Video transcript

advertisement

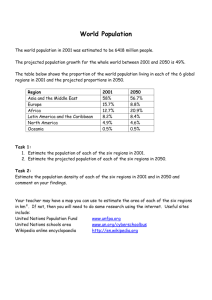

Future of Agriculture Jamie Penm Thank you, Paul, for the introduction. Good morning to our Outlook delegates. In this session, I will present an assessment on the opportunities that are expected to rise in Asia for Australian agricultural exports towards 2050. World food demand is expected to increase through to 2050 because of a larger global population, growth in per person incomes, and increasing urbanisation, especially in developing countries. At the Outlook conference in 2012, two years ago, ABS presented its projection of the world food demand by 2050, which is expected to be around 75% higher than world food consumption in 2007. At last year's Outlook conference, we presented the implication of world food prices of this projected increase in food demand. World food prices, on average, were projected to be around 12% higher by 2050 in real terms compared with prices in 2007. The expected increase in global food demand will present export opportunities for Australian agriculture, with food consumption to increase most strong in Asia, doubling between 2007 and 2050. For many agricultural products, much off the increase of consumption in Asia would be met through higher production in Asian countries themselves. In recent decades, Asia has accounted for over 50% of growth in global agricultural production, supported by strong agricultural productivity growth, especially in China. However, our projections indicate that the expected increase in food production in Asia will not be sufficient to meet the rising food demand. Asian demand for imported agricultural products will increase towards 2050. Of course there will also be strong competition in Asia from other agricultural exporting countries around the world because other exporters will also want to take advantage of the opportunities in Asia. The interesting question is which Asian market will increase in the greatest opportunity towards 2050 and what agricultural products will be in demand. The short answer is the market opportunities in Asia vary by country and by product. Let us first have a look at the prospects for food consumption in Japan and the Republic of Korea to 2050. Food consumption growth in Japan and Korea is likely to be limited through to 2050. This is the results of the already high incomes and per person food consumption in these two countries combined with expectations of declining populations and modest future income growth all to 2050. It is, however, noteworthy that Japan and Korea are the so-called high value export markets for many Australian agricultural products. This situation is unlikely to change towards 2050, which remains strong competition will continue in this market for market shares. Now, what about India? India is one off the largest consumers and producers of cereals in Asia and has a sell-sufficiency policy. By 2050, India is projected to remain an exporter of rice and coarse grains and to be a relatively small importer of wheat. India does not have a culture of drinking wine and is expected to remain a large exporter of beef, mainly buffalo meat to 2050. Horticultural production in India has been growing by an average offer 4% a year over the past two decades. And consumption has been growing at a similar rate. By 2050, India is forecast to become a significant importer of both vegetables and fruits because domestic production is not expected to be able to keep pace with growth and consumption. For dairy products, India is the largest producer in Asia and currently has a relatively small imports and exports. Many consumers in India are vegetarians and supplement their protein requirements with dairy products. Which substantial income growth expected in India over the next several decades, India is likely to become a significant importer of dairy products by 2050. Now what are the prospects for the ASEAN countries? For the ASEAN region, rice accounts for more than 80% of total cereal consumption for food. Consumption of wheat among ASEAN countries has been rising. Wheat is now produced in larger amounts in the ASEAN region. By 2050, the value of wheat imports in the ASEAN region is projected to be around 40% higher in real terms than 2007 levels. ASEAN countries in total are net exporters of horticultural products. But imports have to rising. Total consumption of horticultural products in the region is projected to rise to 2050. But most of this growth is likely to be met by increased regional production. Despite higher domestic production in ASEAN countries, there will be opportunities for imports of horticultural products. Beef consumption in ASEAN countries has increased substantially over the past few decades. Beef consumption in 2050 is projected to double from the level in 2007 with a significant expansion in imports. With relatively strong income growth to 2050, dairy consumption in the ASEAN region is projected to be more than double that of 2007 with strong growth in import demand. Using ABS global agrifood model, we have identified China as the country which will have the strongest growth in food demand in the foreseeable future. Towards 2050, China is projected to account for close to half