and expenses 2009 - Dundee City Council

advertisement

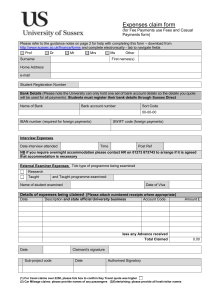

DUNDEE CITY COUNCIL SCHEME OF COUNCILLORS' SALARIES AND EXPENSES 2009 October 2009 1 The following paragraphs detail the key elements of the following Regulations: Local Governance (Scotland) Act 2004 (Remuneration) Regulations 2007 Local Government Pensions Etc (Councillors and VisitScotland) (Scotland) Amendment Regulations 2007 Local Governance (Scotland) Act 2004 (Allowances and Expenses) Regulations 2007 1 SALARIES Under the aforementioned regulations the elected members' salaries for the City Council are detailed below: The Leader of the Administration shall receive a salary of £32,470. The Civic Head, ie Lord Provost, shall receive a salary of £24,353. In addition to the Civic Head's remuneration, the Council may pay the Lord Provost a civic allowance of up to £3,000. This allowance shall be reimbursed in respect of receipted expenditure which has been incurred by the Civic Head. The City Council can pay remuneration to up to 13 Senior Councillors. Each local authority shall pay to each of its Senior Councillors an amount to be determined by the authority, but which shall be greater than the basic Councillor's salary. The total amount payable to Senior Councillors is determined by a formula and for the City Council this total sum is £263,822. Each Council shall not pay its senior Councillors any amount of remuneration as the Leader of the Administration, the Civic Head or as a basic Councillor. The remaining Councillors who are not the Leader of Administration, Civic Head or Senior Councillors shall each be a Basic Councillor and will receive remuneration of £16,234 per annum. In terms of the Police and Fire and Rescue Joint Boards, the regulations permit the payment of remuneration to one Convener and one Vice-Convener for each Joint Board. The remuneration is payable by the local authority of which the Convener or Vice-Convener is a member and then recovered from the Joint Board. Since 1995 the Convener and Vice-Conveners of the three Tayside Joint Boards, being Police, Fire & Rescue and Valuation, have rotated between the three Tayside Councils at each election. The total amount payable to a Dundee elected member as convener of either the Police or Fire and Rescue Joint Boards, when added to his/her Basic Councillor or Senior Councillor remuneration, shall not exceed 75% of the Leader of the Administration remuneration, being £24,352. It should be noted that the Convenerships are not currently filled by Dundee City Council. 2 In respect of the Vice-Convener of either of the Police or Fire and Rescue Joint Boards, the amount payable shall be an amount which equates to 75% of the Convener's remuneration, and shall not exceed £18,264. The Vice-Conveners of Tayside Joint Police Board and Tayside Fire and Rescue are positions which are currently filled by Dundee City Council. In terms of any other Joint Board, being Tayside Valuation Joint Board and Tay Road Bridge Joint Board, the Convener shall be paid a total yearly amount of £20,294 (inclusive of any amount payable to the Convener as a Councillor or Senior Councillor), or if greater, the amount payable to the Convener as a Senior Councillor. The Convenership of the Tayside Valuation Joint Board is a position which is currently filled by Dundee City Council. The Vice Conveners of the two Joint Boards referred to immediately above shall be paid a total yearly amount of £19,279 (inclusive of any amount payable to the Vice Convener as a Councillor or Senior Councillor), or if greater, the amount payable to the elected member as a Senior Councillor. It should be noted that the Vice-Convenership of Tay Road Bridge Joint Board is currently filled by Dundee City Council. It should be noted that for the period from 2009 to 2011, the City Council will provide the following Joint Board posts at the following salaries: Vice Convener of Tay Road Bridge Joint Board Convener of Tayside Valuation Joint Board Vice Convener of Tayside Joint Police Board Vice Convener of Tayside Fire & Rescue Board 2 £19,279 £20,294 £18,264 £18,264 It should be noted that an elected member cannot receive more than one salary and he/she will receive the higher salary of the respective posts they are holding. PENSIONS Under the Local Government Pensions Etc (Councillors and VisitScotland) (Scotland) Amendment Regulations 2007, the following conditions will apply: Elected members should have access to the Local Government Pension Scheme (LGPS) and must formally elect if they wish to join the LGPS. The same normal retirement age and employee contribution rate, ie aged 65 and variable based on salary scale should apply to elected members as others in the scheme. The pension would be a career average scheme, rather than a final salary, as is the case for employees, to reflect the possibility that elected members may hold positions of responsibility with higher remuneration at various points in their career. An elected member who has attained age 65 may join the Pension Scheme but membership must cease before age 75. 