UNIVERSITETET I OSLO

advertisement

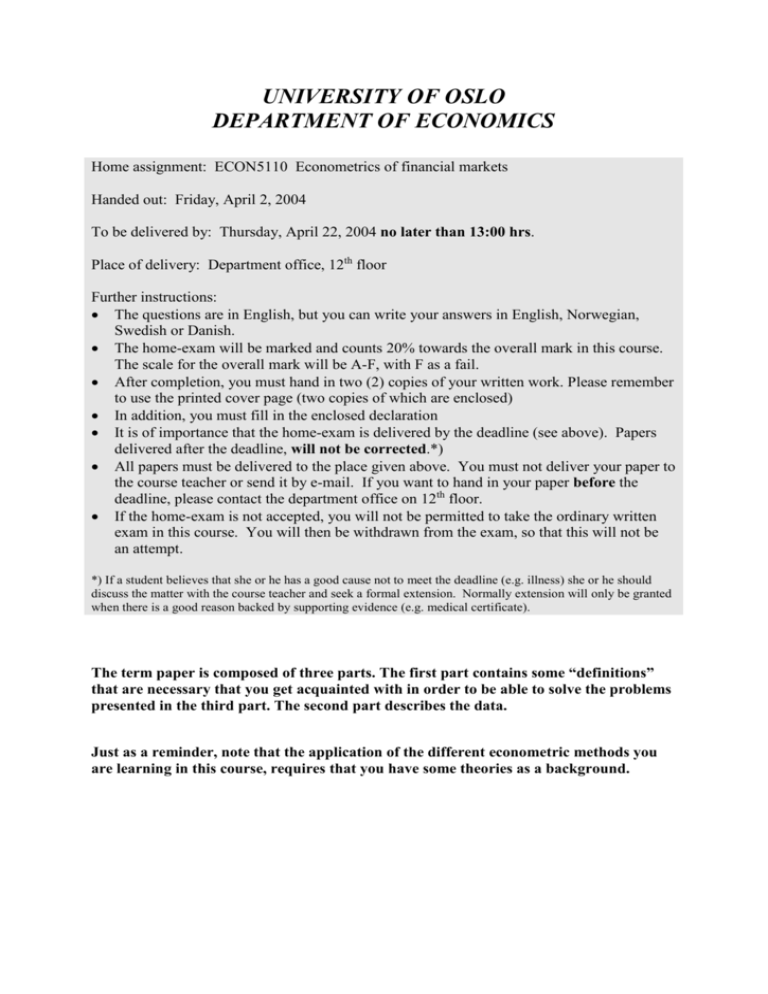

UNIVERSITY OF OSLO DEPARTMENT OF ECONOMICS Home assignment: ECON5110 Econometrics of financial markets Handed out: Friday, April 2, 2004 To be delivered by: Thursday, April 22, 2004 no later than 13:00 hrs. Place of delivery: Department office, 12th floor Further instructions: The questions are in English, but you can write your answers in English, Norwegian, Swedish or Danish. The home-exam will be marked and counts 20% towards the overall mark in this course. The scale for the overall mark will be A-F, with F as a fail. After completion, you must hand in two (2) copies of your written work. Please remember to use the printed cover page (two copies of which are enclosed) In addition, you must fill in the enclosed declaration It is of importance that the home-exam is delivered by the deadline (see above). Papers delivered after the deadline, will not be corrected.*) All papers must be delivered to the place given above. You must not deliver your paper to the course teacher or send it by e-mail. If you want to hand in your paper before the deadline, please contact the department office on 12th floor. If the home-exam is not accepted, you will not be permitted to take the ordinary written exam in this course. You will then be withdrawn from the exam, so that this will not be an attempt. *) If a student believes that she or he has a good cause not to meet the deadline (e.g. illness) she or he should discuss the matter with the course teacher and seek a formal extension. Normally extension will only be granted when there is a good reason backed by supporting evidence (e.g. medical certificate). The term paper is composed of three parts. The first part contains some “definitions” that are necessary that you get acquainted with in order to be able to solve the problems presented in the third part. The second part describes the data. Just as a reminder, note that the application of the different econometric methods you are learning in this course, requires that you have some theories as a background. FIRST PART OVERVIEW OF THE THEORY OF TARGET ZONES 1. Background - The daily data that we are providing for this term paper covers the period October 1st, 1986 until February 9th, 1990. During this period Norway adopted a unilateral target zones. What is a target zone? - In a target-zone exchange-rate (or currency band) system, governments announce the limits that their exchange rates can move within. The gap between the upper limit (when the exchange rate is weakest) and the lower limit (when the exchange rate is strongest) defines a zone of flexibility. There will be a realignment if the exchange rate moves outside those limits. In such case there will be a change in the central parity (i.e. this is usually the mid-way between the upper and the lower limits). In practise (and in theory), central banks needed to intervene in the foreign exchange market in order to avoid the exchange rate to move out of the target zone or currency band. It should be noted however that in certain cases, interventions also tok place to avoid big variations of the exchange rate even within the currency band. - When the target zones are credible (i.e. there are not expectations that a realignment will occur), there should be a negative relationship between the interest rate differentials and the exchange rate deviation from the central parity of the target zone. For example, if today the exchange rate starts to move (or it is found) in the weak (upper) area of the band, the market should expect that in the near future, the exchange rate will move toward its central parity (i.e. an appreciation within the band should be expected). As a consequence today's domestic interest rate should decrease. The interest rate differential should then also decrease. Krugman, P. (1991), “Target zones and exchange rate dynamics”, Quarterly Journal of Economics, 106, 669-682, developed the theory of target-zone exchange-rate systems. If you are interested in reading more about it, here is the link to his paper: http://www.jstor.org/cgibin/jstor/printpage/00335533/di971082/97p0045r/0.pdf?userID=8 1f03059@uio.no/018dd5534000501084211&backcontext=table-ofcontents&config=jstor&dowhat=Acrobat&0.pdf Svensson, L.E.O. (1992), "An interpretation of recent research on exchange rate target zones", Journal of Economic Perspectives, 6, 119-144, presents a non-technical description of a target zone and experiences about implementing it. Here is also the link to his paper, in