note6

advertisement

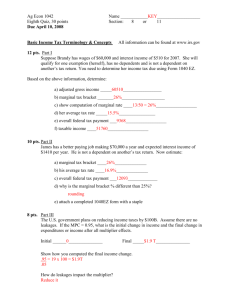

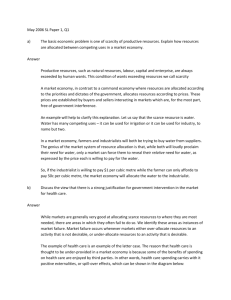

©David M. Nowlan 1999 Introductory Note on Public Goods According to the standard theory of fiscal federalism, higher levels of government – the federal or the provincial levels – should have responsibility for redistributive policies, including redistributive taxation, while the lower or municipal levels should focus on providing government goods and services efficiently with minimal redistributive effects. From this perspective, the ideal municipal tax would be a "benefits" tax, one that equated at the margin the tax cost of some service to the value of the benefit received on a person-by-person basis. Governments at all levels, including municipal governments, will normally provide goods and services that are difficult to provide, at least to provide efficiently, through the private market. These will typically be goods and services that, to some extent at least, residents share: roads, clean air, pure water, police and fire services, parks, administrative services and so on. We can begin to understand the difficulty of providing these goods and services in efficient amounts, and the equally great difficulty of paying for them through a benefits tax, by considering the nature of public goods and the conditions that are necessary theoretically for their efficient provision. The simplest form of public good, sometimes called a "pure" public good, is a good or service that, once it exists, is available to all without congestion. Its benefits may have a geographic dimension, i.e., they may be exhausted beyond some range or distance, and different people may have very different views about the value of the benefits to them, but having more people enjoy the benefits of the public good does not diminish its value to the rest. Because of this feature, public goods are said to be "nonrivalrous" in consumption. Private goods by contrast are "rivalrous." With respect to a private good, what I have you can't have; that is why they are called rivalrous. With a public good, what I have, you can have too; they are nonrivalrous. Examples of pure public goods of this sort are not easy to find, since most shared goods are subject to congestion, and if more people are to get the benefit of a congested good, then more of the good will have to be provided if the benefits to the rest are not diminished. Perhaps, at the municipal level, clean air or a good water supply come close to being pure public goods, but within limits we might also think of uncongested roads or uncongested parks and perhaps good administrative leadership as being close to what we could call pure public goods. Rare or not, let us continue to look first at the allocation of resources to pure public goods. We can back into this by recalling the conditions for efficient resource allocation to private goods. For some given rivalrous private good -- a bottle of beer, a loaf of bread – the efficiency conditions are that every consumer's marginal valuation, MV, of the good must be the same and this common MV must equal the marginal resource cost of the good, the MC. If we had a set of consumers, A, B, C and so on then the efficient allocation of resources to private good X requires that MVA = MVB = MVC = …… = MCX . If you think about it, you'll appreciate that a competitive market achieves exactly this result. Every consumer and every producer is a price-taker; the consumers adjust their consumption amounts, shown by their demand curves, so that the price just equals each persons MV of the good, and the producers adjust their supply so that the price equals their marginal cost. Thus, the price functions as a signal, signalling forward to the consumers who adjust demand and backward to producers who adjust supply. In equilibrium, there is just one price and it serves to bring MVs and MCs into line. Thinking in terms of demand curves, you will recall that the market demand curve for a private product is just the summation horizontally of each consumer's demand curve, and the equilibrium price will be where this market demand curve cuts the market supply curve. This price then reflects back to each consumer's demand curve and determines quantity consumed. The efficient allocation of resources to pure public goods looks quite different. Because a pure public good is available to benefit everybody, we must now compare the sum total of everybody's marginal valuation of the good to the marginal resource cost of producing the good. [Notice that even if the benefits of the good are exhausted beyond some geographic range – say outside the municipal jurisdiction – we can still write about its being available to "everybody" and simply assign a zero MV to anybody who is beyond the effective range of the good or service.] This is equivalent to writing, for our hypothetical community of person A, person B, person C etc., the following as the efficiency condition: MVA + MVB + MVC + …. = MCG, where "G" is our pure public good. This efficiency condition may be illustrated by the accompanying diagram 1, which shows the demand curves of three individuals, DA, DB and DC. These represent the marginal valuation curves and the efficiency condition given above implies that