3 3 EXPENSES Under the Local Governance Scotland Act 2004 (Allowances and Expenses Regulations 2007), the following conditions will apply: Expenditure on travel, subsistence or other expenses by an elected member on approved duties must be receipted and will be reimbursed by the local authorities. Each local authority shall not make any payments to its members by way of travel or subsistence allowances (as opposed to the reimbursement of receipted expenditure incurred) in respect of carrying out any approved duty, except where that is permitted by these Regulations. The Dundee City Council approved Duties are as shown below:i Attendance at Meetings of Other Organisations Attendance at meetings of, or performance of other duties for bodies to which the claimant has been appointed by the Council as a representative of the Council; provided that such duties relate to one or more of the functions of the Council and performance thereof will contribute to the claimant's work in the discharge of these functions. ii Attendance at meetings of any Committee or Sub-Committee of the Council, provided such attendance is a b c as a member of the Committee or Sub-Committee; or at the invitation of the Committee or Sub-Committee; or expressly authorised by the Committee or the Sub-Committee or the Council itself. iii Performance of duties for other bodies which have been appropriately prescribed by the Secretary of State; to which the claimant has been appointed or nominated by the Council and which do not themselves provide attendance allowances. iv Attendance, with the minuted approval of the Council or of the appropriate Committee or Sub-Committee, at (a) meetings or events held for the purpose of or in connection with the discharge of the functions of the Council or (b) conferences, seminars, or similar functions, convened for the purpose of discussing matters relating to the interests of the City Council or any part thereof, including meetings held in response to invitations issued by Government departments, or other Councils, or other public bodies. v Attendance at meetings convened by Conveners or Vice-Conveners of Committees with officers to discuss departmental matters or matters relating to Committee business. (See Note 2) vi Attendance at surgeries or clinics for dealing with constituents' problems. 4 vii Either (a) work relative to the claimant's electoral division, being either the investigation of matters raised by constituents, or visits to sites or locations to investigate matters under consideration by the Council, or (b) work relating to the Committees or Sub-Committees of which he or she is a member, other than attendance at meetings of these bodies. viii Attendance at meetings of a political group of the Council or at meetings of the executive committee of such a group, in connection with the functions of the Council attendance list to be provided by Group Secretaries. ix Attendance at Planning Appeals (as a representative of the City Council); x Duties performed by the Lord Provost, the Leader of the Administration, Committee Conveners, Group Secretaries, the Leader of the Labour Group, the Leader of the Liberal Democrat Group, the Leader of the Conservative Group, in connection with the efficient operation of the Dundee City Council; xi Conferences and Meetings - if approved by the City Council. xii Visits Abroad - if approved by the City Council; xiii Attendance at Convention of Scottish Local Authorities meetings; xiv General Duties - Duties performed by Elected Members on behalf of the electorate in connection with the efficient discharge of the City Council's functions, at meetings with officials to discuss matters affecting Members' areas of functions of the Council. This could, for example, include duties as a Shadow Convener, which involves a meeting with an official. Details of the duty performed to be shown on the claims form. Details required by the Director of Finance are:Clinic; Name and Address of Constituent; Name of Official consulted. xv The performance by the Convener of the Council or one of its Committees, or by another member of the Council on the nomination of the appropriate Convener, of any thing for the purpose of, or in connection with, the discharge of the functions of the Council, or of one of its Committees, as the case may be, including the Council's functions of providing assistance to other bodies and of providing information relative to the functions of the authority. xvi The performance, by the Councillors who are appointed to act as Secretary of the Administration Group and of the two main Opposition Groups respectively, of duties which they carry out in arranging for the discharge of business to be considered by the City Council or by Committees or Sub-Committees of the Council. xvii Attendance at school prize-giving ceremonies held at a school within, or the catchment area of which includes, the electoral division of the claimant. xviii Attendance at meetings of (a) Community Councils, or (b) School Councils, (or School Boards), or any Committee or Sub-Committee thereof, whose catchment area includes the electoral division of the claimant. 