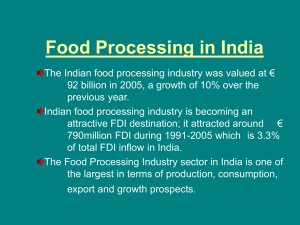

Food Processing Industry in India

advertisement