of the global increase in food consumption. Given this importance, ABS has undertaken further research to have a close look at the prospects for food demand in China by separating consumers in China into three groups-- urban high income, urban middle income, and rural consumers. In doing so, we also update the model using data from 2009 as the base year to analyse future food demand in China. A factor influencing food consumption pattern in China has been urbanisation. Significant urbanisation in China has occurred over the past few decades. A key driver of urbanisation is the difference between urban and rural incomes, which attracts migration from rural to urban areas. In China, urban incomes were around twice are as high as rural incomes in 1990 and around three times higher in 2010. It is expected that the disparities in per person income will continue between urban and rural consumers in China towards 2050. With higher incomes, urban consumers spend more on food than rural consumers and have a more diverse, higher value diet. In China, per person expenditure on food in urban areas is around three times higher than in rural areas. Per person consumption of meat in urban areas in China is around 75% higher than in rural areas. For dairy products, the ratio is over 400%. In contrast, per person consumption of cereals is around 55% lower in urban areas in China compared with rural areas. With continued urbanisation in China, changes in food consumption patterns towards diversification of diets are expected to continue. Towards 2050 urban consumers in China are projected to continue to drive demand growth in many agricultural products, including vegetables, beef, dairy products, lamb, and sugar. Among the urban population, higher income consumers are expected to account for the largest increase in consumption of many agricultural products. Although agricultural production in China is also projected to increase significantly towards 2050, China is unlikely to meet all the increase in food consumption by domestic production. China's import demand for agricultural products is expected to rise towards 2050, especially for beef, dairy products, sugar, lamb, and some other products. In contrast, Chinese consumption of rice, pork, and poultry are likely to be met mainly by domestic production, with trade playing a relatively minor role. As all know, forecasts and projections are subject to uncertainty about the future. An important question is how sensitive the above results are to the underlying assumptions of the population and income growth towards 2050. In our modelling, the projections were based on the median population scenario for China to 2050 prepared by the United Nations. The United Nations also produced projections of high and low population scenarios for China to 2050. And we use these high and low population scenarios to examine the sensitivity of our projections to changes in China's population. Under the high and low population scenarios, total food consumption in China by 2050 will be around 24% higher and 27% lower respectively than the results under the median population scenario. In all modelling, China's income growth in aggregate is assumed to slow from an annual average of close to 7% in this decade to slightly above 2% by 2015. For the sensitivity analysis, we lowered China's income growth across all income groups by half a percentage point a year to 2050. Under the lower income growth assumptions, China's total fuel consumption by 2015 will be around 18% lower than the reference case. In conclusion, let me present you with a few take home messages. First, food consumption in many Asian countries is projected to rise towards 2050. The ability of Asian countries to satisfy the increased demand for food will depend on Asia's domestic production and also on trade. Our projections indicate that food production in Asia will not be sufficient to meet the growth in Asian food consumption for many agricultural products. Asia presents significant market opportunities for Australian agricultural exports. But there will be strong competition. Second, growth in food consumption will not be uniform across different Asian countries, The market opportunities vary by commodity and by country. China will have the most significant growth in food consumption towards 2050 underpinned by strong growth in food demand from urban consumers, especially the high income group. Of course, opportunities also exist in many other Asian countries. In order to meet this new and changing demand, it will be important to reduce import barriers in Asian countries to ensure that imports are able to complement and domestic production. Finally, it will also be important for industry to be active in taking up the opportunities in Asia and taking into account the changing Asian food demand into business planning. For example, with higher incomes, urban consumers are expected to increase their expenditures of convenience foods, fast food, and restaurant food. The share of food purchased at the supermarkets would also increase with greater urbanisation. Taking into account these changes will help to facilitate Australia's agricultural exports to Asia. This concludes my presentation. Thank you.