5 xix Attendance at any event arranged by the City Council to which a formal invitation has been extended by the Council, or the appropriate Committee or Sub-Committee, or by the Convener of the Council. xx The performance of any other duty or the attendance at any other meeting for which the Council, or in emergency the Chief Executive may authorise payment of travelling and subsistence allowances under the said Sections; provided that the Chief Executive certifies (a) that the performance of the duty will significantly contribute to the effective discharge of one or more of the functions of the Council, or (b) that the attendance at the meeting will significantly assist the claimant in the performance of his duties; and provided also that the Chief Executive shall not hereunder vary any existing decision of the Council whether contained in Standing Orders or otherwise. Note 1 Since it will not be practicable for the Director of Finance to verify the details of every claim the declaration by the claimant will be regarded as the primary evidence of the authenticity of the claim. 2 In the case of claims relating to meetings with officers, members are asked to state the names and departments of the officers concerned. 3 Work undertaken at a claimant's home will not be covered. 4 A reference in a Council minute to an attendance not covered by the above Rules will not provide the basis for a claim. Information on Travelling Expenses Payment can only be made if the expenditure has actually been incurred and a receipt is submitted. An air fare can only be claimed if the total cost to the City Council does not exceed travel by rail unless there is a requirement to travel by air due to the need to leave or return early for business or Council purposes. Where a rail/accommodation arrangement has been used then the deduction for accommodation paid by the Council should normally be based on the cost of accommodation included in the package. Most packages offer additional nights accommodation and this is usually the rate for each night's accommodation included in the package. There are one or two exceptions to this, mainly in respect of trips to London at weekends, and if in doubt Members are asked to contact the Director of Finance or Chief Exchequer Officer. The amount to be claimed must be the amount actually spent after deduction of any discounts. a Travel by Rail arranged through Support Services Department. Standard Class fare together with actual expenditure on:i necessary supplements, including seat reservations and deposit or porterage of luggage; ii overnight sleeper accommodation, subject to a reduction of one-third of any subsistence allowance for that night. 6 b Travel by other Public Service The amount of the ordinary fare or any available cheap fare. c Travel by Taxi-Cab Within Dundee The use of taxis within the City Council boundary should be restricted to those situations where another form of public transport is not available or it is not practicable to use public transport. They should not be used for routine business but only in exceptional circumstances. Outwith Dundee The actual fare paid plus a reasonable gratuity where a taxi is used in cases of urgency or where no public service is reasonably available. A receipt will be required before the cost will be reimbursed. d Travel by Air A Member may elect to travel by air where there is a substantial saving in time and/or in the allowances he or she may be paid: i the ordinary fare or any available cheap fare by a regular service, or ii where no such service is available, or in cases of urgency, the actual fare paid. For travel abroad, where elected members are required to take flights in excess of six hours duration, business class travel may be paid. e Travel by Private Vehicle Members shall be entitled to receive payments by way of a mileage allowance in respect of travelling (whether inside or outside the United Kingdom) which is reasonably incurred by them for the purpose of enabling them to perform any approved duty as a member of Dundee City Council. All vehicles used should be insured for business use. The mileage allowance in respect of the types and rates of travelling are as follows: - car or van - 40 pence per mile motorcycle - 24 pence per mile bicycle - 20 pence per mile, and passenger travelling allowance (where both the member and the passengers are carrying out any approved duties) - 5 pence per mile, per passenger Any member may claim amounts of expenditure or allowance by completing and lodging a claim form with the Finance Department. A VAT receipt to cover the value of petrol used for mileage claimed should be submitted each month. 