References - ERCOT.com

advertisement

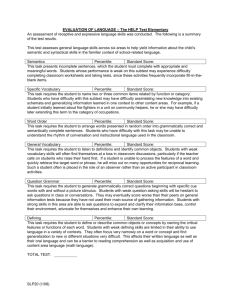

NPRR 206 (Nodal Market Day-Ahead Market Credit Requirements) Design 1 of 16 Credit Exposure Calculation – DAM Energy Bids 1 1.1 Checks 1. Make the first (Q,P) pair as (q0,p0) = (0,p1) where p1 = price of the first submitted price from (q1,p1) 1. If abs(q1-q0) < 0.01, then ignore the first segment for credit check. 2. For a line segment, if abs[q(i+1)-q(i)) < 0.01, then consider it as vertical line segment. No area under curve, no credit check required. Proceed to next line segment. 1.2 Credit Exposure for a Line Segment First pair Second pair = (q(i), p(i)) = (q(i+1), p(i+1)) Credit Exposure = [q(i+1)-q(i)] * 0.5 * [bidExposurePrice(p(i)) + bidExposurePrice(p(i+1))] where bidExposurePrice(p(i)) = IF (bidprice(p(i)) <= 0) THEN bidExposurePrice(p(i)) = 0 ELSE bidExposurePrice(p(i)) = MAX[0, sum(A + B) ] A= B= MIN (dth%DA-SPP, bidprice(p(i))) IF (bidprice(p(i)) > A) THEN B = e1 * (bidprice(p(i)) – A) ELSE B=0 If the dth%DA-SPP lies between q(i) and q(i+1), then find the intercept q(d), p(d). Calculate Credit Exposure for two segments [(q(i), p(i)) – (q(d), p(d))] and [(q(d), p(d)) – (q(i+1), p(i+1))]. Total Credit Exposure for the entire segment is sum of the two credit exposures. Also see Figures 1 and 2 for visual interpretation of the Credit Exposure calculation. 2 of 16 Trapezoid Area A = 0.5 * h * (a+b) where h is the height, and a and b are the lengths of the parallel sides X-intercept with dth Percentile / X-axis Find Slope for the line segment m = (y2-y1) / (x2-x1) BidPrice ($/MW) (q1, p1) (10,800) (q0, p0)) Find Line equation using either first or second (x,y) pair tmp y-y0 = m * (x-x0) (50,600) (q5, p5) Find x-intercept on the dth percentile / x-axis Line equation: y = mx + b x = (y-b) / m Case 2 Scan (q6, p6) e1*A1' (100,110) e1*A2' e1*A3' dth Percentile DA-SPP Case 4 Scan (x,70) (125,65) A1 Case 3 Scan A2 A3 (150,15) A5 A4 A6 Quantity (MW) (175,-30) (200,-45) Figure 1 – Credit Exposure Calculation (Energy Bids) – Positive dth Percentile DA-SPP 3 of 16 BidPrice ($/MW) Credit Exposure Credit Exposure = Max ( 0, sum(A+B) ) (0,800) (50,600) where A = area A1 B = e1* (A1' - A1) Case 1 Scan X-intercept with dth Percentile / X-axis Find Slope for the line segment m = (y2-y1) / (x2-x1) (100,110) Find Line equation using either first or second (x,y) pair y-y0 = m * (x-x0) A1' A2' Find x-intercept on the dth percentile / x-axis Line equation: y = mx + b x = (y-b) / m (125,65) A3' (150,15) A4' A5' Quantity (MW) A1 A2 A3 A4 A5 (175,-30) dth Percentile DA-SPP (x,-40) (200,-45) Figure 2 – Credit Exposure Calculation (Energy Bids) – Negative (or zero) dth Percentile DA-SPP 1.3 Verification – Case 1-Scan for Line Segment (q5,p5), (q6,p6) where dth SPP < 0 bidExposurePrice(q5) = MAX[0, sum(A + B) ] where A = MIN (dth%DA-SPP, bidprice) = d B = e1 * (bidprice – A) = e1 * (p5 – d) bidExposurePrice(q5) = MAX[0, (d + e1 * (p5 – d))] bidExposurePrice(q6) = MAX[0, (d + e1 * (p6 – d))] Credit Exposure = [q(6)-q(5)] * 0.5 * [bidExposurePrice(q5) + bidExposurePrice(q6)] 4 of 16 = (q6-q5) * 0.5 * [MAX[0, (d + e1 * (p5 – d))] + MAX[0, (d + e1 * (p6 – d))] 1.4 Verification – Case 2-Scan for Line Segment (q5,p5), (q6,p6) where p6 >= dth SPP >= 0 bidExposurePrice(q5) = MAX[0, sum(A + B) ] where A = MIN (dth%DA-SPP, bidprice) = d B = e1 * (bidprice – A) = e1 * (p5 – d) bidExposurePrice(q5) = MAX[0, (d + e1 * (p5 – d)}] = (d + e1 * (p5 – d)) bidExposurePrice(q6) = (d + e1 * (p6 – d)) Credit Exposure = [q(6)-q(5)] * 0.5 * [bidExposurePrice(q5) + bidExposurePrice(q6)] = (q6-q5) * 0.5 * [2d + e1*(p5+p6-2d)] = (q6-q5) * d * [1-e1] + 0.5 * (p5+p6)*(q6-q5) 1.5 Verification – Case 3-Scan for Line Segment (q5,p5), (q6,p6) where 0 <= p6 <= p5 <= dth SPP bidExposurePrice(q5) = MAX[0, sum(A + B) ] where A = MIN (dth%DA-SPP, bidprice) = p5 B=0 bidExposurePrice(q5) = MAX[0, p5] = p5 bidExposurePrice(q6) = MAX[0, p6] = p6 Credit Exposure = [q(6)-q(5)] * 0.5 * [bidExposurePrice(q5) + bidExposurePrice(q6)] = [q(6)-q(5)] * 0.5 * (p5+p6) 1.6 Verification – Case 4-Scan for Line Segment (q5,p5), (q6,p6) where 0 <= p6 <= dth SPP <= p5 bidExposurePrice(q5) = MAX[0, sum(A + B) ] where A = MIN (dth%DA-SPP, bidprice) = d 5 of 16 B = e1 * (bidprice – A) = e1 * (p5 – d) bidExposurePrice(q5) = MAX[0, (d + e1 * (p5 – d)}] = (d + e1 * (p5 – d)) bidExposurePrice(qd) = MAX[0, sum(A + B) ] where A = MIN (dth%DA-SPP, bidprice) = d B=0 bidExposurePrice(qd) = MAX[0, d] = d bidExposurePrice(q6) = MAX[0, p6] = p6 CreditExposure1 = [q(d)-q(5)] * 0.5 * [bidExposurePrice(q5) + bidExposurePrice(qd)] = [q(d)-q(5)] * 0.5 * [(d + e1 * (p5 – d)) + d] CreditExposure2 = [q(6)-q(d)] * 0.5 * [bidExposurePrice(qd) + bidExposurePrice(q6)] = [q(6)-q(d)] * 0.5 * [d + p6] CreditExposure = CreditExposure1 + CreditExposure2 = [q(d)-q(5)] * 0.5 * [(d + e1 * (p5 – d)) + d] + [q(6)-q(d)] * 0.5 * [d + p6] = (q(d)-q(5)) + 0.5 * (q(d)-q(5)) * [ e1*(p5-d)] + [q(6)-q(d)] * 0.5 * [d + p6] = (q(d)-q(5))*d*[1-e1] + 0.5 * e1 * (q(d)-q(5)) * (p5+d) + [q(6)-q(d)] * 0.5 * [d + p6] 6 of 16 Credit Exposure Calculation – DAM Energy Offers 2 2.1 Checks 1. Make the first (Q,P) pair as (q0,p0) = (0,p1) where p1 = price of the first submitted price from (q1,p1) 3. If abs(q1-q0) < 0.01, then ignore the first segment for credit check. 4. For a line segment, if abs[q(i+1)-q(i)) < 0.01, then consider it as vertical line segment. No area under curve, no credit check required. Proceed to next line segment. 2.2 Credit Exposure for a Line Segment First pair Second pair B= IF THEN = (q(i), p(i)) = (q(i+1), p(i+1)) [q(i+1)-q(i)] * 95% [the Hrly diff of RT-SPP-DA-SPP)] * e3 [p(i) <= ath%DA-SPP] //Figures 3,4,5,6 q(a) = q(i+1) ELSE IF THEN [p(i+1) > ath%DA-SPP] Calculate intercept q(a) IF THEN ELSE [bth%DA-SPP > 0] A = - ( (q(a)-q(i)) * bth%DA-SPP * e2) A = -((q(a)-q(i)) * bth%DA-SPP) A=0 //Figures 5,6 //Figures 7,8 Credit Exposure = A+B Also see Figures 3-8 for visual interpretation of the Credit Exposure calculation. 7 of 16 OfferPrice ($/MW) ath Percentile DA-SPP (x,150) (q6, p6) (40,100) (q5, p5) (25,50) Quantity (MW) Figure 3 – Credit Exposure Calculation (Energy Offers) – Positive ath Percentile above the Line Segment Quantity (MW) ath Percentile DA-SPP OfferPrice ($/MW) (x,-15) (q6, p6) (40,-100) (q5, p5) (25,-500) Figure 4 – Credit Exposure Calculation (Energy Offers) – Negative ath Percentile above the Line Segment 8 of 16 OfferPrice ($/MW) (q6, p6) (40,100) (qa,75) ath Percentile DA-SPP (x,75) (q5, p5) (25,50) Quantity (MW) Figure 5 – Credit Exposure Calculation (Energy Offers) – Positive ath Percentile intercepting the Line Segment Quantity (MW) OfferPrice ($/MW) (q6, p6) (40,-100) (qa,-150) ath Percentile DA-SPP (q5, p5) (x,-150) (25,-500) Figure 