comprehensiveexam_c - Test Bank & Solution Manual

advertisement

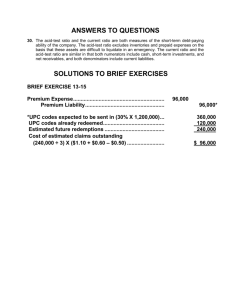

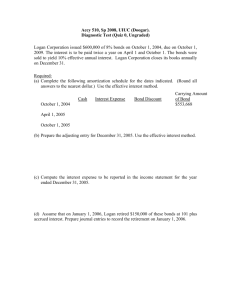

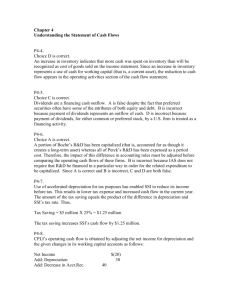

COMPREHENSIVE EXAMINATION C PART 3 (Chapters 10–14) Problem C-I — Multiple Choice — Tangible and Intangible Assets. Choose the best answer for each of the following questions and enter the identifying letter in the space provided. ____ 1. When the sum-of-the-years'-digits method is used, depreciation expense for a given asset will a. decline by a constant amount each year. b. be the same each year. c. decrease rapidly and then slowly over the life of the asset. d. vary from year to year in relation to changes in output. ____ 2. Perry Corporation acquired land, buildings, and equipment from a bankrupt company at a lump-sum price of $550,000. At the time of acquisition Perry paid $50,000 to have the assets appraised. The appraisal disclosed the following values: Land Buildings Equipment $320,000 256,000 64,000 What cost should be assigned to the land, buildings, and equipment, respectively? a. $400,000, $320,000, and $80,000. b. $275,000, $220,000, and $55,000. c. $300,000, $240,000, and $60,000. d. $200,000, $200,000, and $200,000. ____ 3. In accordance with GAAP, the maximum period over which a patent can be amortized is a. 20 years. b. 28 years. c. 40 years. d. 50 years. ____ 4. Purchased goodwill represents a. excess of price paid over fair value of net assets obtained in a combination. b. excess of price paid over the book value of the net assets obtained in a combination. c. the difference in the aggregate amount of the market prices of the stock of the combining companies. d. a tangible asset. C-2 Comprehensive Exam C Use the following data to answer questions 5 through 9: Davis Company purchased a new piece of equipment on July 1, 2012 at a cost of $1,080,000. The equipment has an estimated useful life of 5 years and an estimated salvage value of $90,000. The current year end is 12/31/13. Davis records depreciation to the nearest month. ____ 5. What is straight-line depreciation for 2013? a. $99,000. b. $108,000. c. $198,000. d. $216,000. ____ 6. What is sum-of-the-years'-digits depreciation for 2013? a. $263,999. b. $947,000. c. $324,000. d. $330,000. ____ 7. What is double-declining-balance depreciation for 2013? a. $2,59,200. b. $345,600. c. $396,000. d. $432,000. ____ 8. If Davis expensed the total cost of the equipment at 7/1/12, what was the effect on 2012 and 2013 income before taxes, assuming Davis uses straightline depreciation? a. $882,000 understated and $198,000 overstated. b. $972,000 understated and $108,000 overstated. c. $981,000 understated and $198,000 overstated. d. $1,080,000 understated and $108,000 overstated. ____ 9. If, at the end of 2014, Davis Company decides the equipment still has five more years of life beyond 12/31/14, with a salvage value of $90,000, what is straight-line depreciation for 2014? (Assume straight-line used in all years.) a. $108,000. b. $115,500. c. $130,500. d. $198,000. Comprehensive Exam C C-3 Use the following data for questions 10 through 17. Each question is independent of the other questions. Sawyer Corporation has a machine (Machine A) that it acquired on 1/1/12 for $360,000. On 12/31/12 such machines have a selling price and fair market value of $414,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method. Brown Corporation has a machine (Machine B) that it acquired on 1/1/12 for $486,000. On 12/31/12 such machines have a selling price and fair market value of $360,000. When used in production, such machines have an estimated useful life of 10 years with no salvage value. Use the straight-line method. On 12/31/12 Brown gave Machine B plus $54,000 cash to Sawyer in return for Machine A. ____ 10. Assume that both Sawyer and Brown are new machine dealers and that the machines are still new. Also assume that the exchange lacks commercial substance. At what amount will Machine A be recorded on Brown’s books? a. $486,000. b. $414,000. c. $540,000. d. $360,000. ____ 11. Given the assumptions in 10 above, at what amount will Machine B be recorded on Sawyer's books? a. $313,043. b. $486,000. c. $360,000. d. $421,044. ____ 12. Assume that instead of dealers, both Sawyer and Brown are machine manufacturers and use the machines in production. Assume the exchange lacks commercial substance. At what amount will Brown record Machine A? a. $360,000. b. $414,000. c. $486,000. d. $540,000. ____ 