Mart Case Show the Foreign Corrupt Practices Act Is Obsolete? YES: Jeffrey Miron, from “Prosecute Wal-Mart, but Get Rid of Anti-Bribery Law,” CNN.com (April 26, 2012) NO: Charlie Savage, from “With Wal-Mart Claims, Greater Attention on a Law,” The New York Times (April 25, p. 1, 2012) Jeffrey Miron complains that the law isn’t enforced and is a needless and confusing regulation for businesses in the United States and abroad. He recommends the courts prosecute Wal-Mart for the numerous areas where they have broken the law. Then he advises the act be abolished. Charlie Savage explains the Foreign Corrupt Practices Act (FCPA) has been a law since 1977 and is highly important. The purpose of the act centers on anti-bribery requirements that make it unlawful (for U.S. persons) to make a payment to a foreign official for the purpose of obtaining or retaining business for or with any person, or directing business to any person. At all costs, he believes that honest business practices must be upheld by the FCPA.