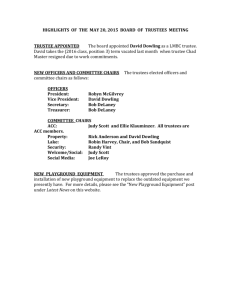

[INSERT ORGANIZATION NAME]

advertisement

![[INSERT ORGANIZATION NAME]](http://s3.studylib.net/store/data/007572527_2-c6c6016d4deeb09c44b7b8aae6e134d8-768x994.png)

[ENTER DATE] [ENTER ORGANIZATION NAME ADDRESS ADDRESS CITY/STATE/ZIP] Re: Form 990 Questionnaire for Board Members Dear Board Member: IRS Form 990 now requires us to disclose certain relationships, arrangements, and transactions concerning both conflicts of interest and the independent decision making of our governing bodies. Before we can provide the required disclosures, we need your help in gathering essential information. Please complete and sign the attached questionnaire, then return it to us by [ENTER DATE] by fax or mail. Fax number: Mailing address: [ENTER FAX NUMBER] [ENTER MAILING ADDRESS] We will review your answers to this questionnaire to determine whether any relationships, arrangements, or transactions meet the criteria for disclosure in our Form 990. We will retain your completed questionnaire as part of our Form 990 documentation to substantiate our efforts to accurately make all required disclosures. To assist you in answering, we have included a list of our officers, directors, trustees, and key employees as Attachment 1 and a list of related organizations as Attachment 2. Definitions of various italicized terms used in the questions as Attachment 3. Thank you for your assistance. [ENTER THE SIGNATURE INFORMATION FOR YOUR ED or CEO] Form 990 Questionnaire for Board Members [ENTER THE NAME OF YOUR ORGANIZATION] Print Name Relationship or Position(s) with our Organization I hereby confirm that I accept your organization’s conflict of interest policy and [check one] I have answered NO to all of the questions on the following pages. I have answered YES to one or more questions and provided the requested information. Signature Date Form 990 Questionnaire for Board Members Family and Business Relationships with Officers, Directors, Trustees, and Key Employees In answering the following questions, refer to the list of our officers, directors, trustees, and key employees (Attachment 1). 1. Did you have a family relationship with any of our organization’s officers, directors, trustees, or key employees at any time during the past calendar year? Yes No If yes, please identify the person(s): 2. Did you have a business relationship with any of our organization’s officers, directors, trustees, or key employees at any time during the past calendar year? Yes No If yes, please identify the person(s): 3. Did you receive compensation from a related organization? Yes No If yes, please provide the organizations and amount(s) received: Organization Amount Form 990 Questionnaire for Board Members Grants and Assistance Benefiting Interested Persons 1. Did you or a family member receive any grants or other economic assistance from our organization? Yes No If yes, please provide the following: Amount of benefit Type of assistance received Recipient’s name Business Transactions Involving Interested Persons Organizations are required to report business transactions for which payments were made during the tax year between our organization and an interested person―if such payments exceed certain reporting thresholds, and regardless of when the transaction was entered into by the parties. 1. Did you or a family member have a business transaction with our organization? Yes No If yes, please provide the following: Name of interested person(s) involved Person’s relationship to our organization Amount of the transaction Description of the transaction(s) Did you share in the revenue? Yes No Independence of the Board Please refer to the list of our related organizations (Attachment 2) in answering these independence questions. 1. Did you receive compensation as an officer or employee of our organization or from a related organization? Yes No 2. Did our organization or a related organization pay you more than $10,000 as an independent contractor―other than reimbursement of expenses or reasonable compensation for services provided in the capacity as a member of the governing body―during the organization’s tax year? Yes No Form 990 Questionnaire for Board Members 3. Were you or a family member involved in a transaction with our organization involving any of the following? Yes No a benefit―from an individual capable of exercising substantial influence over the affairs of our organization―that was greater than the compensation given for the services you or a family member performed an outstanding loan as of the end of our organizations tax year a grant or other economic assistance Attachment 1 As of [ENTER DATE], our organization’s current and former officers, directors, trustees, key employees, and highest-compensated employees are as follows: [ENTER NAMES AND TITLES] [ENTER NAMES AND TITLES] Attachment 2 As of [ENTER DATE], the list of our related organizations is as follows: [ENTER NAMES AND TITLES] [ENTER NAMES AND TITLES] Attachment 3 Business relationship Business relationships between two people include any of the following: One person is employed by another person, either in a sole proprietorship or by an organization for which the other person is a trustee, director, officer, key employee, or greater-than-35% owner. One person transacts business, directly or indirectly, with another person―other than in the ordinary course of either person’s business, on the same terms generally offered to the public. Such business involves cash or property transfers valued at more than $10,000, in aggregate, during the organization’s tax year. The two persons are directors, trustees, officers, or greater-than-10% owners in the same business or investment entity. For these purposes, business relationships do not include the following: Attorney/client, medical professional/patient, priest/clergy, or penitent/communicant relationships. Relationships developed in the ordinary course of business―i.e., on terms generally offered to the public. Business Transaction Business transactions include, but are not limited to, contracts of sale, lease, license, and performance of services―whether initiated during an organization’s tax year or ongoing from a prior year. Business transactions also include new and ongoing joint ventures in which the profits or capital interest of the organization and interested persons each exceeds 10%. Contributions or membership dues paid to the organization by its officers, directors, etc. are not considered business transactions. Family Relationship Family relationships include spouses, ancestors, brothers and sisters (whole and half), children (natural and adopted), grandchildren, great grandchildren―and the spouses of siblings, children, grandchildren and great grandchildren. Interested Person Interested person refers to an organization’s current officers, directors, trustees, key employees, and five highest-compensated employees――as well as any person who fell under one of these categories within the five years prior to the year currently being reported on. Attachment 3 Grants and Other Economic Assistance Grants and other economic assistance include awards, prizes, cash allocations, stipends, scholarships, fellowships, research grants, and similar payments and distributions made by our organization. Economic assistance also includes the goods, services, and use of facilities provided by our organization during the tax year. It does not include salaries or other compensation to employees.