7 When attending a conference which has an early start then it is in order to travel the day before the conference and, of course, to travel home the day after the conference finishes, if it is not possible to return that night at a reasonable time. However, if a Member travels by air, then it may not be reasonable to travel or return the day before or after the conference because the reduced travel time may make it possible, to arrive and leave on the conference days. This is an area which requires careful consideration. It should be stressed that all expenditure, with the exception of road and bridge tolls will only be refunded on production of a receipt. Dundee City Council shall keep a record of the payments of expenditure and allowances made by it in accordance with these Regulations. SUBSISTENCE EXPENSES Day Subsistence Limit The approved duties which qualify for the payment of subsistence expenses are the same as for the payment of travelling expenses (except for General Duties). The maximum subsistence rates payable shall be as follows: - Breakfast (where no overnight subsistence is claimed) Lunch Dinner £8 per day £12 per day £25 per day The conditions are set out in Appendix 1. Meals on Trains These will be subject to the same rules as Day Subsistence Limit above. A receipted invoice for the cost of the meal should be sent to the Finance Department to accompany the claim form. Overnight accommodation away from home and local authority premises. - within London elsewhere staying with family or friends £131 £110 £25 Road and Bridge tolls (no receipt required). Other transport cost eg parking charges, ferry fares, taxi fares and public transport fares. receipted cost of expenses Telephone and computer line rental for use of personal telephone and computer for approved duties. Other telephone and computer costs (including business calls). Members may retain their Council Pay As You Go mobile or use their own mobile, but no business calls will be reimbursed. actual cost of expenses 50% of line rental costs up to max of £10 per month receipted cost of expense 8 4 Members will be offered a Council contract mobile phone but must reimburse any personal calls through its itemised billing. PAYMENT OF SALARIES AND EXPENSES The Remuneration Regulations make provision for local authorities to make payments either calendar monthly or every 4 weeks. In respect of Dundee City Council, payments of salaries and expenses will be made on a calendar monthly basis on the last working day of the month by bank transfer. Expenses will be paid in arrears eg expenses for month of May will be claimed and paid in June. Payment of Travel & Subsistence Claims Claim forms are completed and submitted electronically by the Elected Member. They should be lodged with the Head of Finance by the 10th of the following month so that payment may be made at the month end. Members’ co-operation in this exercise will be greatly appreciated and will ensure the smooth operation of the system for regular payment of these allowances. Declaration All Members must agree the declaration which is incorporated within the travelling & subsistence claim form. It is the duty of each Member to be satisfied that the declaration is correct in respect of all claims for travelling expenses & subsistence. A claim for payment must be made within three months of the date of undertaking the duty. 5 INSURANCE Personal Accident and Travel Insurance Provides personal accident cover for Elected members on a 24 hour basis including; whilst engaged on Council business, Members’ surgeries, meetings or duties carried out on behalf of COSLA and other activities complementary to those specified. Cover is world-wide and includes bodily injury arising from violent or criminal assault. Policy benefits are highlighted in Appendix 1. Claims Procedure Claims should be reported to the Risk & Business Continuity Manager, Finance Department (ext 3301). Successful claims will be paid to the council for onward transmission to the Member. 6 REGISTER OF ALLOWANCES A Register of Allowances is maintained and is available for inspection by electors at no cost. 7 INCOME TAX Tax under Schedule E is payable on Councillor Remuneration and is deducted under the normal PAYE arrangements. HM Revenue and Customs (HMRC) will allow certain expenses to be taken into account in calculating the amount of tax payable. The expenses allowed will be those incurred in carrying out the duties of the office of the elected member 9 but, where the Council meet these expenses on behalf of the elected member, they cannot be claimed. Tax is also payable where HMRC deem an additional benefit to be gained. 