News - The Gulke Group

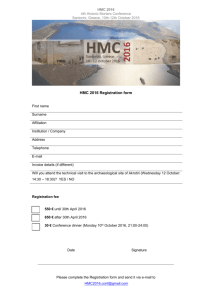

advertisement

` January 4, 2016 Weather Significant rain will reach into Brazil’s driest areas this week easing long term dryness o Rainfall may be heavy at times from mid-week this week into the weekend GFS model data has been suggesting rain totals of 2.00 to more than 5.00 inches of rain from parts of Bahia and northern Minas Gerais to Mato Grosso and Tocantins with more erratic amounts in the week ahead. Temperatures in northern Brazil will trend a little cooler once significant rain begins to fall Southern Brazil temperatures may trend a little warmer during the drier days later this week Argentina received significant rain during the long holiday weekend in southwestern areas from Cordoba, and southwestern Santa Fe to La Pampa, northwestern Buenos Aires and San Luis o Rain totals through midnight CT (0600 GMT) today varied from 0.80 to 2.00 inches with local totals to 3.40 inches in northern San Luis and to 5.55 inches at Laboulaye, Cordoba o Rainfall to 2.40 inches also occurred in southeastern Buenos Aires while 2.00 to more than 5.00 inches occurred near the eastern Chaco/Corrientes/Paraguay border area o Rainfall elsewhere in Argentina ranged from nothing in southern Corrientes and Entre Rios through northern Santa Fe to parts of central Santiago del Estero to less than 0.80 inch elsewhere Argentina temperatures Thursday through Sunday peaked in the 80s and lower 90s Fahrenheit south and in the 90s elsewhere Brazil temperatures Thursday through Sunday peaked in the upper 90s to 104 degrees Fahrenheit in northern and eastern Minas Gerais while middle 90s occurred in eastern Mato Grosso, Rio de Janeiro and Espirito Santo Argentina temperatures this week will remain a little warmer than usual while readings in Brazil are near normal Southwestern Russia, Belarus, the Baltic States experienced an increase in snow cover during the early part of the long New Year holiday providing some protection to winter wheat and rye against bitter cold temperatures News: THIS WEEK - Jan 6-8th TEPP Financial and Marketing Workshop, Myrtle Beach South Carolina. Jeff will be presenting, and will be joined by Scott Mickey and Dave Kohl. Call 480-285-4745 if you are interested in attending. Disclaimer: Commodity trading and other speculative/ hedging investment practices involve substantial risk of loss. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS when utilizing the commodities markets. Gulke Group and its officers, directors, employees and affiliates may take positions for their own accounts that are the same or that are different to the positions and to the contracts referred to herein. This material and any views expressed herein are provided for informational purposes only and should not be construed in any way as an endorsement or inducement to invest. Prices used in trade recommendations are already reflective of known information. ` Gulke Group Winter Conference: We have moved the location of our annual Winter Outlook Conference to La Quinta, CA on Feb. 10-12, 2016. If you’ve been to Gulke Group conferences before you already understand how informative they are, especially during these unprecedented times! You can register for the conference on our website. The fee is $650 for the conference for clients; additional attendees is $350; and $775 for non-clients; banquet only is $55. Registration fees paid in advance please. Call Jamie or Jeff if you have further questions. Currently our speakers include: Jim Stephenson, Wells Fargo; Roger Wallace, President EVFS; Glen Buckley, NPK Fertilizer Advisory Service. Informa Economics will cover fundamental outlook. Gulke Group Analysts will present as well. When making travel arrangements remember that registration will be at noon on Wednesday, Feb. 10 and we will wrap-up presentations around 12:30 pm on Friday, Feb. 12. Details and initial agenda will be on web soon. TP Conference Jan 27-29: If you register for the TP Conference, mention you are with Gulke Group to receive your discount. OTHER NEWS: Technicals: Markets: The hope for a change in commodity prices for the new year seems to be more of the same. Overnight grain markets traded lower to start out the New Year. Soybeans are the downside leader off of rainfall in Brazil bringing relief to many of the areas that need it in the North and forecasts are calling for a more active moisture pattern for the next couple of weeks. Outside markets are where the action is early on. Geopolitical concerns are at the forefront as Saudi Arabia cut off diplomatic relations with Iran following the execution of a prominent Shiite cleric along with 46 others accused of terrorism for inciting violence against the Saudi royal family. Crude oil is trading higher although not materially so as the response to the middle east tension is rather muted thus far. Of as much or more concern was that China’s PMI data showed manufacturing contraction for a 10th consecutive month which sent Chinese equities 7% . US equities are sharply lower, down triple digits, along with the dollar trading lower overnight but has recovered significantly. Interestingly a weaker dollar along with stronger crude should be the catalyst that spurs stronger equities? Granted the day isn’t over yet and more importance will be placed on how markets in general close by the end of the first week of 2016. There is importance to how markets trade the first week of January and the further that prices get from the highs made on Jan 4th the more difficult it may become to trade at new highs for 2016. Thus the short term “risk” is pretty well known today---that is a close higher for the day . Based on early trade, that is about 5-6 cents in soybeans and wheat and 2 cents in corn. If the underlying turmoil in Disclaimer: Commodity trading and other speculative/ hedging investment practices involve substantial risk of loss. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS when utilizing the commodities markets. Gulke Group and its officers, directors, employees and affiliates may take positions for their own accounts that are the same or that are different to the positions and to the contracts referred to herein. This material and any views expressed herein are provided for informational purposes only and should not be construed in any way as an endorsement or inducement to invest. Prices used in trade recommendations are already reflective of known information. ` the Middle East and the weakness in the US Dollar cannot materialize sufficiently to put support in the market, it either speaks even more negatively to outlook than what is obvious. Yesterday’s Trades: No new trades. Advice: Chinese stock market halted at down 7% with rest of the world following suite on more bad economic news out of China---US Stocks down 400 earlier. Crude responding higher up 3% on Middle East tensions with Iran. There is importance to how markets trade the first week of January and the further that prices get from the highs made on Jan 4th the more difficult it may become to trade at new highs for 2016. Thus the short term “risk” is pretty well known today---that is a close higher for the day . Based on early trade, that is about 5-6 cents in soybeans and wheat and 2 cents in corn. If the underlying turmoil in the Middle East and the weakness in the US Dollar cannot materialize sufficiently to put support in the market, it either speaks even more negatively to outlook than what is obvious. We will take some more defensive actions hoping that we see a reversal to the upside and close higher for the day and certainly for the first week of 2016. CORN: Hedge 15% of 2015 crop and 15% of 2016 crop in Mar 2016 and Dec 2016 futures respectfully— best you can. in addition sell 15% of 2015 by selling the CN $3.80 call options (trading about 17-18 cents) and 15% of 2016 crop in those same CN $3.80 calls. SOYBEANS: Sell 15% of 2015 crop and 15% of 2016 crop in SH and SX16 respectfully---best you can. In addition sell 15% in the SN $9 calls (trading about 25-28 cents) and 15% in the same SN $9 call options for 2016 as well—keeping short calls in early months. WHEAT: Sell 10% of 2015 crop in WH16 and 10% of 2016 crop in WN16 best you can. LIVESTOCK: Reports are that current fat Lcattle coming to slaughter have over a $500/hd loss. Hard to believe meats will go lower but there has been a good rally off lows. Retail prices are coming down with specials emerging at retail to test the market. Meats should be negative today considering the eco-political events globally---more by Mid-Day update if needed. Cotton: 63 cents is short term support and being tested again as the equity markets are struggling this morning led by a Chinese sell off. If the market breaks, look for a move back near to 61.50. Use a move blow 62.70 to re-hedge 30% (basis the March contract) Rice: Trying to climb back up to the $12 level reached last week – we have no hedges on. Use a move back below $11.00 to re-instate 30% hedges (basis March contract). Disclaimer: Commodity trading and other speculative/ hedging investment practices involve substantial risk of loss. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS when utilizing the commodities markets. Gulke Group and its officers, directors, employees and affiliates may take positions for their own accounts that are the same or that are different to the positions and to the contracts referred to herein. This material and any views expressed herein are provided for informational purposes only and should not be construed in any way as an endorsement or inducement to invest. Prices used in trade recommendations are already reflective of known information. ` Disclaimer: Commodity trading and other speculative/ hedging investment practices involve substantial risk of loss. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS when utilizing the commodities markets. Gulke Group and its officers, directors, employees and affiliates may take positions for their own accounts that are the same or that are different to the positions and to the contracts referred to herein. This material and any views expressed herein are provided for informational purposes only and should not be construed in any way as an endorsement or inducement to invest. Prices used in trade recommendations are already reflective of known information. ` Disclaimer: Commodity trading and other speculative/ hedging investment practices involve substantial risk of loss. PAST RESULTS ARE NOT NECESSARILY INDICATIVE OF FUTURE RESULTS when utilizing the commodities markets. Gulke Group and its officers, directors, employees and affiliates may take positions for their own accounts that are the same or that are different to the positions and to the contracts referred to herein. This material and any views expressed herein are provided for informational purposes only and should not be construed in any way as an endorsement or inducement to invest. Prices used in trade recommendations are already reflective of known information.