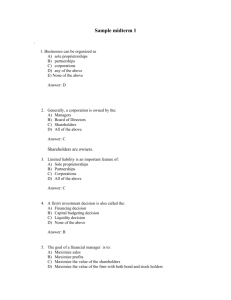

Quiz 1 covers chapter 1 and 3

advertisement

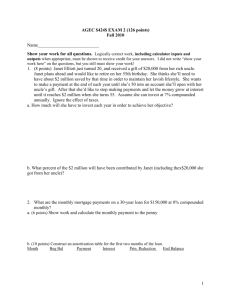

Sample Quiz 2 (with some details). . 1.The annual coupon rate of a bond equals: A) its yield to maturity. B) a percentage of its price. C) the maturity value. D) the ratio of the annual coupon payment to the par value. E) None of the above Answer: D 2.The face value of a bond is received by the bondholder: A) at the time of purchase. B) annually. C) whenever coupon payments are made. D) at maturity. E) none of the above Answer: D 3.Which of the following presents the correct relationship? As the coupon rate of a bond decreases, the bond’s: A) face value increases. B) bond price tends to increase. C) interest payments increase. D) maturity date is extended. E) coupon payments decrease Answer: E 4. How much would an investor expect to pay for a $1,000 par value bond with a 9% annual coupon that matures in 5 years if the interest rate is 9%? A) $696.74 B) $1,075.00 C) $1,000.00 D) $1,123.01 E) None of the above Answer: C 5.The current yield of a bond can be calculated by: A) multiplying the price by the coupon rate. B) dividing the price by the annual coupon payments. C) dividing the price by the par value. D) dividing the annual coupon payments by the price. E) none of the above Answer: D 6. Which of the following statements is correct for a 10% coupon bond that has a current yield of 13%? A) The face value of the bond has decreased. B) The discount rate is 13%. C) The bond’s price is smaller than the bond’s maturity value (par value). D) The bond has few years remaining until maturity. E) None of the above Answer: C 7.What is the coupon rate for a bond (par value of $1,000) with three years until maturity, a price of $1,000, and a yield to maturity of 6%? A) 6% B) 7% C) 8% D) 9% E) None of the above Answer: A 1 $1,000 = PMT 1 3 $1,000 3 .06 .06(1.06) (1.06) $60.00 = PMT $60 6% coupon rate. In fact you don’t need to calculate. Why? 1000 8.What happens to the price of a three-year bond with an 8% coupon when interest rates change from 8% to 6%? A) A price increase of $53.47 B) A price decrease of $51.54 C) A price decrease of $53.47 D) No change in price E) None of the above Answer: A $1,000 1 1 PV = $80 3 3 .06 .06i(1 .06) (1.06) = $80[16.667 – 13.994] + $1,000 1.06 3 = $213.84 + $839.63 = $1,053.47 This represents a price change of $53.47, since the bond had sold for par. 9.Which of the following bonds would be considered to be of speculative-grade? A) A Caa-rated bond. B) An Aaa-rated bond. C) An AAA-rated bond. D) A Baa-rated bond. E) None of the above Answer: A 10.What is the rate of return for an investor who pays $1,054.47 for a three-year bond with a 7% coupon and sells the bond one year later for $1,037.19? A) 5.00% B) 5.33% C) 6.46% D) 7.00% E) none of the above Answer: A Rate of Return = ($70.00 - $17.28)/$1,054.47 = $52.72/$1,054.47 = 5% 11.According to the dividend discount model, the current value of a stock is equal to the: A) present value of all expected future dividends. B) sum of all future expected dividends. C) next expected dividend, discounted to the present. D) discounted value of all dividends growing at a constant rate. E) none of the above Answer: A 12.If a stock’s P/E ratio is 13.5 at a time when earnings are $3 per year, what is the stock’s current price? A) $4.50 B) $18.00 C) $22.22 D) $40.50 E) None of the above Answer: D P/E = 13.5 Then P = 13.5 x $3 Price = $40.50 13. A stock paying $5 in annual dividends sells now for $100 and has an expected return of 20%. What might investors expect to pay for the