8 NATIONAL INSURANCE National Insurance Contributions are payable on salaries at the Class 1 contribution rates applicable to employed people. Certain married women and widows who exercise their right not to pay the full rate are required to pay the reduced rate and those who are treated as retired for National Insurance purposes do not pay any contributions. 9 TELEPHONE 50% of telephone and computer line rental costs will be payable up to a maximum of £10 per month. All elected members will be offered Council contract mobile telephones. Business calls will be paid for by the Council and personal calls will require to be reimbursed to the Council. Members may retain their Council Pay As You Go mobile or use their own mobile but no business calls will be reimbursed. Other telephone and computer costs (including business calls) will be paid on basis of receipts submitted. 10 NON-ELECTED MEMBERS OF CITY COUNCIL COMMITTEES Non-elected members of City Council Committees are entitled to allowances for approved duties. They are not entitled to Basic or Attendance Allowance but to "Financial Loss Allowance", which is a payment not exceeding the prescribed amount in respect of any loss of earnings or any additional expenses (other than travelling or subsistence) necessarily suffered or incurred by them for the purpose of enabling them to perform the approved duties. Special claim forms are available from the Director of Finance. (Travelling and Subsistence Allowances are payable at elected members' rates). 11 VISITS ABROAD Overnight deemed to cover 24 hours Per Central London limit £131 The above limit is the maximum amount within which subsistence expenses may be incurred. If all accommodation/meals etc are provided by host/conference/residential course then a maximum allowance of £40 per 24 hour period may be claimed to cover out of pocket expenses(eg coffees, incidental expenses etc) including hospitality, provided receipts are submitted. An advance of expenses will be available if required. Members are reminded that prior to the commencement of travel outside the UK, the Risk & Business Continuity Manager within the Finance Department must be advised of the destination and duration of each journey. This will ensure that members are insured for travel abroad. 10 12 SUBMISSION OF CLAIMS FOR TRAVELLING AND SUBSISTENCE Duly completed claims should be submitted by elected members on the 10th day of the month. Where members do not submit claims on a regular basis there may be a further delay in payment to allow the necessary checking etc to take place. All claims must be submitted within 3 months of the approved duty and any claims submitted outwith this period may not be paid. Where claims are not received by the relevant date it will not be possible to arrange payment on the due date, ie at the end of the month. APPENDIX 1 Subsistence - Day and Overnight Expenses A receipt will be required for all subsistence claims. The value of the receipt will be paid subject to the following maxima: £ i Breakfast - more than 4 hours away from place of residence before 11:00am 8.00 ii iii iv v Lunch - more than 4 hours away from place of residence including the lunchtime between 12:00 noon & 14:00pm 12.00 Dinner - more than 4 hours away from place of residence ending after 19:00pm 25.00 Standard overnight - deemed to cover period of 24 hours (outside Central London) 110.00 Overnight stay in Central London* 131.00 * Central London = City of London and the London Boroughs of Camden, Greenwich, Hackney, Hammersmith, Islington, Kensington & Chelsea, Lambeth, Lewisham, Southwark, Tower Hamlets, Wandsworth & Westminster. Taxation of Travel and Subsistence Expenses HMRC accepts that members normally have two places of work. This means that travelling expenses are not taxable (other than any profit element) provided that: - the member undertakes duties on behalf of the authority at home and they are paid for travel between home and the authority's offices, or - they are paid for travel between home or the authority's offices and some other place on council business. Meal allowances are not taxable provided a receipt is submitted. Overnight subsistence expenses are not taxable. Conference travelling and subsistence expenses are not taxable. 