periodical payments after the court of appeal

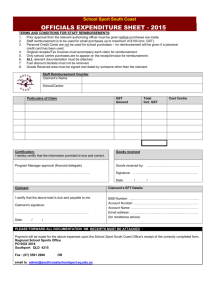

advertisement

PERIODICAL PAYMENTS AFTER THE COURT OF APPEAL DECISION IN THOMPSTONE Delivered by Hefin Rees At The Celtic Manor Hotel, South Wales, On 19 November 2009 1 1. INTRODUCTION: 1.1 Since April 1, 2005 the courts have been empowered to make awards in personal injury cases which include an order that the defendant will make future periodical payments to the claimant. This new power is set out in s. 2 of the Damages Act 19961 (“the Damages Act”). 1.2 The introduction of Periodical Payment Orders (“PPOs”) has given rise to litigation concerning the future value, in real terms, of annual payments and the need to ensure that an appropriate indexation is found to the annual payment to keep pace with inflation. The indexation of a PPO must be directed at ensuring, so far as possible, that the real value of the annual payments is retained over the whole period for which the payments will be payable to take account of inflation. 1.3 The key question is how that inflation is to be calculated and, specifically, by what index the annual payments should be increased. Particular concern has been raised due to the fact that wage increases have in the past been significantly higher than the Retail Prices Index and this position is likely to remain the same for the foreseeable future. 1.4 There are 4 potential indices to choose from: (i) Retail Prices Index (“RPI”); (ii) Average Earnings Index (“AEI”); (iii) Annual Survey of Hours and Earnings (“ASHE”); (iv) Hospital and Community Health Services Index (“HCHS”). 1.5 The debate has tended to focus on whether indexation for future care and case management costs should be on the basis of the RPI or on alternative earnings-based index such as the AEI or the ASHE. Whilst the default position under s. 2(8) of the Damages Act 1996 is the RPI; this default position can be modified, pursuant to s. 2(9), if the court considers it is appropriate and fair to do so. 1 As substituted by s. 100 of the Courts Act 2003. 2 1.6 The Court of Appeal decision in Tameside and Glossop NHS Trust v Thompstone2 (“Thompstone”) clarifies the position with regard to the selection of the correct index with regard to future care and case management costs. It is a very significant case as it decides that for future care and case management costs paid by PPOs the annual payment should be index-linked not to the RPI but to ASHE. 1.7 The question as to which indexation to use for aids and equipment; earnings, therapies etc. is still, however, open to debate. 2 WHAT IS THE RPI? 2.1 The RPI is calculated by the Government and is a measure of the change in the general level of prices that are charged for a collection of goods and services bought by the majority of UK households. It is often described in terms of a shopping basket containing about 650 goods and services. The percentage change in the Headline RPI is calculated monthly showing the percentage change over the previous 12 months. 2.2 The Office for National Statistics reviews the components of the RPI once a year, to keep it as up to date as possible, reflecting changes in consumers’ preferences and the establishment of new products3. 3 WHAT IS AEI? 3.1 The AEI is produced by the Office of National Statistics. It measures growth in average pay and is prepared monthly from data collected from a survey of 8,400 employees. 3.2 It does not, however, differentiate between occupations or regions. Also, there is a tendency for higher earnings to increase faster than lower ones. 4 WHAT IS ASHE? 4.1 ASHE is an annual earnings survey which is also published by the Office of National Statistics. In 2004 ASHE replaced the New Earnings Survey. 2 3 [2008] EWCA Civ 5 The RPI itself is set out in Vol. 2 of Kemp & Kemp: The Quantum of Damages. 3 4.2 ASHE compares occupations and regional earnings and it is a sample of the actual earnings of employees. The earnings are broken down into percentile bands so that higher earnings are tracked differently to lower earnings4. ASHE publishes earnings estimates at 10 centile intervals. ASHE is considered to be more accurate than AEI and has the added benefit of being linked to a specific occupation. 4.3 The ASHE Tables can be found at: http://www.statistics.gov.uk/StatBase/Product.asp?vlnk=15187 Table 1.7a – All Employees Annual Gross pay Table 2.7a – All Employees by Occupation Table 14.5a – All Employees by Occupation (SOC 4) (hourly pay) Table 14.7a – All Employees by Occupation (SOC 4) (annual pay) 4.4 The survey provides for different categories of employees, and ASHE 6115 deals with care assistants and home carers. ASHE 6115 defines a care assistant / home carer in the following way: “Assist[s] residents to dress, undress, wash, and bath, serve[s] meals to residents at tables or in bed; accompany residents on outings and assist recreational activities; undertake light cleaning and domestic duties as required”. 