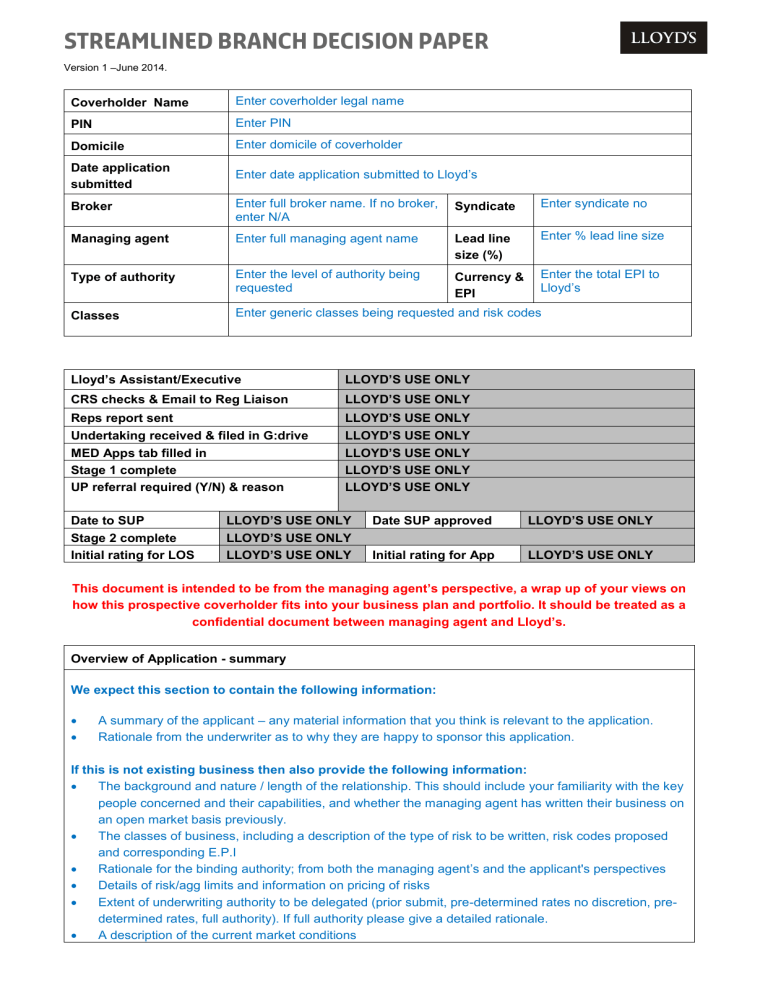

Streamlined Branch Decision Paper 2014 V1

Streamlined Branch Decision Paper

Version 1

–June 2014.

Coverholder Name

PIN

Domicile

Date application submitted

Broker

Managing agent

Type of authority

Classes

Enter coverholder legal name

Enter PIN

Enter domicile of coverholder

Enter date application submitted to Lloyd’s

Enter full broker name. If no broker, enter N/A

Syndicate

Enter syndicate no

Enter full managing agent name Lead line size (%)

Enter % lead line size

Enter the level of authority being requested

Currency &

EPI

Enter the total EPI to

Lloyd’s

Enter generic classes being requested and risk codes

Lloyd’s Assistant/Executive LLOYD’S USE ONLY

CRS checks & Email to Reg Liaison

Reps report sent

Undertaking received & filed in G:drive

MED Apps tab filled in

Stage 1 complete

Date to SUP

Stage 2 complete

LLOYD’S USE ONLY

LLOYD’S USE ONLY

LLOYD’S USE ONLY

LLOYD’S USE ONLY

LLOYD’S USE ONLY

LLOYD’S USE ONLY UP referral required (Y/N) & reason

Initial rating for LOS

LLOYD’S USE ONLY Date SUP approved

LLOYD’S USE ONLY

LLOYD’S USE ONLY Initial rating for App

LLOYD’S USE ONLY

LLOYD’S USE ONLY

This document is intended to be from the managing a gent’s perspective, a wrap up of your views on how this prospective coverholder fits into your business plan and portfolio. It should be treated as a confidential document between managing agent and Ll oyd’s.

Overview of Application - summary

We expect this section to contain the following information:

A summary of the applicant – any material information that you think is relevant to the application.

Rationale from the underwriter as to why they are happy to sponsor this application.

If this is not existing business then also provide the following information:

The background and nature / length of the relationship. This should include your familiarity with the key people concerned and their capabilities, and whether the managing agent has written their business on an open market basis previously.

The classes of business, including a description of the type of risk to be written, risk codes proposed and corresponding E.P.I

Rationale for the binding authority; from both the managing agent’s and the applicant's perspectives

Details of risk/agg limits and information on pricing of risks

Extent of underwriting authority to be delegated (prior submit, pre-determined rates no discretion, predetermined rates, full authority). If full authority please give a detailed rationale.

A description of the current market conditions

Prior year results and forecast results

The extent of any claims authority proposed, the parties involved in the claim chain and their roles/authorities, and how these parties will be audited.

Outcome of any pre-approval underwriting and claims audit or visits (including audits carried out on behalf of other managing agents of the same coverholder/claims administrator)

Whether the proposed insurance documents and bordereaux and any marketing/website material have been vetted/approved by yourselves and are in line with Lloyd’s expectations

Outstanding issues

LLOYD’S USE ONLY

Application Review Stage 2

This section is to provide your statements that you, as the managing agent, have reviewed all the points raised and give your evidence of this. Your response should replace the guidance.

