Chapter 18 The Keynesian Model 1. The popular theory prior to the

advertisement

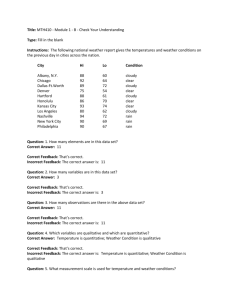

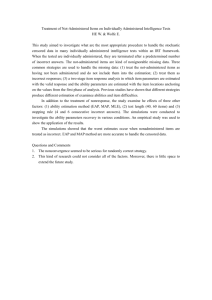

Chapter 18 The Keynesian Model 1. The popular theory prior to the Great Depression that the economy will automatically adjust to achieve full employment in the long run is a. supply-side economics. b. Keynesian economics. c. classical economics. d. mercantilism. ANS a. Incorrect. This is fiscal policy based on increases in aggregate supply. b. Incorrect. This is the theory that the economy will not automatically adjust to full employment and discretionary fiscal is required. c. Correct. The popular theory prior to the Great Depression that the economy will automatically adjust to achieve full employment is classical economics. d. Incorrect. This is a policy to maximize a nation’s gold. 2. The French economist Jean-Baptiste Say transformed the equality of total output and total spending into a law that can be expressed as a. unemployment is not possible in the short run. b. demand and supply are never equal. c. supply creates its own demand. d. demand creates its own supply. ANS a. Incorrect. Say’s Law was a long-run theory-unemployment was possible in the short run. b. Incorrect. Say’s Law does not rule out the possibility that demand and supply can be equal. c. Correct. The French economist Jean-Baptiste Say transformed the equality of total output and total spending into a law that can be expressed as “supply creates its own demand.” d. Incorrect. Say’s Law is “supply creates its own demand.” 3. If the economy is experiencing less than full equilibrium, the Keynesian school recommends that the government a. do nothing to stimulate the economy. b. undertake fiscal policy to stimulate aggregate demand. c. undertake fiscal policy to stimulate aggregate supply. d. balance the budget to stimulate aggregate demand. 1 ANS a. Incorrect. If the economy is experiencing unemployment equilibrium, the Keynesian school recommends that the government undertake fiscal policy to stimulate aggregate demand. b. Correct. If the economy is experiencing unemployment equilibrium, the Keynesian school recommends that the government undertake fiscal policy to stimulate aggregate demand. c. Incorrect. If the economy is experiencing unemployment equilibrium, the Keynesian school recommends that the government undertake fiscal policy to stimulate aggregate demand. d. Incorrect. Keynesian school advocates deficit spending to stimulate aggregate demand. 4. The school of thought that emphasizes the natural tendency for an economy to move toward equilibrium full employment is known as the a. Keynesian school. b. supply-side school. c. noninterventionist school. d. classical school. ANS a. Incorrect. This school believes there is such natural tendency. b. Incorrect. This school advocates increases in aggregate supply to achieve fullemployment equilibrium. c. Incorrect. This theory believes macro policy can be negated by people anticipating the effects of policy. d. Correct. The school of thought that emphasizes the natural tendency for an economy to move toward equilibrium full employment is known as the classical school. 5. What is the title of the John Maynard Keynes's book published in 1936 that challenged the classical self-correction economic theory? a. In the Long-Run We Are Dead. b. Classical Economics Revised. c. General Theory of Employment, Interest, and Money. d. A Keynesian Approach to Economic Policy. ANS a. Incorrect. Answer c. gives the correct title. b. Incorrect. Answer c. gives the correct title. c. Correct. This is the correct title of Keynes’s book. d. Incorrect. Answer c. gives the correct title. 6. What is the vertical intercept of the consumption function that represents the portion of consumption expenditure not associated with a level of disposable income? a. consumption intercept b. disposable income intercept c. autonomous consumption d. automatic consumption line 2 ANS a. Incorrect. This is a meaningless term. b. Incorrect. This is a meaningless term. c. Correct. The vertical intercept of the consumption function that represents the portion of consumption expenditure not associated with a level of disposable income is known as autonomous consumption. d. Incorrect. This is a meaningless term. 7. John Maynard Keynes's central proposition that a dollar increase in disposable income would increase consumption, but by less than the increase in disposable income implies a marginal propensity to consume (MPC) that