stock one year from now? A) $182.00 B) $186.00 C) $115.00 D) $110.00 E) None of the above Answer: C . Expected return 20% = = Div1 P1 Po Po $5 P1 $100 $100 $115 = P1 14.How much should you pay for a share of stock that offers a constant dividend growth rate of 10%, has a discount rate of 16%, and pays a dividend of $3 next year? A) $42.00 B) $45.00 C) $45.45 D) $50.00 E) none of the above Answer: D P0=C1/(r-g)=3/0.06=$50 15.The price of a stock will likely increase if: A) the investment horizon decreases. B) the growth rate of dividends increases. C) the discount rate increases. D) dividends are discounted back to the present. E) none of the above Answer: B 16.What should be the price for a common stock paying $3.50 annually in dividends if the growth rate is zero and the discount rate is 8%? A) $22.86 B) $28.00 C) $42.00 D) $43.75 E) None of the above Answer: D Div 3.50 $43.75 Po = r .08 17.What is the plowback ratio for a stock with current price of $30, earnings of $5 per share next year, a discount rate of 20% , and a rate of return on equity of 25% ? A) 0.5 B) 0.2 C) 0.4 D) 0.1 E) None of the above The idea to solve this problem is that you suppose that the plow-back ratio is the ratio in each choice, then you use the dividend growth model ( P0 = Div1/(r-g) ) to calculate the current stock price. If the calculated stock price is the same as the given stock price of $30, then that choice is the answer. For example, suppose that the plow-back ratio is 0.5 in choice A. Then the dividend growth rate g = plow-back ratio * the rate of return on equity (ROE) =0.5*0.25=12.5%. Div1 =earnings1 * payout ratio =5*(1-plow-back ratio)=$2.5. P0 =Div1/(r-g)=2.5/(0.2-0.125)=$33.3, which is not the same as $30. So choice A is not the answer. Then use the above procedure to test choice B and you will find out P0=4/(0.2-0.5)=$26.7 < $30. So Choice B is not the answer. For choice C, g= 0.4*0.25=10%; P0=Div1/(r-g)=0.6*5/0.1=$30. So choice C is the answer. 18.What is the expected constant growth rate of dividends for a stock currently priced at $50, that is expected to pay a dividend of $5 next year, and has a required return of 20%? A) 13% B) 10% C) 11% D) 12% E) none of the above Answer: B By using the dividend growth model, P0 =div1/(r-g), we have $50 = $5/(.2 – g). g = 0.1=10% 19.If the (current) dividend yield is 5% and the stock price is $25, what will the year three dividend be if dividends grow at a constant 6%? A) $1.33 B) $1.40 C) $1.58 D) $1.67 E) none of the above Answer: B Dividend yield is Div1/P0, which is 5%. So Div1=.05 x 25 = 1.25 then, Div3 = div1*(1+g)2=1.25 x (1.06)2 = $1.4045 20.What would be the current price of a stock when dividends are expected to grow at a 25% rate for three years, then grow at a constant rate of 5%, if the stock’s required return is 13% and next year’s dividend will be $4.00? A) $61.60 B) $62.08 C) $68.62 D) $79.44 E) None of the above Answer: C The idea to solve this problem is to assume that you hold the stock for three years and sell the stock at the end of year 3. After year 3, the dividends have a constant growth rate of 5%. By observing this constant growth rate of dividends, you can use the dividend growth model to calculate the stock price at year 3, which is P3=Div4/(r-g), where r=13% and g =5%. Then the current stock price is the present value of three dividends received in each year in the next three years, and the stock price at year 3. Po = $4.00 (1.13) $4.00(1.25) (1.13)2 $4.00(1.25)2 (1.13)3 $4.00(1.25)2 (1.05) .13 .05 (1.13)3 = 3.54 + $5.00 1.2769 $6.25 1.4429 6.56 .08 1.4429 = 3.54 + 3.92 + 4.33 + 56.83 = $68.62