4.5 In each individual case the selection of the appropriate part of the index will depend upon finding the appropriate centile. It is first necessary to calculate the weighted average hourly rate of pay for carers (and sometimes nurses) in the care package. Depending on the complexity of the package, this can sometimes be a complicated calculation. It is impossible to fix the centile until the weighted hourly rate has been determined. 4.6 The calculation of the year-on-year growth rate for the appropriate centile is included in the schedule to the order and this should be drafted by an independent financial adviser (see section on the use of experts at paragraph 10 below). 4 The 80th centile refers to the average earnings of the top 20%. 4 5. THE TRADITIONAL LUMP SUM AWARD v PPOs: 5.1 The “lump sum” system requires the court to make what is often not much more than a guess to compensate future care costs. This is because of the uncertainties regarding the life expectancy of a claimant. 5.2 In 2002 the Master of the Rolls’s working party published a report which considered the disadvantages of the conventional lump sum award stating: “... The one thing which is certain about a once and for all lump sum award in respect of future loss is that it will inevitably either over-compensate or under-compensate. This will happen particularly where the claimant survives beyond the life expectancy estimated at the time of trial, or alternatively dies earlier...” 5.3 In the days before antibiotics and steroids etc catastrophically injured claimants tended to die soon after injury. Nowadays, with the wonders of modern medicine, such patients can be kept alive, with often no (or little) difference to their overall life expectancy. 5.4 The lump sum system has tended to produce perverse results of either overcompensation or under-compensation. Claimants can be awarded millions of pounds in damages on the basis that they will live for a long time but if they die young their estates receive a windfall; whereas, conversely, if the claimant lives beyond his anticipated life expectancy the award will run out and the care will not be provided as was originally envisaged. The Advantages of PPOs: 5.5 The advantages of a PPO over a traditional lump sum for future loss or expenses are as follows: (1) Lifetime guarantee: The payments to cover the claimant’s future needs for life will continue for the whole of his life so that he will never run out of funding despite any evidential issue raised at trial as to his life expectancy. With periodical payments, under- and over-compensation based on mortality issues alone will be avoided. 5 (2) Inflation: The periodical payment will increase each year in line with the RPI for inflation or such other index as the court may be persuaded to allow (e.g. ASHE 6115 for future care and case management costs). (3) Security: The source of the periodical payments is financially secure because since the Damages Act, periodical payments have been granted 100% protection under the Financial Services Compensation Scheme (“FSCS”) or are underwritten by the Secretary of State5. (4) Variability: The periodical payments may be constructed so that they vary in future to take into account foreseen changes in circumstances. In such cases the order must set out the date of the variation and the increase or decrease in present value terms. (5) Tax free: The periodical payments are tax free and will not affect the claimant’s entitlement to means tested benefits6. This removes any uncertainties associated with possible future changes to the arrangements for taxation of investment income. (6) Bankruptcy: Should the claimant go bankrupt in future the payments will continue and will not be affected by the bankruptcy nor will the claimant’s debtors be able to enforce against the periodical payments7. (7) Investment risk: As the level of income under the PPO is set at the point of settlement the investment risks are carried by the defendant. (8) Vulnerability: unscrupulous relatives and friends are less likely to be able to take advantage of the claimant. (9) Reduce the impact of a 2.5% discount rate8. 5 This means that if the provider of periodical payments were to become insolvent or cease to exist, the FSCS or the Government would ensure that the ordered or agreed periodical payments would continue to be paid without deduction. 6 See s. 329AA (1) of the Income and Corporation Taxes Act 1988 (now ss. 731 to 734 of the Income Tax (Trading and Other Income) Act 2005) and s. 100 of the Courts Act 2003. 7 See Courts Act 2003, s. 101. 