13. Given the assumption in 12 above, at what amount will Sawyer record Machine B? a. $371,739. b. $270,000. c. $335,736. d. $281,739. C-4 Comprehensive Exam C ____ 14. Given the assumption in 12 above except that the fair values of Machines A and B are $504,000 and $450,000, respectively, at what amount will Brown record Machine A? a. $437,400. b. $504,000. c. $450,000. d. $491,400. ____ 15. Return to the original problem. Assume that Sawyer is a dealer selling new machines and that Brown is a manufacturer. Assume that the exchange has commercial substance. For this transaction, at what amount will Sawyer record the truck? a. $360,000. b. $491,400. c. $414,000. d. $437,400. ____ 16. Given the assumptions in 15 above, at what amount will Brown record Machine A? a. $360,000. b. $414,000. c. $405,000. d. $364,500. ____ 17. Given the assumptions in 15 above except that the selling prices and fair market values of A and B are $504,000 and $450,000, respectively, at what amount will Brown record Machine A? a. $437,400. b. $405,000. c. $504,000. d. $450,000. For the following two questions, indicate the nature of the account or accounts to be debited when recording each transaction. ____ 18. A replacement, which extended the life but did not increase the quality of units produced by the asset, cost $15,000. a. Asset(s) only. b. Accumulated amortization, or depletion or depreciation only. c. Expense only. d. Asset(s) and expense. ____ 19. Jim Dolan and Matt Stine, maintenance repairmen, spent five days in unloading and setting up a new $30,000 precision machine in the plant. Their wages earned in this five-day period totaled $800. a. Asset(s) only. b. Accumulated amortization, depletion, or depreciation only. c. Expense only. d. Asset(s) and expense. Comprehensive Exam C C-5 ____ 20. Property, plant, and equipment are conventionally presented in the balance sheet at a. replacement cost less accumulated depreciation. b. historical cost less salvage value. c. original cost less accumulated depreciation. d. acquisition cost less net book value thereof. ____ 21. As generally used in accounting, what is depreciation? a. It is a process of asset valuation for balance sheet purposes. b. It applies only to long-lived intangible assets. c. It is used to indicate a decline in market value of a long-lived asset. d. It is an accounting process which allocates long-lived asset cost to accounting periods. Problem C-II — Assignment of Costs. Match the following cost items with these appropriate accounts: a. Land b. Buildings c. Land Improvements d. Other ____ 1. Interest cost incurred during building construction. ____ 2. Back taxes on purchased plot of land to be used for building site. ____ 3. Assessment by city for drainage system. ____ 4. Building permits. ____ 5. Landscaping shrubs planted after building has been constructed. ____ 6. Demolition costs of building on land bought for plant site. ____ 7. Interest cost incurred after completion of building construction. ____ 8. Recording fees for land. ____ 9. Architect's fees. ____ 10. Grading and filling building site. ____ 11. Parking lots. ____ 12. Fences. C-6 Comprehensive Exam C Problem C-III — Research and Development. Identify (in accordance with FASB Statement No. 2) each of the following activities as: a. Research and development b. Not research and development ____ 1. Testing in search for, or evaluation of, product or process alternatives. ____ 2. Cost of marketing research to promote new product. ____ 3. Adaptation of an existing capability to a particular requirement or customer's need. ____ 4. Design, construction, and testing of pre-production prototypes and models. ____ 5. Routine, on-going efforts to refine, enrich, or improve the qualities of an existing product. ____ 6. Engineering activity required to advance the design of a product to the manufacturing stage. ____ 7. Searching for applications of new research findings. ____ 8. Laboratory research aimed at discovery of new knowledge. ____ 9. Conceptual formulation and design of possible product or process alternatives. ____ 10. Trouble-shooting break-downs during production. ____ 11. Periodic design changes to existing products. ____ 12. Quality control during commercial production including routine testing. ____ 13. Costs of testing prototype and design modifications. ____ 14. Engineering follow-through in an early phase of production. ____ 15. Design, construction, and operation of a pilot