2 Taxation of Car Mileage Allowance As the City Council now pay mileage rates in accordance with the tax free mileage rates published by Her Majesty's Revenues and Customs there is no Income Tax or National Insurance Contributions Liability on these payments. For Tax Year 2009/10 the following Approved Mileage Allowance Payment (AMAP) rates (ie tax-free mileage rates) apply: All Engine Sizes 40.0p 25.0p for first 10,000 miles thereafter Income Tax From 6 April 2009 the rates of Income Tax are as follows: Basic Rate Higher Rate Taxable Income £ 0 - 37,400 Over 37,400 20% 40% National Insurance From 6 April 2009 - Employees earnings bands and contribution rates are as follows Standard Rate Monthly Earnings On First £476 £476 to £3,656 Up to £3,656 0.00% 9.4% (Members of Local Reduced Rate Earnings over £3,656 4.85% 1% Government Pension Scheme) 11.00% (Not in Local Government Pension Scheme) i The normal deduction from Elected Members is at the standard rate (see above table). Monthly Earnings of less than £476 attract no deduction. ii Certain married women and widows qualify for the reduced rate (4.85%). (Reduced Liability Certificate required). iii Men over 65 and women over 60 - nil. (Certificate of Age Exception required). iv Elected Member - Employed If you are also employed you may pay more than the upper level of National Insurance Contributions. This can be avoided by deferring payment in one or more jobs until the end of the Tax Year. See booklet CA72 for more information. If you are also self-employed you will have to pay Class 1 and Class 2 contributions (and possibly Class 4 contributions). Payment of Class 2 and Class 4 contributions may be deferred until after the end of the Tax Year. This will avoid the need for a refund. See booklet CA72 if you want further information. 3 Insurance Personal Accident Insurance Limits of indemnity are: Death/Capital sum Scale Benefits apply to lesser injuries Weekly Benefits - temporary total disability - temporary partial disability £100,000 £200) per week £100) max 104 weeks Travel Insurance (in addition to benefits above) Medical Expenses Baggage and Personal Effects Money Cancellation/curtailment Public Liability Legal Expenses Travel Delay £5m £3,000 £2,000 £3,000 £30m £25,000 £1,000 Claims Procedure Claims should be reported to the Risk & Business Continuity Manager (ext 3301). Successful claims will be paid to the Council for onward transmission to the Member. Advance of Expenses Where it is necessary for a Councillor to be absent from home for one or more nights thereby incurring additional expenditure, an appropriate advance may be made available by the Director of Finance. In this instance Form Advance/M should be obtained from the appropriate Group Secretary, completed and passed to the Banking & Office Services Section of the Finance Department who will authorise the advance and make arrangements for payment. Any advance issued will be deducted from the relevant claim form covering the particular duty and should be submitted to the Finance Department by the 10th of the next month. Local Government Pensions Scheme Councillors will be eligible to join the Local Government Pension Scheme. Employee contribution (2009/10) Employer contribution (2009/10) Variable-Based on salary scale 18.5% 4 Members' Salaries 2009/10 EXPENDITURE MET BY CITY COUNCIL Salary (£) Leader Lord Provost 32,470.00 24,353.00 Senior Councillors Convener, City Developments Committee Convener Leisure, Arts and Communities Committee Convener Housing, DCS and Environmental Services Committee Convener Education Committee Convener Social Work Committee Depute Convener, Policy & Resources Convener Development Quality Depute Convener, Education Depute Convener, Leisure, Arts & Communities Depute Convener, Licensing Depute Convener, City Developments Business Leaders Contact Leader of Opposition 21,562.75 21,562.75 21,562.75 21,562.75 21,562.75 21,562.75 21,562.75 18,264.00 18,264.00 18,264.00 18,264.00 18,264.00 21,562.75 Total Senior Councillors Cost 263,822.00 Depute Lord Provost Basic Councillors Salaries (13) 16,234.00 267,865.00 TOTAL SALARIES 547,921.00 The Salary is subject to income tax in accordance with Section 19 of the Income & Corporation Taxes Act 1988. 5 APPENDIX 2 MEMBERS - TRAVEL ABROAD - CODE OF PRACTICE SUBSISTENCE ABROAD - VARIOUS SITUATIONS WHICH COULD ARISE 1 Member travels outside UK - arrangements for accommodation are made by individual himself/herself. Subject to hotel accommodation equating to at least 50% of outside UK overnight maximum (currently £131.00) balance may be claimed if necessarily incurred, EXAMPLE: Overnight Maximum Hotel Accommodation per night (SAY) Balance Available for other subsistence £131.00 85.00* £46.00 If the accommodation is less than 50% of outside UK overnight maximum - a maximum balance of £65.00 only may be claimed if necessarily incurred, EXAMPLE: Overnight Maximum Hotel Accommodation (say) Balance Available** £131.00 55.00* £76.00 ** Restricted to 50% of £131.00= £65.00 2 Member travels outside UK - arrangements for accommodation only are provided by host or as part of a conference fee. Maximum of 50% of outside UK overnight maximum (£131.00 ÷ 2 = £65.00) may be claimed if necessarily incurred. 3 Member travels outside UK - arrangements for accommodation/main meals etc are provided by host/conference/residential course etc. A maximum amount of £40 per 24 hour period* may be claimed to cover out of pocket expenses (eg coffees, incidental expenses, etc) including hospitality. This must be accompanied by receipts for actual expenditure incurred. * Receipt Required CODE.PRA/SchemeofSalaries