8 It is argued that the discount rate of 2.5%, as set by the Lord Chancellor in 2001, is now too high. Index-Linked Government Stock yields have dramatically reduced from 2.46% in 2001 to a current level of 1.3%. In the circumstances it is submitted that the discount rate should be, after tax, now be at 1%. 6 The Disadvantages of PPOs: 5.6 The disadvantages of PPOs are as follows: (1) Control: The claimant does not have control over his money and he cannot invest it to gain high profit if he so wishes. (2) Continued links with the tortfeasor: The claimant has to provide proof of life annually. (3) Withering: The RPI for inflation may be inadequate as a measure for the future increase in the costs which the claimant has to meet: for instance care or treatment costs may increase faster than the RPI leaving the claimant with inadequate income to meet his necessary expenses9. (4) Borrowing on the PPO: The claimant cannot assign or mortgage the security of the periodical payments without the consent of the court: see s. 2(6) of the 1996 Act. (5) Beneficiaries: If the claimant dies early – at least before his life expectancy – no money will go into this estate, and the defendants will retain the remaining sums for their own benefit; unless the order makes specific provision for the payments to continue after death, as it may under CPR r. 41.8(2). The obvious example of the use of r 41.8(2) is a PPO to cover loss of earnings where the death is likely to occur as a result of the tortfeasor’s negligence. This is, in effect, making provision for the claimant’s dependents10. (6) Inflexibility: Whilst PPOs are not wholly inflexible – as variations (stepped PPOs can occur) – but such variations are only allowed in limited circumstances which are foreseeable and provable at the time of trial. If unforeseen circumstances arise which render the periodical payments temporarily inadequate the claimant will not be allowed to vary the level of payments or to use the capital in other ways. Problems are often experienced in agreeing stepped changes in PPOs for care for instance when particular care may change to commercial care at some time in the future. 9 However, as multipliers for lump sums are also assessed on the RPI this is an illusory concern. Note: PPOs continuing after death are not free of tax: see ss. 731 – 734 of the Income Tax (Trading and Other Income) Act 2005. 10 7 (7) Contributory negligence: Where there is contributory negligence there is likely to be insufficient funds to meet the claimant’s annual care costs11. The Current Position: 5.7 It is now common practice to seek PPOs with respect to future care and case management costs, with the other heads of loss still mostly determined on the lump sum award basis. Use of PPOs for Future Loss of Earnings: 5.8 Whether periodical payments will be attractive for a claimant seeking future loss of earnings will depend: (1) On the individual claimant as to whether he had an existing career path; (2) Whether the court can be persuaded to make variable or stepped orders. 5.9 If the claimant has an established career and there is sufficient evidence to show that he would have advanced up the earnings ladder at a level that is higher than simply RPI inflation, the periodical payments would need to reflect the likely increase in salary as he did so. 5.10 In such a case variation dates and new higher sums would need to be built into the order – see CPR r. 41.8(3). The RPI can then be applied to those higher sums. 5.11 On the other hand, if the claimant is a child and the future loss of earning figures is estimated by reference to the average earning figures for, say, manual workers in England and Wales, a PPO indexed to ASHE or AEI would appear as a very attractive solution for the claimant. 11 See Rowe v Dolman [2008] EWCA Civ 1040 8 The Position of the NHSLA: 5.12 PPOs are also quite attractive to defendants, in particular the National Health Service Litigation Authority (“NHSLA”) as they spread future costs over time. Thus, instead of having to fund large lump sum awards, the NHSLA can now make annual payments which are easier to manage in terms of their own annual budgets. 5.13 There is, however, a problem in the present annuity market, as there is only one provider of Structured Settlement Annuities in the market place. This only offers a product that is index linked to RPI. There is currently no annuity product which will provide payments linked to any earnings based index, let alone linked to ASHE 6115. 5.14 With the Thompstone case, the funding of PPOs has therefore altered radically. This means that defendants and insurers are left with little option but to self-fund12. It is, of course, still open to the NHSLA to purchase an annuity on an RPI basis, but they would then have to align the payments on an annual basis, topping up any shortfall from the difference between increases in RPI and ASHE 6115. 