plant not useful for commercial production. Comprehensive Exam C C-7 Problem C-IV — Exchange of Assets. Assume that the following cases are independent and rely on the following data. Make entries on the books of both companies. Jensen Co. Merton Co. Equipment (cost) $900,000 $1,650,000 Accumulated depreciation 290,000 900,000 Fair value of equipment 700,000 700,000 1. Jensen Co. and Merton Co. traded the above equipment. The exchange has commercial substance. Jensen Co.'s Books: Merton Co.'s Books: 2. Jensen Co. and Merton Co. traded the above equipment. The exchange lacks commercial substance. Jensen Co.'s Books: Merton Co.'s Books: Assume that the following cases are independent and rely on the following data. Make entries on the books of both companies. Jensen Co. Merton Co. Equipment (cost) $900,000 $1,650,000 Accumulated depreciation 290,000 1,050,000 Fair value of equipment 560,000 700,000 Cash received (paid) (140,000) 140,000 3. Jensen Co. and Merton Co. traded the above equipment. The exchange has commercial substance. Jensen Co.'s Books: Merton Co.'s Books: 4. Jensen Co. and Merton Co. traded the above equipment. The exchange lacks commercial substance. Jensen Co.'s Books: Merton Co.'s Books: C-8 Comprehensive Exam C Problem C-V — Long-Term Debt. 1. On March 31, 2009, Hanson Corporation sold $7,000,000 of its 8%, 10-year bonds for $6,730,500 including accrued interest. The bonds were dated January 1, 2009. Interest is paid semiannually on January 1 and July 1. On April 1, 2013, Hanson purchased 1/2 of the bonds on the open market at 99 plus accrued interest and canceled them. Hanson uses the straight-line method for amortization of bond premiums and discounts. (a) What was the amount of the gain or loss on retirement of the bonds? (b) Prepare the journal entry needed at April 1, 2013 to record retirement of the bonds. Assume that interest and premium or discount amortization have been recorded through January 1, 2013. Record interest and amortization on only the bonds retired. (c) Prepare the journal entry needed at July 1, 2013 to record interest and premium or discount amortization. 2. On January 1 of the current year, Feller Corporation issued $3,000,000 of 10% debenture bonds on a basis to yield 9%, receiving $3,134,580. Interest is payable annually on December 31 and the bonds mature in 6 years. The effective-interest method is used. (a) What is the interest expense for the first year? (b) What is the interest expense for the second year? Comprehensive Exam C C-9 3. On October 1, 2012, Noller Company issued $4,000,000 par value, 10%, 10-year bonds dated July 1, 2012, with interest payable semiannually on January 1 and July 1. The bonds are issued at $4,542,000 (to yield 8%) plus accrued interest. The effective interest method is used. (a) Prepare the journal entry at the date the bonds are issued. (b) Prepare the adjusting entry at December 31, 2012, the end of the fiscal year. (c) Prepare the entry for the interest payment on January 1, 2013. Problem C-VI — Depreciation Methods. A high-speed multiple-bit drill press costing $720,000 has an estimated salvage value of $60,000 and a life of ten years. What is the annual depreciation for each of the first two full years under the following depreciation methods? 1. Double-declining-balance method: a. Year one, $______________. b. Year two, $______________. 2. Units of production (activity) method (lifetime output is estimated at 110,000 units; the press produced 12,000 units in year one and 18,000 in year two): a. Year one, $______________. b. Year two, $______________. 3. Sum-of-the-years'-digits method: a. Year one, $______________. b. Year two, $______________. 4. Straight-line depreciation method: a. Year one, $______________. b. Year two, $______________. C-10 Comprehensive Exam C Problem C-VII — Current Liabilities. Moon Company includes 1 coupon in each box of soap powder that it packs, 20 coupons being redeemable for a premium consisting of a kitchen utensil. In 2012, Moon Company purchased 18,000 premiums at $1.00 each and sold 540,000 boxes of soap powder @ $4.00 per box. Based on past experience, it is estimated that 60% of the coupons will be redeemed. During 2012, 144,000 coupons were presented for redemption. During 2013, 29,000 premiums were purchased at $1.10. The company sold 1,200,000 boxes of soap at $4.00 and 495,000 coupons were presented for redemption. Instructions Prepare all the entries that would be made relative to sales of soap powder and to the premium plan in both 2012 and 2013. Assume a FIFO inventory flow. *Problem C-VIII — Accounting for Troubled Debt Restructurings. On December 31, 2012, Federal Bank enters into a debt restructuring agreement with Carson Company which is experiencing financial difficulties. The bank restructures a $3,000,000 note receivable by: 1. Reducing the principal obligation from $4,000,000 to $3,200,000. 