Information on the Costing of Research Projects Some issues to

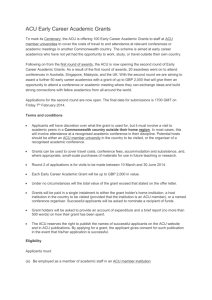

advertisement

Information on the Costing of Research Projects Some issues to consider when preparing your application Some principles - ACU projects (i.e. Grants, commercial research or research consultancy) should be fully costed. - Grants: For grants, full costs will not necessarily be sought in a grant application.The majority of competitive grant schemes do not fund indirect costs and most will have rules about ineligible budget items (e.g. Investigator salaries). Remember that the costs not funded by a grant will need to be borne by the University or by other sources, and by approving a grant application the University may be certifying that it will cover those costs. Commercial research and research consultancies: You must endeavour to seek full cost recovery for projects funded by commercial research and research consultancies, as well as pricing of tenders for commercial research and consultancies that includes a profit margin. It is a myth that the cheapest project wins the research grant or tender. I often see grant applications that have been under-costed. Applicants are often very anxious about increasing budgets, believing that a smaller budget makes their application or commercial research more competitive. For the latter category there is a “price point” that the sponsor is willing to fund and 1 we do need to have regard to not-for-profit agencies that are sometimes cash poor. Having said that, ACU does receive sub-contracts through notfor-profit agencies that have been funded by the Federal Government for a few million dollars to complete multi-state longitudinal studies. In such cases, it is reasonable to ensure full cost recovery on our sub-contracts. Quality of your application is one of the most important assessment criteria (if not the most important criterion) and costing/pricing is infrequently an assessment concern (unless you have applied for more than the maximum grant in the scheme). - Costing of Research Projects - Some basic terminology - Direct costs - Fixed or variable costs - Indirect costs/overheads/infrastructure costs - Salary on-costs - Indexation of grants - Competitive neutrality - Cost substitution - Budget justification Basic Terminology Direct Costs of a research project are all costs (from all sources: not just the items you are seeking funding for in an application or commercial research but also items funded from other sources, including ACU contributions) that can be directly attributed to a specific research project. Fixed and variable costs Fixed costs do not change, irrespective of how much or how many activities are undertaken. A fixed cost would be the development of a survey instrument that is used multiple times with different subject groups. The number of hours you 2 engage a research assistant to apply the survey instrument to subject groups is a variable cost. Indirect costs/overheads/infrastructure costs Indirect costs (often called overheads or infrastructure costs) are costs for items that are essential to a research project but cannot be accounted as a direct cost. E.G. - University facilities such as libraries and IT networks University services such as finance and accounting, research management, HR, etc. Provision of space and general infrastructure (e.g. office and laboratory furniture and equipment such as phones, faxes, desktop computers) Major research equipment and facilities that are not devoted to one specific research project. In most cases, for research grants indirect costs are calculated at 125% of academic salaries plus on-costs for laboratory based projects and 92% of academic salaries plus oncosts for non-laboratory based projects (this is a long standing policy of Universities Australia, previously known as the Australian Vice-Chancellors’ Committee). The University’s policy on “Commercial Research Conducted by Academic Staff” stipulates the apportionment of “levies” (page 6 of the policy) as – University – 10% if the funding is greater than $10,000 or 7.5% if the funding is less than $10,000 or for charitable (that is, not for profit) organisations Faculty – same as for the University distribution. (Clause 6.2.4 states, “The Faculty will determine the distribution of these funds”) Full-costing of research projects means exactly that. In practice, full project costs are calculated by adding direct and indirect costs of the research project. Pricing of research projects for commercial research or research consultancies – Unless there are good reasons not to, tenders for commercial research and research consultancies are priced by adding a profit margin to the full-cost of the research project. The profit margin is usually calculated as a percentage of academic salaries but other factors need to be taken into account, such as the market value of the services and what you are “giving up” by accepting a contract (e.g. restriction on publication). Salary on-costs should not be confused with indirect costs/overheads.They are a direct cost and comprise superannuation, workers’ compensation, payroll tax, recreation leave loading, and long-service and maternity leave provision. For research applications, tenders and commercial research, 28% is a commonly accepted level (being used by the Australian Research Council). Indexation of grants. Some government funding organisations (e.g. ARC) index successful grants. This means that grant allocations are adjusted annually to take account of increased costs. Indexation is usually less than the inflation rate. Normally, where grants are indexed the scheme guidelines will say so and may also include a rule that you are not allowed to include any contingency to account for increased costs. Competitive Neutrality is about ensuring that the business activities of publicly owned entities (including universities) compete fairly in the market when it is in the public interest for them to do so. If ACU’s commercial research is not fully costed and appropriately priced in instances where we may be competing for business with a private entity, the University may be in breach of Commonwealth Competitive Neutrality Guidelines/Legislation. 