Soc.Sec.-History

advertisement

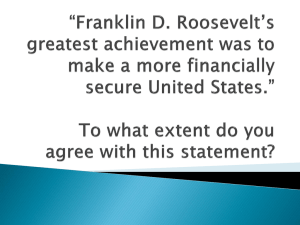

Bush revives Debate launched under FDR by David Westphal, Bee Washington Bureau Chief, (202) 383-0002 or <dwestphal@mcclatchydc.com> The Sacramento Bee, February 6, 2005, A1&A17. SOCIAL SECURITY COMES OF AGE Jan.4,1935: In a message to Congress, President Franklin D. Roosevelt, proposes assistance for poor children and for the unemployed, aged, and physically handicapped. Aug.14,1935: Roosevelt signs the Social Security Act. It provides retirement benefits to workers only. Legislation establishes threemember bipartisan SS Board to implement provisions. Sept.25,1936: The Post Office agrees to help with the enumeration of citizens for old-age benefits. More than 35 million SS Cards are issued. Sept.27,1936: Republican presidential candidate Alf Landon criticizes Social Security, calling it a “cruel hoax.” Jan.1,1937: Workers and employers become subject to a 1 percent tax on wages up to $3,000 a year. Workers begin acquiring credits toward retirement benefits. May24,1937: The Supreme Court rules that old-age pension provisions in the Social Security Act are constitutional. Aug.10,1939: Roosevelt signs legislation broadening Social Security to include dependents’ and survivors’ benefits. Jan.31,1940: Ida M.Fuller, 65, of Vermont becomes the first person to receive an old-age benefit check under Social Security. Her first check is for $22.54 and she will contnue to receive monthly payments until her death at age 100. July 1946: SSA replaces SS Board. 1950: Cost-of-living adjustments (COLAs) mandated to offset effects of inflation on fixed incomes. 1953: SSA becomes part of the Department of Health, Education and Welfare (which becomes the Department of Health and Human Servises in 1980). Sept.1954: Disability Insurance program enacted. First version pays no cash benefits but establishes a “freeze” to help prevent erosion of disabled workers’ benefits. Aug.1956: Disability program amended to provide benefits to permanently disabled workers 50 to 65 and adult children if disabled before age 18. (Today disabled workers of any age qualify.) June1961:Act amended to permit all workers to receive reduced retirement benefits at 62. July1965: Medicare program established, offering health coverage to SS beneficiaries 65 and older. July1972: A 20percent COLA authorized. Oct.1972: The Supplemental Security Income program established to oversee benefits for needy aged, blind and disabled people; begins operation in 1974. June1980: Greater work incentives for disabled beneficiaries. Aug.1981: Student benefits phased out; lump-sum death payments limited. Jan.1983: National Commission on SS Reform sends Congress recommendations to resolve SS program’s financial problems. Apr.1983: Amendments passed to augment SS financing. Provisions include taxing SS Benefits, covering federal employees, raising retirement age beginning in 2000 and increasing reserves in SS trust funds. March1995: SSA becomes an independent agency. 1996: Rules changed for disability benefits, new applicants no longer eligible if drug addiction or alcoholism is a material factor in disability. Aug.1995: SS eligibility ended for most non-citizens (modified in 1997), and eligibility rules for children are tightened. Apr.2000: Retirement earnings test eliminated, allowing beneficiaries at or above normal retirement age who continue to work to collect full benefits instead of having them reduced based on earnings. -Linkage of benefits to wages came about in the 1970s and was intended to prevent Rs and Ds from using the benefits for political points (Montagne). They also did not adjust for increased life expectancy. Over time the system grows and forever faster than the economy (?,Steurele). The retirement age 65 was the accepted age in 1940s and at that age life expectancy was 14. Now it is 20. Source: Social Security Administration Social Security: Depression spurred program As he barnstormed the nation last week to sell Americans on the idea of private Social Security accounts, president Bush was rejoining a philosophical debate that was present at the system’s founding 70 years ago. The United States was one of the last developed countries to establish a government-run retirement program, in part because of a strong national political bias against collective action and in favor of individual responsibility, historians say. By most accounts, it took the massive losses of the 1929 stock market crash and the ravages of the subsequent Great Depression to overcome those biases and produce the Social Security Act of 1935. Even then, intense debates continued over the wisdom of operating a massive government support system for the aged. ‘The Bush administration, by urging private accounts, draws upon a good deal of history,” said historian James Patterson, professor emeritus at Brown University in Rhode Island. Today, Bush is asking the nation to revisit that Depression debate, suggesting that the government shift greater responsibility back to individuals in providing for their retirements. It’s the kind of rugged individualist sentiment very much evident in the 1920s, when American financial prosperity reached a zenith and President Hoover declared the country was “in sight of the day when poverty will be banished in the nation.” Historians say the country’s self-reliance ethic had much to do with its immigrant character. “Generally speaking, only self-centered and self-reliant characters break the social bonds that hold them at home, leave neighbors and friends and stake everything on the doubtful venture of emigration to a new land,” Columbia University economist Henry Rogers Seager wrote in his 1910 book, “Social Insurance: A Program of Social Reform.” “The 27 million-odd … immigrants who have come to this country since it was discovered by Europeans have thus left a strong individualistic impress on their descendants.” Germany had operated a social insurance system for 50 years, Great Britain for nearly 25. But in the United States, the idea that the federal government should be handing out assistance to people in need remained almost unimaginable. President Franklin D. Roosevelt himself had believed that welfare should be the province of local charities supplemented by states and local governments. Then came 1929 and the stock market crash that, over the next three years, would wipe out nearly 90 percent of the market’s