Slide 1: Lecture 3 – Bond-Pricing and YTM Welcome to Lecture 3

advertisement

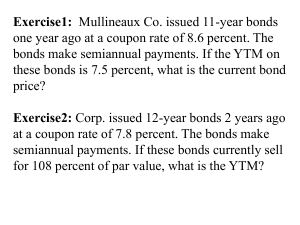

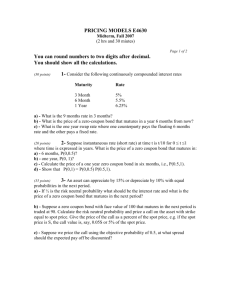

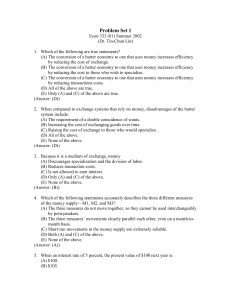

Slide 1: Lecture 3 – Bond-Pricing and YTM Welcome to Lecture 3: Bond-pricing and yield-to-maturity. Slide 2: Two parts to this lecture This lecture is divided into two parts: part one is a discussion of bond-pricing and part two is a discussion on calculating YTM or “yield-to-maturity.” Slide 3: Part 1 – Bond-Pricing Without further ado, let’s start with bond-pricing. In bond-pricing, we say that the price of a bond is equal to the sum of the present values of all its future cash-flows. In the case of a ‘coupon bond,’ the present value of the bond cash-flows is equal to the present value of its coupon payments plus the present value of its face value or principal value. The formula we are interested in is this one right here: PV(Bond) = PV(Coupon payments) + PV(Face value or principal) =PMT [(1 – (1/(1+r)^N)) / r] + [FV/(1+r)^N]. The variables required to use this formula for bond pricing are: PMT, which is the coupon payment per coupon period, r, which is the discount rate on the bond; N, which is the total number of remaining coupon payments, and last but not least, FV, the face value or principal value, which is also sometimes called the ‘par value’ of the bond. Slide 4: Cash-flows from coupon bond Before we move on to discuss the bond-pricing formula further, let’s go back to the very beginning. Let’s figure out what the cash-flow stream from a coupon bond looks like on a timeline. The best way to illustrate this is with the use of a numerical example. Let’s say that we have a coupon bond with a face value of $1,000, a coupon rate of 8 percent, coupon payments made semiannually (i.e., twice a year), which has 9 years till maturity, and a required return of 10%. The first thing to do here is to figure out the numbers that go with each of the required variables: PMT, N, r, and FV. FV is the easiest to get, as it’s simply the face value, FV = $1,000. N is the next easiest to figure out. We know that the time to maturity is 9 years, but we also know that the bond pays 2 coupons a year, thus, N = 9 x 2 = 18, as there should be 9 x 2 = 18 remaining payments. The next variable to approach is PMT, which is the coupon payment per payment period of 6 months. The annual coupon rate is 8%, which is paid on the face value of $1000, which means that per year, we get 0.08 x $1,000 = $80 in coupon payments. However, since coupons are made every 6 months, each coupon payment is then $80/2 = $40. Therefore, PMT = $40. The more difficult variable to obtain is the r. Sometimes it can get a bit complicated when the compounding period is different from the payment period per year. In this example, let’s make things simple and assume that the compounding period is the same as the payment period, i.e., the interest rate is compounded semiannually, just like the coupon payment period. In that case, the semiannual rate is simply 10%/2 = 5%. That was easy! So now, we have all the variables needed to calculate the bond-price. But first, let’s draw the timeline of cash-flows for this bond. Slide 5: Timeline of cash-flows We first start with a relatively straight line like this one. Then, partition it into N = 18 equal sections. Then, fill in the times from t =0, 1, 2, 3, …, 17, 18, where t = 0 represents now. t= 0 1 2 3 13 14 15 16 17 4 18 5 6 7 8 9 10 11 12 We get PMT = 40 in each period. We also have one last payment of 1000 at the end of the 18th period. 