3 Cost substitution means to use grant funds to pay for budget items that, if not funded from the grant, would nonetheless be covered by ACU. E.g. You have an allocation from your Faculty of half a research assistant. You use your grant budget to reimburse the Faculty for the cost of the research assistant, as you will be using the RA for the project. Budget justification is about demonstrating in a grant application why a particular budget item is either essential or not essential but would add value. Secondly, it is about justifying the cost of the budget item. - - - - Recommend including at least 20% to 30% of non-essential justification to a research grant budget request. Most successful grant budgets are cut (especially by large agencies such as the ARC and NHMRC) and if cuts are targeted at non-essential items there will be less impact on your ability to complete the project. Commercial research is not usually associated with funding cuts but the price is negotiated to match the deliverable. Accurately pricing the cost of a deliverable is essential as you and the University can be held accountable for failure to “deliver” within the terms of the agreement. When justifying a budget item, be careful to be consistent with the described research program. For example, if you are seeking funds for a research assistant, in your justification you should describe the tasks in the research plan that the person will be responsible for performing to demonstrate that the position is indeed essential and demonstrate that the level and fraction of appointment is appropriate to the tasks to be undertaken. When grant assessors are considering whether the cost of an item is justified, they are typically drawing on their own experiences of what is reasonable. If your costing appears reasonable then little attention will be given to your cost justification. You need to pay more attention to justifying cost if you are requesting an item that is “unusual” but you can justify why the cost is unusually high (or maybe low, if a supplier is providing the item below cost). General research budget costing guide – 1. Determine and cost what ACU already has that will be essential to the project 2. Determine and cost what will be essential to the project that ACU does not have 3. Determine and cost what would add value to the project, but is not essential, that ACU does not have 4. Determine the project’s indirect costs 5. If you are applying for a grant, determine which items above are eligible budget items for the scheme your are applying to. Your grant application should seek all eligible budget items, unless you have a valid reason to seek a reduced budget (e.g. scheme limit on amount that can be requested). 6. If you are tendering for commercial research, all of items 1,2 and 4 must be included as costs to be borne by the client. You may include items from point 3. In addition, a price including a profit margin needs to be identified, taking account of your discipline/profession and what is charged by private consultants. Don’t under sell yourself. Costing of some commonly requested “direct” budget items Salaries and salary on-costs When costing salaries you must take account of the following: 4 1. Existing staff: the salary and on-cost value of the time they will spend on the project 2. Staff to be appointed with external funds: the level and fraction of personnel you will need, taking into account the role of the person in the project and ACU’s classification descriptors (outlined in the relevant Enterprise Bargaining Agreement). If you are applying for a research grant, be aware that the majority of successful grant applicants will have their budgets cut: if you can make a case for requesting a higher-level of staff and/or a higher fraction do so (if you do not request a higher-level you may end up with insufficient funds to employ the level and/or fraction of staff you need for the project). 3. Salary on-costs: calculate at the rate of 28% regardless of the type of appointment. 4. Appointment expenses: your Faculty or Institute Administration Office should be able to advise you about how much you should budget for appointment expenses. HR may also be in a position to provide advice as they have an institutional perspective and deal with new staff appointments and transfers on a regular basis. Appointment expenses can vary depending on where you wish to advertise, what relocation expenses if any should be offered to successful candidates, and whether you require shortlisted applicants based outside of your city/town to be interviewed in person or by phone. For grant application budgets, check funding rules carefully as many schemes will not fund this expense (in which case the Faculty or Institute would need to cover the expense). 