value. With poverty spreading across the land – by some estimates touching half the population – calls for drastic federal action built quickly. Political movements like the Townsend Plan, which proposed a then-whopping $200-a-month subsidy for every nonworking American age 60 and over, swept the country. California was a hotbed of populist ideas for supporting the aged. Novelist Upton Sinclair organized a program called End Poverty in California, which proposed $50 monthly pensions for the aged in need. A movement called “Ham and Eggs” called for giving $30 worth of special scrip every Thursday to unemployed people over 50. Roosevelt got the message. In the summer of 1934 he appointed an advisory committee, headed by Labor Secretary Frances Perkins, to study proposals for strengthening Americans’ economic security. Years later, Perkins would recall the harrowing conditions that confronted many Americans. “The specter of unemployment, of starvation, of hunger, of the wandering boys, of the broken homes …, stalked everywhere,” she said in a 1962 speech. “The unpaid rent. The eviction notices, the furniture and bedding on the sidewalk, the old lady weeping over it. The real roots of the Social Security Act were in the Great Depression of 1929,” Perkins said. “Nothing else would have bumped the American people into a Social Security system except something so shocking, so terrifying, as the depression.” In January 1935, Perkins’ committee delivered its report, and Roosevelt offered its recommendations to Congress, calling for federal old-age insurance and a federal-state package of public assistance and unemployment programs. On August 14, 1935, the president signed the historic legislation, following its approval by overwhelming majorities in the House and the Senate. Quite quickly, it seemed, no one was happy with the results. Townsend Plan supporters denounced it as far too insufficient to respond to the nation’s economic crisis. Many Republicans railed at it from the other side, with GOP presidential candidate Alf Landon calling Social Security a “cruel hoax.” It would take most of five years’ worth of start-up problems and funding debates before the first monthly benefit check was written. The recipient was Vermont resident Ida M. Fuller, 65, and the initial check was for a mere $22.54. That check symbolized Social Security’s modest beginnings – only about 20 percent of the nation was covered in the early years – but also its potential. Fuller would live to be 100 and, despite the fact that she contributed only $24.75 to the system between 1937 and 1939, she ended up receiving more than $22,000 in benefits during her 35 years as a beneficiary. With Congress adding surviving benefits (in 1939) and disability benefits (in 1956), Social Security was on its way toward becoming what former Social Commissioner Kenneth Apfel described as “the most successful, most popular domestic government program in the nation’s history.” In the early years, when workers and their employers contributed only 2 percent of wages, the benefits were meager additions to a retiree’s income. But now the employee-employer tax rate is at 12,4 percent, and Social Security is the single most important source of income for Americans 65 and over. According to the Social Security Administration, it accounts for 39 percent of elderly income; for nearly one-fourth of the elderly, it’s the only source of income. Given its popularity, Social Security has been a difficult political targetfor biggovernment opponents, and the philosophical opposition to the system has remained mostly underground for years. But with the one-two punch of a baby-boom generation about to retire and a slowgrowing work force, Social Security’s looming financial problems have given foes an opportunity to restate their grievances against a tax-supported retirement system. “President Bush is to commended for recognizing the need for personal accounts within Social Security,” said Edward Crane, president and founder of the libertarian Cato Institute. “For too long leaders in both parties have been unwilling to provide leadership in reforming this deeply flawed system. The major flaws are the lack of ownership, wealth creation and inheritability that plague the current system.” No single argument accounts for the breadth of opposition to the current system. Some critics are philosophically opposed to the idea of the government providing so large a stipend to retirees. Some say the payroll taxes are a drag on overall economic growth. Bush argues workers will simply come out ahead if they invest in the market themselves instead of having the government make its conservative investments. On that point, some historians say they see a bit of irony in the president’s reliance on the stock market to save a system that came about because of a market disaster. Michael Katz, a historian at the University of Pennsylvania, said the motivation of Social Security’s creators was “to provide the elderly with a guarantee in old age – to remove them from the destitution in which a huge proportion lived – not to give them an investment vehicle. “I believe that the founders would have considered individual accounts, or privatization, call it what you will,” said Katz, “a complete perversion of the program’s philosophy and purposes.” Notes. 1. Raising the growth rate may not do much on keeping the revenues-outlays in balance for a longer period, because wages will also rise. Observation made by Secretary Snow on February 8, 2005, ESP2. 03/01/05 Berkovitch, The History of SS, George Washington university Professor of History and Public Policy, interviewed on Terry Gross’s NPR Fresh Air. SS enjoyed low popularity in the first ten years. It is a tax and there are few beneficiaries. It gains in popularity in the 50s with increased benefits. But under Carter and democrats benefits are increased too much. The Cato Institute and others rise up to have private insurance take over. In 1983 the campaigns for IRA, TIA, Kraft gain support. Democratic politicians (Tipp O’Neal) promise more and more, republicans are beaten at the polls under Reagan. Berkovitch feels disability payments, survivor’s payments are important and will always be needed, with or without SS. Liberals are wrong in outguessing FDR, too smug. Berkowitz's books include America's Welfare State: From Roosevelt to Reagan and Social Security and Medicare: A Policy Primer.