6 THE PRE-THOMPSTONE DEBATE: 6.1 Since the Second World War the cost of labour has risen much more quickly than the cost of goods. By way of example, an annual payment of £1,000 in 1963 indexed to the RPI would have risen to £14,483 in 2006. If the salary-based costs of care had risen according to the growth in ASHE, these would have risen to £32,841 in 200613. 6.2 The case of Charles Beattie is an example of one where the RPI has failed to keep pace with care costs14. Mr Beattie was born in 1970. Shortly before his 18th birthday he was knocked off his motorbike and severely injured. The case settled in 1992 for £1.53 million. Although the annuity has risen in line with the RPI, it has failed to keep up with Mr Beattie’s care costs. He is now no longer able to afford the care package he really needs. 12 This is in the opinion of Stephen Ashcroft of Frankel Topping Limited. Statistics taken from an article by Dr Wass (of Cardiff Business School) entitled, “The Indexation of Future Care Costs” for the September 2007 issue of Journal of Personal Injury Law [2007] J.P.I.L. 247. 14 The facts of this case are taken from a lecture delivered by Master Lush (Master of the Court of Protection delivered at The Inner Temple, April 19, 2005. 13 9 6.3 For these reasons Claimants have tended to argue for ASHE as the correct index to apply for future costs of care and case management. This is because catastrophically injured claimants have high care needs which often require high staff wages. Thus, claimants whose periodical payments are intended to meet care costs have sought indexation which will track an earnings index as opposed to the RPI. 6.4 Defendants have tended to argue for RPI as this is the index that the Damages Act anticipates being the standard index to be used for PPOs. 6.5 In A v B Hospitals NHS Trust15 the claimant sought a lump sum award and the trust sought a PPO. Lloyd Jones J ruled that a lump sum award was appropriate in a clinical negligence case on the basis that periodical payments linked to the RPI would not cover the future care costs adequately. 6.6 In A v Powys16 no periodical payments order was made and instead a traditional lump sum was ordered because the Claimant lived in Ireland and there was no adequate ASHE 6115 style index to use for PPO inflation. 6.7 The financial difference between the RPI index and the ASHE index may prove to be very significant; particularly when dealing with a young claimant. For instance, if a claimant will live for, say, 40 years and the care claim is £100,000 per annum, then each 1% by which the payment is up-rated will cost more than £1 million in today’s money. Thus, if 1% represents the differential between RPI and ASHE, the indexation argument is worth £1 million. 6.8 It should be noted, however, that the hypothesis of a 1% differential may indeed prove to be very conservative, as if Dr Wass is correct the differential may prove to be nearer to 2 – 3% if historic trends continue. In Facts & Figures 2008/2009 (p. 131) it is stated that over the past few decades the differential between the cost of earnings and the cost of goods has amounted to an average of between 1.5 – 2.5% per year. The precise figure will depend upon the exact period of years and other factors. 15 16 [2006] EWHC 2833 (Admin) [2007] EWHC 2996 10 7 PERIODICAL PAYMENT ORDERS: 7.1 The Damages Act gives the court the power to order the imposition of periodical payments in an appropriate case17. 7.2 Section 2(1) of the Damages Act states: “A court awarding damages for future pecuniary loss in respect of personal injury – (a) may order that the damages are wholly or partly to take the form of periodical payments, and (b) shall consider whether to make the order” 7.3 Sections 2(8) and 2(9) of the Damages Act state: “2(8) An order for a periodical payment shall be treated as providing for the amount of payments to vary by reference to the retail prices index at such times, and in such a manner as may be determined by or in accordance with the CPR.” 2(9) But an order for periodical payments may include provision: (a) Disapplying subsection (8); or (b) Modifying the effect of subsection (8)”. 7.4 The rules governing the award of damages by way of periodical payments are set out in CPR rr 41.4 – 41.10. CPR 41.8(1) provides: “Where the court awards damages in the form of periodical payments, the order must specify – (a) the annual amount awarded, how each payment is to be made during the year and at what intervals, (b) the amount awarded for future – (i) loss of earnings and other income; and (ii) care and medical costs and other recurring or capital costs; (c) that the claimant’s annual future pecuniary losses, as assessed by the court, are to be paid for the duration of the claimant’s life, or such other period as the court orders, and (d) that the amount of the payments shall vary annually by reference to the retail price index, unless the court orders otherwise under section 2(9) of the 1996 Act.” 17 As from 1 April 2005 s. 2(1) of the 1996 Act17 the court has been required to consider whether to make an order for periodical payments. 