5. Use salary rates that will be current for the proposed period of employment. Take into account Enterprise Bargaining increases. If the project runs beyond the current Enterprise Bargaining Agreement, use 4% per year for years not covered by an Agreement (this is an indicative amount). 6. Take salary increments into account and accrued leave of new staff . If you appoint someone from within ACU, the appointee could be at the top of their scale and may also have accrued long service and recreation leave that is due. You don’t want to inherit someone else’s financial liabilities! 7. If your project is collaborative and involves the appointment of staff by collaborating organisations, their own salary scales (not ACU’s) should be used for those staff. 8. If you are applying for a salary for a named “research fellow”, check the scheme funding rules carefully. Salary levels and on-costs may be prescribed by the Scheme. If they are prescribed and the equivalent ACU salary is higher, then if successful the appointment would have to be made at the higher salary level with ACU paying the difference (normally the Faculty or Institute). A Faculty or Institute may also choose to “top-up” a fellowship salary to entice an attractive candidate. 9. Your Faculty or Institute Administration Office may be able to check your draft salaries budget for correctness or seek advice from a colleague who is experienced in developing project budgets, specific to your disciplinary interests. Research Scholarships 1. If you are costing a research scholarship for a grant, check the scheme funding rules carefully. Many schemes prescribe scholarship rates as well as additional costs such as appointment expenses, relocation and thesis allowances. Some may fund 6 month extensions for PhD scholarships and others won’t. Usually where a rate is prescribed the scholarship amount will be indexed and you cannot budget a contingency amount to cover increases. 2. If the scheme does not prescribe the scholarship rate, the prevailing APA rate can be used or the current University scholarship rate. In these cases build indexation and other costs into your budget. 3. Research scholarships as part of contract research or consultancies are rare because of IP and publishing conditions. However, if you are costing one follow advice from point 2 above. 5 4. Consider whether a top-up to a requested scholarship is appropriate to give you a better chance of making an appointment if your proposal is successful. Check the scheme funding rules to determine whether top-up requests are allowed, or must be funded from another source. 5. You may also consider, where you already have a scholarship secured, seeking solely a top-up scholarship. Follow advice from point 4 above. Teaching relief/relief from other duties 1. If you are seeking teaching relief or relief from other duties from a grant scheme to allow a person to dedicate time to research, check the scheme funding rules carefully, as the scheme may prescribe limits and salary rates to be used. 2. Where limits and salary rates are not prescribed use the salary-rate and salary on-costs of the staff member to be relieved proportioned to the hours of relief being sought. Equipment 1. Equipment to be used specifically for a grant-funded project. Before costing, check the scheme funding rules carefully. In particular look out for: a. Limits (upper and lower) to funding that can be requested for equipment. b. Requirements for quotes to be either discussed or attached. c. Requirement that equipment sought from a particular scheme be required solely to support a particular project (i.e. will not be used more widely), or alternatively that funding only be sought equivalent to the fraction of use of the equipment for the project. d. Requirements for contributions towards the cost of equipment. e. Restrictions on requests for general maintenance and installation costs. 2. Grant-funded equipment to be built in-house. Many grant schemes will fund hardware required to build research equipment but will not fund workshop costs involved in building it (because workshop time is usually considered to be an indirect cost). In these cases you should cost hardware and building costs and in the grant budget just request “the equipment” without mention of it being built in-house. 3. Grant-funded expensive research infrastructure. Again, check the funding rules carefully to determine what can be sought from the scheme and what needs to be covered from other sources. Schemes funding expensive equipment often require contributions towards the cost from other sources. They also may or may not fund the costs of installation and maintenance and running costs, and if maintenance and/or running costs are funded it may only be for a specified period. Maintenance and running costs of major research infrastructure can be very expensive: if these costs will not be met (or will only be partially met) by the scheme then your Faculty or Institute may need a viable plan for these costs to be recovered (e.g. by charging users, but note the grant scheme may also place restrictions on cost recovery). 4. Equipment funded from contract research and consultancies. This is simply a matter of costing the equipment, installation costs, and maintenance and running costs for the duration of the contract (proportioned if the equipment will not be dedicated to contract project use). 