Appendix E - Natural Disaster Relief and Recovery Arrangements

advertisement

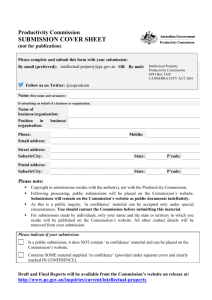

Appendix E: Natural Disaster Relief and Recovery Arrangements (NDRRA) Addendum to the Review of States’ Submissions – 29 August 2012 APPENDIX E | NDRRA PHASE 2 REPORT Copyright Notice ISBN: 978-1-922096-15-9 (print) ISBN: 978-1-922096-16-6 (online) With the exception of the Commonwealth Coat of Arms, this work is licensed under a Creative Commons Attribution 3.0 Australia licence (CC BY 3.0) (http://creativecommons.org/licenses/by/3.0/au/deed.en). This work must be attributed as: “Commonwealth of Australia, Department of Finance and Deregulation, Review of the Insurance Arrangements of State and Territory Governments under the Natural Disaster Relief and Recovery Arrangements Determination 2011”. Natural Disaster Relief and Recovery Arrangements (NDRRA) Addendum to the Review of States’ Submissions 29 August 2012 This report contains 9 pages Contents 1 Introduction 2 1.1 Reliances and Limitations 3 2 Addendum to NSW Submission 4 3 QLD Re-submission 5 4 Addendum to SA Submission 6 1 1 Introduction The Department of Finance and Deregulation (Finance) agreed to undertake an independent review of state and territory (State) insurance arrangements (the Review) in accordance with Guideline 5/2011 of the Natural Disaster Relief and Recovery Arrangements (NDRRA) Determination 2011 (Determination). KPMG Actuarial Pty Ltd (KPMG) was engaged by Finance to perform the Commonwealth review of the States’ submissions on behalf of Finance. The outcome of the Review is set out in a document entitled “Natural Disaster Relief and Recovery Arrangements (NDRRA) – Review of States’ Submissions” dated 6 March 2012 (States’ Submissions Report). This document is set out as Appendix C in the report, “Review of the Insurance Arrangements of State and Territory Governments under the Natural Disaster Relief and Recovery Arrangements Determination 2011 – Phase 1 Report” by the Department of Finance and Deregulation, dated 8 March 2012. Based on our review of the States’ submissions, recommendations were made for each State. The recommendations are generally of two categories: (i) Improvements for the next submission; and (ii) Re-submission or an addendum to be provided. With respect to improvements for the next submissions, the common themes in the recommendations are summarised below: For States with no reinsurance arrangements, for road assets in particular, we recommend alternative insurance options be explored, and subsequent cost-benefit analysis performed, before maintaining the current decision of non-coverage. These analyses should be presented in the next submission. We recommend that market quotes be sought to support any assertion on cost-benefit. We recommend analysis of past efficacy of the external insurance/reinsurance arrangements (if any) be presented in the next submission to support consideration of the cost effectiveness of the insurance/reinsurance arrangements for the State and, subsequently, to the Commonwealth. For States which have only discussed the assets insured with their captive insurer, we recommend information for all State assets that may be considered Essential Public Assets (EPA) (regardless of whether covered by the captive insurer or not) be set out in detail in the next submission, including any associated insurance arrangements. The points below summarise, by State, the details requested in the state re-submissions or addendums: NSW – Provide a firm conclusion on the adequacy of insurance arrangements by the independent specialist, and alternative insurance options and market quotes for road assets. QLD – Provide a re-submission upon finalisation of their new insurance arrangements, and further exploration of alternative insurance options for road assets with market quotes and cost-benefit analysis to support any decision of non-coverage. SA – Provide a re-submission or an addendum to their existing submission when the outcome of the market quotes for road assets is available including subsequent cost-benefit analysis. 2 WA and TAS – Provide a firm conclusion on the adequacy of insurance arrangements by the independent specialist. NT – Provide a re-submission or addendum to include market quotes for non-road and road assets and cost-benefit analysis to support the cost effectiveness of their current insurance arrangements. This Addendum summarises the results of the resubmissions / addendums from the States and updates our conclusions in light of any additional information. At the time of writing this Addendum, Finance has received a re-submission from QLD and addendums to NSW and SA submissions. With respect to these re-submission and addendums, they are summarised by State in the sections that follow. 1.1 Reliances and Limitations This Addendum has been prepared in accordance with the agreed scope as set out in the “Our Scope” section of the States’ Submissions Report. We draw your attention to the limitations of scope set out therein. In summary: In preparing this Addendum, full reliance was made on data supplied. The accuracy of the results therefore depends upon the accuracy and completeness of the data. This Addendum must be read in its entirety – note that the opinions expressed in the Addendum are based on a number of assumptions and qualifications which are set out in full in the Report. We have prepared this Addendum on the basis of information supplied to us, in particular the States’ submissions to the Commonwealth under the Determination. Nothing in this paper should be taken to imply that KPMG has verified any information supplied to it, or has in any way carried out an audit of the information provided in the States’ submissions. We have no reason to believe that any material facts have been withheld from us but do not warrant that our inquiries have revealed all of the matters which an audit or extensive examination might disclose. Further, we have not verified, and do not assume responsibility for the accuracy or completeness of, information provided to us. 3 2 Addendum to NSW Submission The specialist, Finity Consulting, who performed NSW’s State assessment prepared the addendum to the original NSW submission. The results are set out in a letter to the Director of Justice Police and Emergency Services Branch dated 2 May 2012. The re-submission provides clear conclusions on the adequacy of the State’s insurance arrangements noting in particular: The insurance arrangements for NSW