the three curves should be added vertically, in contrast with the horizontal addition of private-good demand curves, to get a community demand curve, SUMD, which should equal the public good's marginal cost at point of optimal provision, G* on the diagram. Diagram 1 40 $ 35 30 DA DB DC SUM D MC 25 20 15 10 tC 5 tB tA G* 0 1 2 3 G amount of public good (The representation of the optimality condition through the vertical summation of stable demand curves is not completely general. Because of income effects, these demand curves may move about, depending on the payment scheme that is implemented. Only if the income elasticity of demand for the public good is zero will the demand curves remain stable. The first-order optimality condition MV i MCG is completely general; the vertical summation of demand i curves is a useful heuristic device to illustrate the condition.) In order for a government to provide optimal amounts of a public good, the marginal valuations of all members of the community for different amounts of the public good must be known, so the government will know when the optimality condition is being met. There is no such need for centralized knowledge in the case of competitive private-good markets. The price in a privategood market adjust up or down depending on whether there is excess demand or supply, and each buyer and seller adjust his or her buying and selling action to the market price. This is said to be an efficient decentralized mechanism for allocating resources to private goods. As Samuelson noted in his 1954 article ("The Pure Theory of Public Expenditures," Review of Economics and Statistics,vol. XXXVI, November 1954, 387-389), the basic problem of public good provision is that there is no decentralized pricing or signalling scheme that can be used to lead governments to efficient levels of public-good output. If people in the community are simply asked about their preferences, as reflected in marginal public good valuations at different levels of provision they will have strong incentives to give misleading answers, to lie about their true preferences. The type of bias in the community's answers depends on what the people think will be the payment scheme for the public good. Suppose people are told, or believe, that they will be charged an amount that reflects their own personal valuation of the good. In terms of the accompanying diagram, this would mean that if persons A, B and C reported DA, DB and DC as their respective marginal valuation schedules, then the authorities would provide G* of the public good and charge tA per unit of the good to person A, tB to person B and tC to person C. In this way the cost of the public good would be covered and each person would pay a "price" that just equalled his or her stated marginal valuation. Suppose DA, DB and DC are the true marginal valuation schedules. All three of the people, and Person C in particular, have strong incentives to say that his or her marginal valuation is really lower than the true schedules. If person C, for example, gave a schedule that was only half as high as the true DC, then that person would only have to pay a tax cost per unit, tC, that, for each level of public-good provision, was only one-half the amount that would have to be paid if he or she gave the true DC schedule. Each person has the same incentive to understate his or her schedule of marginal valuations. You might think that the best strategy under these circumstances would be to say (falsely) that you place no value whatsoever on the public good. However, if there are literally only two or three people in the community, this might not be best. Notice that if you are one of these people and if you give a lower-than-truthful valuation, the authorities will provide less of the public good MVi schedule will be lower), whereas you would always like more of the public (because the i good provided you didn't have to pay for it. So, with a small number of people, you may be aware that your understating your true preference may have a noticeable affect on the amount of public good provided, and this will limit the extent of your strategic untruthfulness. (As an aside, the outcome of two or three people interacting to provide a public good can often be modelled as a Nash equilibrium, much like the duopoly equilibrium outcome that you have studied in microtheory.) If the community is very large, with thousands or tens of thousands of people, you might reasonably feel that whatever you say is not going to affect in any noticeable way the level of public good provision. In this case, you best apparent strategy will be to say that you place no value on the good; your marginal valuation curve is horizontal at $ = 0. Of course, everybody else will likely feel the same way, so the authorities would be faced with adding up many zero valuation curves: they would be led to provide none of the public good. It is a classic prisoner's dilemma situation. No one has an incentive to do other than lie, but everybody's lying leads to a community outcome that is worse for everybody than if they had shared the cost in proportions that honestly represented their different preferences. You can begin to see why Samuelson was skeptical about the existence of a decentralized