is a. greater than or equal to one. b. equal to one. c. less than one but greater than zero. d. negative. ANS a. Incorrect. John Maynard Keynes's central proposition that a dollar increase in disposable income would increase consumption, but by less than the increase in disposable income implies a marginal propensity to consume (MPC) that is less than one but greater than zero. b. Incorrect. The MPC is less than one but greater than zero. c. Correct. The MPC is less than one but greater than zero. d. Incorrect. The MPC is less than one but greater than zero. 8. The marginal propensity to consume (MPC) is the slope of the a. GDP curve. b. disposable income curve. c. consumption function. d. autonomous consumption curve. ANS a. Incorrect. The marginal propensity to consume (MPC) is the slope of the . consumption function. b. Incorrect. The marginal propensity to consume (MPC) is the slope of the . consumption function. c. Correct. The marginal propensity to consume (MPC) is the slope of the . consumption function. d. Incorrect. The marginal propensity to consume (MPC) is the slope of the . consumption function. 3 9. The sum of the marginal propensity to consume (MPC) and the marginal propensity to save (MPS) always equals a. 1. b. 0. c. the interest rate. d. the marginal propensity to invest (MPI). ANS a. Correct. The sum of the marginal propensity to consume (MPC) propensity to save (MPS) always equals 1. b. Incorrect. The sum of the marginal propensity to consume (MPC) propensity to save (MPS) always equals 1. c. Incorrect. The sum of the marginal propensity to consume (MPC) propensity to save (MPS) always equals 1. d. Incorrect. The sum of the marginal propensity to consume (MPC) propensity to save (MPS) always equals 1. 10. The relationship between MPC and MPS is a. 1 + MPC = MPS. b. 1 – MPC = MPS. c. 1 + MPS = MPC. d. MPC – MPS = 1. ANS a. Incorrect. Answer b. gives the correct formula. b. Correct. The relationship between MPC and MPS is 1 – MPC = MPS. c. Incorrect. Answer b. gives the correct formula. d. Incorrect. Answer b. gives the correct formula. 11. If the marginal propensity to consume = 0.75, then a. the marginal propensity to save = 0.75. b. the marginal propensity to save = 1.33. c. the marginal propensity to save = 0.20. d. the marginal propensity to save = 0.25. ANS a. Incorrect. See the correct calculation in answer d. b. Incorrect. See the correct calculation in answer d. c. Incorrect. See the correct calculation in answer d. d. Correct. MPS = (1 - MPC) = 1 - 0.75 = 0.25. 4 and the marginal and the marginal and the marginal and the marginal Real consumption (trillions of dollars per year) Exhibit 10 Consumption function 8 6 Consumption Function 4 2 45o 0 2 4 6 8 Real disposable income (trillions of dollars per year) 12. As shown in Exhibit 10 autonomous consumption is a. 0. b. $2 trillion. c. $4 trillion. d. $6 trillion. e. $8 trillion. ANS a. Incorrect. This is not the vertical intercept of the consumption function. b. Correct. This is the vertical intercept of the consumption function. c. Incorrect. This is not the vertical intercept of the consumption function. d. Incorrect. This is not the vertical intercept of the consumption function. 13. As shown in Exhibit 10, savings occurs a. at 0. b. between 0 and $4 trillion. c. where disposable income is greater than $4 trillion. d. at $2 trillion. 5 ANS a. Incorrect. After $4 trillion, consumption read on the vertical axis is less than disposable income read on the horizontal axis, and savings occurs. b. Incorrect. After $4 trillion, consumption read on the vertical axis is less than disposable income read on the horizontal axis, and savings occurs. c. Correct. After $4 trillion, consumption read on the vertical axis is less than disposable income read on the horizontal axis, and savings occurs. d. Incorrect. After $4 trillion, consumption read on the vertical axis is less than disposable income read on the horizontal axis, and savings occurs. 14. As shown in Exhibit 10, dissaving occurs a. at $5 trillion. b. between 0 and $4 trillion. c. where disposable income is greater than $4 trillion. d. at $8 trillion. ANS a. Incorrect. Below $4 trillion, consumption read on the vertical axis is greater than disposable income read on the horizontal axis, and dissaving occurs. b. Correct. Below $4 trillion, consumption read on the vertical axis is greater than disposable income read on the horizontal axis, and dissaving occurs. c. Incorrect. Below $4 trillion, consumption read on the vertical axis is greater than disposable income read on the horizontal axis, and dissaving occurs. d. Incorrect. Below $4 trillion, consumption read on the vertical axis is greater than disposable income read on the horizontal axis, and dissaving occurs. 