State’s owned assets are reasonable and appropriate in respect of those matters relevant to NDRRA. NSW has placed reinsurance for the State’s owned civic assets reducing financial exposure borne by both State and Commonwealth taxpayers. However, the independent specialist noted they are not able to assess the cost effectiveness of these arrangements. Civil assets are not insured although these assets represent a large proportion of past NDRRA expenditure and support. The non insurance is generally consistent with most other jurisdictions in Australia. The conclusions made by the independent specialist are broadly in line with ours as set out in the States’ Submissions Report. However, we note the State’s position on whether an appropriate range of insurance options has been considered for civil assets depends entirely on whether cross reference to a status quo / or government norm is adequate. Although benchmarking of practice has its merits, it can imbed a norm that may require redress or change. We recommend future submissions evidence the final conclusion from a first principles perspective, rather than depending on the benchmark presented. When coverage is not available it is unclear from the submission, whether a tailored solution such as limiting coverage to the largest EPA or essential roads has been explored, rather than solely seeking an ‘all or nothing’ solution. The lack of ability to further assess the cost effectiveness of civic asset insurance has not been resolved. This difficulty is acknowledged and we accept the position presented. We recommend future submissions detail this requirement explicitly. 4 3 QLD Re-submission A specialist, Finity Consulting has performed the re-submission on the assessment of the State’s insurance arrangements. The results are set out in the document entitled, “NDRRA: Independent Assessment of State Insurance Arrangements – Queensland” dated February 2012. Our Review is based on the information within this document. The re-submission provides clear conclusions on the adequacy of the States’ insurance arrangements noting in particular: The insurance arrangements for QLD’s State owned assets are “consistent with market practice”. QLD has placed reinsurance arrangements for the State’s owned civic assets and Brisbane bridges reducing financial exposure borne by State and Commonwealth taxpayers. However, the independent specialist was not able to assess the cost effectiveness of the arrangements. They also note such arrangements could potentially reduce claims on NDRRA. Civil assets are not insured and non insurance is generally consistent with most other jurisdictions in Australia. Based on our review of QLD’s re-submission, our conclusions set out in the States’ Submission Report remained unchanged. With respect to the non insurance of civil assets, the re-submission noted that this practice of non insurance is “generally consistent with other States and Territories in Australia”; and there is very little appetite in the insurance/reinsurance market. It is unclear from the submission, when the coverage is not available, whether a tailored solution such as limiting coverage to the largest EPA or essential roads to recover communities in the event of natural disaster has been sought, rather than solely exploring an ‘all or nothing’ solution. In securing coverage for Brisbane bridges the response appears to illustrate that more targeted insurance solutions are available in the market. The position on whether an appropriate range of insurance options has been considered for civil assets depends entirely on whether cross reference to a status quo / or government norm is adequate. Although benchmarking of practice has its merits, it can imbed a norm that may require redress or change. We recommend that future submissions require greater support for their final conclusions from a first principles perspective, rather than depending on the benchmark presented. The lack of ability to further assess the cost effectiveness of civic asset insurance has not been resolved. This difficulty is acknowledged and we accept the position presented. We recommend future submissions detail this requirement explicitly. 5 4 Addendum to SA Submission The addendum to SA’s original submission is set out in a letter from AON to the Director of SAICORP entitled “NDRRA Determination – Review of Insurance Options for Road Assets” dated 22 May 2012. A Letter from the Director of SAICORP to Finance dated 20 June 2012 further supports this. The results of the review of insurance options for road assets in SA can be summarised as follows: Both traditional and alternative insurance options were explored, in particular coverage for earthquakes. Under traditional insurance options, there is limited local market appetite. Lloyds of London markets were approached and market quotes were obtained. However, the arrangements generally include a self-insured retention of $25m to $50m and a limit of $250m for any one event. Under an alternative insurance option, the limit of coverage offered varies between $200m and $300m. The complication under this option is defining a parameter that will closely correlate to the occurrence and severity of an event. Prima facie, the coverage offered by both the traditional and alternative insurance markets does not appear high. However, with an earthquake event, different financial models appear to give different results, thus complicating the decision of coverage based on a pre-determined return period. It is also noted in the SA addendum that Finance has agreed a cost-benefit analysis is not required at this stage due to the lack of insurance options available for road assets and given SA’s low exposure to floods. We note SA has explored a range of insurance options for the State’s owned roads. However, it appears the approach of including all roads was adopted. It is not necessarily clear or reasonable that all roads (albeit State or local government owned) are essential for recovering communities in the event of a natural disaster. This “all or nothing” approach could promulgate the misconception that “there is no market appetite for road insurance” and/or “it is not cost effective”. We recommend SA review their approach to the reinsurance market in seeking road insurance. Considerations in reducing uninsured exposures could be made through targeted solutions which limit coverage to roads and civil assets which are “essential” to recovering communities in the event of a natural disaster. 6