11 7.5 CPR Pt 41.7 further provides that when considering whether to make an order under s 2(1)(a) of the 1996 Act the court: “shall have regard to all the circumstances of the case and in particular the form of award which best meets the claimant’s needs, having regard to the factors set out in the Practice Direction.” 7.6 The Practice Direction to CPR 41 lists the factors to which the court must have regard, which include: (1) the scale of the annual payments taking into account any deductions for contributory negligence; (2) the form of award preferred by the claimant including (a) the reasons for the claimant’s preference; and (b) the nature of any financial advice received by the claimant when considering the form of award; and (3) the form of award preferred by the defendant including the reasons for the defendant’s preference. 7.7 In 2006, the first full year in which the power to order periodical payments was in force, 16% of all settlements approved by the Court of Protection involved periodical payments18. 8 FLORA V WAKOM19 8.1 The first reported Court of Appeal case on the issue of the correct index to use for PPOs was Flora v Wakom. In that case the Court of Appeal considered the correct construction of ss. 2(8) and 2(9) of the Damages Act. 8.2 In the case of Flora the claimant sought an order that with respect to the PPO the court should dis-apply s. 2(8) and provide for the amount of such payments to vary by reference to a wage-related index rather than the RPI. 18 19 See Facts & Figures 2007/2008. [2006] EWCA Civ 1103 12 8.3 To support that case, the claimant relied on the expert evidence of Dr Victoria Wass, an academic labour economist based at the Cardiff Business School. The defendant applied to strike out the relevant parts of the statement of case and to exclude the evidence of Dr Wass on the grounds that use could only be made of s 2(9) in “exceptional circumstances”. 8.4 The court at first instance refused the defendant’s applications and the Court of appeal dismissed an appeal, holding that s 2(8) identified a default position and that s 2(9) allowed the court to make the orders identified therein not simply in exceptional circumstances but whenever it appeared appropriate and fair to do so. 8.5 Brooke LJ held that it was permissible for the claimant to argue that periodical payments should be indexed according to a suitable earnings measure and dismissed the defendants’ various arguments that it was not appropriate to depart from the RPI save in exceptional circumstances. 8.6 Brooke LJ envisaged that there would be a “basket” of appeals to test the point since Flora had come to the Court of Appeal on a preliminary issue. Three of the four cases that were heard sub nom Thameside and Others v Thompstone and Others20 had involved full argument of the indexation points at first instance. 9. THOMPSTONE: 9.1 In Thompstone the Court of Appeal heard together 4 appeals on the issue of the appropriate index to use for PPOs. Each of the 4 cases concerned claimants with severe injuries who were seeking future losses, particularly cost of future care and case management. The issue on appeal was whether periodical payments to meet the future costs of care and case management should be uprated by reference to the RPI or by reference to a suitable earnings index. 9.2 The first instance judges had decided that the appropriate measure for indexation was ASHE. 9.3 Dr Wass (whose expert evidence was adduced by the claimants in all of the cases) proposed that the weighted average of the claimant’s cost of care (which will vary case by case) should be matched to the appropriate percentile of ASHE 6115. 20 [2008] EWCA Civ 5 13 Thereafter, the cost of the care will be tracked to that percentile which will, Dr Wass argued, reflect the changing costs of care as accurately as possible. 9.4 Swift J in Thompstone had ordered that the PPOs should alter on the following index: “75th percentile of the ASHE 6115 or any equivalent or comparable occupational group that may from time to time replace that index”. 9.5 Swift J’s approach was expressly approved by the Court of Appeal in the case of Thompstone. 9.6 By applying ASHE, as opposed to RPI, the court decided to make an order under s. 2(9) of the Act modifying the effect of s. 2(8) by providing for the amount of the payments to vary by reference to ASHE as opposed to RPI. 9.7 In the Court of Appeal the appellants argued that as the default position was the RPI, a claimant should only be able to detract from that default position in “exceptional circumstances”. 