SOC 364

advertisement

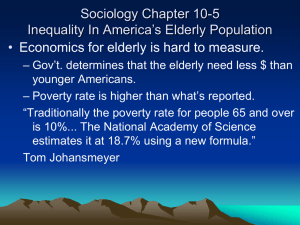

SOC 364 Notes Chapter 13: The Economics of Aging Chapter Outline Economic needs Income Poverty Sources of Income Effects of Inflation Conclusion Defining the Elderly Age 65+ Generally no children at home Retired Own their own homes Expenses are lower in comparison to their middle years Higher expenses in medical care compared to middle years Today’s Retirees Experience economic deprivation Used to deprivation by growing up in a hardened historical and cultural environment War The Depression Generally more politically conservative Must maintain an adequate standard of living on a relatively unchanging income Statistics on Elderly Americans 44.3% are living alone (excluding institutionalized) 41.3% living with a spouse 4.4% living with children 0.8% living with spouse & children <5% are living in nursing homes 1.2% other living arrangement Income 1980s -1990s saw an improvement in retirement incomes Congress included a cost-of living increase in social security payments to compromise for the inflation A trend towards families having retirement incomes from both parents Companies are beginning to invest part of their employees’ salaries in private pension programs = private retirement pensions + social security Poverty Poverty Index- Established guidelines below which a person is assumed to lack funds to meet basic survival needs Older people are less likely to be poor But once poor, they are likely to remain poor for a longer period of time in comparison with the younger Time and Length older persons qualify and receive public assistance programs is considerably longer than the younger It is hard to come out of poverty for the elderly Hard to get hired, since they’re competing with younger individuals Sources of Income Elderly receive both Social Security and Medicare benefits The higher the income, the less social security is the major source of income The elderly income is not homogenous Most are kept above the poverty line by their own means Critical Question: Should the family or the government take care of the elderly? One study found that only 10% of the elderly receive benefits from their family Social Security- A Burden? Concern that social security will cause a burden on young taxpayers Fewer working people supporting more people who are receiving social security benefit Unlikely of a revolution against: Practically every taxpayer has an older family member receiving social security Each taxpayer hopes to be able to draw a social security check upon retirement A dwindling number of workers pay into the pool of Social Security funds that support retirees: In 1950, 16 workers paid Social Security taxes for each beneficiary. Today, only 3.3 workers support each beneficiary and by 2034 just 2 will carry the burden. Excess of Funds Going into Social Security Current taxpayers are paying more into the social security program than is being paid out surplus of funds is growing This surplus of funds are put into a OASDI (Old Age Survival Disability Insurance) trust fund May not be used for any other purpose than payment of benefits The OASDI must invest funds by law in special-issue government securities. The government may spend this “borrowed money” in any way it wants. Supplemental Security Income (SSI) 1972: Congress legislated the SSI program to be administered by the Social Security Administration Program provides a national minimum level of income for the aged, blind, and disabled. In 1982: SSI guaranteed $284.30 monthly income to individuals ($3,411.60 yearly) $426.40 monthly income for an elderly couple ($5,116.80 yearly) Problems With Private Pension Programs Workers have to stay with company throughout career in order to receive such benefits The company has to remain in business after the worker retires Private pensions tend to be fixed permanently, with no compensation for inflationary factors They generally offer no coverage for the spouse after the death of the other Assets of the Elderly May include: stocks and bonds, farmland, and houses Home ownership- Most common asset, “locked in”, non liquid asset, No quick turnover into cash, Stocks and bonds can much more quickly be turned into instant cash for dayto-day use than can homes Owning a home, requires less income since there is no mortgage or rent payments each month Two other factors must be taken into account in considering the incomes of the elderly: In-kind Income: Consisting of services or goods that older persons may purchase at a reduced price Ex: Subsidized Government housing, paying a price below market value Tax Breaks: Permitting persons over 65 to double their personal tax exemption tends to help the higher-income elderly Effects of Inflation As inflation increases it is hard on the elderly since their incomes are normally fixed The retired are forced to either sell assets or reduce standard of living when prices increase Medical costs have vastly increased, causing a burden on the retired Becoming more common Retirement programs having a cost-of-living escalator built into them to deflect the cost of inflation Solutions to the Problem of Falling Real Income Internal People control their destinies through their decision on how to allocate their money and purchases External The individual is dependent on alternatives determined by an outside agent government Inflation allows for the worth of the retirees homes to increase, while insurance policies, bonds, and savings accounts, tend to decrease in relative value