QUIET TITLE TRAINING

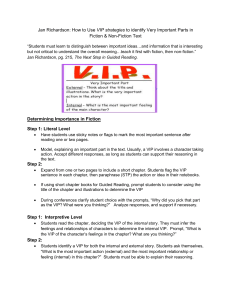

advertisement