Chapter 9

advertisement

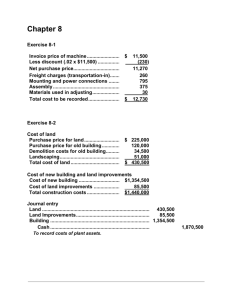

Chapter 9 1. ________________ are resources owned by a business that enable it to produce the goods/service that are sold to customers. 2. What is the difference between tangible and intangible assets? 3. Under the cost principle what amounts should be recorded as a cost of a long-lived asset? 4. To ________ a cost is to record it as an asset rather than an expense. 5. What is the difference between ordinary repairs and extraordinary repairs? How is each accounted for? 6. American Golf Corporation operates over 170 golf courses throughout the country. For each of the following items, enter the correct letter to show whether the cost should be capitalized ( C ) or expensed (E). ___ Purchased a golf course in Orange County, California. ___ Paid a landscaping company to clear one hundred acres of land on which to build a new course. ___ Paid a landscaping company to apply fertilizer to the fairways on its Coyote Hlls Golf Course. ___ Hired a building maintenance company to build a 2,000 square foot addition on a clubhouse. ___ Hired a building maintenance company to replace the locks on a clubhouse and equipment shed. ___ Paid an advertising company to create a campaign to build goodwill. 7. For each of the following items, enter the correct letter to the left to show whether the expenditure should be capitalized ( C ) or expensed ( E ). ___ Paid $600 for ordinary repairs. ___ Paid $16,000 for extraordinary repairs. ___ Paid cash, $200,000, for addition to old building ___ Paid $250 for routine maintenance ___ Purchased a machine, $70,000; gave long-term note. ___ Purchased a patent, $45,300 cash. ___ Paid $20,000 for monthly sales. 8. _________________ is the allocation of the cost of long-lived tangible assets over their productive lives. 9. _________________ is the name given to allocating the cost of intangible assets over their limited useful lives. 10. What two accounts are used to record depreciation? And what statements does each of these accounts affect? 11. ____________ is the acquisition cost of an asset less accumulated depreciation. 12. What is the only tangible asset that is not depreciated because it has an unlimited useful life? 13. What are the three depreciation methods? 14. What is the formula for the straight line method? 15. What is the formula for the Units-of-Production method? 16. What is the formula for the Declining-Balance Method? 17. Calculate the book value of a two-year old machine that cost $200,000, has an estimated residual value of $40,000 and has an estimated useful life of four years. The company uses straight-line depreciation. (Calculate the depreciation for each year and subtract from the cost to find book value of the two-year old machine) 18. Calculate the book value of a two-year old machine that costs $200,000, has an estimated residual value of $40,000, and has an estimated useful life of 20,000 machine hours. The company uses units-of-production deprecation and ran the machine 3,000 hours in year 1 and 8,000 hours in year 2. (Calculate the depreciation for each year and subtract from the cost to find book value of the two-year old machine) 19. Calculate the book value of two year-old machine that cost $200,000, has an estimated residual value of $40,000, and has an estimated useful life of four years. The company uses doubledeclining-balance depreciation. Round to the nearest dollar. (Calculate the depreciation for each year and subtract from the cost to find book value of the two-year old machine) 20. Plastic Works Corporation bought a machine at the beginning of the year at a cost of $12,000. The estimated useful life was five years, and the residual value was $2,000. Assume that the estimated productive life of the machine is 10,000 units. Expected annual production was: year 1 3,000 units; year 2 3,000 units; year 3 2,000 units; year 4 1,000 units, and year 5 1,000 units. Complete a depreciation schedule for each of the alternative methods. Year one has been completed for you. a. Straight-line: Income Statement Balance Sheet Computation Depreciation Expense Cost Accumulated Depreciation Book Value $12,000 1 ($12,000 - $2,000) x 1/5 $2,000 $12,000 $2,000 10,000 2 ($12,000 - $2,000) x 1/5 2,000 12,000 4,000 8,000 Year At acquisition 3 4 5 2,000 b. Units-of-production ( Year At acquisition 1 ? ) ? = $1.00 per unit of output Computation Depreciation Expense Cost Accumulated Depreciation $1 x 3,000 units $3,000 $12,000 $3,000 Book Value $12,000 9,000 2 3 4 5 2,000 c. Double-declining-balance: Year At acquisition 1 Computation ($12,000 - $0) x 2/5 Depreciation Expense Cost Accumulated Depreciation $4,800 $12,000 $4,800 Book Value $12,000 7,200 2 3 4 2,000

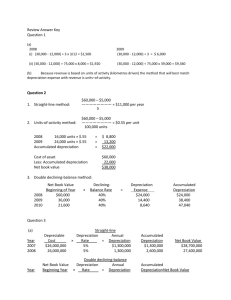

![Quiz chpt 10 11 Fall 2009[1]](http://s3.studylib.net/store/data/005849483_1-1498b7684848d5ceeaf2be2a433c27bf-300x300.png)