6 – Credit Exposure Calculation (Energy Offers) – Negative ath Percentile intercepting the Line Segment 9 of 16 OfferPrice ($/MW) (q6, p6) (40,100) (q5, p5) (25,50) ath Percentile DA-SPP (x,15) Quantity (MW) Figure 7 – Credit Exposure Calculation (Energy Offers) – Positive ath Percentile below the Line Segment Quantity (MW) (q6, p6) (40,-100) OfferPrice ($/MW) (q5, p5) (25,-500) ath Percentile DA-SPP (x,-650) Figure 8 – Credit Exposure Calculation (Energy Offers) – Negative ath Percentile below the Line Segment 10 of 16 Credit Exposure Calculation – Three-Part Offers 3 3.1 Checks 1. Make the first (Q,P) pair as (q0,p0) = (0,p1) where p1 = price of the first submitted price from (q1,p1) 5. If abs(q1-q0) < 0.01, then ignore the first segment for credit check. 6. For a line segment, if abs[q(i+1)-q(i)) < 0.01, then consider it as vertical line segment. No area under curve, no credit check required. Proceed to next line segment. 3.2 Credit Exposure Calculation The Credit Exposure calculation for a Three-Part offer is calculated by identifying the target line segment first. The target line segment is one of the following line segments – (a) The last segment of the Three-Part offer curve, if yth percentile is above or below the offer curve, or (b) The segment of the Three-Part offer curve that is intercepting the yth percentile. Target Segment first pair Target Segment second pair IF THEN = (q(i), p(i)) = (q(i+1), p(i+1)) [p(i) <= yth%DA-SPP] //Figures 9,10,11,12 q(y) = q(i+1) IF THEN [p(i+1) > yth%DA-SPP] Calculate intercept q(y) //Figures 11,12 Credit Exposure = - [q(y) * (zth%DA-SPP)] ELSE Credit Exposure = 0 //Figures 13,14 Also see Figures 9-14 for visual interpretation of the Credit Exposure calculation. 11 of 16 OfferPrice ($/MW) yth Percentile DA-SPP (x,150) (40,100) (25,50) (q(i+1), p(i+1)) (q(i), p(i)) Quantity (MW) Figure 9 – Credit Exposure Calculation (Three-Part Offers) – Positive yth Percentile above the Line Segment Quantity (MW) yth Percentile DA-SPP OfferPrice ($/MW) (x,-15) (q(i+1), p(i+1)) (40,-100) (q(i), p(i)) (25,-500) Figure 10 – Credit Exposure Calculation (Three-Part Offers) – Negative yth Percentile above the Line Segment 12 of 16 OfferPrice ($/MW) (40,100) (q(i+1), p(i+1)) (qy,75) yth Percentile DA-SPP (x,75) (25,50) (q(i), p(i)) Quantity (MW) Figure 11 – Credit Exposure Calculation (Three-Part Offers) – Positive yth Percentile intercepting the Line Segment Quantity (MW) OfferPrice ($/MW) (40,-100) (q(i+1), p(i+1)) (qy,-150) (q(i), p(i)) (25,-500) yth Percentile DA-SPP (x,-150) Figure 12 – Credit Exposure Calculation (Three-Part Offers) – Negative yth Percentile intercepting the Line Segment 13 of 16 OfferPrice ($/MW) (40,100) (25,50) (q(i+1), p(i+1)) (q(i), p(i)) yth Percentile DA-SPP (x,15) Quantity (MW) Figure 13 – Credit Exposure Calculation (Three-Part Offers) – Positive yth Percentile below the Line Segment Quantity (MW) OfferPrice ($/MW) (q(i+1), p(i+1)) (40,-100) (q(i), p(i)) (25,-500) yth Percentile DA-SPP (x,-650) Figure 14 – Credit Exposure Calculation (Three-Part Offers) – Negative yth Percentile below the Line Segment 14 of 16 4 Credit Exposure Calculation – PTP Obligation Bids Credit Exposure = [Q * (max(bidPrice,0) + uth%RTSourcePrice-RTSinkPrice)] 15 of 16 5 Credit Exposure Calculation – AS Not self-arranged Credit Exposure = [Q * tth%(DAM-AS-MCPC)] 16 of 16