2. Extending the maturity date from 12/31/12 to 12/31/15, and 3. Reducing the interest rate from 12% to 6%. Interest has been paid up to date as of 12/31/12. Instructions Discuss the nature of this transaction, indicating whether any gain or loss is recognized by either party and preparing any 12/31/12 journal entries that may be required by the debtor (Carson). Comprehensive Exam C Solutions — Comprehensive Examination C Problem C-I — Solution. 1. 2. 3. 4. 5. 6. a c a a c b 7. 8. 9. 10. 11. 12. b c b b a b 13. 14. 15 16. 17. 18. d d a b c b 19. 20. 21. a c d Solutions to selected computational Multiple Choice questions. 6. ($990,000 × 5/15 × 1/2) + ($990,000 × 4/15 × 1/2) = $297,000. 7. $1,080,000 × .4 × 1/2 = $216,000; ($1,080,000 – $216,000) × .4 = $345,000. 9. ($1,080,000 – $297,000 – $90,000) × 1/6 = $115,500. 11. $360,000 – (360/414 × $54,000) = $313,043. 13. $360,000 – (360/414 × $90,000) = $281,739. Problem C-II — Solution. 1. 2. 3. 4. 5. b a a b a 6. 7. 8. 9. 10. a d a b a 11. 12. c c 11. 12. 13. 14. 15. b b a b a Problem C-III — Solution. 1. 2. 3. 4. 5. a b b a b 6. 7. 8. 9. 10. a a a a b C-11 C-12 Comprehensive Exam C Problem C-IV — Solution. 1. Jensen Co.'s Books Merton Co.'s Books Equipment Accum. Depreciation Gain on Disposal Equipment 700,000 290,000 2. Equipment Accum. Depreciation Equipment 610,000 290,000 3. Equipment Accum. Depreciation Loss on Disposal Equipment Cash 700,000 290,000 50,000 4. Same as 3. 90,000 900,000 Equipment Accum. Depreciation Loss on Disposal Equipment 700,000 900,000 50,000 1,650,000 Same as 1. 900,000 900,000 140,000 Equipment Accum. Depreciation Cash Gain on Disposal Equipment 560,000 1,050,000 140,000 Equipment Accum. Depreciation Cash Gain on Disposal Equipment 480,000 1,050,000 140,000 100,000 1,650,000 20,000 1,650,000 [$140,000 ÷ ($140,000 + $560,000) × $100,000 = $20,000 gain] Problem C-V — Solution. 1. (a) Face amount of bonds Total selling price Less accrued interest ($7,000,000 × .08 × 3/12) Carrying value at 3/31/09 $7,000,000 $6,730,500 400,000 $6,590,500 Discount at 3/31/09 $409,500 Less discount amortized ($409,500 ÷ 117 mos. × 48 months) 168,000 Unamortized discount at 4/1/13 Carrying value at 4/1/13 Carrying value of 1/2 of the bonds Less acquisition price ($7,000,000 ×.99 × 1/2) Loss on retirement (b) Interest Expense ...................................................................... Discount on Bonds Payable ($1,750 × 3) ..................... Cash ............................................................................ (To accrue interest to 4/1/13: $7,000,000 × .08 × 3/12 × 1/2 = $70,000) 241,500 $6,758,500 $ 3,379,250 3,465,000 $ 85,750 75,250 Bonds Payable ........................................................................ 3,500,000 Loss on Redemption of Bonds .................................................. 85,750 Discount on Bonds Payable ($241,500 × 1/2) ............... Cash ............................................................................ (To remove carrying value of bonds) 5,250 70,000 120,750 3,465,000 Comprehensive Exam C (c) Interest Expense ........................................................................... Discount on Bonds Payable ......................................... Cash ............................................................................ (Discount amortization: $409,500 ÷ 117 mos. × 6 mos. × 1/2 = $10,500) C-13 150,500 10,500 140,000 2. (a) First year interest expense: $3,134,580 × .09 = $282,112 (b) Second year interest expense: $300,000 – $282,112 = $17,888 Premium amortization (First year). $3,134,580 – $17,888 = $3,116,692 Book value of bonds at the beginning of the second year. $3,116,692 × .09 = $280,502 Interest expense. 3. (a) Cash ........................................................................................ 4,642,000 Bonds Payable ............................................................. Premium on Bonds Payable ......................................... Interest Payable ........................................................... (b) Interest Expense ...................................................................... Premium on Bonds Payable .................................................... Interest Payable ........................................................... 