case you are interested: http://www.jstor.org/cgibin/jstor/printpage/08953309/di980573/98p0062o/0.pdf?userID=8 1f03059@uio.no/018dd5534000501084230&backcontext=table-of contents&config=jstor&dowhat=Acrobat&0.pdf On central bank interventions in the foreign exchange market in general, see L. Sarno and M.P. Taylor (2001), “Official intervention in the foreign exchange market: Is it effective and, if so, how does it work?”, Journal of Economic Literature, 34, 839-869. SECOND PART DATA DESCRIPTION - As mentioned above, the daily data that we are providing for this term paper covers the period October 1st, 1986 until February 9th, 1990. - The data in excel format, termpap1.xls (the link to the data can be found on the webpage of the course), contain in the first and second columns the Norwegian krone against a basket of foreign currencies (these currencies were of the largest trader partners of Norway) observed daily at 09.00 and 15.00, respectively. In the third column is reported the 3-month (annualised) interest rate differential between the Norwegian interest rate and the basket of foreign interest rates (which correspond to the same currencies that form the currency basket to which the Norwegian krone was pegged to). The fourth column contains a dummy variable indicating when the Norwegian Central Bank (Norges Bank) decided to intervene in the foreign exchange market, by either buying or selling. There are two additional dummies in the fifth and sixth columns, respectively. In the fifth column, the dummy indicates whether Norges Bank bought foreign currency (mostly because the Norwegian krone was too strong) while the third dummy (in the sixth column) indicates whether Norges Bank sold foreign currency (mostly because the Norwegian krone was too weak). - Note then from the data that the upper limit of the Norwegian target zone was then 114.5; the lower limit was 109.5; while the central parity (the midway in the target zone) was 112. - Before you proceed in answering the questions below, it would be useful that you plot the data and analyse them. We provide figure 1 which shows both the Norwegian exchange rate and the net amount of central bank interventions (CBI). Just note that a positive (negative) number implies that Norges Bank bought (sold) foreign currency. THIRD PART THE PROBLEMS 1. Testing the credibility of the Norwegian target zone Consider the provided data and the following equation: it – i*t = a0 + a1(t - CP) + t (1) where CP is the log of the central parity of the exchange rate (i.e. log(112)). t is the log of the exchange rate at day t, it – it* is the interest rate differential at day t, as we defined above. a. Interpret equation (1) in light of the Target Zone model explained above. b. Explain how equation (1) can be estimated by the Generalised Method of Moments (GMM). c. Estimate then (1) by using, for example PC give. d. Estimate (1) under the assumption that t follows an ARCH or GARCH process. Explain why you have chosen either ARCH or GARCH. e. Interpret the results in light of the target zone model 2. The effect of Central Bank Interventions on the exchange rate Consider the change in the log of the Norwegian exchange rate. In light of the data provided, you should intuitively decide whether you would like to consider an intradaily, daily, weekly or quarterly change. f. Setup an ARCH or a GARCH model for your chosen change in the exchange rate. (Hint: You may want to assume an autoregressive process for your chosen change in the exchange rate, and assume that the disturbance of this process follows an ARCH or a GARCH process. g. Estimate the model that you have setup in f. h. Find how intervention decisions (make use of the dummies) will affect the estimates that you have obtained in g. Interpret not only the value of the parameters but also interpret them in light of the Target Zone model. i. Find how intervention decisions (make use of the dummies) will affect not only the conditional mean of your chosen change in the log of the Norwegian exchange rate but also its conditional variance. Also here, interpret not only the value of the parameters but also interpret them in light of the Target Zone model. j. Have you consider a constant term in the conditional mean equations above? Do you think it is reasonable to include this constant? Why? k. Consider now the conditional mean without the constant term and estimate again your ARCH or GARCH model as you did in h and i. Interpret these new results. Are these new estimates any different from the ones you found above?