5. Very important. You must let your Faculty or Institute know as early as possible if equipment to be requested will have space implications (particularly building of new or renovation of existing facilities), as approval and costing involvement from other areas of the University may be required and there are likely to be costs involved that you hadn’t envisaged. Travel 6 1. ACU’s Division of Finance website should be reviewed to ensure conformity with University travel policy - http://www.acu.edu.au/staff/services/finance/travel/ 2. Travel costs should be broken down into the following components: a. Airfares: international and local b. Accommodation c. Per-diem d. Other modes of travel (e.g. train or coach, car hire, private vehicle mileage allowance, etc.) e. Other (e.g. visa expenses) 3. If you are applying for a grant, check the scheme funding rules for any restrictions or requirements relating to travel requests. Also check general budgeting rules as there may be a requirement to use “current costs”: if there is be careful to cost full, not discounted rates, so that costs increase after award your grant may still be sufficient to purchase travel at a discount. If there is no requirement to use “current costs” you should still cost full rates but also build in a contingency line to account for cost increases (particularly given the current oil pricing climate). 4. Airfares. ACU travel policy requires nearly all staff to fly economy class (and grant schemes generally only fund economy class fares). Cost economy airfares and when seeking a quote ensure the provider has estimated travel dates (at minimum they will need to know what season (peak, shoulder, low) and year you intend to travel). Do not cost discounted airfares because (a) you will not know at time of submission of application or tender if the discount will still be available, and (b) if you are applying for a grant and you are successful your budget is likely to be cut. 5. Accommodation. Once again, do not cost discounted accommodation rates (for the same reasons mentioned above). If you intend to stay with family or friends still cost and seek funds for accommodation as the additional funds may be able to be used to offset other cost increases. Funding organisations and clients do not expect you to “rough it”, so you do not need to cost for sub-standard accommodation. On the other hand, be reasonable and don’t cost five star hotels unless you can justify the need (e.g. in some cities that might be the only “safe” accommodation). 6. Incidental travel expenses, including meals, local travel such as train, bus, taxi. ACU travel policy is to reimburse costs on production of receipts (see link to travel advice at point 1 above). It is difficult to determine what will be the cost of incidental expenses in a project less than 12 months let alone one that is over a three year period. In order to provide some benchmark for researchers to calculate incidental travel costs, including accommodation at Australian capital cities, the Australian Tax Office per diem rates for 2009/2010 should be used as a widely accepted standard. The complete URL for the 2009/2010 per diem rates is http://law.ato.gov.au/atolaw/view.htm?rank=find&criteria=OR~TXD%2FTD200721~make sref~exact:::OR~TXD%2FTD200721(%3F~makesref~exact:::OR~TXD%2FTD200721% 2FNAT%2FATO%2F00001~makesref~exact:::OR~TXD%2FTD200721%2FNAT%2FAT O%2F00001(%3F~makesref~exact:::OR~TXD%2FTD200721%2FNAT%2FATO~makesr ef~exact:::OR~TXD%2FTD200721%2FNAT%2FATO(%3F~makesref~exact&target=FA &style=java&sdocid=TXD/TD200915/NAT/ATO/00001&recStart=1&PiT=9999123123595 8&lookupdocument=TXD%2FTD200721%2FNAT%2FATO%2F00001&lookupquery=ran k%3Dfind%26style%3Dhtml%26sdocid%3DTXD%2FTD200721%2FNAT%2FATO%2F0 0001%26recStart%3D1%26PiT%3D99991231235958&lookuptitles=Determinations%20( Including%20GST%20Bulletins)~Taxation~TD%202007%2F21~Income%20tax%3A%20 what%20are%20the%20reasonable%20travel%20and%20meal%20allowance%20expen 7 se%20amounts%20for%2020072008%3F%20(As%20at%2025%20July%202007)&recnum=2&tot=2&pn=ALL:::ALL This URL is ridiculously lengthy but provides access to the per diem rates current as at June 2009. An alternative is to go to the ATO legal database and search for per diem expenses (short URL - http://law.ato.gov.au/atolaw/ ). Go to the top right hand corner of the ATO legal database page and select “all of the legal database” and then the current financial year per diem rates. 7. Travel justification issues for grants. When applying for grants there are specific travel related issues you need to consider: a. If travel budgets on grant applications are very large it can help to demonstrate that you have tried to economise (e.g. by combining trips with round-the-world tickets). However, do not try to economise through use of discounted rates or you may end up with insufficient funds to cover essential travel. b. If more than one person is travelling to a destination you will need to justify why that is essential. c. Justification of lengthy and multiple/frequent trips is normally looked at closely by grant assessors Maintenance and Other 1. The kinds of things that are costed as Maintenance and Other vary significantly between discipline areas and the type of project being proposed. 2. Please take advantage of advice available from your Faculty or Institute Administration Office and more experienced peers and always ask yourself if you might have missed something. Also, check that things you think will be available to you actually will be, when you need them (for example, the Department’s digital video recorders might be needed for student projects at the time you were hoping to use them, so you may need to request dedicated equipment in a grant application). 8