4,000,000 542,000 100,000 90,840 9,160 100,000 (Interest expense: $4,542,000 × .08 × 3/12 = $90,840) (c) Interest Payable ....................................................................... Cash ............................................................................ Problem C-VI -— Solution. 1. a. $144,000 b. $115,200 2. a. $72,000 b. $108,000 3. a. $120,000 b. $108,000 4. a. $66,000 b. $66,000 200,000 200,000 C-14 Comprehensive Exam C Problem C-VII — Solution. 2012 Premium Inventory (2012) ................................................................... Cash (or Accounts Payable) .................................................... (18,000 × $1.00) 18,000 18,000 Cash (or Accounts Receivable) ........................................................... 2,160,000 Sales Revenve ......................................................................... (540,000 × $4.00) Premium Expense ............................................................................... Premium Inventory (2012) ....................................................... (144,000 ÷ 20 = 7,200× $1.00 = $7,200) 7,200 Premium Expense ............................................................................... Premium Liability ..................................................................... 540,000 × .60 = 324,000 coupons 324,000 – 144,000 = 180,000 ÷ 20 = 9,000 premiums 9,000 × $1.00 = $9,000) 9,000 2013 Premium Inventory (2013) ................................................................... Cash (or Accounts Payable) .................................................... (29,000 × $1.10) 7,200 9,000 31,900 31,900 Cash (or Accounts Receivable) ........................................................... 4,800,000 Sales Revenve ......................................................................... (1,200,000 × $4.00) Premium Liability .................................................................................... Premium Inventory (2012) .......................................................... (9,000 × $1.00 = $9,000; balance of 2012 coupons redeemed) 9,000 Premium Expense .................................................................................. Premium Inventory (2012) .......................................................... 18,000 – 7,200 – 9,000 = 1,800 × $1.00 = $1,800] Premium Inventory (2013) .......................................................... [495,000 ÷ 20 = 24,750 – (1,800 + 9,000) = 13,950 × $1.10 = $15,345] 17,145 Premium Expense .................................................................................. Premium Liability ........................................................................ 22,275 [Total 2013 coupons estimated to be redeemed: Coupons redeemed in 2013 Coupons redeemed in 2013 attributable to 2012 Coupons estimated to be redeemed subsequent to 2013 Estimated liability 405,000 ÷ 20 = 20,250 × $1.10) 2,160,000 4,800,000 9,000 1,800 15,345 22,275 1,200,000 ×.60 = 720,000 495,000 (180,000) 315,000 405,000 $22,275] Comprehensive Exam C C-15 Problem C-VIlI — Solution. The transaction between Carson Company and Federal Bank represents a "troubled debt restructuring," wherein there is a continuation of the debt with a modification of terms. Because the total future cash flows after restructuring of $3,776,000 are less than the total prerestructure carrying amount of $4,000,000, the debtor must record a gain and the creditor must record a loss due to the restructuring of the debt. Carson Company would record the debt restructure as follows on December 31, 2012: Note Payable........................................................................................ Gain on Restructured Debt ....................................................... 224,000* 224,000 *[$4,000,000 – ($3,200,000 + $192,000 + $192,000 + $192,000)] Because the new effective interest rate is 0%, all of the future cash flows reduce the principal balance, and no interest expense would be recognized by the debtor throughout the remainder of the note. Federal Bank would calculate its loss based upon the expected future cash flows discounted at the historical effective rate of the loan. The loss on restructuring is written off against the allowance account and the note receivable is reduced.