40 40 40 40 40 40 40 40 40 40+1000 t= 0 1 2 3 15 16 17 18 4 5 40 6 40 7 40 8 40 9 40 10 40 11 12 40 13 40 14 Tada! That’s our cash flow stream from the coupon bond. Slide 6: Bond-Valuation using PVs of lump sums A more tedious method is to calculate the present value of each cash flow one by one, and then add them up. So, for this example, we have bond-price = (40/1.05) + (40/1.05^2) + (40/1.05^3) + … all the way to (40/1.05^18) plus the present value of the principal payment of 1000, which is (1000/1.05^18). When you plug all these into your calculator, you will find the answer of 883.10, but, there is an easier way of calculating the bond-price. Slide 7: Bond-Valuation using separation of cash-flow streams Valuation using separation of cash-flow stream is an easier method for bond valuation. If we take a look at the cash-flow timeline we drew previously, we can see that there are actually two streams of cash-flows: one is an annuity of $40 for 18 periods, and the other is the $1000 principal payment at the end of the 18th period. Cash-flow stream #1: Annuity 40 40 40 40 40 40 40 t= 0 1 17 18 2 3 40 4 40 5 40 6 40 7 40 8 40 9 40 10 11 40 12 40 40 40 13 14 15 16 Cash-flow stream #2: Lump Sum 1000 t= 0 1 2 16 17 18 3 4 5 6 7 8 9 10 11 12 13 14 15 This means that we can calculate the present value of the first cash-flow stream as the present value of an annuity, and the present value of the second cash-flow stream as the present value of a lump sum, and then add them together to get the total present value of cash-flows from the bond. In terms of the formula, we have: Bond Price = PV(PMT of $40 for 18 periods) + PV(Lump sum of $1000 at t=18) Slide 8: Numerical Example of Bond-Valuation using separation of cash-flow streams Now let’s do some button-pushing on the financial calculator. So… the coupon payments are constant and this cash-flow stream is an annuity, which means that we can calculate its present value using the PV(Annuity) formula: PV(PMT) = PMT x (1 – (1/(1+r)^N)) / r. We know that PMT = $40 r = 0.05 N = 18 Plugging in the numbers for PMT, r and N for this bond to this formula, we get PV(PMT=40) = 40 x (1 – (1/(1+0.05)^18)) / 0.05 = 467.58 For the second part of the bond-price, we calculate the PV of the face value, which is paid in a lump sum at the end of the bond’s life. Therefore, we can use the PV(lump sum) formula: PV(FV) = FV/(1+r)^N. Plugging in FV=1000, r=0.05, and N=18, we get PV(FV) = 1000/(1+0.05)^18 = 415.52. Therefore, as the bond-price is equal to the sum of the present value of its two cash flow streams: Bond price = PV(PMT) + PV(FV) = 467.58 + 415.52 = 883.10. This is the same answer we obtained previously by doing it the long and tedious way. Of course, after all that work, I must tell you that there is an easier way to calculate the price of a coupon bond. Don’t get mad (I can actually hear some of the pained groans now), the reason that we just went through ALL THAT is so that you can understand what is going on when you start punching the buttons on your financial calculator. Also, now that you know the basics of cash-flow identification, drawing timelines, and calculation of PVs of these cash-flows, you won’t have to fret next time you see a bond issue that has different cash-flows than the simple coupon bond discussed in this lecture. Slide 9: Bond-Valuation using financial calculator So, to use your financial calculator to calculate bond-price, you will need to enter the following information into the calculator: FV = -1000 PMT = -40 I/Y or r = 5 N = 18 The press the buttons: COMP PV This should get you to the same answer as we had calculated before using formulas. See how good it feels to know what’s going on behind the keystrokes? Slide 10: Part II - YTM Calculation Okay! Now that we know how to calculate bond-prices, let’s ask the question: “Since we can easily find the bond-prices listed on our daily business newspaper or on the internet, can we turn it around and ask: what is the yield on this bond?” The answer, as always, is “Yes we can!” This question is referring to “yield-to-maturity,” which is the discount rate that makes the present value of the bond’s future cash-flows equal to the bondprice. YTMs are nifty for comparison across different bond