Company Information

State where BRANCH IS LOCATED and that you have engaged with the

Country Manager (if rep located in this territory)

Is this branch in the same country/state/province as the head office?

If NO please attach the correct licenses to ATLAS.

Underwriting and Claims

State here if the branch will have the same underwriting authority level?

If different authority from head office provide a rationale for this.

Claims

State here if the branch will have the same claims handling arrangements?

If no, state who will be handling claims.

If TPA then confirm you have a separate TPA agreement in place and they are on the Lloyd’s approved TPA list.

State the following if this location is applying for claims authority:

The level of authority that the applicant will have.

If the applicant has a claims handling limit – what is the limit? Who will handle claims after this limit?

Which staff listed under the ‘key staff’ section has the relevant experience to administer the proposed claims function?

Is there a segregation of duties?

The procedures for sanction checking prior to claims payment

Please provide a copy of the claims agreement.

Are you aware of this applicant ever having claims authority under a binder cancelled by underwriters?

Principal Staff & Reputation

List each key staff here and confirm the following:

Are any of the key staff the same from the approved offices?

Is the coverholder requesting claims authority? If so, state which key staff will be handling claims? If the applicant is not applying for claims

Outcome

LLOYD’S USE ONLY

LLOYD’S USE ONLY

LLOYD’S USE ONLY

authority, then they should not have any individuals ticked as having responsibility for claims – confirm this is correctly showing on Atlas.

State here if any of the key staff are remote workers.

If only one key staff member listed state what would happen in the event this person is suddenly unable to work.

Reputation & Standing:

State your awareness of any declarations under the ‘Reputation &

Standing’ section. If any declarations made, please provide details around these, including the rationale why the Managing agent is happy with this issue. If none state “No reputational self disclosure”

State whether the applicant has ever had a binding authority nonrenewed or terminated.

If so please give your understanding of why this happened

Class of business

State here if the business will be written under an existing binder and

EPI?

If NO state the following:

Which classes are different and attach a business plan.

State you have checked the risk code mapping document and the correct classes have been requested on Atlas. If classes differ please explain the reasons behind this.

Lloyd’s DAT will assess whether the application requires referral to Syndicate

Underwriting Performance and will follow up on any queries they have.

Give a statement here to say that you have satisfied yourselves that the

Coverholder is aware of all the regulatory and tax obligations it has for the territories in which it is doing business. List any specifics for each territory and how these have been addressed.

Regions

Does this branch cover the same regions as the already approved office?

For other licensed and non licensed state which specific territories this is for.

For other regions we request additional information, i.e. for Canada, we expect a signed copy of the Canadian Questionnaire from the applicant to be submitted with the application.

For details of all the information we require for each region check the following link http://www.lloyds.com/the-market/i-am-a/delegatedauthority/changing-coverholder-details

Systems & Bank Accounts

Does the branch office operate off the same systems and link into the already approved office?

If no, please state the system used.

Are the management policies, processes, procedures and oversight regime the same as the already approved office? Including complaints

LLOYD’S USE ONLY

LLOYD’S USE ONLY

LLOYD’S USE ONLY

and financial crime policies?

Are existing bank accounts used?

If not provide details, including account signatories, and assurances that they are not sweep accou nts and meet Lloyd’s standards.

Professional Indemnity

State here if the E&O Policy for the already approved office covers this branch office?

Is the current PI cert/policy uploaded to the head office on Atlas?

If not provide the updated policy and confirm when this will be uploaded to

Atlas.

Does it state it that includes binding authority activities in its coverage?

LLOYD’S USE ONLY LLOYD’S USE ONLY

LLOYD’S USE ONLY

Specific Information Rationale

Classes and codes specified Facilitates precision and correct coding on Atlas

GPW per class

Description of risks to be written

Risk/ Aggregate Limits

Important to get COB split and view against syndicate

SBF. Confirm SBF spreadsheet checked.

Helps understand target business profile/risks

Per risk/event and Agg limits help assess overall review

Received

Y/N

Info on pricing of risks

Info on market conditions

Rationale for selecting Lloyd's

Prior year result data

Info on forecast results

Relevant experience of personnel

Extent of delegation

Critical Lloyd's understands basis of pricing and terms

Assists our understanding of local market issues

Useful information on local market and Lloyd's positioning

Insight into profitability performance to date

Managing agent forecast of future loss ratios by year

Underwriting capabilities of coverholder key staff

Lead syndicate proposed line

Describe claims handling

Policy/Cert wording agreed

Whether full, pre determined or prior submit

Critical to understand limit assumed by lead

Any delegation to coverholder/TPA and limits applicable

Contract certainty requirement prior to inception

Bordereau format (ACORD etc) Check on whether in line with Lloyd's expectations

If a Service Company check that they are compliant with control framework phase I

Control Framework Phase II

Requirement of Control framework project

The managing agent must give a statement to say that they have satisfied themselves that the Coverholder is aware of all the regulatory and tax obligations it has for the territories in which it is doing business. List any specifics for each territory and how these have been addressed. The use of Crystal Assist tests are advocated for all Coverholders writing multi territories.

Time with MA/Broker LLOYD’S USE ONLY Time with DAT LLOYD’S USE ONLY

Approval

Managing Agent Please sign here Date Add date of sign off

Peer (DAT executive)

Manager

LLOYD’S USE ONLY

LLOYD’S USE ONLY

Date

Date

Please ensure you send a pdf version with the Managing agent sign off and also a word version to coverholders@lloyds.com