15. As shown in Exhibit 10, the marginal propensity to consume (MPC) is a. 0.33. b. 0.50. c. 0.67. d. 0.75. ANS a. Incorrect. The marginal propensity to consume (MPC) equals the slope of the consumption function. MPC = change in consumption/change in disposable income= $2 trillion/$4 trillion = 0.50. b. Correct. The marginal propensity to consume (MPC) equals the slope of the consumption function. MPC = change in consumption/change in disposable income= $2 trillion/$4 trillion = 0.50. c. Incorrect. The marginal propensity to consume (MPC) equals the slope of the consumption function. MPC = change in consumption/change in disposable income= $2 trillion/$4 trillion = 0.50. d. Incorrect. The marginal propensity to consume (MPC) equals the slope of the consumption function. MPC = change in consumption/change in disposable income= $2 trillion/$4 trillion = 0.50. 6 16. As shown in Exhibit 10, the break-even income is a. $2 trillion. b. $4 trillion. c. $6 trillion. d. $8 trillion. ANS a. Incorrect. The break-even income occurs where the consumption function intersects the 45 degree line at $4 trillion. b. Correct. The break-even income occurs where the consumption function intersects the 45 degree line at $4 trillion. c. Incorrect. The break-even income occurs where the consumption function intersects the 45 degree line at $4 trillion. d. Incorrect. The break-even income occurs where the consumption function intersects the 45 degree line at $4 trillion. 17. As shown in Exhibit 10, the 450 line represents a. autonomous consumption. b. real consumption spending. c. real disposable income. d. all points where real consumption equals real disposable income. a. Incorrect. Autonomous consumption occurs where the consumption function intersects the vertical axis (real consumption spending). b. Incorrect. Real consumption spending is represented by the consumption function line. c. Incorrect. Real disposable income is measured on the horizontal axis. d. Correct. Only where the consumption function intersects the 450 line does it equal real disposable income. 18. The consumption function is drawn on a graph with disposable income on the horizontal axis. Assume investment is autonomous consumption increases.. The effect is a. an upward adjustment in the vertical intercept. b. no change in the adjustment in the vertical intercept. c. an increase in the slope of the consumption function. d. a decrease in the slope of the consumption function. ANS a. Correct. An equal amount of consumption (C) is added at each level of disposable income (DI), and the vertical intercept increases. b. Incorrect. An equal amount of consumption (C) is added at each level of disposable income (DI), and the vertical intercept increases. c. Incorrect. The slope is determined by the MPC. d. Incorrect. The slope is determined by the MPC. 7 19. The investment demand curve shows the amount businesses spend for investment goods at different possible a. price levels. b. levels of GDP. c. rates of interest. d. levels of taxation. ANS a. Incorrect. The investment demand curve shows the investment goods at different possible rates of interest. b. Incorrect. The investment demand curve shows the investment goods at different possible rates of interest. c. Correct. The investment demand curve shows the investment goods at different possible rates of interest. d. Incorrect. The investment demand curve shows the investment goods at different possible rates of interest. amount businesses spend for amount businesses spend for amount businesses spend for amount businesses spend for 20. A rightward shift of the investment demand curve would be caused by a (an) a. increase in the expected rate of return on investment caused by an increase in business confidence. b. decrease in the expected rate of return on investment caused by a decrease in business confidence. c. increase in the rate of interest. d. decrease in the rate of interest. ANS a. Correct. A rightward shift of the investment demand curve would be caused by an increase in the expected rate of return on investment caused by an increase in business confidence. b. Incorrect. This would cause an leftward shift. c. Incorrect. This would cause a movement along the investment curve. d. Incorrect. This would cause a movement along the investment curve. 8