9.8 The Court of Appeal held that: (1) In the exercise of its power under s. 2(9) of the Damages Act the court could provide for payment to vary by reference to a wage-related index rather than the RPI if it were appropriate and fair to do so. (2) The question whether the RPI should be replaced depended on the alternatives available and was necessarily a comparative exercise. (3) The suitability of any proposed index should be tested against the following criteria: a. the accuracy of the match of the particular data series to the loss or expenditure being compensated; b. the authority of the collector of the data; c. statistical reliability; d. accessibility; e. consistency over time; 14 f. reproducibility in the future; g. simplicity and consistency in application. (4) In the case of claimants with catastrophic injuries, where the court considered it appropriate to order periodical payments for future care and case management and the main element of those damages was the wages of the carers, since the RPI was not suitable to track wage inflation the more suitable and useable index was the measure of the ASHE for the occupational group of care assistants and home carers. The Court allowed an index for future care increases based on the 75th centile mark for average wages increased for carers. (5) That would be the correct index in all such subsequent cases and it would not be appropriate to reopen the issue of its suitability in future proceedings unless there were evidence and argument significantly different from and more persuasive than that deployed in the present cases. In particular at paragraph 100 of his judgment Waller LJ said: “We hope that as a result of these proceedings the National Health Service, and other defendants in proceedings that involve catastrophic injury, will now accept that the appropriateness of indexation on the basis of ASHE 6115 has been established after an exhaustive review of all the possible objections to its use, both in itself and as applied to the recovery of costs of care and case management. It will not be appropriate to reopen that issue in any future proceedings unless the defendant can produce evidence and argument significantly different from, and more persuasive than, that which has been deployed in the present cases. Judges should not hesitate to strike out any defences that do not meet that requirement.” 9.9 Leave to appeal was given by the House of Lords in June 2008, but the defendants decided to abandon the appeals. This means that the Court of Appeal judgments in Thompstone define the way in which the courts must approach indexation issues. 15 10. THE USE OF EXPERTS: 10.1 The effect of the Court of Appeal judgment in Thompstone is that a claimant should now instruct an independent financial adviser (“IFA”) to advise both as to the suitability of periodical payments in general and as to the indexation point. They can also assist in drafting the schedule to the order. Even if the parties agree on all issues, such a report is likely to be of assistance to the judge who is asked to approve the form of order. 10.2 The practice direction anticipates that the claimant will usually have such evidence. However, the practice direction does not anticipate that the defendant will instruct its own financial adviser. 10.3 Waller LJ in Thompstone said: “… We think that judges should have regard to the defendant’s general preferences advanced on instructions without the need for evidence to be called… In short, it is our view that it will only be in a rare case that it will be appropriate for a defendant, such as the NHS, to call expert evidence to seek to demonstrate that the form of order preferred by the claimant will not best meet his needs. Also we consider that judges should require a demonstration that the point clearly arises before they permit the evidence of a second IFA to be adduced…” (paras 110 – 112) 10.4 Because one of the stated factors in the rules under CPR 41 is the nature of the investment advice which the claimant has received, it is very sensible for the claimant to obtain award management and investment advice and to disclose it to the court21. This advice should cover: (1) Periodical payments; (2) Trusts; (3) The impact of State benefits and the statutory provision of care; and (4) A combination of these options. 21 It is interesting to note that in Kemp & Kemp the author suggests (at 32-013) that the claimant should seek professional advice if the likely level of the award is greater than £30,000 16 It should then expressly set out the relative advantages of the preferred option. HEFIN REES 19 November 2009 17