signalling mechanism. The problem exists also if people are told or believe that what they pay for the public good will bear no relationship to the marginal valuation schedule they volunteer. In that case, why not claim that you place an enormous valuation on the public good, as long as you continue to get some benefit from having more of it? In the limit, everyone would choose the amount of the public good beyond which it delivered no value to them (i.e., where their demand curve hits the horizontal axis) and say that they placed an extremely high valuation on that amount of the good – essentially claiming a vertical marginal valuation curve at that point. The authorities, if they followed the adding up process to arrive at an optimal amount of the good, would have to provide an amount equal to the amount the most good-loving person gave, and resources would be very overcommitted to this public good. Mechanisms that aim to have people directly reveal their preferences for this public good seem doomed to failure. Instead, very commonly members of a community will decide on the appropriate amount of the public good through a voting procedure, either through a direct vote or indirectly through their elected representatives. Just before leaving this introductory section, I will comment upon the possibility of achieving an optimal allocation of resources to a public good through such a voting mechanism. There is a theorem that says that optimal allocations are possible, under some circumstances. Suppose that every member of the community will contribute equally to the cost of the public good and that the only question is, how much to provide? With three people in the community, and with constant costs (a horizontal MC curve), each member would pay MC/3 per unit of public good provided. This per-person cost is shown in the second diagram, above. Suppose a vote is now taken of the following sort: the three people are first asked whether they prefer one unit of the good or two. The winning amount would then be tested against 3 units of the public good. In a vote of one unit versus two, clearly two units will win. Look at diagram 2. Person A prefers one unit to two, but both B and C would prefer two units to one. (Remember that they are all paying MC/3 dollars per unit, so you just have to see what the demand or marginal valuation schedules say about each person's demand at that "price.") Now ask for their opinion on two units versus three. In this case, two will again win: persons A and B favour two; only person C favours three units. Diagram 2 40 35 30 25 DA DB DC SUM D MC MC/3 MC $ 20 15 10 MC/3 5 G* 0 1 2 3 4 amount of public good Notice that two units is exactly the preferred amount of person B (given the price of MC/3 per unit). Person B is the "median" voter, the voter who, with respect to preferences, has an equal number of people on either side; in this case, at any price, one person always prefers more than person B and one person always prefers less. As a general matter, in any pairwise comparison of possible amounts of public good, the preferences of such a median voter will always win the vote and become the chosen option. This is the "median voter theorem." An extension of this theorem goes on to say something quite remarkable: that if the voters preferences are distributed symmetrically around the preferences of the median voter, than the vote-winning amount of public good will also be the efficient or optimal amount. To see this, look again at the diagram and look at the marginal valuations for two units of the public good. This is the amount chosen by the voting procedure described above. Now, if person A's marginal valuation lies the same amount below person B's as Person C's lies above, then two units is exactly the amount of public good where the sum of the demand curves cuts the MC curve. In general, such a symmetry of marginal valuations above and below the median valuations will result in the median voter's choice also being the efficient or optimal choice. Bowen, who pointed this out in 1943 ("The Interpretation of Voting in the Allocation of Economic Resources," Quarterly Journal of Economics, vol. 58, 27-48), thought that symmetrical distributions of preferences were likely to be common for a number of public goods and that voting outcomes may often, therefore, give reasonable approximations to optimal outcomes. To get this result, it may not be necessary to assume that for each public good communities are faced with a potentially large array of pairwise choices; in fact, this is not a procedure that is used very widely. Instead, elected representatives will often decide upon the chosen amount. In this circumstance, we can call upon another theorem from political economy: that elected representatives act in ways that maximize their chances of re-election. If this is true, then no elected representative is going to want to support amounts of the public good that don’t have a high degree of community support. This will tend to lead to support for the preferences of the median person, so that nobody feels too upset. The dynamics of desiring re-election will, as a general matter, lead the choices of elected officials to cluster together near the centre of the spectrum of possibilities.