issues, and as a result, are an important tool for investors. Slide 11: Information needed to calculate YTM First, we must ask ourselves, “what information do we need to calculate the YTM?” Based on the definition of the YTM, we know that the proper formula to use is the bondpricing formula: Bond price = [PMT(1 – (1/(1+r)^N))/r] + [FV/(1+r)^N]. To find the YTM, we substitute the r for the YTM/m, where m stands for the number of compounding periods per year. So, if the interest rate is compounded semiannually, then m = 2; if quarterly, then m = 4; if monthly, then m = 12, etc. Therefore, the information needed to calculate YTM are: PMT, N, FV, m, and of course, the bond-price. The bond formula to find the YTM, then, looks like this: Bond-Price = [PMT x (1 – (1/(1+(YTM/m))^N)) / (YTM/m)] + [FV/(1+(YTM/m))^N] Slide 12: Numerical Example – YTM Calculation Let’s put this formula through a numerical example. calculate the YTM of this coupon bond. Given the information below, Bond-price = $950 Coupon rate = 8%, paid semi-annually Time to maturity = 9 years Face value = $1,000 So, we have: PV = Bond-price = $950 PMT = 0.08 x 1000 /2 due to semiannual coupon payment, which gives us 40 N = 9 x 2 due to semiannual payment, which gives us 18 FV = face value of the bond = 1000 m = 2, as we assume semiannual compounding of interest rate Plugging in all these to the bond price formula, we get 950 = [40 x (1 – (1/(1+(YTM/2))^18)) / (YTM/2)] + [1000/(1+(YTM/2))^18] Looking at this formula here, we soon realize that it is not very easy to solve for the YTM mathematically. Slide 13: Three ways to calculate YTM Fortunately, there are three quite easy ways of solving for YTM: By trial and error, financial calculator or spreadsheet. With trial-and-error, we simply start with an arbitrary number for YTM, say, 10%, plug it into the bond price formula, and check to see if the resulting bond-price is close to the actual bond-price. If not, we try another number. Hence, “trial-and-error.” We try to get as close to the actual bond-price as possible by plugging in different YTMs. As you can imagine, this is a long a tedious process and most people loathe using it. Now, method number 3 is not too bad as long as you have some skills in using or writing programs in a spreadsheet. If you don’t, then method number 2 is the way to go. Let’s try that out with our numerical example, shall we? Slide 14: YTM calculation with financial calculator Enter this information into your financial calculator: PV = 950 PMT = -40 N = 18 FV = -1000 Then press the buttons: COMP I/Y (or r) When the answer of 4.408181445 pops up on your calculator, multiply it by 2 (the number of compounding periods per year, m). This should give you the YTM of 8.816362889. That is, the yield on this coupon bond with a price of $950 is approximately 8.82%. Slide 15: Practice question We all know what comes next – Practice practice practice! Try your hand at this YTM calculation and see if you can get this answer. Given a bond with a current price of $1,020, face value of $1,000, coupon rate of 10%, semiannual coupon payments, and 13 years to maturity. Calculate the yield-to-maturity on this bond. Check answer: YTM = 9.725665243% Slide 16: Practice makes comfortable Now try another practice question. Given a bond with a current price of $1,020, face value of $1,000, coupon rate of 10%, quarterly coupon payments, and 13 years to maturity. Calculate the yield-to-maturity on this bond. Check answer: YTM = 9.727270497% Slide 17: Practice makes everything easy Now try just one more. I promise this is the last one, and with that, I bid you a good day of fun with numbers! Given a zero-coupon bond (that does not make any coupon payment) with a current market price of $550, face value of $1,000, and 13 years to maturity. What is the yieldto-maturity if the interest on this bond is compounded semi-annually? Check answer: YTM = 4.652024901%